Japan is sitting on a massive pile of $14.9 trillion in household financial assets. However, its fixed income market is offering some of the lowest returns globally. The 10-year Japanese Government Bond barely yields ~1%, and corporate bonds struggle to surpass 2%. This has left pension funds, insurers, and banks stuck in low-return investments due to the absence of better alternatives.

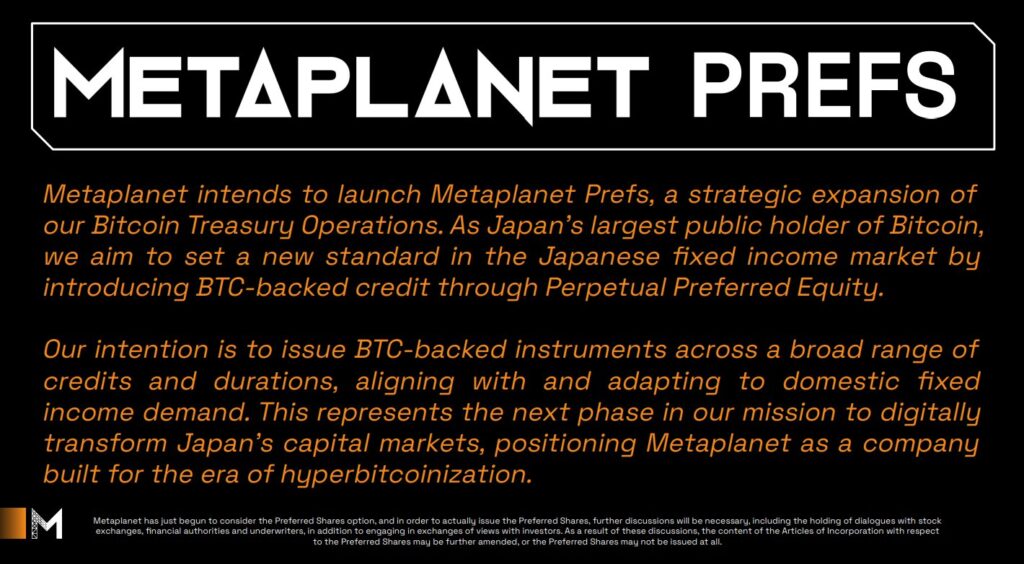

In response to this dire situation, Metaplanet has made a bold move in Q2. The company introduced:

- "Metaplanet Prefs" — a groundbreaking program of Bitcoin-Backed Preferred Shares aimed at expanding its Bitcoin treasury operations.

- A strategic initiative to establish a Bitcoin-backed yield curve in Japan’s fixed income market.

In a market where "high yield" usually means low single-digit returns, a well-designed Bitcoin-Backed Preferred Share offering 7–12% could attract significant attention—and capital.

Record Q2 Growth Fuels Bitcoin-Backed Preferred Share Strategy

Metaplanet’s Q2 wasn’t just about unveiling a new funding model—it marked one of the company’s most successful quarters. Revenue and profitability soared, while assets and net assets skyrocketed, showcasing the company's vast scale.

Metaplanet Q2 Earnings Results:

- Revenue: ¥1.239B ($8.4M) +41% QoQ

- Gross Profit: ¥816M ($5.5M) +38% QoQ

- Ordinary Profit: ¥17.4B ($117.8M) vs. -¥6.9B

- Net Income: ¥11.1B ($75.1M) vs. -¥5.0B

- Assets: ¥238.2B ($1.61B) +333% QoQ

- Net Assets: ¥201.0B ($1.36B) +299% QoQ

This remarkable financial growth enhances Metaplanet’s credibility with investors, paving the way for the widespread adoption of Bitcoin-Backed Preferred Shares to tap into Japan’s huge yet yield-deprived fixed income market.

BTC-Backed Preferred Equity: How ‘Metaplanet Prefs’ Will Work

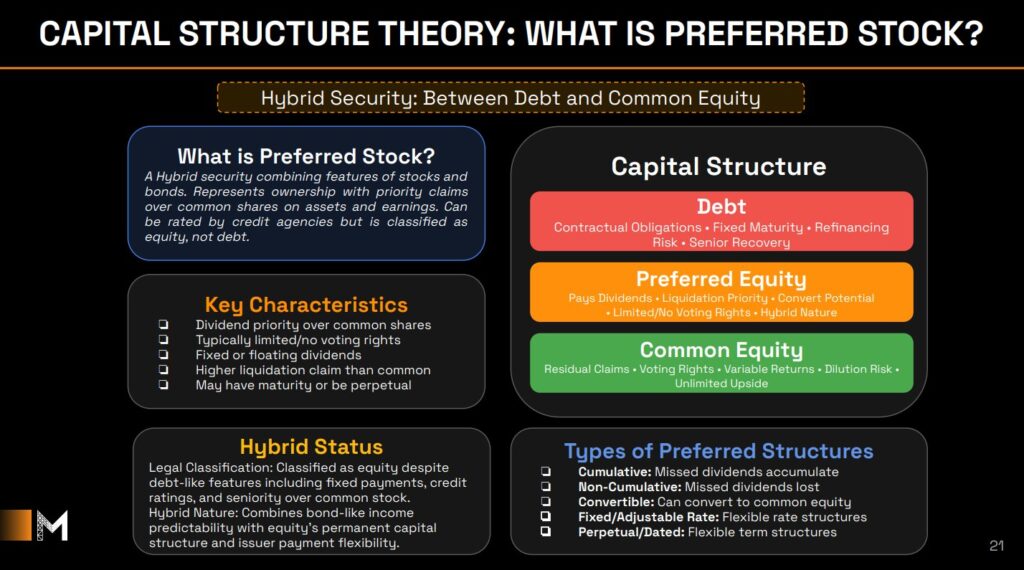

Preferred equity occupies a unique position between debt and common stock in a company’s capital structure. It provides dividend priority, stronger liquidation claims, and predictable payouts without voting dilution.

Metaplanet’s Bitcoin-Backed Preferred Shares are crafted to:

- Offer significantly higher yields than JGBs while maintaining a format familiar to Japanese institutions.

- Avoid the refinancing risk associated with debt maturity.

- Diversify funding channels for Bitcoin accumulation beyond common equity issuance.

The Precedent: Strategy’s Multi-Class Stack

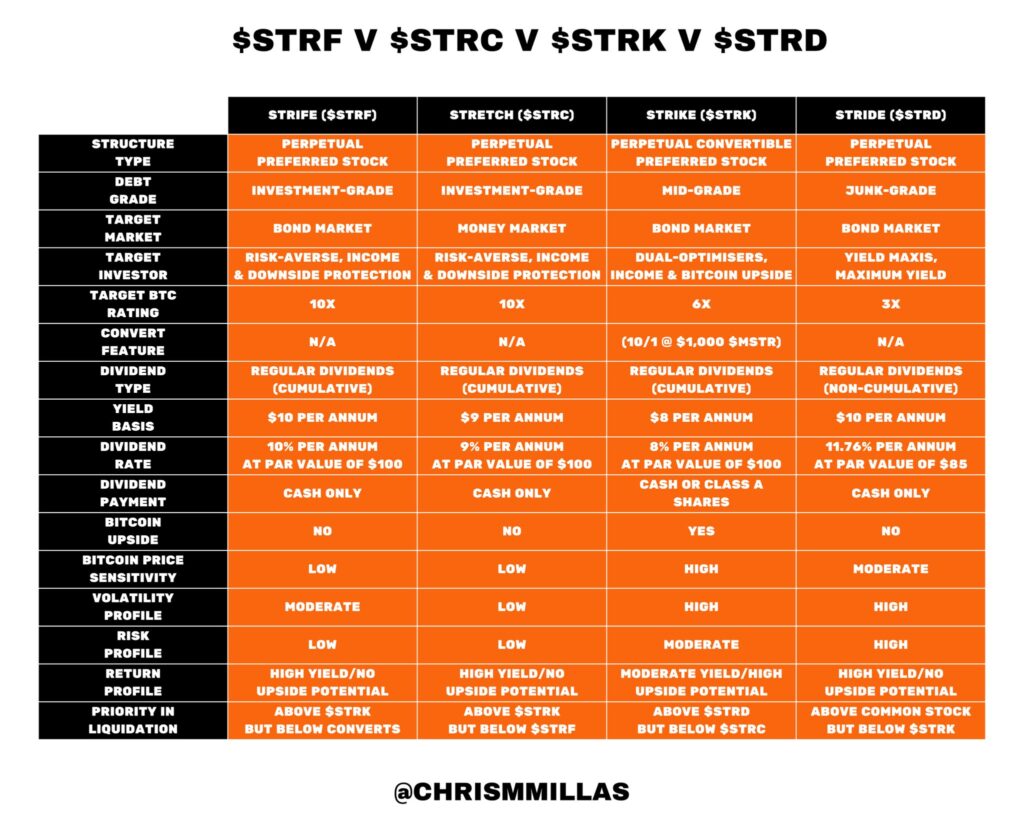

Strategy (formerly MicroStrategy) has set a precedent. The company created a series of Bitcoin-backed preferred equity classes, tailored to various parts of the yield curve and investor profiles:

- Stable, income-focused classes for risk-averse investors.

- Convertible preferreds blending fixed income with BTC upside potential.

- Higher-yield classes catering to risk-tolerant investors.

By aligning each issuance with market demand, Strategy amassed billions and expanded its Bitcoin holdings to over 500,000 BTC—without solely relying on common equity dilution.

Metaplanet is embracing the multi-class model in a market where preferred share issuance is scarce, attracting yield-hungry investors who could quickly adopt Bitcoin-Backed Preferred Shares.

Japan’s Capital Market: A $14.9 Trillion Opportunity

Japan’s fixed income market has long grappled with near-zero yields, leaving trillions of capital with limited income-generating options. This scarcity positions Japan as an ideal ground for high-yield instruments like Bitcoin-Backed Preferred Shares.

Japan’s household financial assets are distributed as follows:

- $9.5 trillion in fixed income

- $6.8 trillion in equities

- $7.6 trillion in cash and deposits

The listed preferred share market represents only $2.7 billion—a fraction of total financial assets. However, the demand for stable, income-oriented products is enormous.

Here lies the opportunity: a Bitcoin-Backed Preferred Share yielding 8% provides 8 times the return of a 10-year JGB and 4 times the return of most high-grade corporate bonds. Presented in a compliant, familiar structure, this margin could allure both domestic institutions and retail investors seeking yield within the fixed income realm.

Engineering a Bitcoin-Backed Yield Curve

Metaplanet intends to issue multiple classes of Bitcoin-Backed Preferred Shares, tailored to different investor segments:

- Short Duration Variable Dividend Perpetuals linked to short-term JGB spreads for conservative investors.

- Medium Duration Variable Dividend Perpetuals serving as a mid-range corporate credit substitute.

- Senior Fixed Dividend Perpetuals (Class A) for long-term, stability-focused portfolios.

- Fixed Dividend Convertibles (Class B) combining steady income with BTC potential.

- High Yield Fixed Dividend Perpetuals for investors seeking higher returns at increased risk.

This isn’t just a product range—it’s the construction of an investable BTC-backed yield curve. Strategy built one in the U.S.; now, Metaplanet is replicating the same in Japan, leveraging a market hungry for yield.

Implications for Corporate Bitcoin Strategy

Metaplanet’s approach offers three key insights for corporate planners:

- Capital Efficiency: Bitcoin-Backed Preferred Shares attract yield-seeking capital without heavy reliance on common equity. They offer lasting capital without the maturity constraints of debt.

- Market Fit is Key: Strategy thrived in the U.S. with convertible debt and equity raises due to deep, liquid markets. Metaplanet is tailoring its strategy to suit Japan’s unique capital structure norms, crucial for successful adoption.

- Bitcoin’s Collateral Legitimacy: Each issuance of Bitcoin-Backed Preferred Shares integrated into regulated, yield-focused portfolios chips away at Bitcoin's speculative image. Normalizing such assets in a major economy paves the way for replication elsewhere.

The Bigger Picture: Bitcoin’s Fixed Income Era

Metaplanet’s Q2 developments could serve as a roadmap for integrating Bitcoin into national capital markets.

By blending a proven capital structure model with one of the world's most yield-constrained environments, Metaplanet is establishing Bitcoin as a legitimate, income-generating asset base for a significant fixed income market.

If successful, Japan’s pioneering Bitcoin-Backed Preferred Share program won’t be the last. It could mark the start of Bitcoin’s fixed income era—and a blueprint on how corporate Bitcoin strategies adapt to their target markets.

Frequently Asked Questions

How much of your IRA should include precious metals?

Protect yourself from inflation by investing in precious metallics like silver and gold. It's not just an investment for retirement; it also helps you prepare for any economic downturn.

Although silver and gold prices have increased in recent years, they can still be considered safe investments as they don't fluctuate nearly as much as stocks. Plus, there's always a demand for these materials.

Predictable and stable prices for gold and silver are common. They increase with economic growth and decrease in recessions. This makes them excellent money-savers, and long-term investment options.

Ten percent should go into precious metals. This percentage can be increased if your portfolio is more diverse.

Which type of IRA works best?

It is essential to find an IRA that matches your needs and lifestyle when you are choosing one. You should consider whether you wish to maximize tax deferred growth, minimize taxes now, pay penalties later or avoid taxes altogether.

The Roth option is a good choice if you have a lot of money saved for retirement, but not enough to invest. It's also worth considering if your plan is to work after the age of 59 1/2.

The traditional IRA is better if you want to retire earlier because you will likely owe tax on your earnings. If you are going to be working beyond 65 years old, the traditional IRA may make more sense because you can withdraw all or part of your earnings without having to pay taxes.

Are precious metal IRAs a wise investment?

The answer depends on how much you are willing to risk an IRA account losing value. These are good if you have $10,000 of cash and don't expect them grow quickly. However, if you plan on saving for retirement over several decades and want to invest in assets that are likely to increase in value (gold), these may not be the best choice. These fees can reduce any gains.

Is a gold IRA worth it?

Yes, but not as much. It all depends on how risky you are willing to take. If you are comfortable investing $10,000 annually for 20 years, you could potentially have $1 million at retirement age. But if you put all your eggs in one basket, you'll lose everything.

Diversifying your investments is important. Inflation is a problem for gold. It is important to invest in assets that increase with inflation. Stocks are able to do this because they rise as companies make more profit. This is also true with bonds. They pay annual interest. So they're great during times of economic growth.

But what happens if inflation is not present? Stocks fall more and bonds lose value during deflationary times. Investors should refrain from putting all their savings into one type of investment such as a mutual fund or bond.

They should instead invest in a combination of different types of funds. They could, for example, invest in stocks and bonds. Or, they could invest in both bonds and cash.

This gives them exposure to both sides. Inflation and deflation. And they will still see a return over time.

What are the three types?

There are three main types of IRAs. Each type has its advantages and limitations. Each of these types will be described below.

Traditional Individual Retirement Account (IRA).

A traditional IRA allows you contribute pretax money to an account which can be used to defer taxes and earn interest. Once you retire, withdrawals from the account are tax-free.

Roth IRA

With a Roth IRA, you deposit after-tax dollars into an account, which means any earnings grow tax-free. Withdrawals from the account are also tax-free when you withdraw funds for retirement purposes.

SEP IRA

Similar to a Roth IRA except that employees must make additional contributions. These extra contributions are subject to income tax but any earnings will grow tax-deferred again. When you leave the company the whole amount may be converted to a Roth IRA.

How to open a Precious Metal IRA

You can open an IRA in precious metals by opening a Roth Individual Retirement Account (IRA), which you can self-direct.

This account is better compared to other types because you don’t need to pay any taxes until you withdraw the investments.

This makes it very attractive to people who want to save money but also need a tax break.

You do not have to only invest in gold and silver. If it meets the IRS guidelines, you can invest in any asset that interests you.

Although most people think of gold and silver when they hear the term “precious metal,” there are many kinds of precious metals.

You can find examples in palladium (platinum), rhodium (osmium), iridium and ruthenium.

There are many ways to invest in precious materials. These include purchasing bullion coins and bars, as well as shares in mining companies.

Bullion Coins, Bars

The easiest way to invest in precious materials is to buy bullion coins or bars. Bullion is a general term that refers to physical ounces of gold and silver.

Bullion bars and bullion coins are actual pieces of the metal.

While you might not feel any change when you buy bullion coin bars or coins from a retailer, you will experience some benefits over time.

You will receive a tangible piece if history, for example. Every coin and every bar has a unique story.

It is often worth less than its nominal price if you examine the face value. In 1986, the American Eagle Silver Coin was $1.00 per ounce. The price of an American Eagle is now closer to $40.00 a ounce.

Bullion has seen a dramatic rise in value since its introduction. Many investors would rather buy bullion coins or bullion bars than futures contracts.

Mining Companies

A great way to get precious metals is by investing in shares in mining companies. You invest in the company's ability produce gold and silver when you buy shares of mining companies.

You will then receive dividends, which are calculated based upon the company's profit. These dividends will be used to pay shareholders.

You will also benefit from the company's growth potential. As the demand for the product grows, the company's share price should increase.

Because these stocks fluctuate in price, it's important to diversify your portfolio. This allows you to spread your risk among multiple companies.

It is important to keep in mind that mining companies can lose their financial investments just as stock markets investors.

Your share of ownership may be worthless if gold prices fall significantly.

The Bottom Line

Precious metals, such as silver and gold, can be a refuge during economic uncertainty.

But, silver and gold can be subject to price swings. If you're looking to make a long-term, profitable investment in precious metallics, then consider opening a precious precious metals IRA Account with a reputable business.

This way, you can take advantage of tax advantages while benefiting from owning physical assets.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- Silver must be 99.9% pure • (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

takemetothesite.com

wsj.com

regalassets.com

forbes.com

- Gold IRA, Add Some Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

How to Buy Gold For Your Gold IRA

Precious metal is a term used to describe gold, silver, platinum, palladium, rhodium, iridium, osmium, ruthenium, rhenium, and others. It refers to any naturally occurring element with atomic numbers 79 through 110 (excluding helium), which is considered valuable because of its rarity and beauty. The most common precious metals are gold and silver. Precious metals can be used to make money, jewelry, industrial products, and art objects.

Supply and demand affect the gold price daily. There has been a significant demand for precious metals over the past decade as investors look for safe havens in unstable economies. Prices have risen significantly due to this increased demand. Some are concerned about the increased cost of production and have resisted investing in precious materials.

Gold is a solid investment as it is both rare and long-lasting. The value of gold is never lost, which is unlike many other investments. Gold can be bought and sold without tax. There are two ways you can invest in gold. You have two options: you can buy gold bars and coins, or you can invest in futures contracts.

Instant liquidity is provided by physical gold coins and bars. They are easy for you to store and trade. However, they are not very inflation-proof. To protect yourself from rising gold prices, you can consider buying gold bullion. Bullion is physical gold that comes in different sizes and shapes. One-ounce pieces are available for billions, while larger quantities such as kilobars and tens of thousands can be purchased. Bullion is usually stored in vaults protected from theft and fire.

If you prefer owning shares of gold rather than holding actual gold, you should consider buying gold futures. Futures allow you to speculate on how the price of gold might change. Buying gold futures exposes you to gold's price without owning the physical commodity itself.

For example, if I wanted to speculate on whether the price of gold would go up or down, I could purchase a gold contract. My position at the expiration of the contract will be either “long-term” or “short-term.” A long contract means I believe the gold price will rise, so I am willing to hand over money now in return for the promise of more money when the contract expires. A short contract on the other side means that I believe gold's price will fall. I'm willing now to accept the money in exchange for the promise of making less later.

When the contract expires, I'll receive the amount of gold specified in the contract plus interest. That way, I've gained exposure to the price of the gold without actually having to hold the gold myself.

Precious metals can be a great investment because they are very hard to counterfeit. While paper currency can be easily counterfeited simply by printing new notes, precious metals cannot. Because of this, precious metals have traditionally held their value well over time.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]