Introduction

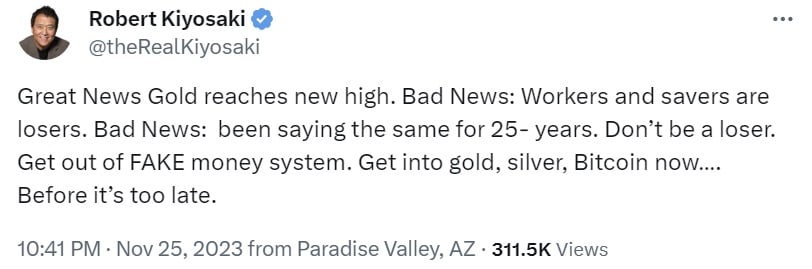

Renowned author Robert Kiyosaki, best known for his book 'Rich Dad Poor Dad,' has once again emphasized the importance of investing in bitcoin and abandoning traditional fiat money. In his recent social media post, Kiyosaki urged workers and savers to take immediate action and enter the world of gold, silver, and bitcoin before it's too late. This article delves into Kiyosaki's advice and his reasons behind advocating for these alternative forms of currency.

Robert Kiyosaki's Recommendation

As the co-author of the highly acclaimed book 'Rich Dad Poor Dad,' Robert Kiyosaki has established himself as a reputable figure in the financial world. With over 32 million copies sold worldwide, his book has become a go-to guide for achieving financial independence. Kiyosaki continues to emphasize the importance of diversifying one's investments by allocating funds to gold, silver, and bitcoin, while strongly discouraging reliance on fiat currency.

Fiat Money: The 'Fake Money' System

Kiyosaki frequently refers to fiat money as 'fake money.' He attributes this label to the United States' abandonment of the gold standard in 1971, during President Richard Nixon's tenure. According to Kiyosaki, this move severed the ties between the U.S. dollar and real assets such as gold, resulting in a currency system based solely on the 'full faith and credit' of the United States. In contrast, Kiyosaki views gold and silver as 'God's money' and considers bitcoin as 'people's money.'

Protecting Wealth from Central Bankers

Kiyosaki has consistently voiced his lack of trust in the Federal Reserve, the Biden administration, and Wall Street. He warns that the Fed and Treasury's actions are gradually eroding the value of the U.S. dollar, making fiat money an unsafe investment. According to Kiyosaki, individuals who possess gold, silver, and bitcoin will prosper while those relying on fake money will suffer the most. He firmly believes that investing in real assets is the key to financial security in today's uncertain economic climate.

Bullish Predictions for Bitcoin and Precious Metals

Throughout his career, Kiyosaki has made several predictions about the future prices of bitcoin, gold, and silver. He has projected that bitcoin could surge to $135,000 in the near term and potentially reach $1 million in the event of a global economic crisis. Additionally, Kiyosaki envisions gold reaching a price of $75,000 and silver climbing to $60,000 under similar circumstances. In February, he further predicted that bitcoin's value could skyrocket to $500,000 by 2025, with gold and silver experiencing significant price increases as well.

Conclusion

Robert Kiyosaki's advice to embrace bitcoin and alternative forms of currency serves as a reminder of the importance of diversifying one's investment portfolio. As an influential figure in the financial world, his recommendations carry weight and resonate with many individuals seeking to protect their wealth from the uncertainties of the traditional financial system. By considering Kiyosaki's advice and exploring the potential of bitcoin, gold, and silver, investors can position themselves for long-term financial success.

What are your thoughts on Robert Kiyosaki's advice? Share your opinions in the comments section below.

Frequently Asked Questions

How Much of Your IRA Should Include Precious Metals?

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don’t need to have a lot of money to invest. You can actually make money without spending a lot on gold or silver investments.

You could also consider buying physical coins like bullion bars, rounds or bullion bars. You could also buy shares in companies that produce precious metals. You might also want to use an IRA rollover program offered through your retirement plan provider.

No matter what your preference, precious metals will still be of benefit to you. Although they aren’t stocks, they offer the possibility for long-term gains.

And unlike traditional investments, they tend to increase in value over time. If you decide to sell your investment, you will likely make more than with traditional investments.

What Is a Precious Metal IRA?

An IRA with precious metals allows you to diversify retirement savings into gold and silver, palladium, rhodiums, iridiums, osmium, or other rare metals. These are called “precious” metals because they're very hard to find and very valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals are often referred to as “bullion.” Bullion refers actually to the metal.

Bullion can be purchased via a variety of channels including online sellers, large coin dealers, and grocery stores.

A precious metal IRA allows you to invest directly in bullion, rather than buying stock shares. This ensures that you will receive dividends each and every year.

Precious metal IRAs are not like regular IRAs. They don't need paperwork and don't have to be renewed annually. Instead, you only pay a small percentage on your gains. Plus, you get free access to your funds whenever you want.

Should You Purchase Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

Some experts think that this could change in the near future. They believe gold prices could increase dramatically if there is another global financial crises.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

These are some things you should consider when considering gold investing.

- Consider first whether you will need the money to save for retirement. You can save for retirement and not invest your savings in gold. However, when you retire at age 65, gold can provide additional protection.

- Second, ensure you fully understand the risks involved in buying gold. Each one offers different levels security and flexibility.

- Remember that gold is not as safe as a bank account. It is possible to lose your gold coins.

If you are thinking of buying gold, do your research. If you already have gold, make sure you protect it.

What are the fees for an IRA that holds gold?

$6 per month is the Individual Retirement Account Fee (IRA). This includes the account maintenance fees and any investment costs associated with your chosen investments.

Diversifying your portfolio may require you to pay additional fees. These fees can vary depending on which type of IRA account you choose. Some companies offer free check accounts, but charge monthly fee for IRA accounts.

Many providers also charge annual management fees. These fees are usually between 0% and 1%. The average rate is.25% each year. These rates can be waived if the broker is TD Ameritrade.

Is physical gold allowed in an IRA.

Gold is money and not just paper currency. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Today, investors invest in gold as part a diversified portfolio. This is because gold tends do better in financial turmoil.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. Even though owning gold is not a guarantee of making money, there are many reasons why you might want to add gold to your retirement savings portfolio.

One reason is that gold historically performs better than other assets during financial panics. The S&P 500 dropped 21 percent in the same time period, while gold prices rose by nearly 100 percent between August 2011-early 2013. During turbulent market conditions gold was one of few assets that outperformed stock prices.

The best thing about gold investing is the fact that there's virtually no counterparty risk. Even if your stock portfolio is down, your shares are still yours. However, if you have gold, your value will rise even if the company that you invested in defaults on its loans.

Finally, gold offers liquidity. This means you can easily sell your gold any time, unlike other investments. Gold is liquid and therefore it makes sense to purchase small amounts. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

How do I open a Precious Metal IRA

First, you must decide if your Individual Retirement Account (IRA) is what you want. To open the account, complete Form 8606. You will then need to complete Form 5204 in order to determine which type IRA you are eligible. This form should not be completed more than 60 days after the account is opened. Once you have completed this form, it is possible to begin investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. Otherwise, the process is identical to an ordinary IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS requires that you are at least 18 years old and have earned an income. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. Additionally, you must make regular contributions. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can use a precious-metals IRA to purchase gold, silver and palladium. However, you won't be able purchase physical bullion. This means that you will not be allowed to trade shares or bonds.

Your precious metals IRA can be used to directly invest in precious metals-related companies. This option is offered by some IRA providers.

However, investing in precious metals via an IRA has two serious drawbacks. First, they aren't as liquid than stocks and bonds. It is therefore harder to sell them when required. Second, they are not able to generate dividends as stocks and bonds. So, you'll lose money over time rather than gain it.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

investopedia.com

finance.yahoo.com

bbb.org

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

The best place to buy silver or gold online

To buy gold, you must first understand how it works. It is a precious metal that is very similar to platinum. It's rare and often used to make money due its resistance and durability to corrosion. It is hard to use, so most people prefer jewelry made of it to real bars of gold.

Today, there are two types available in gold coins: one is legal tender and the other is bullion. Legal tender coins are designed for circulation in a country. They often have denominations like $1 or $5 or $10.

Bullion coins can only be used as investment currency. They increase in value due to inflation.

They aren't circulated in any currency exchange systems. A person can buy 100 grams of gold for $100. Each dollar spent by the buyer is worth 1 gram.

When you are looking to purchase gold, the next thing to know is where to get it. There are several options available if your goal is to purchase gold from a dealer. First off, you can go through your local coin shop. You can also try going through a reputable website like eBay. You may also be interested in buying gold through private sellers online.

Individuals who sell gold at wholesale and retail prices are called private sellers. Private sellers typically charge 10% to 15% commission on each transaction. A private seller will usually return less money than a coin shop and eBay. This option is often a great choice for investing gold as it allows you more control over its price.

Another option for buying gold is to invest in physical gold. Although physical gold is easier to store than paper certificates you will still need to ensure it is safe. To ensure that your physical gold remains safe, you need to secure it in an impenetrable container such as a vault or safety deposit box.

To purchase gold by yourself, you can visit a bank and a pawnshop. A bank can provide you with a loan to cover the amount you wish to invest in gold. Small establishments that allow customers to borrow money for items they have brought are called pawnshops. Banks usually charge higher interest rates that pawn shops.

A third way to buy gold? Simply ask someone else! Selling gold is easy too. It is easy to sell gold by contacting a company like GoldMoney.com. You can create a simple account immediately and begin receiving payments.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]