The introduction of Bitcoin ETFs in January 2024 was anticipated to revolutionize the market, attracting institutional capital and propelling Bitcoin prices to unprecedented levels. However, a year later, have Bitcoin ETFs truly lived up to the hype?

The Initial Impact

Since their inception, Bitcoin ETFs have amassed over 1 million BTC, equivalent to roughly $40 billion in assets under management. Despite outflows from competitors like the Grayscale Bitcoin Trust (GBTC), which experienced withdrawals of over 400,000 BTC, net inflows have remained substantial at approximately 540,000 BTC.

A Strong Start

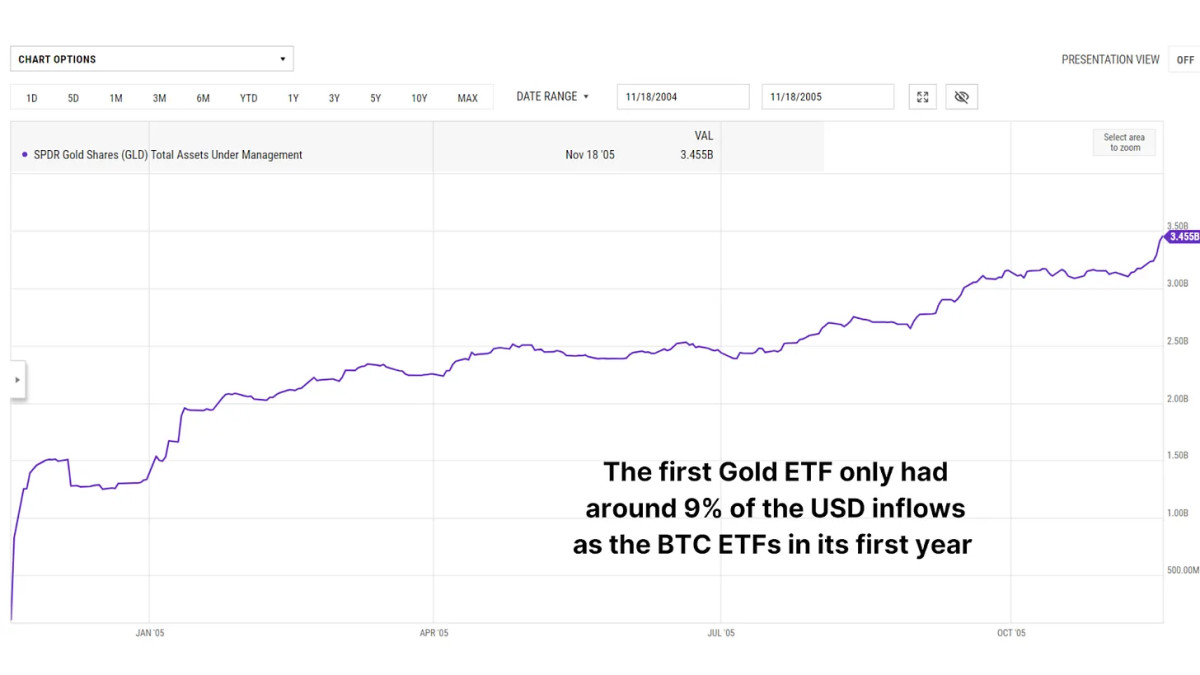

Comparing these figures to the launch of the first gold ETFs in 2004 reveals a stark contrast. Gold ETFs attracted $3.45 billion in their inaugural year, significantly less than the $37.5 billion influx seen by Bitcoin ETFs during the same timeframe. This underscores the significant institutional interest in Bitcoin as a financial asset.

Bitcoin’s Growth Trajectory

Following the introduction of Bitcoin ETFs, initial price movements were lackluster, with Bitcoin briefly dipping by almost 20% in a "buy the rumor, sell the news" scenario. However, this bearish trend swiftly reversed, and over the past year, Bitcoin prices have surged by around 120%, reaching unprecedented levels. In comparison, the year following the launch of gold ETFs saw a modest 9% uptick in gold prices.

Comparing to Gold

Considering Bitcoin's 24/7 trading schedule, resulting in approximately 5.3 times more yearly trading hours than gold, a striking similarity emerges. Overlaying Bitcoin’s ETF price action in its first year with historical gold data (adjusted for trading hours) reveals nearly identical percentage returns. If Bitcoin mirrors gold’s trajectory, we could witness an additional 83% price surge by mid-2025, potentially propelling Bitcoin’s price to around $188,000.

Institutional Insights

One intriguing revelation from Bitcoin ETFs is the correlation between fund inflows and price shifts. A strategy of purchasing Bitcoin on days with positive ETF inflows and selling on days with outflows has consistently outperformed a traditional buy-and-hold approach. From January 2024 to date, this strategy has yielded returns of 130%, surpassing the ~100% return for buy-and-hold investors by nearly 10%.

Supply and Demand Landscape

While Bitcoin ETFs have accumulated over 1 million BTC, a fraction of Bitcoin’s total circulating supply of 19.8 million BTC, corporations like MicroStrategy have bolstered institutional adoption by collectively holding hundreds of thousands of BTC. Nonetheless, the majority of Bitcoin remains with individual investors, underscoring that market dynamics are still steered by decentralized supply and demand.

Final Thoughts

After a year, Bitcoin ETFs have surpassed expectations, attracting billions in inflows, influencing price appreciation, and fostering increased institutional adoption. While initial skeptics may have been disappointed by the absence of immediate explosive price movements, the long-term outlook remains highly optimistic.

By drawing parallels to gold ETFs, a promising roadmap for Bitcoin’s future emerges. If the gold fractal remains valid, we could witness a significant rally on the horizon. Coupled with favorable macroeconomic conditions and escalating institutional interest, Bitcoin’s future shines brighter than ever.

For real-time data, charts, indicators, and comprehensive research to stay informed about Bitcoin's price trends, visit Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes solely and should not be construed as financial advice. Always conduct thorough research before making any investment decisions.

Frequently Asked Questions

Is the government allowed to take your gold

Because you have it, the government can't take it. You have earned it by working hard for it. It belongs exclusively to you. There may be exceptions to this rule. You can lose your gold if you have been convicted for fraud against the federal governments. You can also lose precious metals if you owe taxes. However, even if you don't pay your taxes, your gold can be kept as property of the United States Government.

How to Open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. Once you have decided to open an Individual Retirement Account (IRA), you will need to complete Form 806. Then you must fill out Form 5204 to determine what type of IRA you are eligible for. This form should not be completed more than 60 days after the account is opened. Once you have completed this form, it is possible to begin investing. You can also contribute directly to your paycheck via payroll deduction.

You must complete Form 8903 if you choose a Roth IRA. The process for an ordinary IRA will not be affected.

You'll need to meet specific requirements to qualify for a precious metals IRA. You must be at least 18 years of age and have earned income to qualify for a precious metals IRA. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). And, you have to make contributions regularly. These rules apply regardless of whether you are contributing directly to your paychecks or through your employer.

You can invest in precious metals IRAs to buy gold, palladium and platinum. But, you'll only be able to purchase physical bullion. You won't have the ability to trade stocks or bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is offered by some IRA providers.

However, investing in precious metals via an IRA has two serious drawbacks. First, they are not as liquid or as easy to sell as stocks and bonds. They are therefore more difficult to sell when necessary. They don't yield dividends like bonds and stocks. So, you'll lose money over time rather than gain it.

What precious metals could you invest in to retire?

Gold and silver are the best precious metal investments. They are both easy to trade and have been around for years. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: Gold is one the oldest forms currency known to man. It is very stable and secure. It is a good way for wealth preservation during uncertain times.

Silver: Investors have always loved silver. This is a great choice for people who want to avoid volatility. Silver tends instead to go up than down, which is unlike gold.

Platinium is another precious metal that is becoming increasingly popular. It's resistant to corrosion and durable, similar to gold and silver. It's however much more costly than any of its counterparts.

Rhodium: Rhodium is used in catalytic converters. It is also used for jewelry making. It is also quite affordable compared with other types of precious metals.

Palladium – Palladium is an alternative to platinum that's more common but less scarce. It's also much more affordable. Investors looking to add precious and rare metals to their portfolios love it for these reasons.

Is gold a good investment IRA?

Any person looking to save money is well-served by gold. You can diversify your portfolio with gold. But gold has more to it than meets the eyes.

It has been used throughout history as currency and it is still a very popular method of payment. It is often called “the oldest currency in the world.”

But unlike paper currencies, which governments create, gold is mined out of the earth. This makes it highly valuable as it is hard and rare to produce.

The supply and demand factors determine how much gold is worth. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. The value of gold rises as a consequence.

On the flip side, people save cash for emergencies and don't spend it. This leads to more gold being produced which decreases its value.

This is why gold investment makes sense for both individuals and businesses. If you have gold to invest, you will reap the rewards when the economy expands.

Your investments will also generate interest, which can help you increase your wealth. If gold's value falls, you don't have to lose any of your investments.

What does a gold IRA look like?

Gold Ira accounts are tax-free investment vehicles for people who want to invest in precious metals.

You can purchase gold bullion coins in physical form at any moment. To start investing in gold, it doesn't matter if you are retired.

An IRA allows you to keep your gold forever. Your gold assets will not be subjected tax upon your death.

Your heirs inherit your gold without paying capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). Once you've done so, you'll be given an IRA custodian. This company acts like a middleman between the IRS and you.

Your gold IRA custodian is responsible for handling all paperwork and submitting the required forms to the IRS. This includes filing annual reports.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. Minimum deposit is $1,000 The minimum deposit is $1,000. However, you will receive a higher percentage of interest if your deposit is greater.

You will pay taxes when you withdraw your gold from your IRA. You'll have to pay income taxes and a 10% penalty if you withdraw the entire amount.

You may not be required to pay taxes if you take out only a small amount. However, there are some exceptions. You'll owe federal income tax and a 20% penalty if you take out more than 30% of your total IRA assets.

It is best to not take out more than 50% annually of your total IRA assets. You could end up with severe financial consequences.

How is gold taxed within an IRA?

The fair market value of gold sold is the basis for tax. You don't have tax to pay when you buy or sell gold. It's not considered income. If you decide to sell it later, there will be a taxable gain if its price rises.

Gold can be used as collateral for loans. When you borrow against your assets, lenders try to find the highest return possible. Selling gold is usually the best option. However, there is no guarantee that the lender would do this. They may hold on to it. They might decide that they want to resell it. Either way you will lose potential profit.

If you plan on using your gold as collateral, then you shouldn't lend against it. Otherwise, it's better to leave it alone.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Lawful – WSJ

finance.yahoo.com

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation board of trade as contract marketplaces

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

Investing In Gold vs. Investing In Stocks

It might seem risky to invest in gold as an investment vehicle these days. Many people believe that investing in gold is not profitable. This belief is based on the fact that gold prices are being driven down by global economic conditions. They think that they would lose money if they invested in gold. In reality, however there are still many significant benefits to gold investing. Here are some examples.

One of the oldest currencies known to man is gold. It has been used for thousands of years. It has been used as a store for value by people all over the globe. It is still used as a payment method by South Africa and other countries.

When deciding whether to invest in gold, the first thing you need to do is to decide what price per gram you are willing to pay. You must determine how much gold bullion you can afford per gram before you consider buying it. If you don't know your current market rate, you could always contact a local jeweler and ask them what they think the price is.

It's also important to note that, although gold prices are down in recent months, the costs of producing it have risen. The price of gold may have fallen, but the production costs haven’t.

You should also consider the amount of your intended purchase when considering whether you should buy or not. It makes sense to save any gold you don't need to purchase if your goal is to use it for wedding rings. However, if you are planning on doing so for long-term investments, then it is worth considering. It is possible to make a profit by selling your gold at higher prices than when you purchased it.

We hope that this article has helped you gain a better understanding and appreciation for gold as an investment option. We recommend that you investigate all options before making any major decisions. Only after you have done this can you make an informed choice.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]