Hey there, crypto enthusiasts! Ready to dive into the latest on Bitcoin price trends? Let's explore how Bitcoin bulls are eyeing a potential $94,000 breakout as we approach a critical FOMC rate cut decision. Exciting times ahead!

The Bitcoin Price Rollercoaster

A Rollercoaster Ride

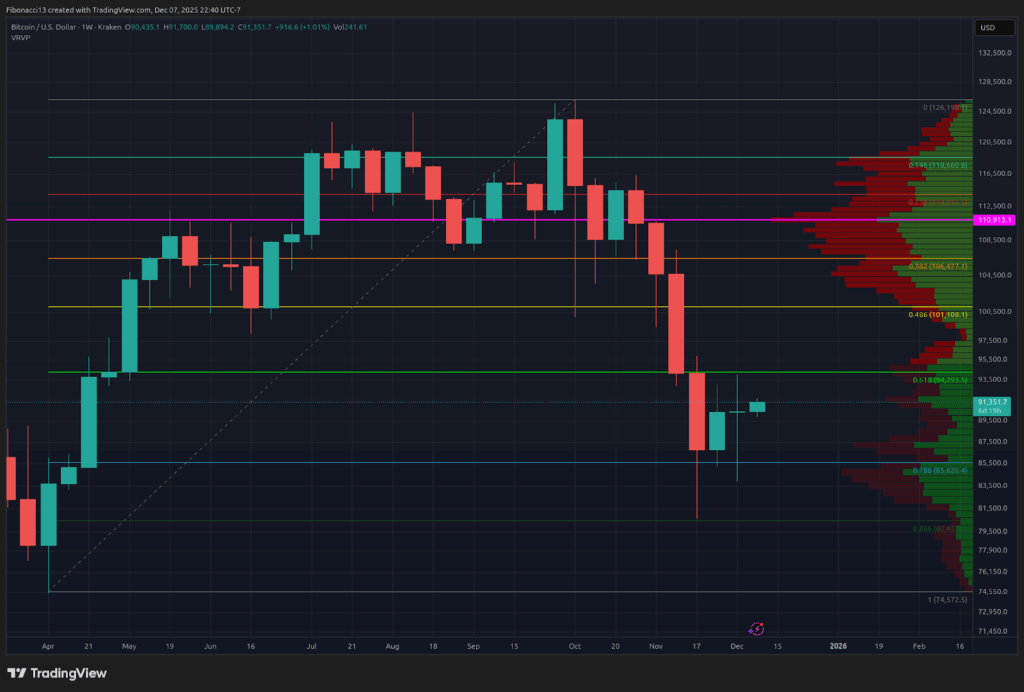

Last week, Bitcoin experienced quite the rollercoaster ride. Bears initially pushed the price to the $84,000 support level, but the bulls swiftly rallied it up to $94,000. Despite a dip below $88,000, a small weekend rally closed the week at $90,429. The focus now shifts to the FOMC meeting for a potential rate cut, aiming to create a more favorable investment climate for Bitcoin and other assets. Can Bitcoin surpass $94,000 this week and tilt the market in the bulls' favor?

Navigating Support and Resistance

The Battle of Support and Resistance

As Bitcoin ended the week with a doji candle, signaling buyer-seller indecision, the bulls are eyeing the $94,000 resistance level as their conquest. Beyond this, $101,000 looms as the next major hurdle, with sellers likely to intervene above $96,000. Further resistance zones lie at $104,000 and a range between $107,000 and $110,000. Support-wise, bulls aim to maintain $87,200 to avoid revisiting the $84,000 level. A broader support zone of $72,000 to $68,000 provides a safety net, with a potential fallback to the 0.618 Fibonacci retracement at $57,700. However, a dip to this level seems unlikely in the short term.

Short-term Momentum Check

Keeping Momentum Alive

The bulls enjoy a slight advantage in short-term momentum early this week. The Relative Strength Index (RSI) on the daily chart shows positive progress, bouncing off the 13 SMA support. Bulls hope the 13 SMA continues to support and pushes the RSI above 60 into bullish territory. Maintaining support levels before the FOMC meeting is critical. A surprise rate cut announcement could propel Bitcoin to higher levels, but any disappointment might jeopardize the $84,000 support.

Market Sentiment and Future Outlook

Setting the Tone

The market sentiment remains very bearish, with bulls struggling to sustain recent rallies. The bearish cross on the monthly MACD oscillator casts a shadow over December and likely into January. Bitcoin's price trajectory hinges on staying above the 100-week SMA at $84,700, amidst looming resistance at $110,000. A pullback from this level would confirm a lower high on the weekly chart, bolstering bearish sentiment.

Empowering You with Terminology

Decoding Crypto Jargon

- Bulls/Bullish: Optimistic investors anticipating price hikes.

- Bears/Bearish: Pessimistic sellers expecting price drops.

- Support/Resistance Levels: Key price levels dictating asset movements.

- SMA: Simple Moving Average, a price trend indicator.

- Fibonacci Retracements: Ratios guiding price corrections.

- Oscillators: Technical tools tracking price momentum.

- RSI and MACD: Popular oscillators aiding trend analysis.

Exciting times lie ahead for Bitcoin as bulls gear up for a potential breakout. Stay informed, stay engaged, and ride the crypto wave with confidence!

Frequently Asked Questions

Is gold a good IRA investment?

Any person looking to save money is well-served by gold. It can be used to diversify your portfolio. But there is more to gold than meets the eye.

It has been used as a currency throughout history and is still a popular method of payment. It is often called “the most ancient currency in the universe.”

But gold is mined from the earth, unlike paper currencies that governments create. That makes it very valuable because it's rare and hard to create.

The supply and demand factors determine how much gold is worth. When the economy is strong, people tend to spend more money, which means fewer people mine gold. Gold's value rises as a result.

On the flipside, people may save cash rather than spend it when the economy slows. This leads to more gold being produced which decreases its value.

This is why investing in gold makes sense for individuals and businesses. If you have gold to invest, you will reap the rewards when the economy expands.

You'll also earn interest on your investments, which helps you grow your wealth. Additionally, you won't lose cash if the gold price falls.

Can the government take your gold

The government cannot take your gold because you own it. You have earned it by working hard for it. It belongs to your. This rule could be broken by exceptions. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. Additionally, your precious metals may be forfeited if you owe the IRS taxes. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

Is it a good retirement strategy to buy gold?

Buying gold as an investment may not seem very appealing at first glance, but when you consider how much people spend on average on gold per year worldwide, it becomes worth considering.

Physical bullion bars are the most popular way to invest in gold. However, there are many other ways to invest in gold. It is best to research all options and make informed decisions based on your goals.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. If you need cash flow to finance your investment, then gold stocks could be a good option.

You can also put your money in exchange traded funds (ETFs). These funds allow you to be exposed to the price and value of gold by holding gold related securities. These ETFs often include stocks of gold miners, precious metals refiners, and commodity trading companies.

Is it a good idea to open a Precious Metal IRA

Precious metals are not insured. This is the most important fact to know before you open an IRA account. You cannot recover any money you have invested. This includes any loss of investments from theft, fire, flood or other circumstances.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items are timeless and have a lifetime value. You would probably get more if you sold them today than you paid when they were first created.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. You should also consider using a third party custodian to protect your assets and give you access at any time.

Do not open an account unless you're ready to retire. Don't forget the future!

How is gold taxed by Roth IRA?

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

You don't pay tax if you have the money in a traditional IRA/401k. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

The rules governing these accounts vary by state. Maryland is an example of this. You must withdraw your funds within 60 calendar days of turning 59 1/2. In Massachusetts, you can wait until April 1st. And in New York, you have until age 70 1/2 . To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

How Do You Make a Withdrawal from a Precious Metal IRA?

First, decide if it is possible to withdraw funds from an IRA. After that, you need to decide if you want to withdraw funds from an IRA account. Next, make sure you have enough money in order for you pay any fees or penalties.

You should open a taxable brokerage account if you're willing to pay a penalty if you withdraw early. If you decide to go with this option, you will need to take into account the taxes due on the amount you withdraw.

Next, you need to determine how much money is going to be taken out from your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. However, a debit card is better than a card. This will save you unnecessary fees.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. Some storage areas will accept bullion, while others require you to purchase individual coins. You'll have to weigh the pros of each option before you make a decision.

Bullion bars are easier to store than individual coins. You will need to count each coin individually. However, keeping individual coins in a separate place allows you to easily track their values.

Some people prefer to keep coins safe in a vault. Others prefer to place them in safe deposit boxes. Whichever method you choose, make sure you store your bullion safely so you can enjoy its benefits for years to come.

How much should I contribute to my Roth IRA account?

Roth IRAs allow you to deposit your money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. However, if you do decide to take out some of your contributions before then, there are specific rules you must follow. First, you cannot touch your principal (the original amount deposited). You cannot withdraw more than the original amount you contributed. If you decide to withdraw more money than what you contributed initially, you will need to pay taxes.

You cannot withhold your earnings from income taxes. You will pay income taxes when you withdraw your earnings. Let's take, for example, $5,000 in annual Roth IRA contributions. Let's further assume you earn $10,000 annually after contributing. Federal income taxes would apply to the earnings. You would be responsible for $3500 You would have $6,500 less. You can only take out what you originally contributed.

You would still owe tax on $1,500 if you took out $4,000 of your earnings. In addition, 50% of your earnings will be subject to tax again (half of 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types if Roth IRAs, Roth and Traditional. Traditional IRAs allow for pre-tax deductions from your taxable earnings. When you retire, you can use your traditional IRA to withdraw your contribution balance plus interest. A traditional IRA can be withdrawn up to the maximum amount allowed.

Roth IRAs are not allowed to allow you deductions for contributions. After you have retired, the full amount of your contributions and accrued interest can be withdrawn. There is no minimum withdrawal requirement, unlike traditional IRAs. You don’t have to wait for your turn 70 1/2 years before you can withdraw your contributions.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

bbb.org

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear in 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not exactly legal – WSJ

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

finance.yahoo.com

How To

Tips for Investing Gold

One of the most sought-after investment strategies is investing in gold. There are many benefits to investing in gold. There are many options for investing in gold. Some people prefer to buy gold coins in physical form, while others prefer to invest in gold ETFs.

Before you buy any type of gold, there are some things that you should think about.

- First, check to see if your country permits you to possess gold. If the answer is yes, you can go ahead. If not, you may want to consider purchasing gold from overseas.

- You should also know the type of gold coin that you desire. You have options: you can choose from yellow gold, white or rose gold.

- Thirdly, you should take into consideration the price of gold. It is best to begin small and work your ways up. You should diversify your portfolio when buying gold. You should invest in different assets such as stocks, bonds, real estate, mutual funds, and commodities.

- Don't forget to keep in mind that gold prices often change. You need to keep up with current trends.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]