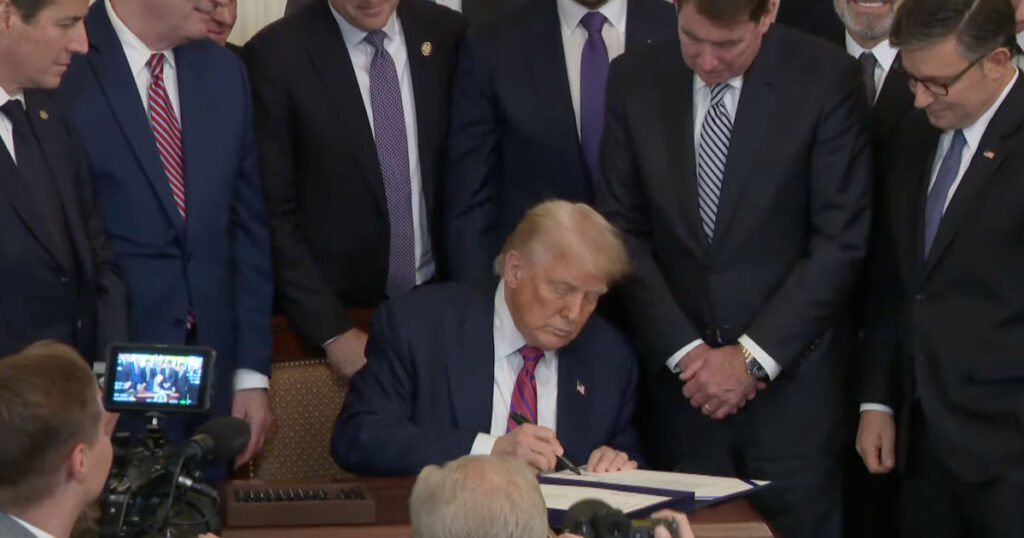

Have you heard the news? Bitcoin is on a wild ride, hitting $116,000 thanks to an upcoming executive order from Trump that might open the doors for Bitcoin and other cryptocurrencies to enter 401(k) plans. Exciting, right? Let's dive into what this means for you.

The Dawn of a New Era for Retirement Plans

Unlocking Opportunities for Alternative Assets

Picture this: the Labor Department is gearing up to redefine the rules for retirement funds, making it easier for them to include alternative assets like Bitcoin. This move could break down barriers that have long kept cryptocurrencies out of retirement accounts. Imagine having Bitcoin as part of your retirement savings strategy!

What Does This Mean for Investors?

Game-Changing Potential for Retirement Investments

This shift in fiduciary responsibilities could be a game-changer for retirement providers. By clarifying regulations, it opens the door for more institutional players to explore Bitcoin investments. Think of it as a green light for retirement funds to get a taste of the crypto action.

Institutional Interest on the Rise

The Rise of Bitcoin as an Institutional Asset

With the executive order aligning with the surge in institutional interest in Bitcoin, we're witnessing a pivotal moment. Innovative financial products, such as Bitcoin-denominated bonds, are emerging, catering to institutional demands. It's a sign that the market is evolving to welcome bigger players.

Bitcoin Leading the Way

Institutional Focus on the Crypto King

While the executive order impacts various alternative assets, Bitcoin stands out as the star of the show. Institutional investors are eyeing Bitcoin as their gateway to the crypto realm. The spotlight is on Bitcoin for those seeking exposure to the booming crypto market.

Market Frenzy and Investor Sentiment

Investor Excitement and Market Response

Following the news, cryptocurrency exchanges saw a frenzy, with a staggering $30 billion in Bitcoin trades within 24 hours. Investors are buzzing with excitement, anticipating the long-term implications of including Bitcoin in retirement portfolios.

Get ready for a financial landscape shift as Bitcoin and crypto potentially enter the realm of retirement accounts. The future looks bright for crypto enthusiasts and investors alike. Stay tuned for more updates on this thrilling development!

CFTC

forbes.com

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

The best place to buy silver or gold online

Understanding how gold works is essential before you buy it. The precious metal gold is similar to platinum. It's very rare and is used as money because of its durability and resistance to corrosion. It is difficult to use so people prefer to buy jewelry made from it to gold bars.

There are two types currently available: legal tender and bullion. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coins are only minted to be used for investment purposes. Their value increases over time because of inflation.

They cannot be used in currency exchanges. For example, if a person buys $100 worth of gold, he/she gets 100 grams of gold with a value of $100. Each dollar spent earns the buyer 1 gram gold.

Next, you need to find out where to buy gold. There are many options for buying gold directly from dealers. First off, you can go through your local coin shop. Another option is to go through a reputable site like eBay. You can also look into buying gold online from private sellers.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. Private sellers charge a 10% to 15% commission per transaction. Private sellers will typically get you less than a coin shop, eBay or other online retailers. This is a great option for gold investing because you have more control over the item’s price.

An alternative option to buying gold is to buy physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. Physical gold should be stored in an impenetrable container, such a vault and safety deposit box to ensure its safety.

A bank or pawnshop can help you buy gold. A bank can offer you a loan for the amount that you need to buy gold. The pawnshop is a small business that allows customers to borrow money to buy items. Banks tend to charge higher interest rates, while pawnshops are typically lower.

The final option is to ask someone to buy your gold! Selling gold can be as easy as selling. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]