Unlocking a New Era of Capital Growth with Nakamoto

Imagine a world where Bitcoin isn't just a digital asset stored in treasuries but a catalyst for revolutionizing global finance. That's the vision driving the Nakamoto strategy, reshaping how capital is formed in the Bitcoin era. It's not about hoarding BTC; it's about leveraging Bitcoin to empower a vibrant, interconnected capital ecosystem.

The Rise of Bitcoin Treasury Companies

Empowering Growth Through Strategic Partnerships

Nakamoto's strategy goes beyond holding Bitcoin on a balance sheet. It's about combining Bitcoin's foundational value with public equity to invest strategically in promising small-cap companies. By doing so, Nakamoto aims to amplify exposure, broaden market reach, and nurture a decentralized financial landscape rooted in Bitcoin.

Leading the Charge in Global Capital Expansion

UTXO Management has kickstarted this movement by championing Bitcoin treasury companies like Metaplanet, The Smarter Web Company, and The Blockchain Group. These companies have not only flourished but have set new benchmarks in the financial world, showcasing the potential of Nakamoto's strategy.

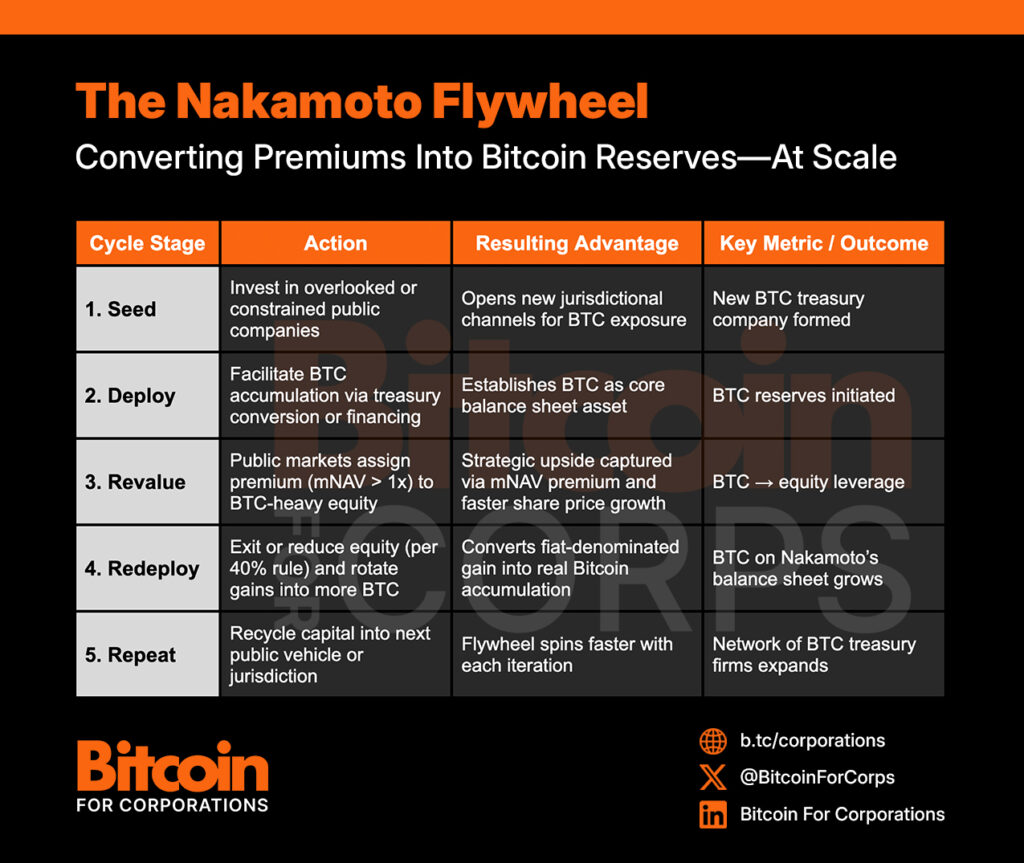

Decoding the Nakamoto Approach

At the core of Nakamoto's strategy lies a simple yet profound insight: the key to unlocking capital isn't just Bitcoin itself but also overcoming market access barriers. By creating Bitcoin treasury companies in regions with restricted BTC access, Nakamoto opens up avenues for strategic Bitcoin deployment through innovative financing mechanisms.

Driving Value Creation: Unveiling the Mechanics

Harnessing mNAV Arbitrage for Growth

Nakamoto's strategy thrives on leveraging market dynamics to drive value creation. Through mNAV arbitrage, Nakamoto strategically invests in Bitcoin treasury firms, setting off a chain reaction that elevates the market value of Bitcoin holdings and fuels long-term growth.

Measuring Success with BTC Yield

Unlike traditional metrics, Nakamoto focuses on BTC Yield to gauge success. By tracking Bitcoin per diluted share, Nakamoto ensures that every move aligns with Bitcoin's inherent value, fostering sustainable growth and value creation.

Embracing Innovation with Convertible Notes

To navigate regulatory constraints and market volatility, Nakamoto pioneers the use of Bitcoin-denominated convertible notes. These instruments offer flexibility, compliance, and strategic exposure management, laying the groundwork for future growth and stability.

The Art of Balancing Risk and Reward

In a world of uncertainties, Nakamoto faces various criticisms, from tax implications to market volatility concerns. However, by staying true to its strategic vision, emphasizing tangible value creation, and fostering transparent governance, Nakamoto continues to pave the way for Bitcoin-native capital markets.

Join the Bitcoin Revolution with Nakamoto

As Nakamoto reshapes global capital markets, you have the opportunity to be part of this transformative journey. Explore the world of Bitcoin treasury companies, embrace innovative financial strategies, and witness the evolution of capital formation in the Bitcoin era.

Are you ready to ride the wave of change with Nakamoto?

Frequently Asked Questions

How does an IRA with gold or silver work?

You can make investments in precious metals (such as gold or silver) without having to pay tax. These precious metals are an attractive investment for anyone looking to diversify their portfolios.

If you are over 59 1/2, income tax is not due on the interest earned from these accounts. The appreciation of the account's value does not trigger capital gains tax. The maximum amount that you can invest in this type of account is $10,000. Minimum amount allowed is $10,000 You cannot invest at all if you are under age 59 1/2. The maximum annual contribution is $5,500.

Your beneficiaries could receive less if you die before your retirement. Your estate should contain sufficient assets to cover your account's remaining balance after paying any other expenses.

Some banks offer gold and silver IRA options, while others require you to open a regular brokerage account through which you buy shares or certificates.

Can a gold IRA earn any interest?

It depends on how many dollars you put into it. If your income is $100,000, then yes. If your net worth is less than 100,000, no.

The amount you deposit into an IRA will affect its potential to earn interest.

If you are putting in more than $100,000 annually for retirement savings, you should open a regular brokerage account.

While you may earn more interest there than elsewhere, you are also exposed to more risky investments. You don't want your entire portfolio to go bankrupt if the stock markets crash.

An IRA may be better for you if your annual income is less than $100,000. At least until there is a rebound in the market.

Can I put gold in my IRA?

Yes! You can add gold to your retirement plan. Because it doesn’t lose value over the years, gold makes a good investment. It is also resistant to inflation. It is also exempt from taxes.

It's important to understand the differences between gold and other investments before investing in it. You cannot buy shares of companies that are gold, like stocks and bonds. They are also not available for sale.

Instead, you must convert your gold to cash. This means that you must get rid of your gold. You cannot just keep it.

This makes gold an attractive investment. Like other investments, you can always dispose of them later. That's not true with gold.

Even worse, you can't use the gold as collateral for loans. For example, if you take out a mortgage, you may give up some of your gold to cover the loan.

What does that mean? You can't hold onto your gold forever. You'll eventually need to convert it into cash.

However, there is no need to panic about it. All you need to do is create an IRA. After that, you can start investing in gold.

How much of your IRA should include precious metals?

You can protect yourself against inflation by investing your money in precious metals, such as silver and gold. It's not just for retirement. It can also be used to prepare for economic downturns.

Although gold and silver prices have risen significantly in the past few years they are still considered safe investments. They don't fluctuate quite as much like stocks. These materials are always in demand.

Silver and gold prices are typically predictable and stable. They are most likely to rise when the economy grows and fall during recessions. They are great money-savers as well as long-term investments.

Your total portfolio should be 10 percent in precious metals. You can increase this percentage if you want further diversification.

What are the fees for an IRA that holds gold?

The average annual fee to open an individual retirement account (IRA), is $1,000. There are many types available: SIMPLE IRAs (SEP-IRAs), Roth IRAs, Traditional IRAs and Roth IRAs. Each type of IRA has its own rules and requirements. If the earnings are not tax-deferred you could be subject to taxes. You must also consider how long you want to hold onto the money. If you have a long-term goal of holding on to your money, you'll be able to save more money if you open a Traditional IRA.

A traditional IRA allows for contributions up to $5500 ($6,500 if older than 50). A Roth IRA gives you the ability to contribute unlimited amounts per year. The difference is that a traditional IRA allows you to withdraw your money without having to pay taxes. On the other hand, you'll owe taxes on any withdrawals made from a Roth IRA.

Are gold and silver IRAs a good idea?

This is a great option if you're looking for an easy way of investing in both silver and gold simultaneously. However, there are many other options available as well. Contact us anytime if you have questions about these types investment options. We're always glad to help!

Do you need to open a Precious Metal IRA

It all depends on your investment goals and risk tolerance.

Open an account today if your retirement plan calls for you to withdraw the funds.

It is likely that precious metals will appreciate over the long-term. You can also diversify your portfolio with them.

Furthermore, the prices of gold and silver tend to move together. They are therefore a better option for investing in both assets.

Do not invest in precious metals IRAs if your goal is to save money or take on any risk.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

External Links

takemetothesite.com

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

regalassets.com

investopedia.com

How To

How to turn your IRA into a IRA with gold content

Are you interested in moving your retirement savings to a more gold-colored IRA instead of a traditional IRA? This article will guide you through the process. Here's how to make the switch.

The process of transferring money out of one type of IRA (traditional) and into another (gold) is called “rolling over.” Rolling an account over offers tax advantages. Some people also prefer to invest in physical assets such as precious metals.

There are two types IRAs – Traditional IRAs (or Roth IRAs). The main difference between the two types of IRAs is that Roth IRAs do not allow investors to deduct taxes from their earnings. This means that if a Traditional IRA is invested $5,000 today, it will be able to withdraw $4,850 over five years. If you invested the same amount in a Roth IRA, however, you'd be able to keep every penny.

These are some things to consider if you plan to convert from a Traditional IRA to a Gold IRA.

First, you will need to decide whether your current balance should be transferred to a new account. Any earnings over $10,000 will be subject to income tax at the regular rate. You can rollover your IRA to avoid paying income tax until you are 59 1/2.

After you have made your decision, you will need to open a new account. You may be asked for proof of identity (e.g., a Social Security or passport card, birth certificate, etc.). After that, you'll need to sign paperwork proving you own an IRA. Once you've completed the forms, you'll submit them to your bank. After verifying your identity, they will give you instructions about where to send wire transfers or checks.

Now comes the fun part. The fun part is when you deposit cash into the account, and then wait for the IRS approval. You will be notified by mail that your request has been approved.

That's it! You can now relax and watch your money grow. Remember that if you are unsure whether you want to convert your IRA, it is possible to close it and roll the balance over into a new IRA.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]