Venezuela: The Highest Inflation Rate at 360%

According to the International Monetary Fund (IMF), Venezuela is currently experiencing the highest inflation rate in the world at a staggering 360%. The Venezuelan bolivar has been consistently struggling against diminishing purchasing power, making it difficult for the citizens to afford goods and services.

Zimbabwe: Triple-Digit Inflation at 314.5%

Zimbabwe's currency, the Zimbabwean dollar, is facing triple-digit inflation, registering at 314.5% according to the IMF's data. The country has been wrestling with escalating inflation for a considerable period, leading to significant devaluations and fluctuations in recent times.

Sudan: Inflation Rate of Approximately 256.2%

Sudan, nestled in Northeast Africa, is enduring an inflation rate of approximately 256.2%. The Sudanese pound has been on a downward spiral for an extended period, marked by significant devaluations and fluctuations.

Argentina: Economic Turmoil with an Inflation Rate Soaring to 121.7%

Argentina is facing its own economic turmoil with an inflation rate soaring to 121.7%. The country's inflation saga is extensive, with a significant driver being the swift increase in money supply, leading to a substantial decline in purchasing power of the Argentine peso.

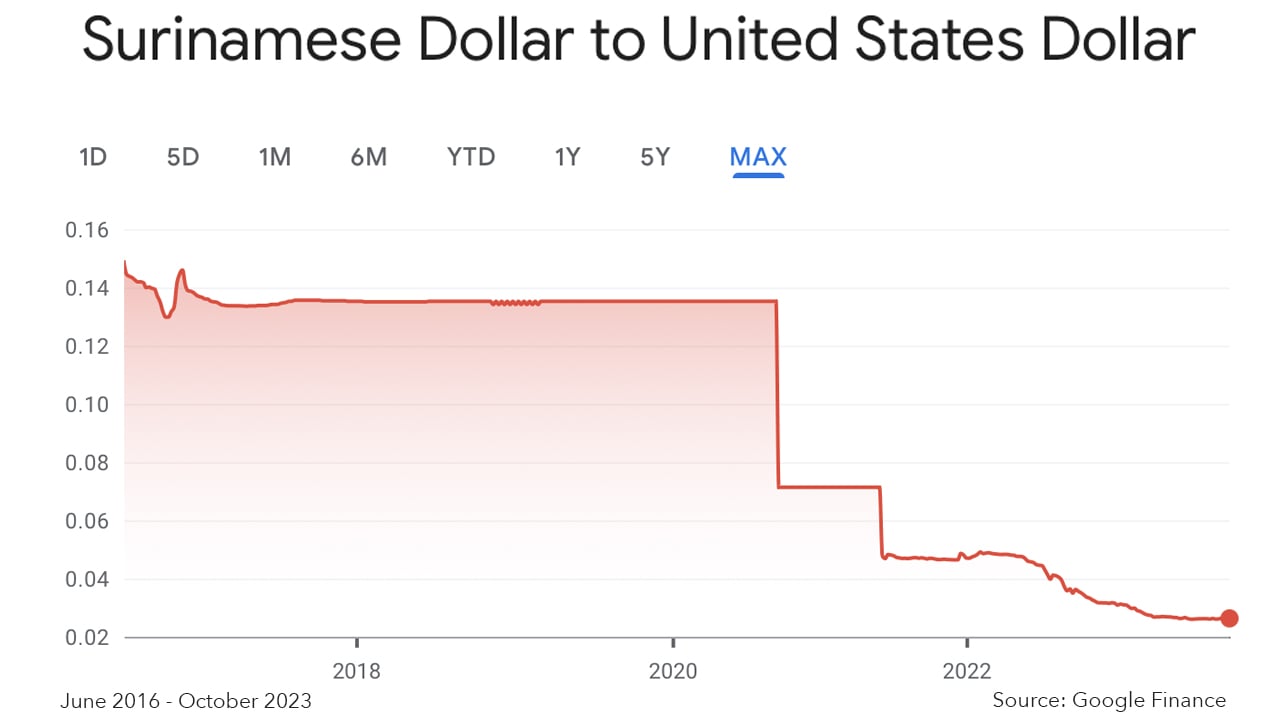

Suriname: Inflation Rate of 53.3%

Suriname, the smallest sovereign nation in South America, is experiencing an inflation rate of 53.3%. The inflationary pressures in Suriname stem from factors such as rampant money creation, fiscal imbalances, and external disruptions.

Turkey: Inflation Rate of 51.2%

Turkey is contending with an inflation rate of 51.2%. The country's economic challenge is fueled by President Recep Tayyip Erdogan's unconventional stance favoring low interest rates. Turkey has a history of rapid and prolonged inflationary periods.

Sri Lanka, Iran, Haiti, and Sierra Leone: High Inflation Rates

Completing the list of the top ten nations grappling with high inflation rates are Sri Lanka (48.19%), Iran (47%), Haiti (43.6%), and Sierra Leone (42.9%). These countries are also facing significant economic challenges due to inflation.

Barter Systems and Digital Currencies as Solutions

Residents in these countries are adopting various strategies to mitigate the effects of inflation. One such strategy is engaging in barter systems, where they trade goods and services directly instead of relying on their weakening national currencies. Additionally, digital currencies like bitcoin (BTC) and stablecoins are gaining popularity as a means to preserve wealth against inflating fiat currencies.

Reports indicate that cryptocurrency usage is prevalent in the regions most affected by inflation. In Venezuela, stablecoins like USDT have helped many overcome the hyperinflation crisis. Zimbabwe and Argentina have also seen an increase in the use of crypto assets. Sudan and Turkey are witnessing a noticeable shift towards digital currencies as well.

By embracing borderless financial assets like cryptocurrencies, individuals in these countries have found a viable alternative to protect their wealth in the face of soaring inflation rates.

What are your thoughts on the top ten countries grappling with high inflation rates? Share your opinions in the comments section below.

Frequently Asked Questions

How much of your portfolio should be in precious metals?

To answer this question we need to first define precious metals. Precious metals have elements with an extremely high worth relative to other commodity. This makes them extremely valuable for trading and investing. Today, gold is the most commonly traded precious metal.

But, there are other types of precious metals available, including platinum and silver. While gold's price fluctuates during economic turmoil, it tends to remain relatively stable. It also remains relatively unaffected by inflation and deflation.

All precious metals prices tend to rise with the overall market. That said, they do not always move in lockstep with each other. The price of gold tends to rise when the economy is not doing well, but the prices of the other precious metals tends downwards. Investors expect lower interest rate, making bonds less appealing investments.

The opposite effect happens when the economy is strong. Investors want safe assets such Treasury Bonds and are less inclined to demand precious metals. They are more rare, so they become more expensive and less valuable.

Diversifying across precious metals is a great way to maximize your investment returns. Additionally, since the prices of precious metals tend to rise and fall together, it's best to invest in several different types of precious metals rather than just focusing on one type.

What precious metals could you invest in to retire?

These precious metals are among the most attractive investments. Both are easy to sell and can be bought easily. You should add them to your portfolio if you are looking to diversify.

Gold: Gold is one of man's oldest forms of currency. It's stable and safe. This makes it a good option to preserve wealth in uncertain times.

Silver: Silver is a popular investment choice. It's an ideal choice for those who prefer to avoid volatility. Unlike gold, silver tends to go up instead of down.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. It's durable and resists corrosion, just like gold and silver. It is however more expensive than its counterparts.

Rhodium: The catalytic converters use Rhodium. It is also used as a jewelry material. It is also very affordable in comparison to other types.

Palladium: Palladium has a similarity to platinum but is more rare. It is also cheaper. This is why it has become a favourite among investors looking for precious metals.

Should You Invest Gold in Retirement?

The answer depends on how much money you have saved and whether gold was an investment option available when you started saving. Consider investing in both.

Gold is a safe investment and can also offer potential returns. It is a good choice for retirees.

Gold is more volatile than most other investments. Because of this, gold's value can fluctuate over time.

But this doesn't mean you shouldn't invest in gold. It is important to consider the fluctuations when planning your portfolio.

Another advantage to gold is that it can be used as a tangible asset. Gold is much easier to store than bonds and stocks. It is also easily portable.

Your gold will always be accessible as long you keep it in a safe place. You don't have to pay storage fees for physical gold.

Investing in gold can help protect against inflation. Because gold prices tend to rise along with other commodities, it's a good way to hedge against rising costs.

Additionally, it will be a benefit to have some of your savings invested into something that won't lose value. Gold rises in the face of a falling stock market.

Investing in gold has another advantage: you can sell it anytime you want. You can easily liquidate your investment, just as with stocks. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. You shouldn't try to put all of your eggs into one basket.

Don't buy too many at once. Start with a few ounces. Add more as you're able.

It's not about getting rich fast. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

How much should your IRA include precious metals

When investing in precious metals, the most important thing to know is that they aren't just for wealthy people. You don't need to be rich to make an investment in precious metals. There are many methods to make money off of silver and gold investments.

You might think about buying physical coins such a bullion bar or round. Also, you could buy shares in companies producing precious metals. You may also be interested in an IRA transfer program offered by your retirement provider.

You can still get benefits from precious metals regardless of what choice you make. Even though they aren't stocks, they still offer the possibility of long-term growth.

Their prices are more volatile than traditional investments. This means that if you decide on selling your investment later, you'll likely get more profit than you would with traditional investing.

How much money should I put into my Roth IRA?

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. You can't withdraw money from these accounts before you reach the age of 59 1/2. There are some rules that you need to keep in mind if you want to withdraw funds from these accounts before you reach 59 1/2. First, you can't touch your principal (the initial amount that was deposited). You cannot withdraw more than the original amount you contributed. If you wish to withdraw more than you originally contributed, you will have to pay taxes.

The second rule is that your earnings cannot be withheld without income tax. Withdrawing your earnings will result in you paying taxes. Consider, for instance, that you contribute $5,000 per year to your Roth IRA. Let's also assume that you make $10,000 per year from your Roth IRA contributions. Federal income taxes would apply to the earnings. You would be responsible for $3500 This leaves you with $6,500 remaining. This is the maximum amount you can withdraw because you are limited to what you initially contributed.

Therefore, even if you take $4,000 out of your earnings you still owe taxes on $1,500. You'd also lose half the earnings that you took out, as they would be subject to a second 50% tax (half of 40%). So, even though you ended up with $7,000 in your Roth IRA, you only got back $4,000.

There are two types: Roth IRAs that are traditional and Roth. Traditional IRAs allow for pre-tax deductions from your taxable earnings. Your traditional IRA allows you to withdraw your entire contribution plus any interest. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs won't let you deduct your contributions. Once you are retired, however, you may withdraw all of your contributions plus accrued interest. There is no minimum withdrawal limit, unlike traditional IRAs. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

How much gold should you have in your portfolio?

The amount of money you need to make depends on how much capital you are looking for. Start small with $5k-10k. As you grow, it is possible to rent desks or office space. Renting out desks and other equipment is a great way to save money on rent. Rent is only paid per month.

You also need to consider what type of business you will run. In my case, I run a website-creation company. Our clients pay us between $1000-2000/month and depending on their order. Consider how much you expect to make from each client, if you decide to do this kinda thing.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. You may get paid just once every 6 months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k-$2k of gold and growing from there.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)