Bitcoin's corporate treasuries and the bitcoin mining sector have been stealing the spotlight in this market cycle. From (Micro)Strategy's billion-dollar Bitcoin buys to the emergence of MetaPlanet and the rapid growth of bitcoin mining companies, institutional and industrial adoption are playing a crucial role in supporting the network. However, we're now at a turning point where the data hints at a potential shift. This moment could determine whether Bitcoin's corporate treasuries and mining stocks will maintain their lead or start to fall behind in the upcoming phase of the cycle.

Bitcoin Treasury Accumulation

The Rise of Bitcoin in Corporate Treasuries

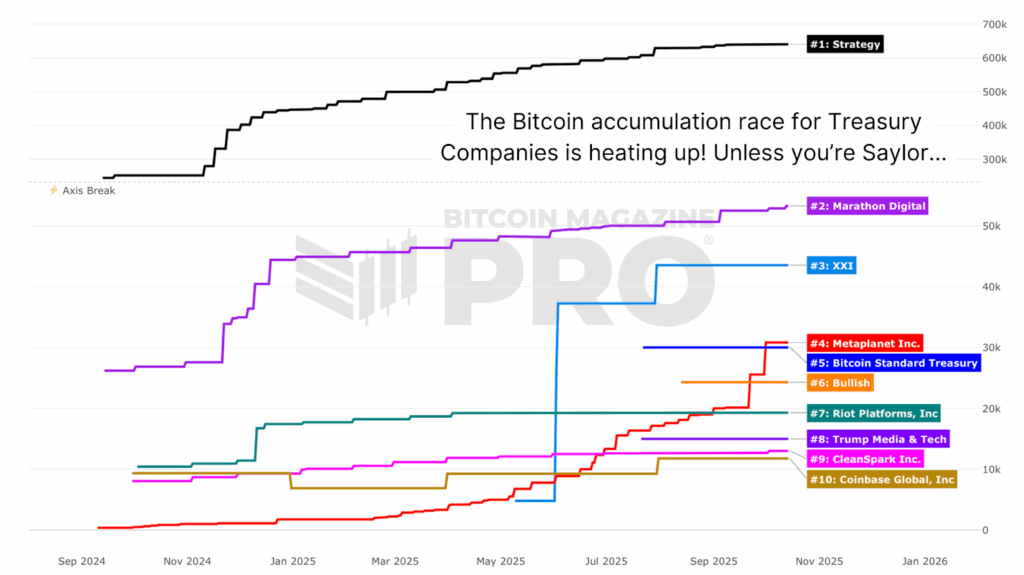

Our brand-new Bitcoin Treasury Tracker offers daily insights into the Bitcoin holdings of major public and private treasury companies, showcasing their accumulation trends and evolving positions. These treasuries now collectively hold over 1 million BTC, which is more than 5% of the total circulating supply.

Valuation Compression Across Bitcoin Treasuries

Understanding the Impact on Equity Valuations

(Micro)Strategy / MSTR, a trailblazer in corporate Bitcoin adoption, holds the largest publicly traded Bitcoin stash. However, recent months have seen its stock underperform compared to Bitcoin's price movements. This underperformance has led to a closer alignment of its Net Asset Value (NAV) Premium to parity at 1.0x.

The Shift in Market Perception

This parity indicates that investors are now valuing the company almost solely based on its Bitcoin exposure, with little premium for other factors like management decisions or strategic planning. The move towards parity signals a decrease in speculative interest and mirrors previous market behaviors during late-stage expansions.

A Pivotal Moment for Bitcoin and Bitcoin Mining Stocks

The BTCUSD to MSTR Ratio Revealed

The BTCUSD to MSTR ratio, showing how many MSTR shares can be bought with one Bitcoin, is currently a critical indicator. Breaking above 380-400 would suggest renewed Bitcoin dominance and potential MSTR underperformance. On the other hand, a drop below 330 could signal MSTR's resurgence as a leader leveraging into the next phase of the bull market.

Bitcoin Mining Stocks Taking the Lead

While corporate treasuries lag, Bitcoin miners are thriving. In the last six months, Bitcoin has grown by 38%, whereas Listed Miner equities have skyrocketed: Marathon Digital (MARA) rose by 61%, Riot Platforms (RIOT) surged by 231%, and Hive Digital (HIVE) soared by a whopping 369%. The WGMI Bitcoin Mining ETF, comprising major listed miners, has outperformed Bitcoin by about 75% since September, showcasing the sector's newfound momentum.

Bitcoin Mining Stocks and Corporate Treasuries: Different Paths in Market Leadership

The Shifting Landscape

With more than 1 million BTC held in corporate treasuries, these entities significantly impact Bitcoin's supply-demand dynamics. Yet, the balance of power seems to be changing. Treasuries like (Micro)Strategy and MetaPlanet, while bullish in the long run, are struggling to outperform spot BTC. In contrast, miners are enjoying a period of strong relative performance, often signaling broader market momentum to come.

At Bitcoin Magazine Pro, we aim to provide data-driven insights across the Bitcoin ecosystem, cutting through the noise and offering valuable perspectives on corporate holdings, miner trends, on-chain dynamics, and macroeconomic factors. Thank you for reading, and stay tuned for more!

CFTC

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement account

How To

Tips for Investing In Gold

Investing in Gold remains one of the most preferred investment strategies. Because investing in gold has many benefits. There are many ways to invest gold. Some people choose to purchase gold coins physically, while some prefer to invest with gold ETFs.

You should consider some things before you decide to purchase any type of gold.

- First, make sure you check if your country allows you own gold. If it is, you can move on. If not, you may want to consider purchasing gold from overseas.

- You should also know the type of gold coin that you desire. You can choose between yellow gold and white gold as well as rose gold.

- Thirdly, it is important to take into account the gold price. It is best to begin small and work your ways up. One thing that you should never forget when purchasing gold is to diversify your portfolio. Diversifying your portfolio includes stocks, bonds, mutual funds, real estate, commodities, and mutual funds.

- You should also remember that gold prices can change often. Keep an eye on current trends.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]