Hey there, crypto enthusiasts! Ready to dive into the exciting world of Bitcoin price predictions? Well, buckle up because we're about to explore the potential for Bitcoin to hit $130,000 if the Federal Reserve hints at a dovish monetary policy. Let's unravel the current market scenario and what it means for the future of Bitcoin.

Bitcoin's Recent Performance and Market Outlook

Market Momentum Shift

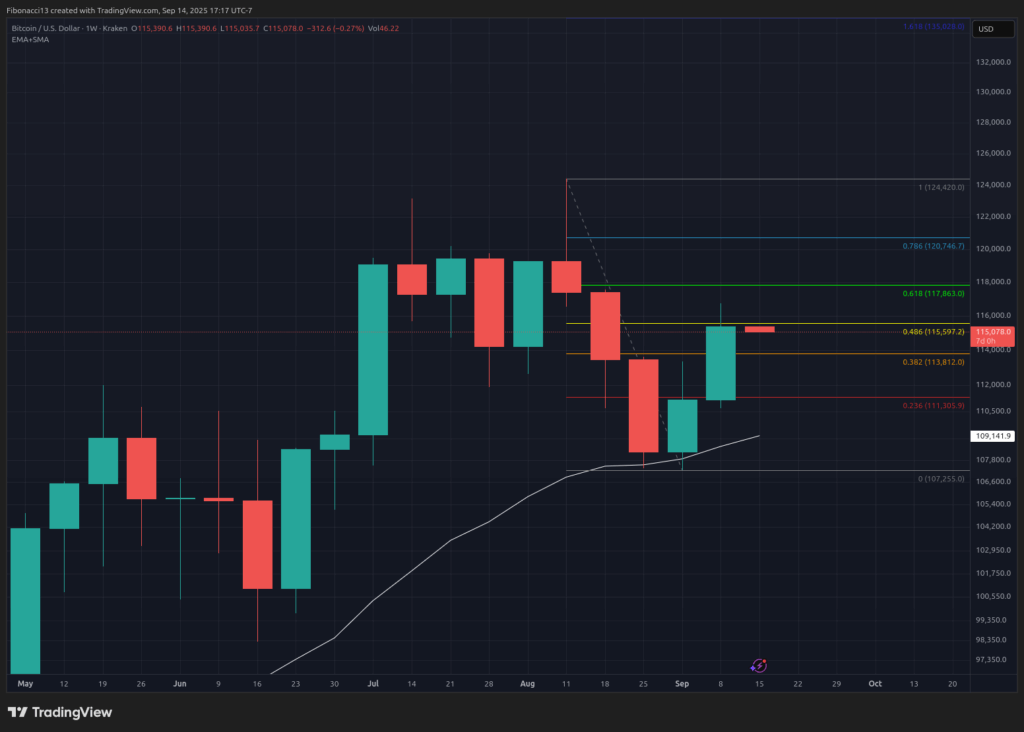

Last week, Bitcoin closed at $115,390, showcasing a bullish trend. With the U.S. Producer Price Index disappointing expectations, anticipation for a Federal Reserve rate cut intensified. The upcoming FOMC Meeting is expected to bring a 0.25% interest rate cut, potentially influencing Bitcoin's trajectory. A deviation from this anticipated move could lead to market corrections, so eyes are on the Fed's decision.

Key Price Levels to Watch

As we navigate this week, Bitcoin faces resistance at $115,500, with $118,000 posing as the next hurdle. A strong performance might push the price above $118,000 temporarily, only to face resistance. Conversely, a dip could find support at $113,800 and $111,000, with a breach risking a challenge to the $107,000 mark.

Predictions for the Week Ahead

Chart Analysis and Market Sentiment

Currently, Bitcoin's daily chart shows a slightly bearish bias post last Friday's rejection from $116,700. However, a bullish reversal is possible if the U.S. stock market resumes its upward trend. Indicators like MACD and RSI suggest a mixed sentiment, awaiting the Fed's decision for a potential market shakeup.

Market mood: The outlook remains bullish, with expectations of testing the $118,000 level this week after two consecutive green candles.

Looking Ahead: Bitcoin's Trajectory

The next few weeks are critical for Bitcoin's journey. Securing support above $118,000 is pivotal for a leap towards $130,000. The Fed's rate cuts and market data will significantly impact Bitcoin's path, potentially propelling it to new highs. Conversely, any unexpected bearish events or a surprise from the Fed could lead to a price retracement.

Understanding Market Terms

Let's Decode Some Jargon

- Bulls/Bullish: Investors anticipating price hikes.

- Bears/Bearish: Traders expecting price declines.

- Support and Resistance: Levels crucial for asset price movements.

- SMA: Simple Moving Average, indicating trend directions.

- Oscillators: Indicators like RSI and MACD reflecting market momentum.

Exciting times lie ahead for Bitcoin enthusiasts! Stay tuned for the Fed's decision, as it holds the key to Bitcoin's potential surge. Whether you're a seasoned investor or a curious newcomer, the crypto world offers thrilling opportunities. Keep an eye on the market trends, stay informed, and let's ride this crypto wave together!

CFTC

finance.yahoo.com

irs.gov

investopedia.com

How To

How to Keep Physical Gold in an IRA

The best way of investing in gold is to purchase shares from companies that produce gold. However, this method comes with many risks because there's no guarantee that these companies will continue to survive. Even if they do survive, there is still the possibility of losing money to fluctuating gold prices.

Another option is to purchase physical gold. You will need to either open an online or bank account or simply buy gold from a reliable seller. This option is convenient because you can access your gold when it's low and doesn't require you to deal with stock brokers. It's also easier to see how much gold you've got stored. You will receive a receipt detailing exactly what you paid. There's also less chance of theft than investing in stocks.

However, there are disadvantages. Bank interest rates and investment funds won't help you. It won't allow you to diversify any of your holdings. Instead, you'll be stuck with what's been bought. Finally, the taxman might want to know where your gold has been placed!

If you'd like to learn more about buying gold in an IRA, visit the website of BullionVault.com today!

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]