Are you curious about Strategy's recent moves in the crypto world? Well, Michael Saylor, the Executive Chairman, has some exciting insights to share. Let's dive into the details of Strategy's aggressive Bitcoin buying strategy and how it's shaping the market.

Michael Saylor Sets the Record Straight

Amidst market chaos, rumors swirled about Strategy offloading its Bitcoin. Michael Saylor swiftly debunked these claims, affirming, "We are buying Bitcoin." He hinted at upcoming reports on the company's new purchases. Saylor assured investors of accelerated buying activities, hinting at positive surprises in store.

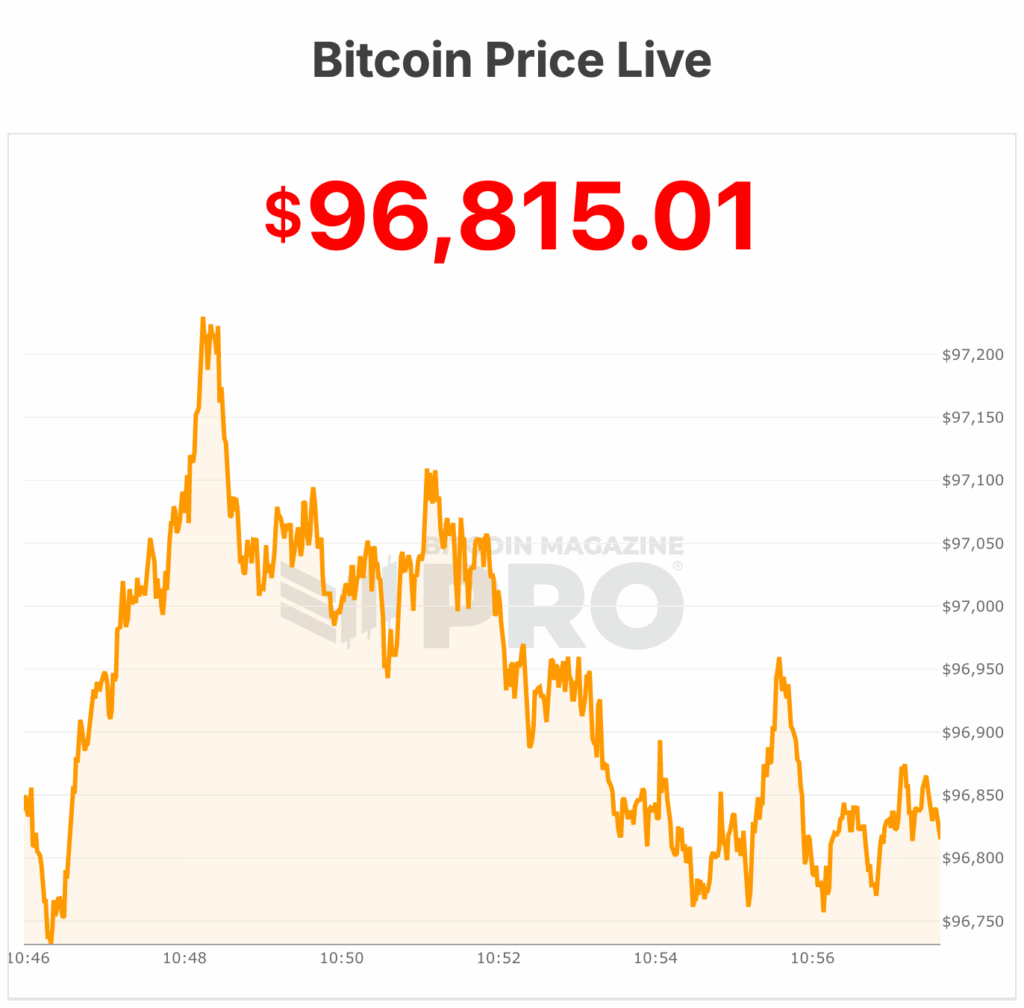

The Bitcoin Rollercoaster

Concerns rose as Bitcoin dipped below $95,000, triggering a drop in MSTR shares. Despite this, Saylor remained unfazed, urging investors to maintain a long-term perspective. He emphasized the resilience of Bitcoin, highlighting its past performance and potential for future growth.

Bitcoin: A Rock-Solid Investment

Saylor's unwavering confidence in Bitcoin shines through. He paints a picture of Bitcoin as a reliable long-term investment, citing its consistent growth over the years. Comparing it to traditional assets, he showcases Bitcoin's superior performance and advises investors to focus on long-term ownership.

Strategic Vision: Trillion-Dollar Bitcoin Balance

In an illuminating interview with Bitcoin Magazine, Saylor shared his grand vision of amassing a trillion-dollar Bitcoin balance sheet. He envisions leveraging Bitcoin's long-term appreciation to revolutionize global finance, offering innovative financial products and reshaping traditional systems.

Embracing Market Volatility

Despite market uncertainties, Strategy remains steadfast in its commitment to Bitcoin. Saylor reassures that they are always on the lookout for opportunities to expand their Bitcoin holdings, even during market downturns. This approach reflects Strategy's confidence in Bitcoin's future prospects.

Ready to ride the Bitcoin wave with Strategy? Stay tuned for more updates on their bold Bitcoin investment journey! Remember, in the world of crypto, fortune favors the bold.

CFTC

finance.yahoo.com

forbes.com

bbb.org

How To

The best way online to buy gold or silver

Understanding how gold works is essential before you buy it. Gold is a precious metallic similar to Platinum. It's very rare, and it is often used as money for its durability and resistance. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. Legal tender coins can be used for circulation within a country. These coins usually come in denominations such $1, $5 and $10.

Bullion coins are minted for investment purposes only, and their values increase over time due to inflation.

They aren’t exchangeable in any currency exchange. A person can buy 100 grams of gold for $100. Each dollar spent by the buyer is worth 1 gram.

Next, you need to find out where to buy gold. There are several options available if your goal is to purchase gold from a dealer. First off, you can go through your local coin shop. You can also try going through a reputable website like eBay. Finally, you can look into purchasing gold through private sellers online.

Private sellers are individuals who offer to sell gold at retail or wholesale prices. You pay a commission fee between 10% and 15% for each transaction when you sell gold through private sellers. A private seller will usually return less money than a coin shop and eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

Another way to buy gold is by investing in physical gold. While physical gold is easier than paper certificates to store, you still need to make sure it is safe. It is important to keep your physical gold safe in an impenetrable box such as a vault, safety deposit box or other secure container.

When buying gold on your own, you can visit a bank or a pawnshop. A bank will provide you with a loan that allows you to purchase the amount of gold you desire. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks tend to charge higher interest rates, while pawnshops are typically lower.

Another way to purchase gold is to ask another person to do it. Selling gold can be as easy as selling. You can contact a company like GoldMoney.com to set up an account and receive payments right away.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]