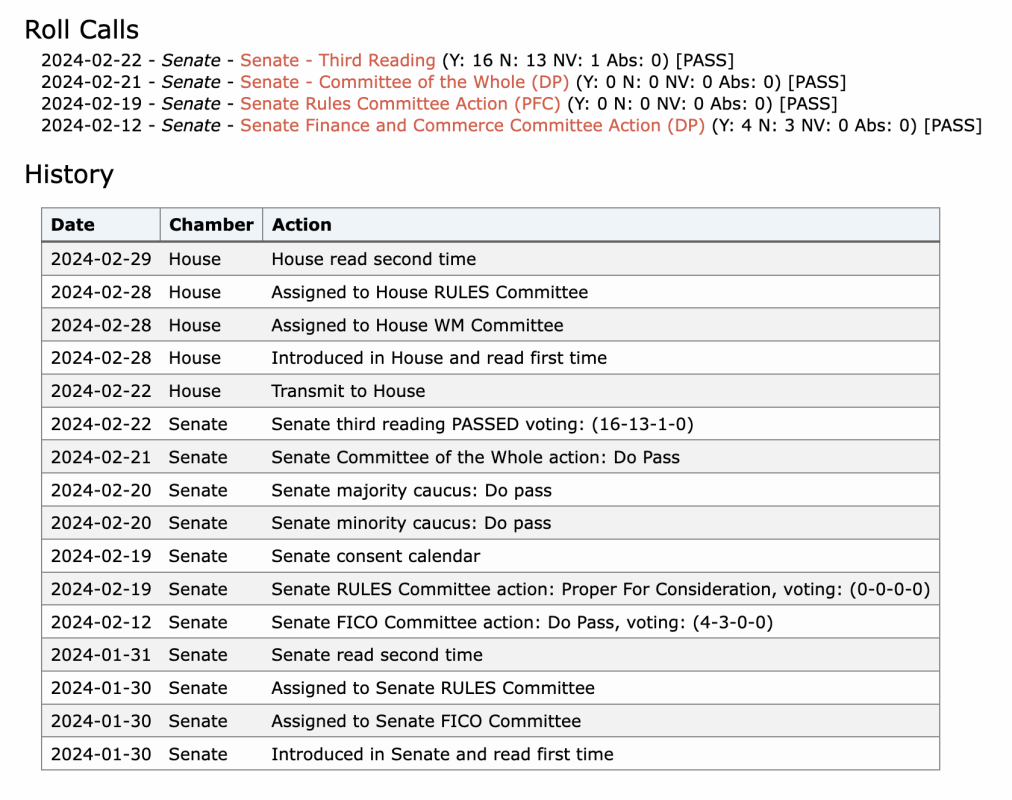

The Arizona State Senate is currently reviewing a proposal to encourage the Arizona State Retirement System (ASRS) and the Public Safety Personnel Retirement System (PSPRS) to explore the possibility of adding Bitcoin ETFs to their investment portfolios. This move comes after the bill passed the Senate's Third Reading on February 22 with a 16-13 vote and is now under review by the House for the second time.

Emphasis on Monitoring and Consideration

The proposal highlights the significance of keeping track of developments in Bitcoin ETFs. It also urges ASRS and PSPRS to carefully consider the implications of incorporating such assets into their portfolios. This includes seeking advice from firms authorized by the U.S. Securities and Exchange Commission to provide Bitcoin ETFs.

Requirement for Comprehensive Reporting

Furthermore, the proposal mandates that ASRS and PSPRS prepare and submit a detailed report on the feasibility, risks, and potential advantages of allocating a portion of state retirement system funds to Bitcoin ETFs. This report, which will present various options and recommendations for secure investments in the asset class, must be delivered to key state officials at least three months prior to the commencement of the Fifty-Seventh Legislature, First Regular Session.

Goal of Informed Decision-Making

The main objective of the proposal is to equip ASRS and PSPRS with the necessary information to make well-informed choices regarding the integration of Bitcoin ETFs into their investment strategies. This move could potentially help diversify their portfolios and open up new avenues for growth and financial opportunities.

Frequently Asked Questions

What proportion of your portfolio should you have in precious metals

Investing in physical gold is the best way to protect yourself from inflation. This is because when you invest in precious metals, you buy into the future value of these assets, not just the current price. So as prices rise, so does the value of your investment.

You will be eligible for tax benefits if you keep your investments in place for at least five consecutive years. If you decide to sell your investments after that period, you will be subject to capital gains tax. Learn more about how you can buy gold coins on our website.

How much do gold IRA fees cost?

The average annual fee to open an individual retirement account (IRA), is $1,000. There are many types of IRAs available, including traditional, Roth, SEP and SIMPLE IRAs. Each type comes with its own set rules and requirements. If your investments are not tax-deferred, you might have to pay taxes on the earnings. You must also consider how long you want to hold onto the money. If you are planning to hold onto your money for a longer time, you will likely save more money opening a Traditional IRA than a Roth IRA.

A traditional IRA allows for contributions up to $5500 ($6,500 if older than 50). A Roth IRA allows for unlimited annual contributions. The difference between them? With a traditional IRA, the money can be withdrawn at your retirement without tax. A Roth IRA will entail taxes for any withdrawals.

Can I store my gold IRA account at home?

An online brokerage account can be a great way to save your money. Online brokerage accounts offer all the same investment options and you do not need any special licenses. Plus, there are no fees for investing.

Many online brokers also offer tools that can help you manage your portfolio. They will even let you download charts to see how your investments perform.

What precious metals are allowed in IRA?

The most common precious metal used for IRA accounts is gold. Investments in gold bullion coins or bars can be made as well.

Precious metals, which don't lose any value over time, are considered safe investments. Precious metals are also great for diversifying an investment portfolio.

Precious metals include silver, platinum, and palladium. These metals share similar properties. Each has its own purpose.

In jewelry making, for instance, platinum is used. To create catalysts, palladium is used. The production of coins is done with silver.

Consider how much you plan to spend on gold when deciding on which precious metal to buy. It may be more cost-effective to purchase gold at lower prices per ounce.

You need to decide if you want your investment to remain private. If you do, you should choose palladium.

Palladium is worth more than gold. It's also more rare than gold. You'll probably have to pay more.

When choosing between gold or silver, another important aspect is the storage fees. The weight of gold is what you store. You will pay more if you store larger amounts.

Silver can be stored by volume. Therefore, smaller amounts of silver will cost less.

You should follow all IRS rules if you plan to store precious metals in an IRA. This includes keeping track, and reporting to the IRS, all transactions.

Can I take physical possession of gold in my IRA?

Many ask themselves whether they can physically possess gold in an IRA account. This is a legitimate question since there is no legal way.

However, if you examine the law carefully, you will see that there are no restrictions on gold ownership in an IRA.

The problem is that most people aren't aware of how much money they could be saving by putting their precious gold in an IRA.

It's very easy to dispose of gold coins, but much harder to make an IRA. You'll have to pay twice taxes if you keep your gold in your home. Two taxes will be charged: one to the IRS, one to the state you live in.

There are two ways to lose your gold: pay taxes twice and keep it in your house. Why would you want it to stay in your home?

Some might argue that gold should be safe at home. However, to guard yourself against theft, it is worth considering storing your gold in a more secure location.

If you are planning to visit frequently, your gold should not be left at home. If your gold is left unattended, thieves could easily steal it when you're away from home.

An insured vault is a better choice for gold storage. Then, your gold will be protected from fire, flood, earthquake, and robbery.

One advantage of storing your gold safely in a vault is the fact that you don't have to worry too much about property tax. Instead, income tax will be charged on any gains made from the sale of your precious metal.

A IRA can be a great option if you want to avoid paying tax on your gold. An IRA allows you to keep your gold free from income taxes, even though it earns interest.

Capital gains tax is not required on gold. If you decide to cash it out, you will have full access to its value.

And since IRAs are federally regulated, you won't have any trouble getting your gold transferred to another bank if you move.

The bottom line is: You can own gold in an IRA. Fear of losing it is the only thing that will hold you back.

Can you hold precious metals in an IRA?

This question is dependent on whether an IRA owner wishes to diversify into gold or silver, or keep them safe.

He can choose to diversify if he so desires. He could purchase physical bars of gold or silver from a dealer and then sell these items to him at the end. Imagine he doesn't desire to sell off his precious metals investments. He could keep the precious metals as long as he wants to.

Which type of IRA can be used to store precious metals?

Most financial institutions and employers offer an Individual Retirement Account (IRA). This is an investment vehicle that most people can use. An IRA allows you to contribute money that is tax-deferred until it is withdrawn.

An IRA lets you save taxes and pay them off later. This allows you to save more money today and pay less taxes tomorrow.

The beauty of an IRA is that contributions and earnings grow tax-free until you withdraw the funds. If you do withdraw the funds earlier than that, you will be subject to penalties.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. If you decide to withdraw your IRA from retirement, you will owe income taxes as well as a 10% federal penalty.

Refunds received before the age of 591/2 are subject to a penalty of 5% from the IRS. There is a 3.4% penalty for withdrawals between the ages 70 1/2 and 59 1/2.

A 6.2% IRS penalty applies to withdrawals exceeding $10,000 per annum.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

investopedia.com

regalassets.com

takemetothesite.com

kitco.com

How To

How to Open a Precious Metal IRA

Precious metals are a highly sought-after investment vehicle. Precious metals are a popular investment option because they provide investors with higher returns than traditional bonds and stocks. However, investing in precious metals requires careful planning and research before purchasing. If you want to open your own precious metal IRA account, here's what you should know first.

There are two main types in precious metal accounts. These are physical precious metals and paper gold or silver certificates (GSCs). Each type has its pros and cons. GSCs and physical precious metals accounts can offer diversification, but they are difficult to trade and easy to access. Read on to find out more.

Physical precious metals accounts consist of coins, bars, and bullion. Although this option can provide diversification benefits, there are some drawbacks. Precious metals can be expensive to store, buy and sell. Moreover, their large size can be difficult to transport them from one location to another.

The silver and paper gold certificates are also relatively affordable. In addition, they're easily accessible and traded online. This makes them an ideal choice for those who don’t desire to invest in precious metallics. But they don't offer as much diversification as their physical counterparts. Because they are supported by government agencies such the U.S. Mint the value of these assets may decrease if inflation rates increase.

If you open a precious metal IRA, choose the right account for your financial situation. These are some factors to consider before you do this:

- Your tolerance level

- Your preferred asset allocation strategy

- What time do you have available to invest?

- It is up to you whether you intend on using the funds short-term for trading purposes.

- What kind of tax treatment you'd prefer

- Which precious metal(s) you'd like to invest in

- How liquid should your portfolio be?

- Your retirement age

- Where to store precious metals

- Your income level

- Your current savings rate

- Your future goals

- Your net worth

- Special circumstances that might affect your decision

- Your financial overall situation

- Your preference between physical and paper assets

- Your willingness and ability to take risks

- Your ability and willingness to accept losses

- Your budget constraints

- You desire to be financially independent

- Your investment experience

- Precious metals are familiar to you

- Your knowledge about precious metals

- Your confidence and faith in the economy

- Your personal preferences

After you have determined the type of precious metal IRA that best suits you, you can open an account with a reputable dealer. These companies can be found through word of mouth, referrals and online research.

After opening your precious metal IRA you will need to decide how big you want it to be. There are different minimum deposits for precious metal IRA accounts. Some accounts will only accept $100, others will allow for you to invest as high as $50,000.

The amount you invest in your precious-metal IRA is entirely up to you, as stated above. You might choose to make a larger initial investment if your goal is to build wealth over the long-term. A lower initial deposit may be better if you plan to invest smaller amounts of money each month.

You have many options when it comes to the type of investments you can make. These are the most popular:

- Bullion bars, rounds and coins in gold – Gold

- Silver – Rounds & coins

- Platinum – Coins

- Palladium Round and Bar Forms

- Mercury – Bar and round forms

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]