Imagine a billion-dollar real estate giant stepping into the future with Bitcoin at the helm. Grupo Murano, a top-tier real estate company from Mexico, is making waves by infusing Bitcoin into its core operations. With CEO Elías Sacal at the helm, they're reshaping the industry, suggesting that Bitcoin is reshaping the realm of real estate by "demonetizing" it. By transitioning from traditional asset-heavy approaches to a Bitcoin-centered treasury, this publicly traded powerhouse aims to fine-tune its financial strategies and leverage Bitcoin’s potential growth, setting a precedent for businesses navigating the ever-changing waters of interest rates and currencies.

Embracing the Bitcoin Revolution

The Vision of Grupo Murano

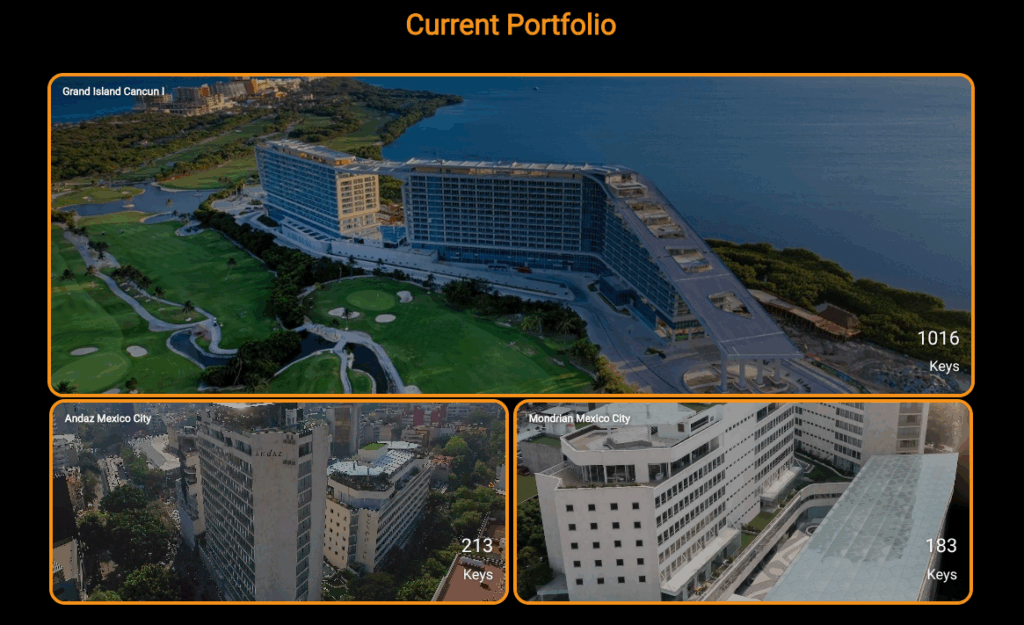

Embarking on this transformative journey, Elías Sacal, a seasoned veteran with three decades of real estate expertise, shared Grupo Murano’s roadmap in an exclusive Bitcoin for Corporations interview. Managing renowned hotel brands like Hyatt and Mondrian alongside residential and commercial properties in vibrant cities such as Cancun and Mexico City, the company plans to convert assets into Bitcoin through innovative methods like refinancing and sale-leasebacks. This strategic shift not only trims down debt and equity on their financial statements but also ensures operational autonomy. Instead of traditional buildings that see minor value increments, Grupo Murano anticipates Bitcoin’s value to surge significantly. Sacal even predicts a remarkable 300% price surge within the next five years.

Redefining Real Estate Finance

Bitcoin as the Game Changer

Sacal’s forward-thinking strategy aims to combat the real estate realm’s heavy reliance on debt financing, especially amidst escalating interest rates, skyrocketing from 4% to 9% in some scenarios. He emphasizes the necessity for real estate to break free from the shackles of fluctuating commodity prices or retail inflation. Bitcoin emerges as a stable solution for various transactions, from global material sourcing to hotel payments. By circumventing intermediaries such as hedge funds and portfolio managers, Bitcoin slashes expenses linked to commissions and currency exchange rates. Sacal illustrates how a $100 payment can dwindle to $85 post-fees, whereas Bitcoin streamlines these transactions, making them more cost-effective.

Educating and Innovating

Bitcoin Integration into Grupo Murano’s Ecosystem

Grupo Murano actively educates its stakeholders – employees, investors, and guests – about Bitcoin’s advantages. Plans are in place to introduce Bitcoin ATMs across their properties and solidify partnerships with major payment platforms, ensuring seamless transactions. This initiative particularly benefits American-oriented hotel guests in Cancun and Mexico City. Aligned with their ambitious goal of establishing a $10 billion Bitcoin treasury within five years, inspired by Strategy’s $100 billion valuation driven by Bitcoin adoption, Grupo Murano is set to embrace Bitcoin payments across its entire portfolio. Additionally, they are exploring avenues to host Bitcoin conferences at their properties.

Strategic Focus and Future Outlook

Bitcoin as the Beacon

Grupo Murano’s strategic focus remains on lucrative development ventures, allocating 20-30% to real estate endeavors and a substantial 70-80% to Bitcoin holdings. Sacal dismisses other cryptocurrencies, firmly labeling Bitcoin as the true champion akin to Formula One or the NFL. He envisions Latin America, spearheaded by trailblazers like El Salvador, as a promising landscape for Bitcoin adoption, despite lingering political uncertainties. Bitcoin has the potential to unite regional economies, diminishing reliance on sectors like tourism and remittances.

A New Dawn for Real Estate

Bitcoin’s Transformative Power

Grupo Murano’s transition underscores Bitcoin’s capability to revolutionize capital-intensive sectors. By prioritizing development over ownership and leveraging Bitcoin’s growth potential, Murano sets a precedent for businesses aiming to weather economic uncertainties. Sacal envisions a future where Bitcoin transactions will reign supreme in the global real estate arena, heralding a shift towards a more resilient and decentralized future.

Are you ready to embrace the future of real estate with Bitcoin? Join Grupo Murano on their pioneering journey towards a more stable and dynamic industry landscape.

Frequently Asked Questions

How much of your portfolio should be in precious metals?

This question can only be answered if we first know what precious metals are. Precious metals have elements with an extremely high worth relative to other commodity. This makes them valuable in investment and trading. Gold is currently the most widely traded precious metal.

However, many other types of precious metals exist, including silver and platinum. The price volatility of gold can be unpredictable, but it is generally stable during periods of economic turmoil. It is also not affected by inflation and depression.

The general trend is for precious metals to increase in price with the overall market. They do not always move in the same direction. For instance, gold's price will rise when the economy is weak, while precious metals prices will fall. Investors expect lower interest rate, making bonds less appealing investments.

Contrary to this, when the economy performs well, the opposite happens. Investors choose safe assets such Treasury Bonds over precious metals. Because they are rare, they become more pricey and lose value.

You must therefore diversify your investments in precious metals to reap the maximum profits. Because precious metals prices are subject to fluctuations, it is best to invest across multiple precious metal types, rather than focusing on one.

Which precious metals are best to invest in retirement?

These precious metals are among the most attractive investments. Both can be easily bought and sold, and have been around since forever. These are great options to diversify your portfolio.

Gold: The oldest form of currency known to man is gold. It is stable and very secure. Because of this, it's considered a good way to preserve wealth during times of uncertainty.

Silver: Silver is a popular investment choice. It is an excellent choice for investors who wish to avoid volatility. Unlike gold, silver tends to go up instead of down.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. Like gold and silver, it's very durable and resistant to corrosion. It's also more expensive than the other two.

Rhodium. Rhodium is used as a catalyst. It is also used in jewelry-making. It is also quite affordable compared with other types of precious metals.

Palladium: Palladium has a similarity to platinum but is more rare. It's also less expensive. Investors looking to add precious and rare metals to their portfolios love it for these reasons.

How much money should my Roth IRA be funded?

Roth IRAs allow you to deposit your money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. You must adhere to certain rules if you are going to withdraw any of your contributions prior. You cannot touch your principal (the amount you originally deposited). No matter how much money you contribute, you cannot take out more than was originally deposited to the account. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule states that income taxes must be paid before you can withdraw earnings. When you withdraw, you will have to pay income tax. Let's take, for example, $5,000 in annual Roth IRA contributions. Let's further assume you earn $10,000 annually after contributing. This would mean that you would have to pay $3,500 in federal income tax. So you would only have $6,500 left. The amount you can withdraw is limited to the original contribution.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. You would also lose half of your earnings because they are subject to another 50% tax (half off 40%). So even though you received $7,000 in Roth IRA contributions, you only received $4,000.

There are two types if Roth IRAs: Roth and Traditional. A traditional IRA allows for you to deduct pretax contributions of your taxable income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. There are no restrictions on the amount you can withdraw from a Traditional IRA.

Roth IRAs are not allowed to allow you deductions for contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. There is no minimum withdrawal requirement, unlike traditional IRAs. You don't have to wait until you turn 70 1/2 years old before withdrawing your contribution.

Can I purchase gold with my self directed IRA?

While you can purchase gold from your self-directed IRA (or any other brokerage firm), you must first open a brokerage account such as TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals to contribute as high as $5,500 ($6,500 if they are married and jointly) to a traditional IRA. Individuals can contribute up $1,000 per annum ($2,000 if they are married and jointly) directly to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contract are financial instruments that depend on the gold price. These financial instruments allow you to speculate about future prices without actually owning the metal. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

External Links

bbb.org

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

finance.yahoo.com

How To

Tips for Investing with Gold

One of the most sought-after investment strategies is investing in gold. Because investing in gold has many benefits. There are several options to invest in the gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

Before you buy any type of gold, there are some things that you should think about.

- First, check to see if your country permits you to possess gold. If your country allows you to own gold, then you are allowed to proceed. If not, you may want to consider purchasing gold from overseas.

- The second is to decide which kind of gold coin it is you want. You have options: you can choose from yellow gold, white or rose gold.

- Thirdly, it is important to take into account the gold price. Start small and move up. When purchasing gold, diversify your portfolio. Diversifying assets should include stocks, bonds real estate mutual funds and commodities.

- Don't forget to keep in mind that gold prices often change. It is important to stay up-to-date with the latest trends.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]