After experiencing a significant sell-off over several weeks, with Bitcoin dropping from over $100,000 to below $80,000, traders are now questioning whether the recent price bounce signifies the return of the Bitcoin bull market or if it is just a temporary rally in a bear market before the next significant upward movement.

Bitcoin’s Recent Performance: Bottoming Out or Pausing the Bull Run?

Despite the deep correction that shook investor confidence, Bitcoin's price correction was not substantial enough to disrupt the overall trend structure. The price appears to have established a local bottom within the $76K–$77K range, and various reliable indicators are beginning to confirm these local lows, indicating a potential upward trajectory.

Key Metrics Supporting Bullish Sentiment

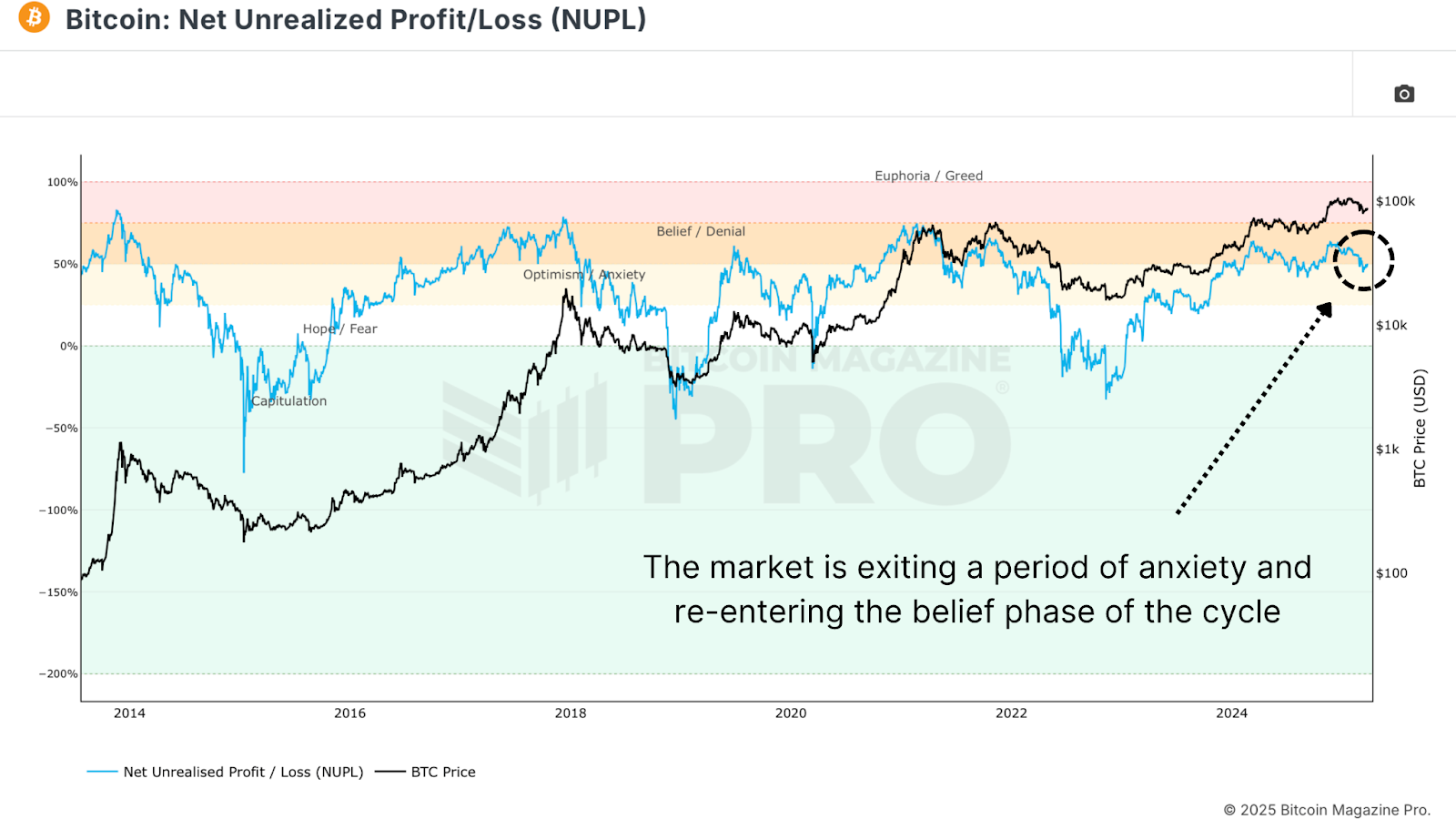

One of the most trusted sentiment indicators for Bitcoin, the Net Unrealized Profit and Loss (NUPL), plunged into the "Anxiety" zone as prices fell. However, following the recent rebound, the NUPL has now re-entered the "Belief" zone, historically associated with higher lows in the market.

The Value Days Destroyed (VDD) Multiple, which analyzes BTC spending based on coin age and transaction size compared to previous averages, currently shows low readings. This suggests that significant, older coins are not being actively traded, indicating strong conviction among long-term investors. Similar patterns have preceded major price rallies in previous bull cycles.

Long-Term Holders Driving Bullish Sentiment

Long-term holders of Bitcoin are now increasing their holdings after taking profits above $100,000. This accumulation phase by experienced participants often leads to supply shortages and subsequent rapid price increases in the market.

Positive Signals from Bitcoin Hash Ribbons

The Hash Ribbons Indicator recently signaled a bullish crossover, indicating a short-term hash rate trend surpassing the long-term average. Historically, this crossover aligns with market bottoms and trend reversals. The current positive trend suggests that miners are optimistic about future price increases.

Bitcoin's Relationship with Stock Markets

Despite positive on-chain data, Bitcoin's performance remains closely linked to broader liquidity trends and equity markets, particularly the S&P 500. As long as this correlation persists, Bitcoin's price movements will be influenced by global monetary policies, risk sentiments, and liquidity flows.

Future Outlook for Bitcoin's Bull Market

Based on data-driven analysis, Bitcoin appears well-positioned for a sustained bullish cycle. On-chain metrics indicate a robust market outlook, with key indicators such as NUPL and VDD signaling strong investor confidence. Additionally, the recent accumulation by long-term holders and the positive Hash Ribbons crossover point towards a potential supply squeeze and subsequent price surge.

While the data supports a positive outlook, external factors such as global economic conditions will also play a crucial role in shaping Bitcoin's future performance. Traders should exercise caution and patience as the market continues to evolve and build momentum towards higher price levels.

For more detailed analysis and real-time insights, consider exploring Bitcoin Magazine Pro for comprehensive coverage of the Bitcoin market.

Disclaimer: This article provides information for educational purposes only and should not be considered financial advice. It is essential to conduct thorough research before making any investment decisions.

Frequently Asked Questions

What Should Your IRA Include in Precious Metals?

Protecting yourself from inflation is best done by investing in precious metals such silver and gold. It's not just a way to save money for retirement.

The prices of gold and silver have increased substantially over the past few decades, but they remain safe investments because they do not fluctuate as frequently as stocks. These materials are always in demand.

Gold and silver prices are usually stable and predictable. They are most likely to rise when the economy grows and fall during recessions. This makes them very valuable money-savers and long term investments.

You should invest 10 percent of your total portfolio into precious metals. This percentage can be increased if your portfolio is more diverse.

Should You Open a Precious Metal IRA?

It all depends on your investment goals and risk tolerance.

If you plan to use the money for retirement, you should open an account now.

It is likely that precious metals will appreciate over the long-term. They can also be used to diversify.

In addition, gold and silver prices tend to move together. This makes them a better choice when investing in both assets.

You should not invest in precious-metal IRAs if it is not your intention to use your money for retirement, or if you are unwilling to take any risks.

How can I choose an IRA?

Understanding your account type is the first step to finding the best IRA. This includes whether your goal is to open a Roth IRA (or a traditional IRA). Also, you should know how much money is available for investment.

Next is deciding which provider best suits your needs. Some providers offer both accounts, while others specialize in just one type.

Last, consider the fees associated to each option. Fees can vary greatly between providers, and may include annual maintenance charges and other fees. Some providers charge a monthly cost based on how many shares you own. Others only charge once per quarter.

What is the cost of gold IRA fees

An average annual fee for an individual retirement plan (IRA) is $1,000. There are many types to choose from, such as Roth, SEP, SIMPLE, traditional and Roth IRAs. Each type has its own set requirements and rules. If you don't have tax-deferred investments, then earnings may need to be taxed. Consider how long you will keep the money. If you plan on holding onto your funds for longer, you'll likely save more money by opening a Traditional IRA rather than a Roth IRA.

Traditional IRAs allow you to contribute up $5,500 annually ($6,500 if 50+). The Roth IRA allows unlimited contributions each year. The difference is that a traditional IRA allows you to withdraw your money without having to pay taxes. A Roth IRA will entail taxes for any withdrawals.

Can you hold precious metals in an IRA?

The answer to that question will depend on whether the IRA owner plans to diversify his holdings to gold and/or keep them safekeeping.

If he does want to diversify, then there are two options available to him. He could either buy bars of physical gold and/or sterling from a dealer or simply sell these items back at the end. But, what if he doesn't want to sell his precious metal investments? He should keep them, as they are perfectly safe to be stored in an IRA account.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

External Links

takemetothesite.com

investopedia.com

regalassets.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

How to Buy Gold For Your Gold IRA

Precious metal is a term used to describe gold, silver, platinum, palladium, rhodium, iridium, osmium, ruthenium, rhenium, and others. It's any element naturally occurring with atomic numbers 79 to 110 (excluding helium), that is valued for its rarity or beauty. Gold and silver are the most popular precious metals. Precious metallics are frequently used as jewelry, money and industrial goods.

Gold prices fluctuate daily because of supply and demande. As investors seek safety from unstable economies, there has been an increase in demand for precious metals in the last decade. This increased demand has caused prices to rise significantly. Some are concerned about the increased cost of production and have resisted investing in precious materials.

Because it is rare and long-lasting, gold makes a great investment. Unlike many investments, gold never loses value. You can also buy and sell gold, without having to pay taxes. There are two methods to invest gold. You have two options: you can buy gold bars and coins, or you can invest in futures contracts.

The physical gold bars and coins provide immediate liquidity. They are easy to trade and keep. But they don't offer much protection against inflation. To protect yourself from rising gold prices, you can consider buying gold bullion. Bullion is physical gold, which comes in many sizes and shapes. One-ounce pieces are available for billions, while larger quantities such as kilobars and tens of thousands can be purchased. Bullion is normally stored in vaults that are fire- and theft-resistant.

Buy gold futures to own shares and not actual gold. Futures let you speculate about how gold's price might change. You can expose yourself to the price of gold by buying gold futures without having to own the physical commodity.

A gold contract could be purchased if you wanted to speculate on the future price of gold. My position when the contract expires is either “long”, or “short”. A long contract means I believe the gold price will rise, so I am willing to hand over money now in return for the promise of more money when the contract expires. A shorter contract will mean that I expect the price to fall. I'm willing and able to take the money now, in return for the promise that I will make less money later.

I'll get the contract's specified amount of gold plus interest when it expires. This way I have exposure to the gold's price without having to actually hold it.

Precious metals are a great investment as they are hard to counterfeit. While paper currencies can be easily counterfeited by printing new bills, precious metals cannot. It is because precious metals are hardier than paper currencies that they can be counterfeited by printing new bills.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]