Hey there, crypto enthusiasts! Today, we're diving into the world of Bitcoin mining stocks and the recent rollercoaster ride they've been on. Brace yourself as we explore the ups, downs, and everything in between!

The Bitcoin Mining Stock Rollercoaster

Market Turmoil Strikes Miners

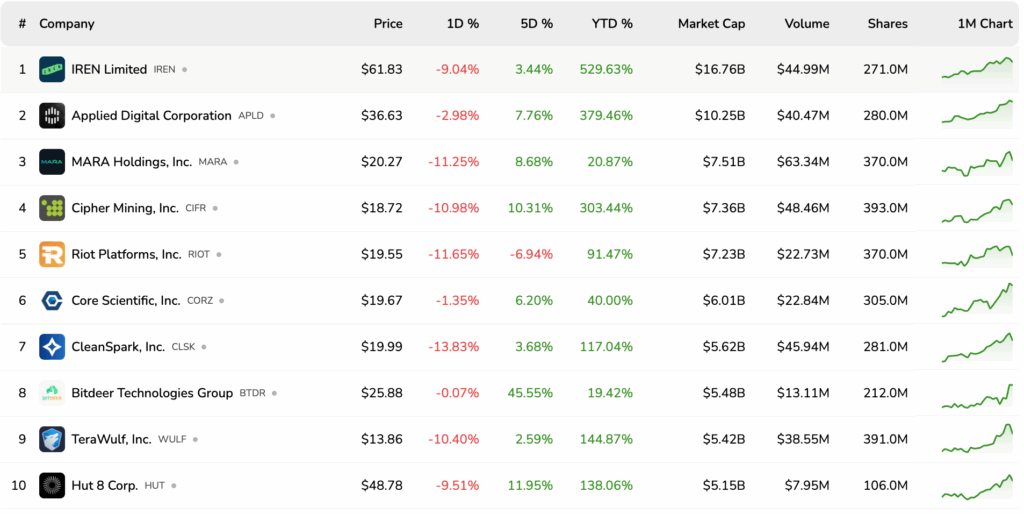

Picture this: Bitcoin mining stocks taking a hit as the market reacts to Bitcoin's downward spiral for the third day straight. Ouch! Big players like Bitfarms ($BITF) are down by a whopping 18%, while Riot Platforms ($RIOT) and Marathon Digital Holdings ($MARA) aren't faring much better with sharp drops of 10%–11%. Hut 8 and Strategy are also feeling the pinch with smaller declines. It's like a wild ride at the stock market theme park!

From Highs to Lows

Just when things were looking rosy for Bitcoin miners with soaring BTC prices and hash rates, the recent pullback has left them in the red. The momentum they've been riding high on for months seems to have hit a roadblock. But hey, it's not all doom and gloom! Despite the recent slump, many players in the Bitcoin mining sector are still enjoying green pastures, with stocks like Applied Digital and Cipher Mining making leaps and bounds over the past year.

The Impact on Bitcoin Mining Stocks

Bitcoin's Price Dance

Bitcoin's price movements are like the puppet master pulling the strings for Bitcoin mining stocks. Today, as Bitcoin took a dip to the $107,000 range, it sent ripples across the mining stock market, coloring it red. The recent price rollercoaster, with leveraged positions being liquidated left and right, has investors holding their breath to see if miners can weather the storm or if more turbulence lies ahead.

A Glimpse into the Future

Earlier this week, Bitcoin mining stocks were on cloud nine, with their combined market cap soaring above $90 billion. The future seemed bright until the recent slump. Bitdeer Technologies even stole the spotlight with a 30% surge, thanks to a significant increase in realized hashrate. Talk about a comeback!

Broader Market Woes

Crypto Stocks Take a Hit

It's not just Bitcoin mining stocks feeling the heat—crypto-related equities are also in the red zone. Players like Coinbase, Robinhood, and Strategy are witnessing price declines, mirroring the broader crypto market trend. The rollercoaster ride seems to be all-encompassing!

What Lies Ahead for Miners?

Adapting to Survive

Bitcoin miners are the backbone of the crypto world, validating transactions and earning rewards. Their fate swings with Bitcoin's price, mining efficiency, and energy costs. Lately, they've been exploring new horizons by venturing into AI and high-performance data services. It's all about evolving to thrive in the ever-changing crypto landscape!

So, fellow crypto adventurers, buckle up as we navigate the twists and turns of the Bitcoin mining stock saga. Stay informed, stay curious, and who knows, you might just strike virtual gold in this digital frontier!

Frequently Asked Questions

Who is the owner of the gold in a gold IRA

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Although gold can help to prevent inflation and price volatility, it's not sensible to have it if it's not going to be used.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

Consult a financial advisor or accountant to determine your options.

Is buying gold a good way to save money for retirement?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion bar is the best way to invest in precious metals. However, there are many other ways to invest in gold. It is best to research all options and make informed decisions based on your goals.

For example, purchasing shares of companies that extract gold or mining equipment might be a better option if you aren't looking for a safe place to store your wealth. If you require cash flow, gold stocks can work well.

ETFs are an exchange-traded investment that allows you to gain exposure to the market for gold. You hold gold-related securities and not actual gold. These ETFs typically include stocks from gold miners, precious metallics refiners, commodity trading companies, and other commodities.

How Much of Your IRA Should Be Made Up Of Precious Metals

It's important to understand that precious metals aren't only for wealthy people. You don't have to be rich to invest in them. You can actually make money without spending a lot on gold or silver investments.

You could also consider buying physical coins like bullion bars, rounds or bullion bars. Shares in precious metals-producing companies could be an option. Your retirement plan provider may offer an IRA rollingover program.

You'll still get the benefit of precious metals no matter which country you live in. These metals are not stocks, but they can still provide long-term growth.

Their prices are more volatile than traditional investments. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

How is gold taxed within a Roth IRA

An investment account's tax is calculated based on the current value of the account, and not on what you paid originally. If you invest $1,000 into a mutual fund, stock, or other investment account, then any gains are subjected tax.

If you place the money in a traditional IRA, 401(k), or other retirement plan, there is no tax when you take it out. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

These rules vary from one state to another. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. Massachusetts allows you to wait until April 1. New York offers a waiting period of up to 70 1/2 years. To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

What precious metal should I invest in?

This depends on what risk you are willing take and what kind of return you desire. Gold has been traditionally considered a haven investment, but it's not always the most profitable choice. If you are looking for quick profits, gold might not be the right investment. If patience and time are your priorities, silver is the best investment.

If you're not looking to make quick money, gold is probably your best choice. If you want to invest in long-term, steady returns, silver is a better choice.

Can the government seize your gold?

Your gold is yours and the government cannot take it. You have earned it by working hard for it. It belongs to you. This rule could be broken by exceptions. If you are convicted of fraud against the federal government, your gold can be forfeit. Your precious metals can also be lost if you owe tax to the IRS. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

Statistics

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts