Bitcoin's recent price fluctuations have sparked curiosity about whether large Bitcoin holders are leveraging price dips to amass more Bitcoin. While initial indicators may suggest an uptick in long-term holdings, a closer examination reveals a more intricate narrative, particularly amidst the current extended period of volatile consolidation.

Long-Term Holders Dynamics

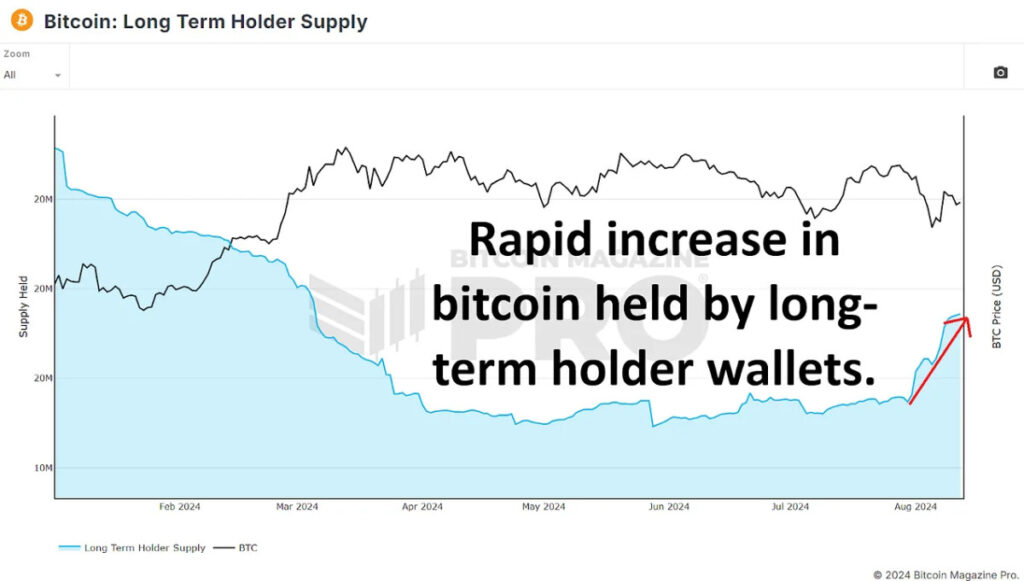

At first glance, it appears that long-term Bitcoin holders are ramping up their holdings. According to the Long Term Holder Supply data, from July 30th onwards, there has been an increase in BTC held by long-term holders from 14.86 million to 15.36 million BTC. This surge of approximately 500,000 BTC has spurred speculation that long-term holders are actively capitalizing on price dips, potentially paving the way for a substantial price upsurge.

However, this interpretation might be somewhat misleading. Long-term holders are defined as wallets that have retained BTC for 155 days or more. Considering we have recently surpassed 155 days since the last all-time high, it is probable that many short-term holders from that period have transitioned into the long-term category without engaging in fresh accumulation. These investors are currently holding onto their BTC, anticipating a price surge. Therefore, this chart alone does not necessarily signify new buying activity from established market participants.

Coin Days Destroyed Analysis

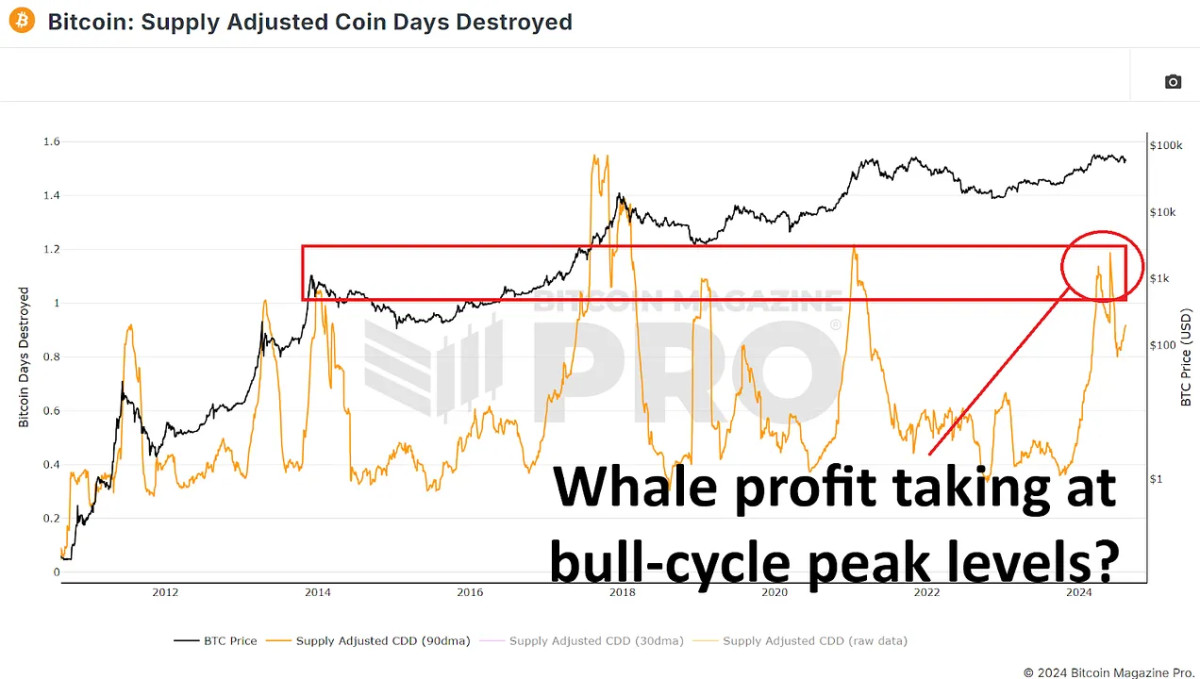

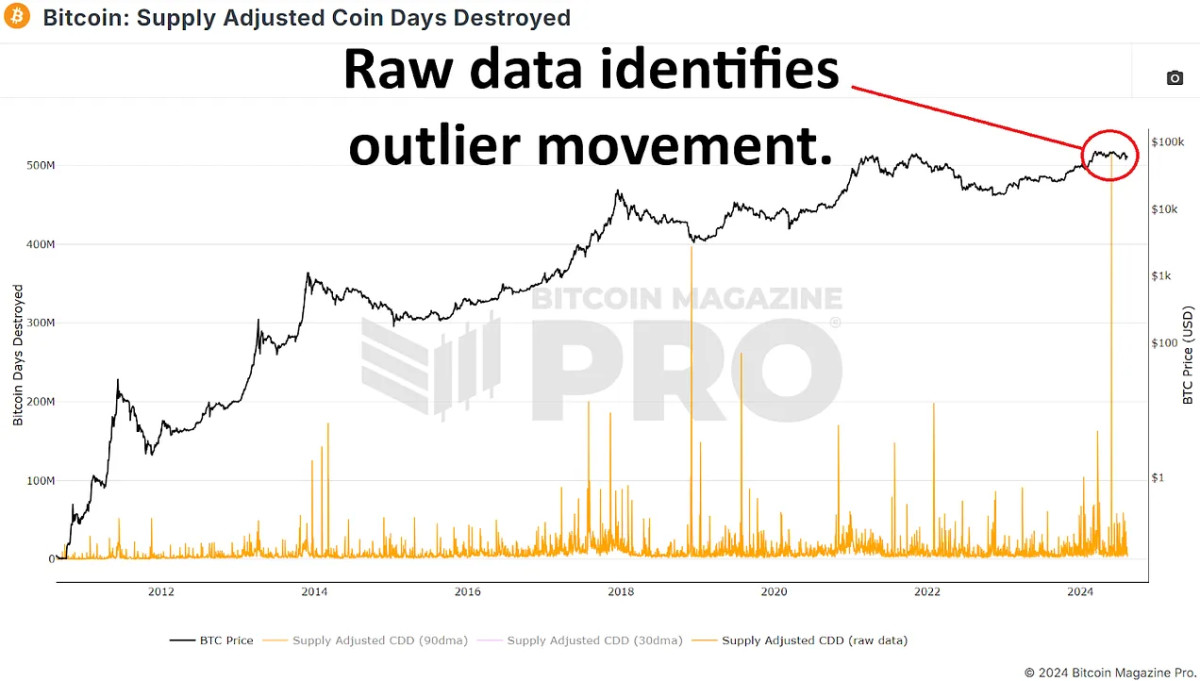

Delving deeper into the behavior of long-term holders, we can analyze the Supply Adjusted Coin Days Destroyed metric over the preceding 155-day span. This metric evaluates the velocity of coin movement, assigning more significance to coins held for extended durations. A notable spike in this metric might indicate that long-term holders, possessing a considerable amount of Bitcoin, are transferring their coins, hinting at more selling rather than accumulating.

Recent data has exhibited a significant uptick in this metric, suggesting that long-term holders could be distributing rather than accumulating BTC. Nevertheless, this spike is predominantly influenced by a single substantial transaction of approximately 140,000 BTC from a known Mt. Gox wallet on May 28, 2024. Excluding this outlier, the data aligns more closely with typical patterns observed during this phase of the market cycle, akin to periods in late 2016, early 2017, and mid-2019 to early 2020.

Whale Wallet Activity

Scrutinizing wallets holding substantial Bitcoin amounts is pivotal in determining whether whales are buying or selling Bitcoin. By examining wallets with a minimum of 10 BTC (approximately $600,000 at current rates), we can assess the actions of significant market players.

Following Bitcoin's previous peak this year, the number of wallets holding at least 10 BTC has slightly risen. Similarly, there has been a modest increase in wallets holding 100 BTC or more. Considering the minimum threshold for inclusion in these analyses, the accumulation of Bitcoin by wallets holding between 10 and 999 BTC might account for tens of thousands of coins bought since the recent all-time high.

Conversely, a reversal in the trend is observed in larger wallets holding 1,000 BTC or more. The count of these substantial wallets has slightly decreased, indicating that some major holders could be distributing their BTC. A notable change is noted in wallets holding 10,000 BTC or more, dwindling from 109 to 104 in recent months. This suggests that some of the largest Bitcoin holders are likely taking profits or redistributing their holdings among smaller wallets. However, given that most of these extremely large wallets are typically exchanges or other centralized wallets, they are more likely a mix of trader and investor coins rather than belonging to a single individual or group.

ETFs and Institutional Inflows Impact

Subsequent to peaking at $60.8 billion in assets under management (AUM) on March 14th, BTC ETFs have witnessed a $6 billion AUM decline. However, factoring in the Bitcoin price drop since the all-time high, this decline roughly equates to an increase of approximately 85,000 BTC. While this is encouraging, the increment has merely offset the amount of newly mined Bitcoin during the same period, also totaling 85,000 BTC. ETFs have aided in alleviating selling pressure from miners and potentially from large holders but have not accumulated significantly enough to positively impact the price.

Retail Interest Surge

Interestingly, while significant holders seem to be offloading BTC, there has been a notable surge in smaller wallets holding between 0.01 and 10 BTC. These smaller wallets have added tens of thousands of BTC, indicating heightened interest from retail investors. A net shift of around 60,000 BTC from wallets with 10+ BTC to those with less than 10 BTC has been observed. While this may raise concerns, it is crucial to note that throughout an entire bullish cycle, we typically witness millions of Bitcoins transitioning from large, long-term holders to new market participants. Therefore, this current trend does not warrant immediate apprehension.

Final Thoughts

Contrary to the narrative of whales accumulating Bitcoin during price downturns and choppy consolidation phases, the data suggests otherwise. Although long-term holder supply metrics may appear optimistic initially, they largely signify the transition of short-term holders to the long-term category rather than fresh accumulation.

The surge in retail holdings and the stabilizing influence of ETFs could lay a robust foundation for future price escalation, particularly if there is renewed institutional interest and sustained retail inflows post-halving. However, at present, these factors are contributing minimally to Bitcoin price appreciation.

The pivotal question remains whether the ongoing distribution phase halts, paving the way for a new accumulation phase that could propel Bitcoin to new highs in the upcoming months. Alternatively, if the flow of old coins to new participants continues, it might potentially dampen the remaining upside potential for our ongoing bullish cycle.

For a more comprehensive analysis of this topic, we recommend checking out our recent YouTube video on whether Bitcoin whales are still actively accumulating. Don't miss our latest YouTube video discussing potential enhancements to one of the prime Bitcoin metrics.

Frequently Asked Questions

How does an IRA for gold and/or silver work?

An IRA that is gold or silver allows you the opportunity to invest in precious metals without paying tax on any gains. People who want to diversify portfolios will find them attractive investments.

If you are over 59 1/2, income tax is not due on the interest earned from these accounts. On any appreciation in value of the account, you don't have to pay capital gain tax. This account has a limit on how much you can put in. Minimum amount allowed is $10,000 Under 59 1/2 years old, you can't make any investments. Maximum annual contribution is $5,000.

Your beneficiaries might not receive the full amount of your account if your death occurs before you retire. Your estate must include enough assets to cover the balance remaining in your account after all other expenses and debts have been paid.

Some banks offer gold and silver IRA options, while others require you to open a regular brokerage account through which you buy shares or certificates.

Are gold IRAs a good place to invest?

Purchase shares in mining companies to invest in precious metals like gold. This is a good way to make money when you invest in gold and other precious metals like silver.

However, there are two drawbacks to owning shares directly:

First, you can lose money by holding onto your stock for too long. Stocks that fall are less than their underlying asset (like silver) and can end up losing more money. This means that you might end up losing more money than you make.

Second, you may miss out on potential profits if you wait until the market recovers before selling. So you may need to be patient and let the market recover before you profit from your gold holdings.

But if you prefer to keep your investments separate from your finances, you can still benefit from owning physical gold. A gold IRA will help protect your portfolio from inflation and diversify it.

You can find out more information about gold investing on our website.

Which type of IRA could be used for precious metals

A Individual Retirement Account (IRA), is an investment vehicle offered by most financial institutions and employers. You can contribute to an IRA account which grows tax-deferred and can be withdrawn at any time.

An IRA allows for you to save taxes while still paying taxes when you retire. This allows you to save more money today and pay less taxes tomorrow.

An IRA has the advantage of allowing contributions and earnings to grow tax-free until you withdraw your funds. If you do withdraw the funds earlier than that, you will be subject to penalties.

After 50 you can still make contributions to your IRA. There is no penalty. You'll owe income tax and a 10% federal penalty if you withdraw from your IRA in retirement.

Withdrawals made before age 59 1/2 are subject to a 5% IRS penalty. Withdrawals between ages 59 1/2 and 70 1/2 are subject to a 3.4% IRS penalty.

There is a 6.2% penalty for withdrawals over $10,000 per calendar year.

What precious metals will be allowed in an IRA account?

The most common precious metallic used in IRA accounts, is gold. You can also invest in gold bullion bars and coins.

Precious metals are considered safe investments because they don't lose value over time. Precious metals are also great for diversifying an investment portfolio.

Precious metals include silver, platinum, and palladium. These three metals have similar properties. However, each one has its unique uses.

For example, platinum is used in making jewelry. To create catalysts, palladium is used. Silver is used to producing coins.

Consider how much you plan to spend on gold when deciding on which precious metal to buy. A lower-cost ounce of gold might be a better option.

Also, think about whether or not you wish to keep your investment secret. If you are unsure, palladium is the right choice.

Palladium can be more valuable than gold. It's also more rare than gold. This means you might have to spend more.

Another important factor when choosing between gold and silver is their storage fees. Storage fees for gold are determined by its weight. You will pay more if you store larger amounts.

Silver is stored by volume. Therefore, smaller amounts of silver will cost less.

You should follow all IRS rules if you plan to store precious metals in an IRA. You must keep track of all transactions and report them to the IRS.

Can I get physical ownership of gold in my IRA

Many people ask themselves whether it is possible to physically own gold in an IRA. This is a valid question as there is no legal route to it.

You can still own gold in an IRA if you look at the law.

Most people don't realize the cost savings they could make by putting their gold into an IRA rather than keeping it in their homes.

It's easy for gold coins to be thrown away, but it's much more difficult to keep them in an IRA. If you decide that you want to keep your gold at home, you'll be responsible for two tax payments. Two taxes will be charged: one to the IRS, one to the state you live in.

Of course, you can also lose your gold in your house and pay taxes twice. Why would you want to keep your gold in your house?

You might argue that you need the security of knowing that your gold is safe in your home. It is important to store your gold somewhere safer in order to prevent theft.

If you plan on visiting often, you shouldn't leave your precious gold at home. If you leave your precious gold unattended thieves will easily steal it.

A better option is to store your gold in an insured vault. Your gold will be protected against fire, floods, earthquakes, and robbery.

You won't be responsible for paying any property tax if you store your gold in a vault. Instead, any gains that you make by selling your gold will be subject to income tax.

You may be interested in an IRA if you don't want to pay taxes on your gold. An IRA will allow you to avoid income tax while earning interest on your gold.

Since you aren't required to pay capital gains tax on your gold, you'll have access to the full value of your investment whenever you want to cash it out.

Because IRAs have federal regulation, it won't be difficult to transfer your gold to another bank if there is a move.

The bottom line is: You can own gold in an IRA. Only thing stopping you from owning gold in an IRA is your fear of getting it stolen.

Can you make money on a gold IRA?

Two things are necessary if you want to make a profit on your investment. First, you need to understand the market. Second, you need to know what type of products you have.

Trading is not a good idea if you don’t know what you need.

You should also find a broker who offers the best service for your account type.

There are many accounts available, including Roth IRAs and standard IRAs.

A rollover is also an option for those who already own stocks and bonds.

What is a Precious Metal IRA, and how can you get one?

Precious metals are an excellent investment for retirement accounts. They have been around since biblical times and continue to hold value today. You can diversify your portfolio by investing in precious metals, such as gold, platinum, and silver.

Certain countries even allow their citizens to save money in foreign currencies. You can buy Canadian gold bars and keep them at home. Then, when you go back to visit family, you can sell those same gold bars for Canadian dollars.

This is an easy way to invest precious metals. It's particularly helpful for people who don't reside in North America.

Statistics

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

kitco.com

takemetothesite.com

en.wikipedia.org

regalassets.com

How To

How to Open a Precious Metal IRA

Precious Metals are one of today's most desired investment vehicles. They offer investors higher returns than traditional investments, such as bonds and stocks. This is why they are so popular. It is worth your time to research and plan before you invest in precious metals. Here's how to open a precious-metal IRA account.

There are two main types of precious metal accounts: physical precious metals accounts and paper gold and silver certificates (GSCs). Each type comes with its own set of advantages and disadvantages. GSCs offer easy access and trade, while physical precious metals accounts provide diversification benefits. You can read more about them below.

Physical precious metals accounts include bullion, bars and coins. While this option provides diversification benefits, it also comes with some drawbacks. It is expensive to buy, store, and sell precious metals. Due to their size, it can be difficult for them to be transported from one place to another.

Paper gold and silver certificates, on the other hand are very affordable. In addition, they're easily accessible and traded online. They're a great choice for people who don’t want precious metals. They aren’t as diversifiable as their physical counterparts. Also, since they're backed by government agencies such as the U.S. Mint, the value of these assets could decrease if inflation rates rise.

You should choose the account that best suits your financial needs before you open a precious-metal IRA. These are some factors to consider before you do this:

- Your tolerance level

- Your preferred asset allocation strategy

- How long do you have to spend?

- No matter if you intend to use the funds in short-term trading.

- What kind of tax treatment you'd prefer

- Which precious metal(s) you'd like to invest in

- How liquid do your portfolio need to be

- Your retirement age

- Where you'll store your precious metals

- Your income level

- Your current savings rates

- Your future goals

- Your net worth

- Special circumstances that may influence your decision

- Your overall financial position

- Your preference between physical and paper assets

- Your willingness to take risks

- Your ability to handle losses

- Your budget constraints

- You desire to be financially independent

- Your investment experience

- Your familiarity with precious metals

- Your knowledge about precious metals

- Your confidence in the economy

- Your personal preferences

Once you've chosen the right type of precious Metal IRA to suit your needs, it is time to open a dealer account. You can find these companies through referrals, word of mouth, or online research.

Once you have opened your precious-metal IRA, it is time to decide how much you want to deposit. It's important to note that each precious metal IRA account carries different minimum initial deposit amounts. Some require only $100, while others will allow you to invest up to $50,000.

As you can see, your precious metal IRA IRA investment amount is completely up to the individual. You might choose to make a larger initial investment if your goal is to build wealth over the long-term. On the other hand, if you're planning on investing smaller sums of money every month, a lower initial deposit might work better for you.

You have many options when it comes to the type of investments you can make. The most common include:

- Bullion bars and rounds of gold, as well as coins

- Silver – Rounds and coins

- Platinum – Coins

- Palladium – Round and bar forms

- Mercury – Round or bar forms

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]