Looking to safeguard your savings from the unpredictable nature of traditional IRA investments? With rising interest rates, inflation, and market volatility, securing your retirement funds is a top priority.

For many investors, the solution lies in transitioning from stock market investments to physical gold through a gold IRA. As you explore options for opening a gold IRA, numerous companies vie for your attention.

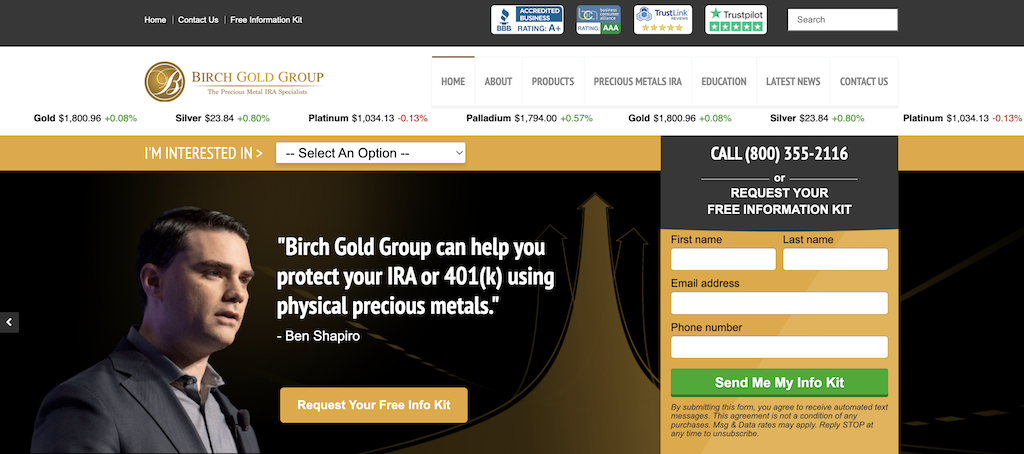

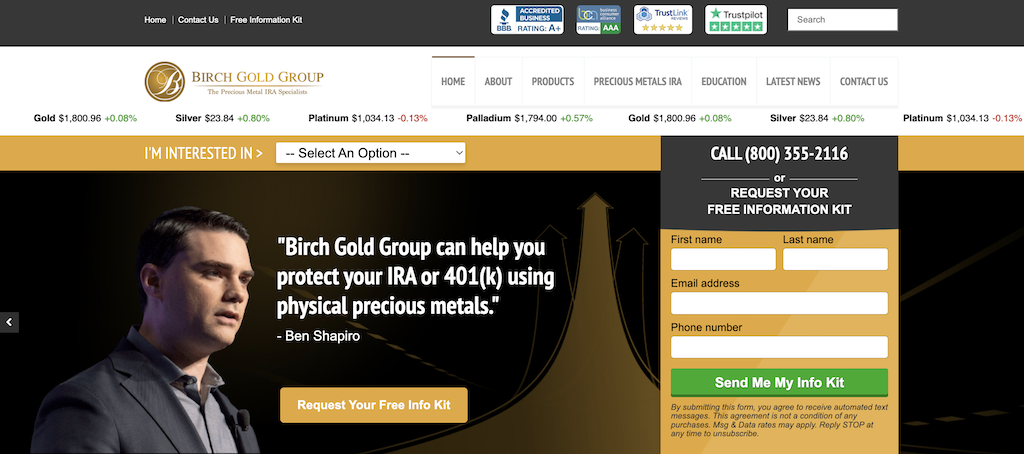

Among the top contenders is Birch Gold Group. With a track record spanning back to 2003, Birch Gold has catered to over 14,000 clients, establishing itself as a premier precious metals dealer in the United States.

Let's delve into this review of Birch Gold Group to determine if it aligns with your investment goals.

Understanding Birch Gold Group

Birchgold.com website

Birchgold.com website

Laith Alsarraf laid the groundwork for Birch Gold Group in 2003, assembling a team of precious metal IRA specialists dedicated to helping clients diversify their investment portfolios with precious metals.

Backed by accolades such as a Better Business Bureau A+ rating, a five-star TrustLink rating, and stellar reviews from ConsumerAffairs and Trustpilot, Birch Gold Group stands as a trusted player in the industry.

Comprehensive Services Offered

Similar to other gold IRA providers, Birch Gold Group offers a range of services tailored to meet diverse investor needs.

Precious Metals IRA

Embracing a precious metals IRA allows investors to enjoy the tax benefits of a traditional IRA while delving into physical precious metal investments.

Under IRS guidelines, IRAs necessitate a custodian to oversee the account, ensuring compliance with regulations. Birch Gold Group steps in to offer precious metals IRA solutions, enabling investors to acquire IRS-approved gold, silver, palladium, and platinum coins and bullion.

- Acquiring Qualified Metals: Birch Gold Group ensures that only IRS-sanctioned metals and coins are utilized in your IRA.

- Secure Metals Storage: Entrust your IRA precious metals to approved storage facilities, managed through Birch Gold Group's partner entities.

- Fraud Prevention: By working with reputable firms like Birch Gold Group, you shield your investments from unscrupulous practices.

- Adherence to IRS Regulations: Birch Gold Group strictly adheres to IRS-approved metal standards for IRAs.

- IRA Rollover Assistance: Navigate the IRA rollover process seamlessly with Birch Gold Group's expert guidance.

Direct Home Delivery

For investors preferring to hold precious metals at home, Birch Gold Group facilitates direct metal deliveries, catering to individual investment preferences.

By purchasing precious metals directly from Birch Gold Group through wire transfers, investors enjoy instant access to their investments. The ease of liquidating direct precious metal purchases adds to their appeal as a hedge against market volatility.

Investors can select from gold, silver, palladium, and platinum options through Birch Gold Group, with a minimum investment threshold of $10,000.

![]()

Flexible Storage Alternatives

Birch Gold Group stands out by offering investors the freedom to choose their preferred gold storage location, setting it apart from companies tied to specific storage facilities.

Investors partnering with Birch Gold Group can opt for secure storage at facilities like The Delaware Depository, Brink's Global Services, Texas Precious Metals Depository, and International Depository Services.

Understanding Fees and Minimum Investments

Precious Metals IRA Transactions (fees may vary)

| Account Setup Fee | $50 |

| Wire Transfer Fee | $30 |

| Custodian Fees | $180 per year |

| Minimum Investment | $10,000 |

Non-IRA Transactions

| Custodian Fees | $0 |

| Minimum Investment | $10,000 |

Ideal Candidates for Birch Gold Group

Birch Gold Group's precious metals IRA might be the right fit if:

- You are new to gold or precious metals investing.

- You seek to diversify your retirement portfolio.

- You prefer a gold IRA with minimal management fees.

Embarking on Your Investment Journey with Birch Gold

Should you opt for Birch Gold Group, their dedicated team will seamlessly guide you through the account setup process, including any necessary rollovers.

For most new clients, investing with Birch Gold Group typically involves these steps:

- Request a free info kit: Dive into Birch Gold Group's educational resources to grasp the nuances of precious metals investing.

- Consult with a representative: Engage with a Birch Gold Group specialist to gain insights and address queries.

- Select your funding method: With a $10,000 minimum investment requirement, consider utilizing a rollover for funding.

- Choose your precious metals: Craft your portfolio with gold, silver, platinum, or palladium options.

- Settle custodian fees: Make a one-time payment for account setup and initial fees.

- Secure metals in a depository: Based on your custodian choice, store your metals in a secure facility.

Is Birch Gold Group Your Ideal Partner?

Glance through Birch Gold Group reviews boasting top ratings and commendations from reputable sources. The company's dedication to customer service and education sets it apart.

![]()

Considering uncertainties in the market and the safety of your retirement nest egg, exploring a precious metals IRA investment via Birch Gold Group could be a prudent move.

Frequently Asked Questions (FAQs)

Here are answers to common queries about Birch Gold Group:

Is Birch Gold Group a reputable company?

Multiple positive reviews from credible sources affirm Birch Gold Group's reputation.

Who owns Birch Gold Group?

Laith Alsarraf, the founder, currently owns Birch Gold Group.

Is Birch Gold endorsed by Ben Shapiro, Steve Bannon, and Phillip Patrick?

Yes, Birch Gold Group enjoys endorsements from Ben Shapiro, Steve Bannon, and Phillip Patrick.

Does Birch Gold face any pending lawsuits or customer complaints?

Birch Gold Group has a clean record without any pending complaints or legal issues.

![]()

Where is Birch Gold located?

Birch Gold Group's headquarters are situated in Burbank, California, at 3500 West Olive Ave., Suite 300, Burbank, CA, 91505.

Frequently Asked Questions

Which is stronger? 14k Gold or Sterling Silver?

Although gold and silver can be strong metals, sterling silver is far less expensive as it contains 92% silver instead of 24%.

Sterling silver is also known as fine silver because it is made from a mixture of silver and other metals such as copper and zinc.

Gold is usually considered to be extremely strong. It is very difficult to separate it from its metal counterpart. It would be much easier to break it apart if you dropped an object on top a piece gold.

However, silver isn't as strong and durable as gold. If you dropped an item onto silver sheets, it would likely fold and bend without cracking.

Silver is usually used in jewelry and coins. Its value fluctuates based on demand and supply.

What Should Your IRA Include in Precious Metals?

Protecting yourself from inflation is best done by investing in precious metals such silver and gold. This is not only an investment for retirement, but it can also help you prepare for any economic downturn.

Although gold and silver prices have risen significantly in the past few years they are still considered safe investments. They don't fluctuate quite as much like stocks. There is always demand for these materials.

Gold and silver prices are usually stable and predictable. They tend to rise during economic growth and drop during recessions. This makes them very valuable money-savers and long term investments.

Your total portfolio should be 10 percent in precious metals. If you wish to diversify further, this percentage could be higher.

Do You Need to Open a Precious Metal IRA

The answer depends on whether you have an investment goal and how much risk tolerance you are willing to take.

Open an account today if your retirement plan calls for you to withdraw the funds.

It is likely that precious metals will appreciate over the long-term. You also get diversification benefits.

The prices of silver and gold tend to be linked. They make a good choice for both assets and are a better investment.

If you're not planning on using your money for retirement or don't want to take any risks, you probably shouldn't invest in precious metal IRAs.

Can I add gold to my IRA?

Yes! Gold can be added to your retirement plan. Because it doesn’t lose value over the years, gold makes a good investment. It protects against inflation. It is also exempt from taxes.

Before you decide to invest in gold, it is important to understand that it isn't like other investments. You cannot purchase shares of gold companies like bonds and stocks. Nor can you sell them.

Instead, you should convert your gold to cash. This means you will need to get rid. You cannot just keep it.

This makes gold an investment that is different from other investments. Like other investments, you can always dispose of them later. This is not true for gold.

Even worse, you can't use the gold as collateral for loans. If you get a mortgage, for example, you might have to give up some of the gold you own in order to pay off the loan.

What does this translate to? You can't hold onto your gold forever. You'll have to turn it into cash at some point.

There's no need to be concerned about this right now. You only need to open an IRA account. You can then invest in gold.

How much of your portfolio should you hold in precious metals

To protect yourself from inflation, investing in physical metals is the best option. This is because when you invest in precious metals, you buy into the future value of these assets, not just the current price. The value of your investment increases with rising prices.

Tax benefits will accrue if your investments are kept for at most five years. And if you sell them after this period, you will have to pay capital gains taxes. Our website has more information about how to purchase gold coins.

Statistics

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

regalassets.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

investopedia.com

takemetothesite.com

How To

How to determine if a Gold IRA works for you

Individual Retirement accounts (IRAs) are the most common type of retirement account. IRAs can be obtained through banks, financial advisors, mutual funds, employers and banks. Individuals can contribute as much as $5,000 per year without any tax consequences. This amount can be contributed to any IRA, regardless of your age. However, certain IRAs have limits on the amount you can deposit. For example, if your age is less than 591/2 years old, you can't contribute to a Roth IRA. If you're under 50, you must wait until you reach age 70 1/2 before making contributions. Some people may also be eligible for matching contributions if they work for their employer.

There are two main types: Roth and traditional IRAs. Traditional IRAs can be used to invest in stocks or bonds, as well other investments. Roth IRAs are only available for after-tax dollars. Roth IRA contributions can be made without tax, but they will still be subject to taxes if you withdraw from it. Some people prefer to combine these two accounts. Each type has its advantages and disadvantages. What should you look at before deciding which type is best for you? These are the three main things you need to remember:

Traditional IRA Pros

- There are many options for contributing to your company.

- Employer match possible

- It is possible to save more than $5.000 per person

- Tax-deferred growth up to withdrawal

- May have restrictions based on income level

- Maximum annual contribution is $5,500 ($6,500 for married couples filing jointly).

- The minimum investment required is $1,000

- You must start receiving mandatory distributions after age 70 1/2

- Must be at least five years old to open an IRA

- Cannot transfer assets between IRAs

Roth IRA pros

- Contributions do not attract taxes

- Earnings grow tax-free

- No minimum distributions

- Stocks, bonds, and mutual fund investments are the only options.

- There is no maximum allowed contribution

- No limitations on transferring assets between IRAs

- Open an IRA if you are 55 years or older

Considering opening a new IRA, it's essential to know that not all companies offer the same IRAs. Some companies provide the choice of a Roth IRA as well as a traditional IRA. Others allow you to combine them. There are different requirements for different types. Roth IRAs do not require a minimum amount of investment, while traditional IRAs are limited to a maximum investment of $1,000.

The Bottom Line

The most important factor when choosing an IRA is whether you plan to pay taxes immediately or later. A traditional IRA may be the right choice if you retire within ten years. If you are not able to retire within ten years, a Roth IRA may work better for you. It doesn't matter what, it is a good idea consult a professional to discuss your retirement plans. You need someone who knows what's happening in the market and can recommend the best options for your situation.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]