Hey there, crypto enthusiasts! The recent fluctuations in Bitcoin prices have sparked debates about whether it’s a temporary dip or the beginning of a new bear market. As an avid follower of the cryptocurrency market, I'm here to break down the current scenario and provide insights to guide your next move.

Is It Wise to "Buy The Dip" in the Bitcoin Market?

When it comes to buying the dip in Bitcoin, it's crucial to tread carefully, especially in uncertain times. Jumping on every price drop might not be the best strategy, especially in a bearish environment. Bear markets often disguise attractive dips that can lead to even lower prices. Keeping a close eye on market data and trends is key to making informed decisions rather than gambling on a market bottom.

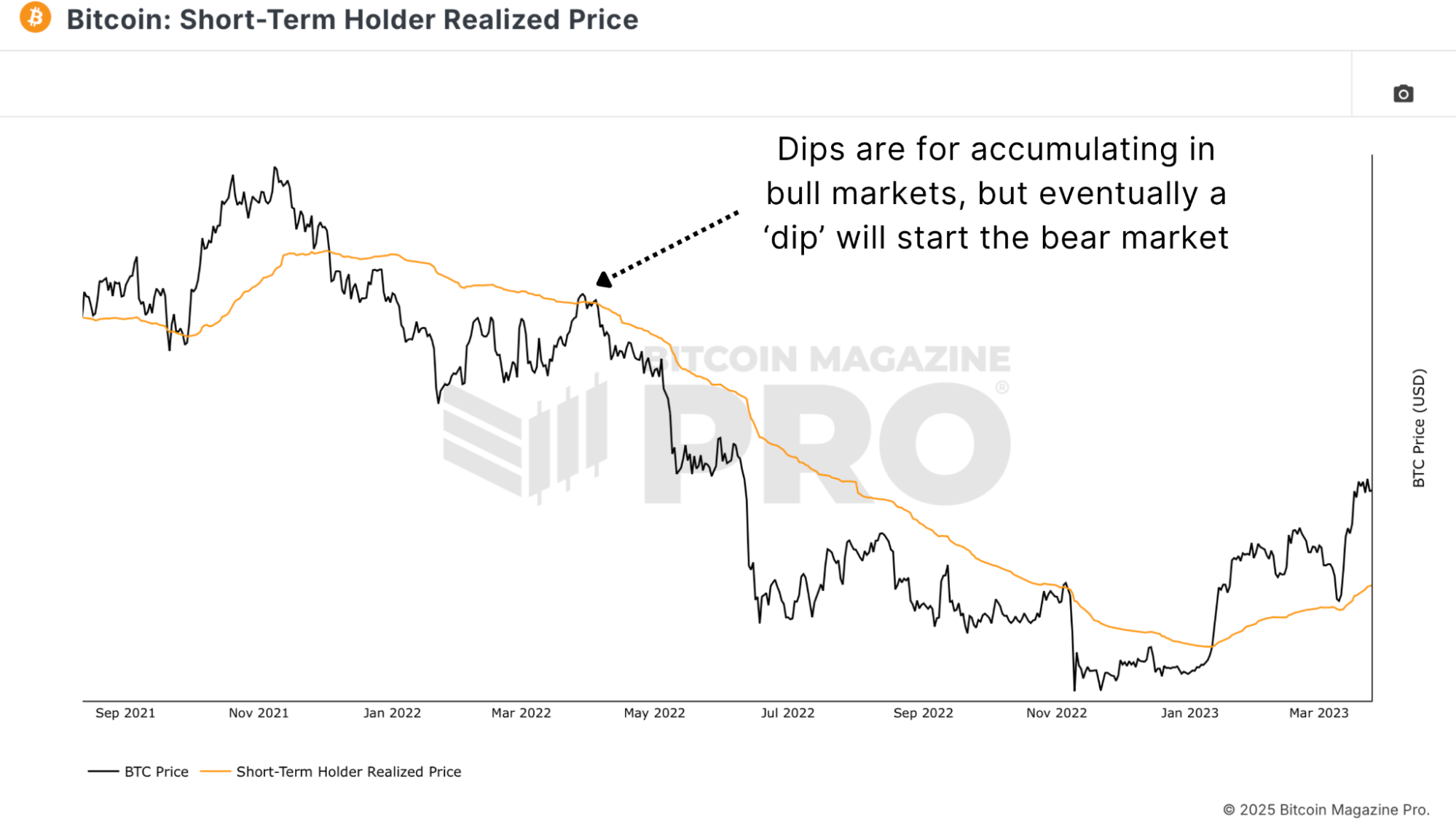

Understanding Short-Term Holder Realized Price Trends

Examining the Short-Term Holder Realized Price chart from previous cycles reveals a pattern of multiple dips before hitting rock bottom. This metric acts as a critical resistance level, signaling recovery only after reclaiming certain price thresholds.

Key Bitcoin Price Levels You Should Monitor

Analyzing metrics like the MVRV Z-Score and Bitcoin Realized Price can provide insights into the market's cost basis. The mid-$50,000 range is currently a focal point, with historical data indicating potential accumulation opportunities when prices align with certain metrics.

Spotting Accumulation Points with the 200-Week Moving Average

The 200-Week Moving Average also points to potential accumulation zones around $55,000, with daily fluctuations influencing possible bottoming levels. Understanding the historical cost of the network and key buy support levels is crucial in identifying value zones.

Deciphering Supply & Demand Signals in Bitcoin Prices

Metrics like the Value Days Destroyed (VDD) Multiple shed light on stress points among long-term holders. The market sentiment can be gauged by observing how experienced players are moving their coins. Monitoring Long-Term Holder Supply trends can offer valuable insights into market bottoms.

Reading Bitcoin Funding Rates for Market Sentiment

Market sentiment can be reflected in Bitcoin funding rates, indicating periods of fear or capitulation. The absence of significant panic selling and shorting suggests that the market may not have fully reset yet, requiring more time to stabilize.

Reclaiming Structural Levels to Counter the Bearish Case

To shift away from a bearish outlook, Bitcoin needs to reclaim key structural levels, including psychological zones like $100,000 and moving averages. Sustained price movements above these levels, along with global market trends, could signal a potential trend reversal.

Final Thoughts on Bitcoin Price Movement

While Bitcoin's long-term fundamentals remain robust, the current market structure leans towards caution. It's advisable not to rush into buying every dip, instead waiting for market confluence and clear signals before making significant moves. Remember, the goal is to position yourself strategically rather than aiming for perfect market timing.

For a deeper dive into this topic, feel free to check out our latest YouTube video: My Bitcoin Strategy Going Forward

Frequently Asked Questions

How much is gold taxed under a Roth IRA

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

However, if the money is deposited into a traditional IRA/401(k), the tax on the withdrawal of the money is not applicable. Taxes are only charged on capital gains or dividends earned, which only apply to investments longer than one calendar year.

These accounts are subject to different rules depending on where you live. For example, in Maryland, you must take withdrawals within 60 days after reaching age 59 1/2 . Massachusetts allows you to wait until April 1. New York allows you to wait until age 70 1/2. To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

Should You Open a Precious Metal IRA?

You should be aware that precious metals cannot be covered by insurance. There are no ways to recover the money you lost in an investment. All your investments can be lost due to theft, fire or flood.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These items can be lost because they have real value and have been around for thousands years. They are likely to fetch more today than the price you paid for them in their original form.

If you decide to open an IRA account, choose a reputable company that offers competitive rates and products. It is also a smart idea to use a third-party trustee who will help you have access to your assets at all times.

If you decide to open an account, remember that you won't see any returns until after you retire. Keep your eyes open for the future.

How much of your IRA should include precious metals?

It is important to remember that precious metals can be a good investment for anyone. They don't require you to be wealthy to invest in them. In fact, there are many ways to make money from gold and silver investments without spending much money.

You might also be interested in buying physical coins, such bullion rounds or bars. Also, you could buy shares in companies producing precious metals. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You will still reap the benefits of owning precious metals, regardless of which option you choose. Even though they aren't stocks, they still offer the possibility of long-term growth.

Their prices are more volatile than traditional investments. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

Who has the gold in a IRA gold?

The IRS considers any individual who holds gold “a form of income” that is subject to taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

Consult a financial advisor or accountant to determine your options.

What precious metals can you invest in for retirement?

Silver and gold are two of the most valuable precious metals. Both can be easily bought and sold, and have been around since forever. They are a great way to diversify your portfolio.

Gold: This is the oldest form of currency that man has ever known. It is also extremely safe and stable. This makes it a good option to preserve wealth in uncertain times.

Silver: Silver has always been popular among investors. It's a great option for those who want stability. Silver tends instead to go up than down, which is unlike gold.

Platinium is another precious metal that is becoming increasingly popular. It's durable and resists corrosion, just like gold and silver. It is however more expensive than its counterparts.

Rhodium – Rhodium is used to make catalytic conversions. It is also used as a jewelry material. It's also relatively inexpensive compared to other precious metals.

Palladium: Palladium is similar to platinum, but it's less rare. It is also cheaper. It is a preferred choice among investors who are looking to add precious materials to their portfolios.

How Do You Make a Withdrawal from a Precious Metal IRA?

First, you must decide if you wish to withdraw money from your IRA account. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

An IRA is not the best option if you don't mind paying a penalty for early withdrawal. Instead, open a taxable brokerage. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, you need to determine how much money is going to be taken out from your IRA. The calculation is influenced by several factors such as your age at withdrawal, the length of time you have owned the account and whether or not you plan to continue contributing to retirement plans.

Once you have an idea of the amount of your total savings you wish to convert into cash you will need to decide what type of IRA you want. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

Once you have completed these calculations, you need to open your brokerage account. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. To avoid unnecessary fees, however, try opening an account using a debit card rather than a credit card.

When it comes time to withdraw your precious metal IRA funds, you will need a safe location where you can keep your coins. Some storage facilities will accept bullion bars, others require you to buy individual coins. Either way, you'll need to weigh the pros and cons of each before choosing one.

Bullion bars are easier to store than individual coins. You will need to count each coin individually. You can track their value by keeping individual coins.

Some people prefer to keep their coins in a vault. Others prefer to store their coins in a vault. Regardless of the method you prefer, ensure that your bullion is safe so that you can continue to enjoy its benefits for many years.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)