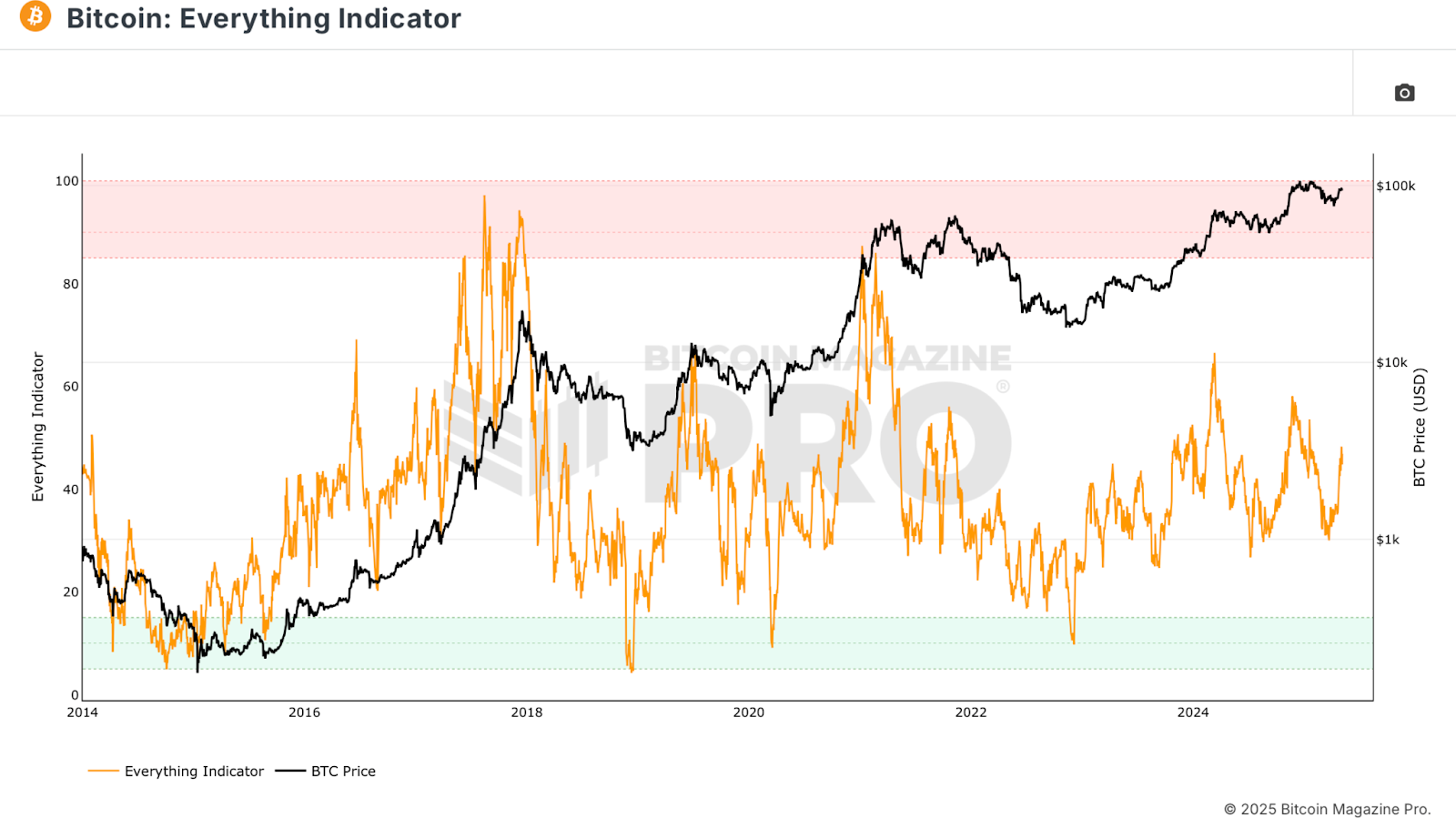

Are you ready to unlock massive profits in the world of Bitcoin trading? If so, the Enhanced Bitcoin Everything Indicator is your ticket to success. This powerful tool provides a holistic view of all the key factors influencing BTC price movements, from on-chain data to macroeconomics, technical analysis, and fundamentals. And now, it's been supercharged to offer even more actionable insights without compromising its accuracy.

Exploring the Bitcoin Everything Indicator

The Backbone of Market Analysis

Let's dive into what makes the Bitcoin Everything Indicator a game-changer. This composite tool combines various signals, including on-chain metrics like MVRV Z-Score and SOPR, macroeconomic data such as the Global M2 Money Supply, network insights like active address sentiment, technical overlays such as the Crosby Ratio, and mining health metrics like the Puell Multiple. Together, these factors create a comprehensive score that captures the dynamics of the broader Bitcoin market. Unlike single indicators, this tool considers multiple dimensions that influence Bitcoin price movements.

Enhancing Signal Frequency

More Signals, More Opportunities

The original indicator was known for its infrequent yet potent signals, marking significant market turning points every few years. While valuable for long-term investors, it lacked real-time guidance for active traders. The solution? Introducing a moving average overlay to increase the signal frequency while preserving the model's macro perspective.

Implementing the Moving Average

Unlocking Market Insights

The magic lies in simplicity. By applying a 200-day moving average to the Everything Indicator, traders can identify trend changes and potential entry or exit points. When the indicator crosses above the moving average, it indicates a bullish trend, offering early entry signals. Conversely, a crossover below the moving average can signal a potential downturn, prompting risk management actions.

Maximizing Trading Efficiency

Shortening Moving Averages for Agility

For active traders seeking more signals, shortening the moving average to 20 periods can offer multiple entry and exit points per market cycle. This adjustment maintains the indicator's core logic while catering to traders who want to respond quickly to market shifts. The tool's versatility shines through, delivering strong returns for both long-term investors and dynamic traders.

Empowering Your Trading Journey

Adapt, Enhance, Succeed

With the Enhanced Bitcoin Everything Indicator, you have the best of both worlds: a robust market overview and the agility to act swiftly on market signals. By customizing overlays, adjusting moving averages, and integrating additional filters, you can tailor these tools to your trading strategy for maximum impact. Don't miss out on this opportunity to elevate your trading game!

Take Your Trading to the Next Level

Ready to supercharge your Bitcoin trading journey? Explore Bitcoin Magazine Pro for in-depth research, real-time alerts, technical indicators, and a vibrant analyst community. Visit BitcoinMagazinePro.com now and elevate your trading experience!

Frequently Asked Questions

Which is stronger: 14k gold or sterling silver?

Both gold and silver make strong metals. Sterling silver is more affordable than sterling silver which has only 24% pure silver.

Sterling silver is also known by the name “fine silver” because it is made up of a mixture from silver and metals like zinc, copper, and zinc.

Gold is usually considered to be extremely strong. It takes great pressure to break it apart. If you dropped an object on top to a gold piece, it would shatter into thousands rather than breaking into two halves.

But silver isn’t nearly as sturdy as gold. If you dropped something onto a sheet made of silver, it would most likely bend and fold easily without breaking.

Silver is often used in jewelry and coins. Its value fluctuates based on demand and supply.

Is gold IRAs a good way to invest?

You can invest in gold by purchasing shares in companies that mine it. These companies are a great way to make money investing in precious metals like gold.

The downside to owning shares is that you can't directly control them.

If you hold on to your stock for too much time, you risk losing money. Stocks that fall are less than their underlying asset (like silver) and can end up losing more money. It could lead to you losing your money, instead of making it.

Second, waiting for the market to recover before selling your gold holdings could result in you missing out on potential profits. It is possible to wait until the market recovers before selling your gold.

Physical gold can be beneficial if you prefer to keep investments separate from your finances. An IRA in gold can diversify your portfolio and protect you against inflation.

Visit our website for more information on gold investing.

Can you make money in a gold IRA

Two things are necessary if you want to make a profit on your investment. First, you need to understand the market. Second, you need to know what type of products you have.

You shouldn't trade if you don't have the right information.

Also, you should find the broker that provides the best service possible for your account type.

You can choose from a variety of accounts, including Roth IRAs or standard IRAs.

You may also wish to consider a rollover if you already have other investments, such as stocks and bonds.

What are the three types of IRAs?

There are three basic types for IRAs. Each type of IRA has its pros and cons. Each one will be discussed below.

Traditional Individual Retirement Accounts (IRA)

A traditional IRA allows pre-tax money to be contributed to an account. This allows you to earn interest and defer taxes. The account can be withdrawn tax-free once you are retired.

Roth IRA

Roth IRAs allow for you to make after-tax deposits into an account. The earnings are tax-free. You can also withdraw money from the account to retire your funds tax-free.

SEP IRA

This is similar to a Roth IRA but requires additional contributions from employees. The additional contributions are taxed but earnings remain tax-deferred. You may choose to convert the entire amount to a Roth IRA when you leave the company.

Are you able to keep precious metals in your IRA?

The answer to that question will depend on whether the IRA owner plans to diversify his holdings to gold and/or keep them safekeeping.

If he does want to diversify, then there are two options available to him. He could either purchase physical bars or silver from a seller, or return these items to the dealer at end of the year. However, suppose he isn't interested in selling back his precious metal investments. In this case, he should hold onto the investments as they are perfect for storing inside an IRA account.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

External Links

investopedia.com

en.wikipedia.org

takemetothesite.com

regalassets.com

How To

How to buy silver with your IRA

How to start buying silver with your IRA – The best way to invest in gold and silver is through direct ownership of physical bullion. Bars and silver coins are the most common form of investment. They offer liquidity, diversification, and convenience.

If you want to buy precious metals like gold and silver, several options are available. You can either buy them directly from their producers like mining companies or refiners. You can buy them directly from the producer or a dealer who purchases and sells bullion.

This article will explain how to invest in silver with an IRA.

- Investing in Gold & Silver through Direct Ownership – The best way to purchase precious metals is to directly go to the source. This involves getting the bullion and having it delivered to your doorstep. Some investors keep their bullion at home, while others store it in a secure storage unit. You should ensure that your precious metal is properly stored when you are preserving it. Most storage facilities offer insurance coverage that protects against theft, fire, or damage. But, even with insurance, you can lose your investments because of natural disasters and human error. The safe storage of precious metals at a bank or credit card union is always recommended.

- Online Precious Metals Buying – If you prefer not to transport heavy boxes of precious metal around, then buying bullion online is an option. Bullion dealers offer bullion in a variety of forms, including bars and coins. Coins come in different sizes, shapes, and designs. Coins are generally more convenient to carry than bars. Bars come in a variety of sizes and weights. Bars come in a variety of sizes and weights. Some bars weigh hundreds while others weigh just a few pounds. You should consider the purpose of the bar before you decide on which one to get. If you plan on giving it as gifts, you might choose something smaller. You might spend more money if you plan to display it and add it to your collection.

- Buying Precious metal from Dealers-A third option is buying bullion through a dealer. Most dealers only specialize in one type of market, either silver or gold. Some dealers specialize in certain types of bullion, such as rounds or minted coins. Others specialize in specific regions. And yet others specialize in bulk purchases. Regardless of which dealer you choose, you'll likely find that they offer competitive prices and convenient payment methods.

- Buy Precious Metals Through Retirement Accounts. Although it is not considered an “investment”, investing in retirement accounts can provide exposure to precious metals. To qualify for tax benefits under Section 219 of the IRS Code, you must invest in precious metals through a qualified retirement account. These include IRAs as well 403(b), 401(k), and 403 (b) plans. These accounts are designed to help you save for retirement and often provide higher returns than other investment vehicles. Many of these accounts let you diversify your holdings across multiple types of metals. The problem? You can't invest in retirement accounts. Only people who work for employers that sponsor them can invest in these accounts.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]