Bitcoin mining has experienced exponential growth since the introduction of the first ASIC miner in 2013, with hardware efficiency improving significantly. However, with the limitations of silicon-based semiconductors becoming apparent, the focus is now shifting towards optimizing other aspects of mining operations, particularly the power setup.

Understanding Power Systems

To grasp the importance of three-phase power in bitcoin mining, it is crucial to first comprehend the fundamentals of single-phase and three-phase power systems.

Single-Phase Power

Single-phase power is commonly used in residential settings and consists of two wires: a live wire and a neutral wire. The power delivery oscillates sinusoidally, leading to periods of peak and zero power output, which can result in inefficiencies, especially in high-demand operations like bitcoin mining.

Three-Phase Power

On the other hand, three-phase power, prevalent in industrial and commercial environments, comprises three live wires, ensuring a more constant and reliable power flow. This results in higher efficiency and reliability, making it ideal for applications such as bitcoin mining.

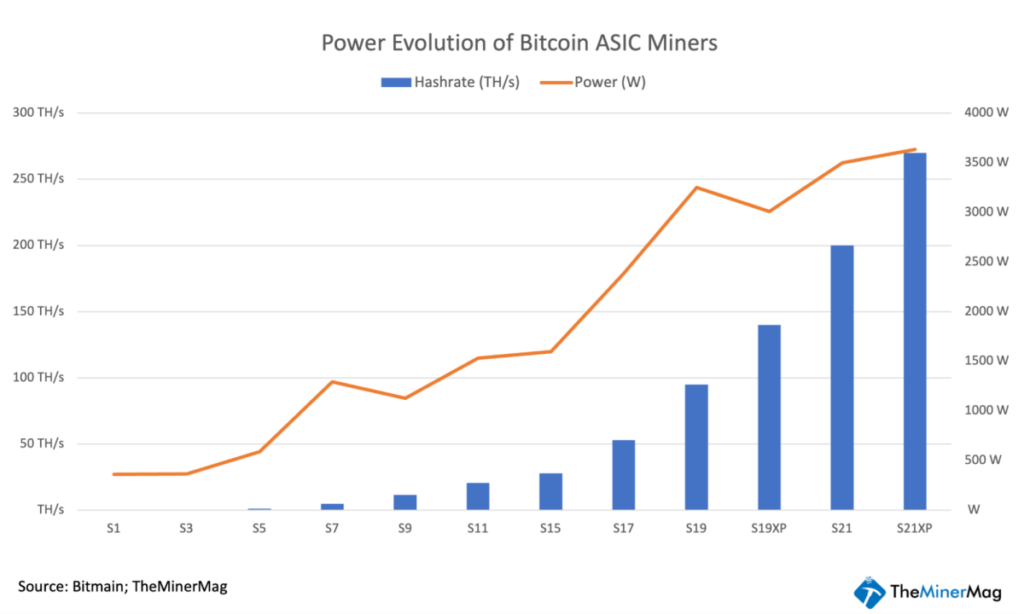

Evolution of Power Requirements

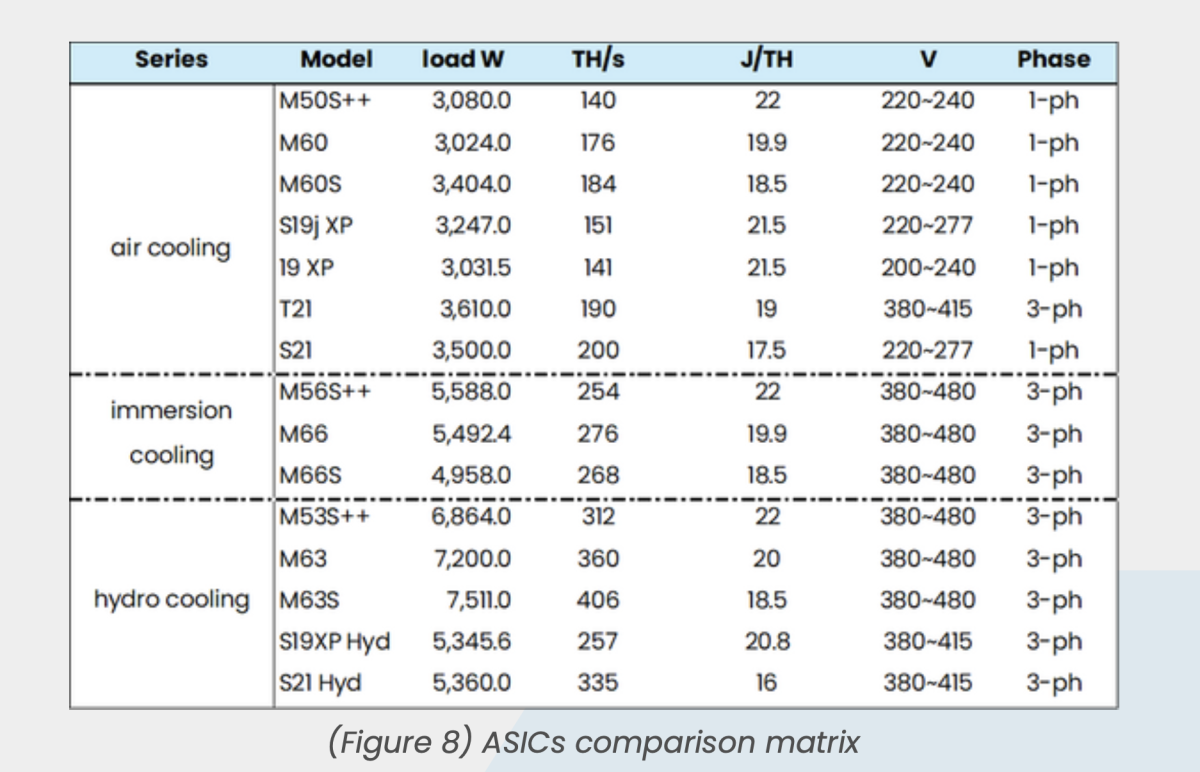

Bitcoin mining has evolved significantly over the years, with a shift towards ASIC miners and increased power demands. The transition to three-phase power has become essential to meet the energy needs of modern mining operations.

Benefits of 480v Three-Phase Power

480v three-phase power offers enhanced efficiency, cost savings, and scalability, making it ideal for industrial applications like bitcoin mining. It delivers higher power density, reduces energy losses, and minimizes infrastructure costs, leading to optimal performance levels.

Implementing Three-Phase Power

Transitioning to a three-phase power system involves assessing power requirements, upgrading electrical infrastructure, configuring ASIC miners, implementing redundancy systems, and ensuring proper monitoring and maintenance. By embracing three-phase power, miners can enhance the sustainability and profitability of their operations.

Conclusion

The adoption of three-phase power systems can revolutionize bitcoin mining operations by offering improved efficiency and scalability. With careful planning and execution, miners can harness the full potential of their equipment and stay competitive in the evolving landscape of bitcoin mining.

Frequently Asked Questions

Which is more powerful: sterling silver or 14k gold?

Gold and silver are strong metals, but sterling silver is much less expensive because it contains 92% pure silver rather than just 24%.

Sterling silver is sometimes called fine silver. This is because it is made with a mix of silver and different metals like copper or zinc.

It is generally believed that gold is very strong. It takes tremendous pressure to split it apart. It would be much easier to break it apart if you dropped an object on top a piece gold.

On the other hand, silver is not nearly as strong as gold. If you dropped an item onto a sheet of silver, it would probably bend and fold without shattering.

Silver is usually used in jewelry and coins. Therefore, its value tends to fluctuate based on supply and demand.

Can I store my Gold IRA at Home?

An online brokerage account is the best option to protect your investment funds. Online brokerage accounts offer all the same investment options and you do not need any special licenses. There are no fees to invest.

Many online brokers also offer tools that can help you manage your portfolio. Online brokers will allow you to download charts so that you can see the performance of your investments.

What Precious Metals Can You Invest in for Retirement?

Understanding what you have now saved and where you are currently saving money is the first step in retirement planning. Start by listing everything you have. This should include all stocks, bonds, mutual fund, certificates of deposits (CDs), insurance policies, life insurance policies and annuities. Add all these items together to calculate how much money you have for investment.

If you are between 59 and 59 1/2 years, you might consider opening a Roth IRA. While a Roth IRA does not allow you to deduct contributions from taxable income, a traditional IRA allows for that. However, you will not be able take tax deductions on future earnings.

If you decide that you need more money you'll need another investment account. You can start with a regular brokerage account.

What are the pros & con's of a golden IRA?

An excellent investment vehicle is a gold IRA. This is for people who wish to diversify but do not have access to traditional banking services. It allows you to invest freely in precious metals, such as gold, silver and platinum until they are withdrawn.

However, if you withdraw money before the due date, you will be subject to ordinary income tax. But because these funds are held outside of the country, there is little chance of them being seized by creditors when you default on your loan.

A gold IRA might be the right choice for you if you enjoy owning gold and don't worry about taxes.

Are gold IRAs a good place to invest?

You should buy shares in companies that produce gold. You should buy shares in these companies to make money from investing in gold and other precious metals such as silver.

However, there are two drawbacks to owning shares directly:

If you hold on to your stock for too much time, you risk losing money. When stocks decline, they fall further than their underlying asset (like gold). You could lose your money, rather than make it.

Second, you could miss out on potential profit if you wait for the market to recover before you sell. Therefore, you might need patience and wait for the market recovery before making any profit from your gold investments.

If you prefer to keep your investments apart from your finances, physical gold is still an option. An IRA in gold can diversify your portfolio and protect you against inflation.

Visit our website to learn more about gold investment.

Which type of IRA could be used for precious metals

Many financial institutions and employers offer an individual retirement account (IRA) as an investment option. An IRA lets you contribute money that will grow tax-deferred to the time it is withdrawn.

You can save taxes and pay them later with an IRA. This allows you to save more money today and pay less taxes tomorrow.

An IRA is a tax-free way to make contributions and earn income until you withdraw the funds. You can face penalties if you withdraw funds before the deadline.

You can also contribute to your IRA beyond age 50 without penalty. If you decide to withdraw funds from your IRA while you are still working, you'll owe income-taxes and a 10% penalty.

Withdrawals before age 59 1/2 will be subject to a 5% IRS penal. Between the ages of 591/2 and 70 1/2, withdrawals are subject to a 3.4% IRS penal.

An IRS penalty of 6.2% applies to withdrawals above $10,000 per year.

How does the gold and silver IRA function?

You can invest in precious metals like gold and silver without having to pay taxes. This makes them an attractive investment for people who want to diversify their portfolios.

If you are older than 59 1/2, interest earned from these account does not attract income tax. Any appreciation in the account's worth does not attract capital gains tax. You have to limit the amount you can deposit into this type account. The minimum amount that you can invest is $10,000. Under 59 1/2 years old, you can't make any investments. The maximum annual contribution is $5,000.

Your beneficiaries could receive less if you die before your retirement. After you have paid all your expenses, your estate should include sufficient assets to cover the balance of your account.

Some banks offer IRA options in gold and silver, while some require you to open a regular brokerage accounts through which you can purchase shares or certificates.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

investopedia.com

wsj.com

takemetothesite.com

en.wikipedia.org

How To

How to Decide if a Gold IRA ‘Is Right For You'

Individual Retirement Account (IRA) is the most popular type. IRAs are available through employers, banks, mutual funds, and financial planners. Individuals are allowed to contribute up to $5,000 each year to IRAs without having to pay tax consequences. This amount is available to all IRAs, regardless of age. You can only put a certain amount into an IRA, but there are restrictions. You cannot contribute to a Roth IRA if you are under 59 1/2 years of age. Contributions must be made by those under 50 years old. Individuals who work for their employer could be eligible for matching employer contributions.

There are two types: Roth and Traditional IRAs. Traditional IRAs allow you to invest in stocks, bonds and other investments. A Roth IRA allows you to only invest in after-tax dollars. Roth IRA contributions don't get taxed as soon as they are made. However, withdrawals from a Roth IRA will be taxed again. A combination of both accounts may be preferred by some people. Each type has its advantages and disadvantages. Before you decide which type of IRA is right for you, what are the pros and cons? These are the three main things you need to remember:

Traditional IRA Pros

- Contribution options vary by company

- Employer match possible

- It is possible to save more than $5.000 per person

- Tax-deferred growth up to withdrawal

- May have restrictions based on income level

- Maximum contribution limit for married couples is $5500 annually ($6,500 jointly).

- Minimum investment is $1,000

- You must start receiving mandatory distributions after age 70 1/2

- You must be at the least five years of age to open an IRA

- Cannot transfer assets between IRAs

Roth IRA pros:

- No taxes owed when contributing

- Earnings grow tax-free

- No minimum distributions

- Only stocks, bonds, mutual funds are available as investment options.

- There is no maximum allowed contribution

- Transfer assets between IRAs is possible without restrictions

- Open an IRA if you are 55 years or older

Considering opening a new IRA, it's essential to know that not all companies offer the same IRAs. For example, you might be able to choose between a Roth IRA (or a traditional one) from some companies. Others allow you to combine them. Noting that different types IRAs have different requirements, it's worth noting. A Roth IRA does not have a minimum investment requirement. Traditional IRAs require a minimum of $1,000.

The Bottom Line

The most important factor when choosing an IRA is whether you plan to pay taxes immediately or later. A traditional IRA may be the right choice if you retire within ten years. A Roth IRA may be a better choice for you. It doesn't matter what, it is a good idea consult a professional to discuss your retirement plans. An expert can advise you on the best options and how to navigate the market.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]