As we step into 2025, investors in the Bitcoin market are closely examining historical data and seasonal patterns to anticipate the performance in February. Given Bitcoin's cyclical nature, especially linked to its halving events, analyzing past trends can offer valuable insights into what to expect in the upcoming month. By delving into historical data, including average monthly returns and February performance post-halving events, we aim to paint a clear picture of what February 2025 might entail.

Deciphering Bitcoin's Seasonal Behavior

Exploring the chart titled "Bitcoin Seasonality," which tracks average monthly returns from 2010 to the most recent monthly close, sheds light on Bitcoin's performance trends and cyclicality. February has historically boasted an average return of 13.62%, positioning it as one of Bitcoin's stronger months performance-wise.

Interestingly, November emerges as the top-performing month with the highest average return at 43.74%, followed by October at 19.46%. Conversely, September has typically been the least performing month with an average return of -1.83%. Given February's robust historical average, it stands among the favorable months for Bitcoin investors, hinting at positive returns in the early months of 2025.

Analyzing February Performance in Post-Halving Years

A deeper analysis of Bitcoin's historical February returns in years following halving events uncovers compelling insights. Bitcoin's halving, occurring approximately every four years, halves block rewards, leading to a supply shock historically resulting in price surges. February's performance in these post-halving years has consistently been optimistic:

- 2013 (Post-2012 Halving): 62.71%

- 2017 (Post-2016 Halving): 22.71%

- 2021 (Post-2020 Halving): 36.80%

Collectively, these three years showcase an impressive average return of 40.74%. Each February in these post-halving periods reflects the bullish momentum typically observed after halving events due to reduced Bitcoin supply issuance and heightened market demand.

Setting the Stage with January 2025 Performance

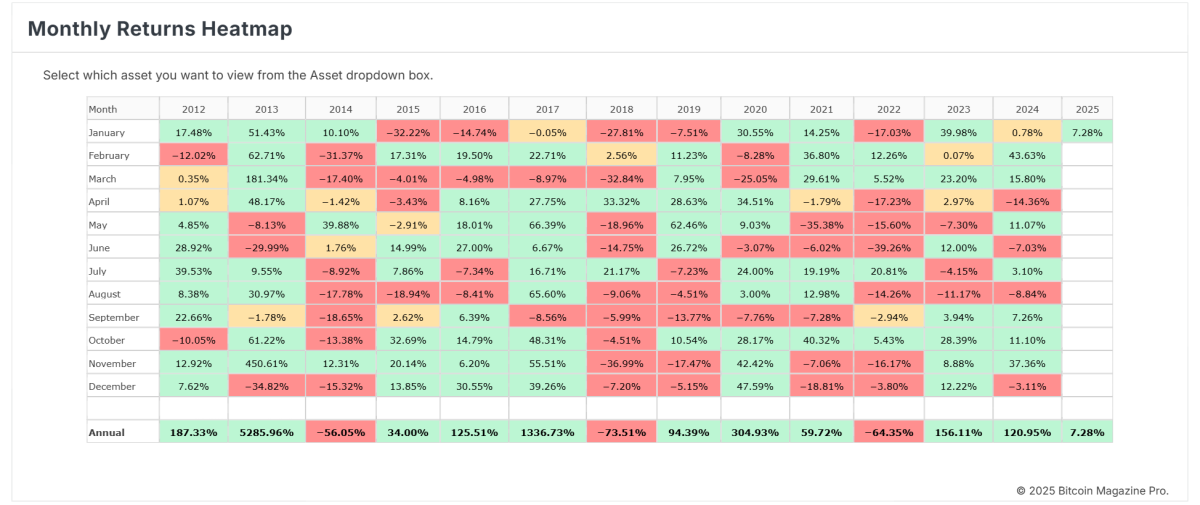

Though February 2025 is yet to unfold, the year commenced with a modest 7.28% return as of January, as depicted in the "Monthly Returns Heatmap." January's positive performance hints at a continuation of bullish sentiment in early 2025, aligning with historical post-halving trends. If February 2025 mirrors past post-halving years' trajectory, investors could anticipate returns ranging from 22% to 63%, with an average expectation of around 40%.

Factors Driving Strong Post-Halving February Performance

Several factors contribute to February's historical robust performance in post-halving years:

- Supply Shock: Halving reduces new Bitcoin supply, enhancing scarcity and fueling price appreciation.

- Market Momentum: Investors respond energetically to halving events, propelling prices upwards in the ensuing months.

- Institutional Interest: Recent cycles have witnessed accelerated institutional adoption post-halving, injecting significant capital into the market.

Key Insights for February 2025

Approaching February 2025 with cautious optimism is advisable for investors. Historical and seasonal data indicate strong potential for positive returns in the month, especially considering Bitcoin's post-halving cycles. With an average return of 40.74% in past post-halving Februarys, investors may anticipate a similar performance this year, barring any substantial macroeconomic or regulatory challenges.

Summing Up

Bitcoin's history serves as a valuable guide for predicting its future performance. February 2025 appears poised for a positive trajectory, driven by the familiar dynamics following halving events that historically led to substantial gains. By amalgamating historical performance data with a favorable regulatory landscape, the incoming pro-Bitcoin administration, and significant industry developments such as the new accounting guideline (ASU 2023-08), 2025 holds promise as a transformative year for Bitcoin. Investors are advised to combine these insights with comprehensive market analysis and brace for Bitcoin's inherent volatility.

By leveraging historical lessons and seasonal patterns, Bitcoin investors can make well-informed decisions as they navigate this pivotal year in the market.

Frequently Asked Questions

How does a Gold IRA account work?

For people who are looking to invest in precious materials, Gold Ira account accounts provide tax-free investments.

You can purchase gold bullion coins in physical form at any moment. You don't have to wait until retirement to start investing in gold.

You can keep gold in an IRA forever. Your gold holdings will not be subject to tax when you are gone.

Your gold will be passed on to your heirs, without you having to pay capital gains taxes. And because your gold remains outside of the estate, you aren't required to include it in your final estate report.

You'll first have to set up an individual retirement account (IRA) to open a gold IRA. After you have done this, an IRA custodian will be assigned to you. This company acts as a middleman between you and the IRS.

Your gold IRA custody will take care of the paperwork and send the forms to IRS. This includes filing annual returns.

Once you've set up your gold IRA, it's possible to buy gold bullion. The minimum deposit is $1,000. However, you'll receive a higher interest rate if you put in more.

You will pay taxes when you withdraw your gold from your IRA. If you're withdrawing the entire balance, you'll owe income taxes plus a 10 percent penalty.

Even if your contribution is small, you might not have to pay any taxes. However, there are exceptions. There are some exceptions. For instance, if you take out 30% or more from your total IRA assets, federal income taxes will apply plus a 20 percent penalty.

It's best not to take out more 50% of your total IRA investments each year. You could end up with severe financial consequences.

What is a Precious Metal IRA and How Can You Benefit From It?

A precious metal IRA allows you to diversify your retirement savings into gold, silver, platinum, palladium, rhodium, iridium, osmium, and other rare metals. These precious metals are extremely rare and valuable. These are good investments for your cash and will help you protect yourself from economic instability and inflation.

Precious metals are often referred to as “bullion.” Bullion refers only to the actual metal.

Bullion can be bought through many channels, including online retailers, large coins dealers, and some grocery shops.

With a precious metal IRA, you invest in bullion directly rather than purchasing shares of stock. This ensures that you will receive dividends each and every year.

Precious metal IRAs do not require paperwork nor annual fees, unlike regular IRAs. Instead, your gains are subject to a small tax. Plus, you can access your funds whenever you like.

Should You Buy or Sell Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

Experts think this could change quickly. They believe gold prices could increase dramatically if there is another global financial crises.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- First, consider whether or not you need the money you're saving for retirement. It's possible to save for retirement without putting your savings into gold. However, when you retire at age 65, gold can provide additional protection.

- Second, be sure to understand your obligations before you purchase gold. Each offer varying degrees of security and flexibility.

- Finally, remember that gold doesn't offer the same level of safety as a bank account. It is possible to lose your gold coins.

If you are thinking of buying gold, do your research. Protect your gold if you already have it.

How much tax is gold subject to in an IRA

The tax on the sale of gold is based on its fair market value when sold. When you purchase gold, you don't have to pay any taxes. It's not considered income. If you sell it later you will have a taxable profit if the price goes down.

For loans, gold can be used to collateral. Lenders look for the highest return when you borrow against assets. Selling gold is usually the best option. The lender might not do this. They may just keep it. Or, they may decide to resell the item themselves. The bottom line is that you could lose potential profit in any case.

To avoid losing money, only lend against gold if you intend to use it for collateral. Otherwise, it's better to leave it alone.

Can I buy Gold with my Self-Directed IRA?

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. You can also transfer funds from another retirement account if you already have one.

Individuals can contribute as much as $5,500 per year ($6,500 if married filing jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contracts can be described as financial instruments that are determined by the gold price. These contracts allow you to speculate on future gold prices without actually owning it. You can only hold physical bullion, which is real silver and gold bars.

Is physical gold allowed in an IRA.

Not just paper money or coins, gold is money. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Today, investors use gold as part of a diversified portfolio because gold tends to do better during financial turmoil.

Many Americans today prefer to invest in precious metals, such as silver and gold, over stocks and bonds. Although owning gold does not guarantee that you will make money investing in it, there are many reasons to consider adding gold into your retirement portfolio.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

One of the best things about investing in gold is its virtually zero counterparty risk. Your shares will still be yours even if your stock portfolio drops. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Gold provides liquidity. This means that you can sell gold anytime, regardless of whether or not another buyer is available. You can buy gold in small amounts because it is so liquid. This allows you to take advantage of short-term fluctuations in the gold market.

How can I withdraw from a Precious metal IRA?

First, determine if you would like to withdraw money directly from an IRA. Make sure you have enough cash in your account to cover any fees, penalties, or charges that may be associated with withdrawing money from an IRA.

If you are willing to pay a penalty for early withdrawal, you should consider opening a taxable brokerage account instead of an IRA. You will also have to account for taxes due on any amount you withdraw if you choose this option.

Next, determine how much money you plan to withdraw from your IRA. This calculation is affected by many factors, such as the age at which you withdraw the money, the amount of time the account has been owned, and whether your plans to continue contributing to your retirement fund.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. Traditional IRAs permit you to withdraw your funds tax-free once you turn 59 1/2. Roth IRAs have income taxes upfront, but you can access the earnings later on without paying additional taxes.

Finally, you'll need to open a brokerage account once these calculations are completed. A majority of brokers offer free signup bonuses, as well as other promotions, to get people to open accounts. Avoid unnecessary fees by opening an account with your debit card, rather than your credit card.

When it's time to make withdrawals from your precious-metal IRA, you'll need a place to keep your coins safe. Some storage facilities can accept bullion bar, while others require you buy individual coins. Before you choose one, weigh the pros and cons.

Because you don't have to store individual coins, bullion bars take up less space than other items. However, each coin will need to be counted individually. You can track their value by keeping individual coins.

Some people prefer to keep coins safe in a vault. Some people prefer to store their coins safely in a vault. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

External Links

investopedia.com

- Do You Need a Gold IRA to Get Retirement?

- What are the Options? Types, Spreads. Example. And Risk Metrics

irs.gov

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement accounts

finance.yahoo.com

How To

The History of Gold as an Asset

From the beginning of history, gold was a popular currency. It was accepted worldwide and became popular due to its durability, purity, divisibility, uniformity, scarcity, and beauty. Aside from its inherent value, it could be traded internationally. Different weights and measurements existed around the world, however, because there were not international standards to measure gold. For example, in England, one pound sterling was equal to 24 carats of silver; in France, one livre tournois was equal to 25 carats of gold; in Germany, one mark was equal to 28 carats of gold; etc.

The United States started issuing American coins in the 1860s made of 90% copper and 10% zinc. This led to a decrease of demand for foreign currencies which in turn caused their prices to rise. In this period, large amounts of gold coin were minted by the United States, which caused the gold price to drop. The U.S. government needed to find a solution to their debt because there was too much money in circulation. To do so, they decided to sell some of the excess gold back to Europe.

Many European countries didn't trust the U.S. dollars and started to accept gold for payment. After World War I, however, many European countries started using paper money to replace gold. Since then, the price of gold has increased significantly. Today, although the price fluctuates, gold remains one of the safest investments you can make.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]