Introduction

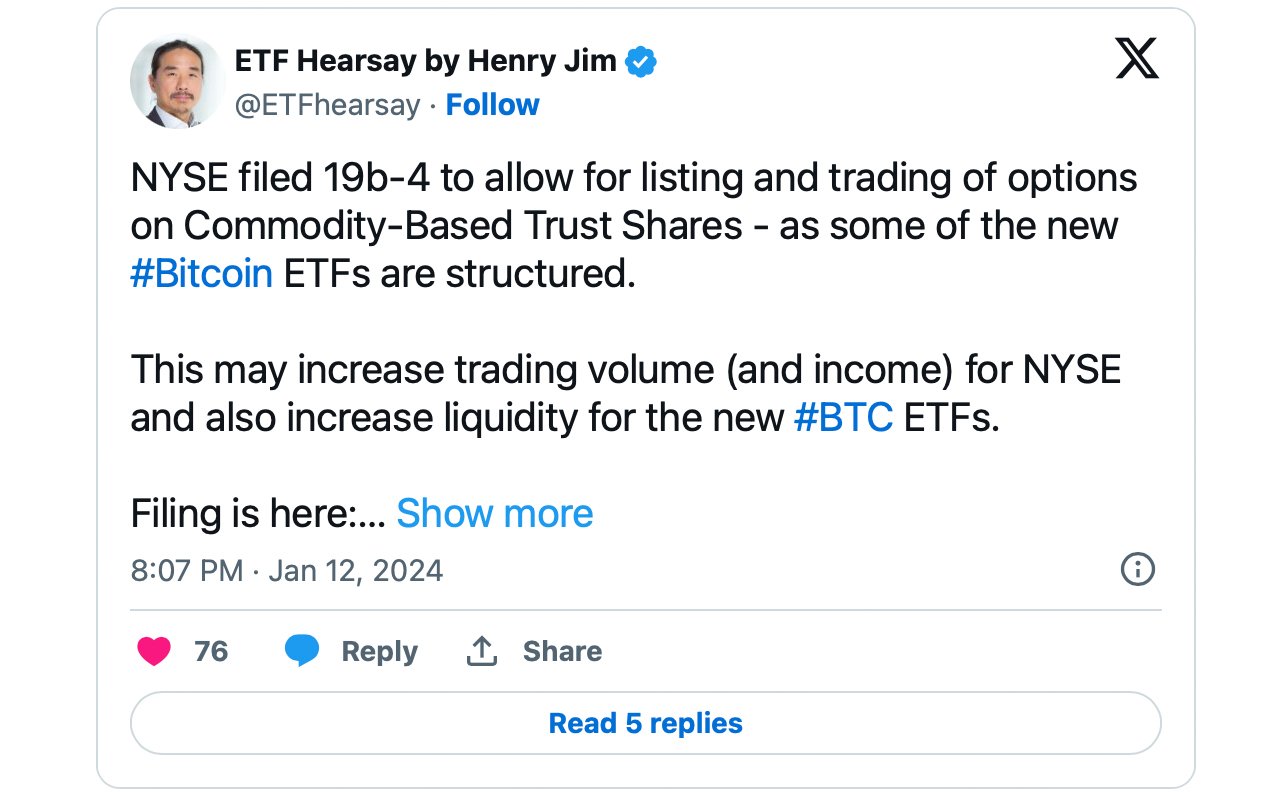

NYSE Arca Inc. has recently made a groundbreaking move by submitting a proposal to amend its rules to allow options trading on commodity-based trust shares, specifically targeting bitcoin-based ETFs. This initiative, outlined in the 19b-4 filing with the SEC, represents a significant advancement in the range of financial products available for crypto investors. The NYSE's proposal aligns with the growing interest in bitcoin ETFs, which generated a trading volume of $9.6 billion within just three days of their introduction.

NYSE Arca's Proposal

The filing by the New York Stock Exchange (NYSE) seeks to amend a rule under Section 19(b)(1) of the Securities Exchange Act of 1934 and Rule 19b-4 to permit options trading on commodity-based trust shares, including the new BTC-based financial instruments. This move comes as the crypto market experiences rapid growth, with spot bitcoin ETFs gaining significant traction among investors.

Benefits of Options Trading

To fully appreciate the significance of this development, it is important to understand what options trading entails. Options are financial derivatives that grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame.

With options trading, investors can speculate on the price movement of bitcoin ETFs without actually owning the asset. This form of trading offers flexibility and leverage, allowing traders to hedge against price fluctuations or make bets on the future direction of an asset's price.

Amendment of Rule 5.3-O

The proposal by NYSE Arca to amend rule 5.3-O reflects a strategic move to accommodate the increasing interest in traditionalized applications for crypto investments. Historically, rule 5.3-O has considered ETFs suitable for options trading. These ETFs, traded on national securities exchanges and classified as "NMS stock" under regulation NMS, typically represent interests in various financial instruments managed by investment companies.

By including spot bitcoin ETFs in this category, it signifies a significant expansion of traditional financial products into the realm of digital assets. This expansion offers investors new opportunities for portfolio diversification and risk management. Additionally, Grayscale Investments has also started developing a covered call ETF anchored in its GBTC, while Proshares recently applied for an array of five leveraged and inverse bitcoin ETFs.

Integration of Crypto Assets in Financial Markets

The submissions from NYSE Arca, Grayscale Investments, and Proshares demonstrate a steady progression in the integration of crypto assets within the broader financial markets. However, the decision of the U.S. securities authority regarding these proposals remains uncertain and separate.

What are your thoughts on NYSE Arca's latest proposal to offer options on the new spot bitcoin ETFs? Share your opinions in the comments section below.

Frequently Asked Questions

Is it possible to hold a gold ETF within a Roth IRA

A 401(k) plan may not offer this option, but you should consider other options, such as an Individual Retirement Account (IRA).

A traditional IRA allows contributions from both employee and employer. Another option is to invest in publicly traded corporations with an Employee Stockownership Plan (ESOP).

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The money you invest in the ESOP will be taxed at a lower rate than if it were directly held by the employee.

You can also get an Individual Retirement Annuity, or IRA. An IRA allows for you to make regular income payments during your life. Contributions to IRAs will not be taxed

What Should Your IRA Include in Precious Metals?

You should remember that precious metals are not only for the wealthy. You don’t need to have a lot of money to invest. You can actually make money without spending a lot on gold or silver investments.

You might think about buying physical coins such a bullion bar or round. Stocks in companies that produce precious materials could be purchased. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You can still get benefits from precious metals regardless of what choice you make. They offer the potential for long-term, sustainable growth even though they aren’t stocks.

Their prices rise with time, which is a different to traditional investments. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

Can the government seize your gold?

Your gold is yours and the government cannot take it. You worked hard to earn it. It belongs to you. But, this rule is not universal. For example, if you were convicted of a crime involving fraud against the federal government, you can lose your gold. Your precious metals can also be lost if you owe tax to the IRS. However, if you do not pay your taxes, you can still keep your gold even though it is considered property of the United States Government.

How is gold taxed by Roth IRA?

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. If you invest $1,000 in mutual funds or stocks and then later sell them, all gains are subjected to taxes.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. Dividends and capital gains are exempt from tax. Capital gains only apply to investments more than one years old.

The rules that govern these accounts differ from one state to the next. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. Massachusetts allows you up to April 1st. New York has a maximum age limit of 70 1/2. To avoid penalties, plan ahead so you can take distributions at the right time.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

finance.yahoo.com

How To

Online buying gold and silver is the best way to purchase it.

First, understand the basics of gold. It is a precious metal that is very similar to platinum. It is rare and used as money due to its durability and resistance against corrosion. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

There are two types of gold coins available today – one type is legal tender, while the other is called bullion. Legal tender coins are minted for circulation in a country and usually include denominations like $1, $5, $10, etc.

Bullion coins are minted for investment purposes only, and their values increase over time due to inflation.

They cannot be used in currency exchanges. One example is that if someone buys $100 worth gold, they get 100 grams with a $100 value. Each dollar spent by the buyer is worth 1 gram.

Next, you need to find out where to buy gold. There are a few options if you wish to buy gold directly from a dealer. First, your local currency shop is a good place to start. You can also try going through a reputable website like eBay. You may also be interested in buying gold through private sellers online.

Individuals who sell gold at wholesale and retail prices are called private sellers. Private sellers typically charge 10% to 15% commission on each transaction. A private seller will usually return less money than a coin shop and eBay. However, this option is often a great choice when investing in gold since it gives you more control over the item's price.

Another way to buy gold is by investing in physical gold. You can store physical gold much more easily than you can with paper certificates. However, it still needs to be safe. You need to make sure that your physical gold is safe by storing it in an impenetrable container like a vault or safety depositbox.

If you are looking to purchase gold on your own, you have two options: a bank or an pawnshop. A bank will be able to provide you with a loan for the amount of money you want to invest in gold. Pawnshops are small establishments allowing customers to borrow money against items they bring. Banks tend to charge higher interest rates, while pawnshops are typically lower.

The final option is to ask someone to buy your gold! Selling gold is simple too. A company such as GoldMoney.com can help you set up a simple bank account and get paid immediately.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]