The Shift in Market Sentiment

Bitcoin has taken the world by storm, with social media conversations and mainstream media coverage all focusing on this digital currency. People who were once unfamiliar with Bitcoin are now seeking advice on how to buy and accumulate it. This shift in market sentiment indicates a growing interest in Bitcoin and a recognition of its potential as a monetary revolution.

Understanding Bitcoin

Bitcoin is not just another investment opportunity; it represents a fundamental shift in the way we think about money. The limitations of the traditional financial system and the fragility of fiat currencies are becoming more evident, and Bitcoin offers a beacon of hope in this ever-evolving digital landscape.

Buying Bitcoin: The Best Approach

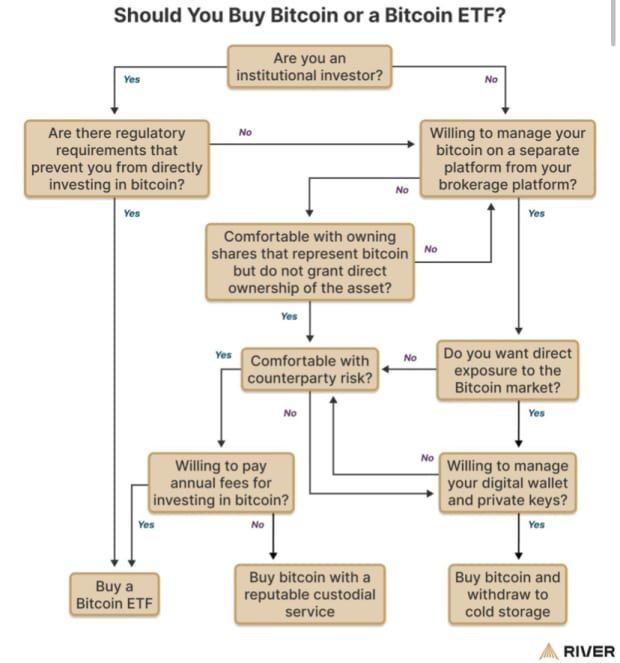

The best way to buy Bitcoin depends on individual needs and preferences. Some individuals prefer to have absolute ownership and control over their Bitcoin by holding their own keys. Others may feel more comfortable using a third-party custodian to store their Bitcoin securely. It's important to ask yourself questions about ownership, privacy, and trust before deciding on the best approach for you.

Timing Your Bitcoin Investment

The Bitcoin halving, which occurs approximately every four years, is an important event to consider when timing your investment. The halving reduces the number of new Bitcoins entering circulation, which historically has led to increased demand and price appreciation. However, it's important to note that past performance is not indicative of future results, and there is ongoing debate about the predictability of the halving cycle.

Determining Your Investment Amount

Deciding how much to invest in Bitcoin is a personal decision that depends on individual risk tolerance and financial goals. It's recommended to start with a small investment and gradually increase your exposure over time. There are open-source tools available, such as the Nakamoto Portfolio, that can help you analyze different investment scenarios and determine the optimal allocation for your portfolio.

Accumulation Strategies: Lump-sum Investing vs. Dollar Cost Averaging

There are two

Frequently Asked Questions

Can you hold precious metals in an IRA?

The answer to that question will depend on whether the IRA owner plans to diversify his holdings to gold and/or keep them safekeeping.

Two options are available for him if diversification is something he desires. He could either buy bars of physical gold and/or sterling from a dealer or simply sell these items back at the end. However, suppose he isn't interested in selling back his precious metal investments. In that case, he should continue holding onto them as they would be perfectly suitable for storing within an IRA account.

What precious metals will be allowed in an IRA account?

The most common precious metallic used in IRA accounts, is gold. As investments, you can also buy bars and bullion coins made of gold.

Precious Metals are safe investments since they don’t lose value over the long-term. They're also considered a great way to diversify an investment portfolio.

Precious metals include palladium and platinum. These three metals have similar properties. Each has its own purpose.

For example, platinum is used in making jewelry. For the creation of catalysts, palladium can be used. Silver is used to producing coins.

Think about how much you can afford to purchase your gold, before you make a decision on the precious metal. A lower-cost ounce of gold might be a better option.

Also, think about whether or not you wish to keep your investment secret. If so, then you should go with palladium.

Palladium can be more valuable than gold. It is also more rare. You'll probably have to pay more.

Storage fees are another important consideration when choosing between silver and gold. The weight of gold is what you store. You will pay more if you store larger amounts.

Silver is stored by volume. So you'll pay less for storing smaller amounts of silver.

Follow all IRS rules regarding silver and gold if you are storing precious metals within an IRA. This includes keeping track and reporting transactions to the IRS.

What precious metals can you invest in for retirement?

First, you need to understand what you have and where you are spending your money. Take a look at everything you own to determine how much you have left. This should include any savings accounts, stocks, bonds, mutual funds, certificates of deposit (CDs), life insurance policies, annuities, 401(k) plans, real estate investments, and other assets such as precious metals. You can then add up all these items to determine the amount of investment you have.

If you are under 59 1/2 you should consider opening a Roth IRA Account. A traditional IRA allows you to deduct contributions from your taxable income, while a Roth IRA doesn't. However, you will not be able take tax deductions on future earnings.

You may need additional money if you decide you want more. Begin with a regular brokerage.

What kind of IRA can you use to hold precious metals in?

A Individual Retirement Account (IRA), is an investment vehicle offered by most financial institutions and employers. An IRA lets you contribute money that will grow tax-deferred to the time it is withdrawn.

You can save taxes by setting up an IRA and then paying them off when you retire. This allows you to save more money today and pay less taxes tomorrow.

An IRA has the advantage of allowing contributions and earnings to grow tax-free until you withdraw your funds. There are penalties for early withdrawal if you do.

Additional contributions can be made to your IRA even after you turn 50, without any penalty. If you take out of your IRA during retirement you will owe income and a 10% federal penal.

Withdrawals made before age 59 1/2 are subject to a 5% IRS penalty. For withdrawals made between the age of 59 1/2 & 70 1/2, a 3.4% IRS penalty will apply.

An IRS penalty of 6.2% applies to withdrawals above $10,000 per year.

Can I place gold in my IRA account?

The answer is yes Gold can be added to your retirement plan. Gold is an excellent investment because it doesn't lose value over time. It also protects against inflation. You don't even have to pay taxes.

Before you decide to invest in gold, it is important to understand that it isn't like other investments. You can't buy shares in companies that make gold unlike bonds or stocks. These shares can also be not sold.

Instead, you should convert your gold to cash. This means that you must get rid of your gold. It's not enough to hold on to it.

This makes gold different from other investments. As with other investments you can always make a profit and sell them later. This is not true for gold.

Even worse, gold cannot be used to secure loans. For example, if you take out a mortgage, you may give up some of your gold to cover the loan.

So what does this mean? You can't just keep your gold forever. It will eventually have to be converted into cash.

You don't have to worry about this now. Open an IRA account. You can then invest in gold.

What are the 3 types of IRA?

There are three basic types for IRAs. There are three types of IRAs: Roth, Traditional, and SEP. Each has its own advantages and disadvantages. Each of these types will be described below.

Traditional Individual Retirement Account (IRA).

A traditional IRA allows you to contribute pre-tax money to an account where you can defer taxes on contributions made now while earning interest. You can withdraw money from the account tax-free after you retire.

Roth IRA

Roth IRAs allow you after-tax dollars to be deposited into an account. Any earnings will grow tax-free. You can also withdraw money from the account to retire your funds tax-free.

SEP IRA

This is similar in structure to a Roth IRA. However, employees will need to make additional contributions. These extra contributions are subject to income tax but any earnings will grow tax-deferred again. You may choose to convert the entire amount to a Roth IRA when you leave the company.

Do you need to open a Precious Metal IRA

This will depend on whether or not you have an investment objective and what level of risk you are willing to accept.

You should start an account if you intend to retire with the money.

This is because precious metals are more likely to appreciate in the future. You can also diversify your portfolio with them.

In addition, gold and silver prices tend to move together. This makes them an excellent choice for investors in both assets.

If you're not planning on using your money for retirement or don't want to take any risks, you probably shouldn't invest in precious metal IRAs.

Statistics

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- Silver must be 99.9% pure • (forbes.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

External Links

wsj.com

takemetothesite.com

investopedia.com

en.wikipedia.org

How To

How to Open a Precious Metal IRA

Precious metals are one of the most sought-after investment vehicles today. Precious metals are a popular investment option because they provide investors with higher returns than traditional bonds and stocks. However, you need to be careful when investing in precious materials. This is what you need to know before you open your precious metal IRA.

There are two main types for precious metal accounts: paper gold and Silver certificates (GSCs), and physical precious Metals accounts. Each type has its advantages and disadvantages. GSCs, on the other hand, are more accessible and can be traded. Read on to find out more.

Physical precious metals accounts can be used to hold bullion, coins and bars. While this option provides diversification benefits, it also comes with some drawbacks. Precious metals can be expensive to store, buy and sell. It can also be difficult to transport their large sizes from one place to the next.

However, silver and gold certificates made of paper are quite affordable. They can also be traded online and are easily accessible. This makes them an ideal choice for those who don’t desire to invest in precious metallics. They aren't as diverse as physical counterparts. They are also backed by government agencies like the U.S. Mint so their value could decline if inflation rates rise.

Choose the best account for you financial situation when opening a precious metal IRA. Before doing so, consider the following factors:

- Your risk tolerance level

- Your preferred asset-allocation strategy

- What time do you have available to invest?

- You can decide whether or not to use the funds for trading purposes.

- What tax treatment do you prefer?

- Which precious metal(s) you'd like to invest in

- How liquid do you need your portfolio to be

- Your retirement age

- You'll need somewhere to keep your precious metals

- Your income level

- Your current savings rate

- Your future goals

- Your net worth

- Any other special circumstances that may impact your decision

- Your overall financial picture

- Preference between paper and physical assets

- Your willingness to accept risks

- Your ability and willingness to accept losses

- Your budget constraints

- Financial independence is your goal

- Your investment experience

- Your familiarity with precious and rare metals

- Your knowledge of precious Metals

- Your confidence and faith in the economy

- Your personal preferences

After you've decided on the best type of precious metal IRA for you, you can start to open an accounts with a reputable broker. These dealers can be found via referrals, word-of-mouth, and online research.

Once you have opened your precious-metal IRA, it is time to decide how much you want to deposit. Every precious metal IRA account will have a different minimum initial deposit amount. Some accounts only require $100, while others may allow you up to $50,000.

The amount you invest in your precious-metal IRA is entirely up to you, as stated above. You might choose to make a larger initial investment if your goal is to build wealth over the long-term. If you are planning to invest small amounts each month, a lower initial investment might be better.

As far as the actual precious metals used in your IRA go, you can purchase any number of different types of investments. The most common include:

- Bullion bars, rounds and coins in gold – Gold

- Silver – Rounds and coins

- Platinum – Coins

- Palladium – Bar and round forms

- Mercury – Round and bar forms

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]