Bitcoin's price movements often steal the spotlight, but the true narrative of BTC unfolds beneath the surface. Beyond the realm of technical analysis and price predictions, on-chain data emerges as a powerful tool, unveiling insights into supply, demand, and investor behavior in real-time. This article delves into the significance of on-chain data and how it empowers traders and investors to anticipate market trends, track institutional movements, and make informed decisions.

Realized Price & MVRV Z-Score

On-chain data refers to the publicly accessible transaction records on Bitcoin's blockchain. Unlike traditional markets that shroud investor activities in secrecy, Bitcoin's transparent nature allows for the instantaneous analysis of every transaction, wallet movement, and network activity. This level of transparency enables investors to identify key trends, accumulation zones, and potential price turning points.

One pivotal on-chain metric is Realized Price, portraying the average cost basis of all BTC in circulation. Unlike conventional assets where determining investor cost bases proves challenging, Bitcoin offers real-time visibility into whether the majority of holders are at a profit or loss.

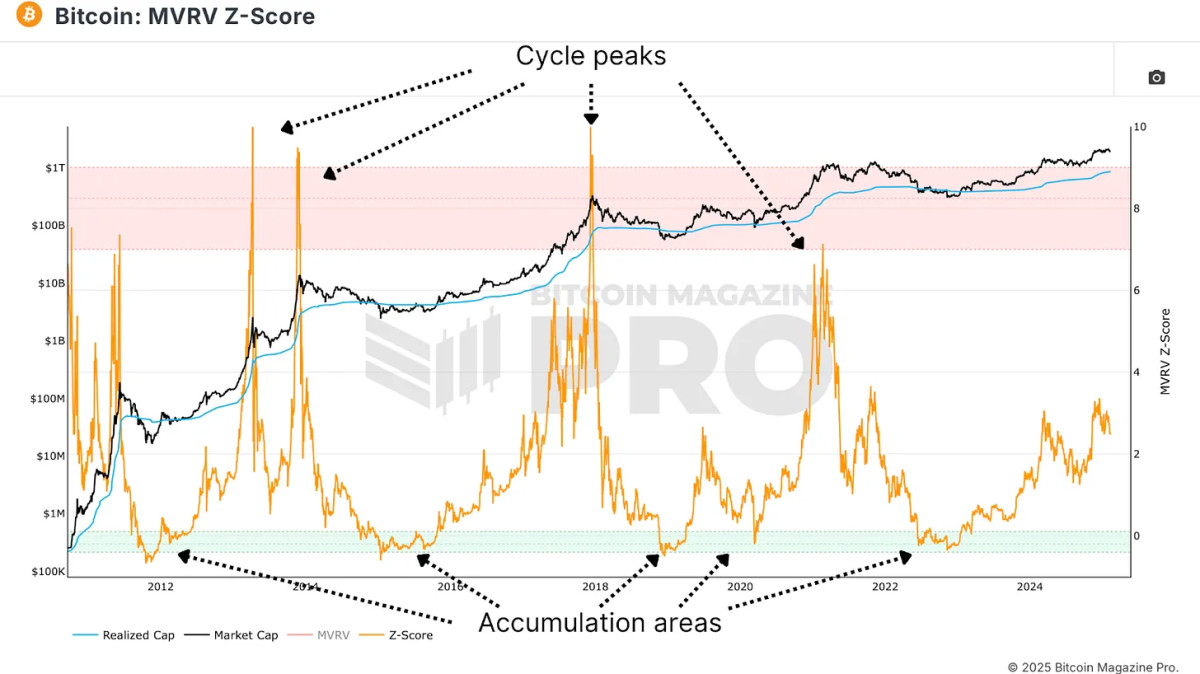

To complement Realized Price, analysts utilize the MVRV Z-Score, which gauges the deviation between market value and realized value, adjusted for Bitcoin's volatility. This metric historically identifies opportune buying opportunities when in the lower range and potential overvaluation when in the red zone.

Monitoring Long-Term Holders

Another essential metric is the 1+ Year HODL Wave, tracking Bitcoin addresses that have remained inactive for at least a year. An ascending HODL wave signifies investors opting to hold onto their assets, diminishing circulating supply and exerting upward pressure on prices. Conversely, a declining HODL wave hints at profit-taking and potential distribution.

HODL Waves illustrate the distribution of Bitcoin ownership across different age bands. Focusing on new market entrants of 3 months or less reveals typical retail participation levels. Peaks in short-term holders often signal market peaks, while low levels indicate favorable accumulation zones.

Spotting Whale Movements

Supply Adjusted Coin Days Destroyed quantifies total BTC moved, factoring in the duration it was held and adjusting this data by the circulating supply at the time. This metric proves invaluable in detecting whale activity and institutional profit-taking. Instances of long-dormant coins suddenly in motion often indicate significant holders exiting positions.

Historical data affirms that spikes in Supply Adjusted CDD correlate with major market peaks and troughs, underscoring its utility in cycle analysis.

Realized Gains & Losses

The Spent Output Profit Ratio (SOPR) reveals the profitability of BTC transactions. A SOPR value above 0 suggests that the average Bitcoin being transacted is in profit, while a value below 0 indicates sales at a loss. Monitoring SOPR spikes enables traders to pinpoint euphoric profit-taking, while declines often coincide with bear market capitulations.

Relying on a singular metric can be misleading. Investors are encouraged to seek confluence among multiple on-chain indicators to enhance the accuracy of signals.

Conclusion

Bitcoin's on-chain data furnishes a transparent, real-time perspective on market dynamics, equipping investors with a competitive edge in decision-making. By monitoring supply trends, investor sentiment, and accumulation/distribution cycles, individuals invested in Bitcoin can strategically position themselves for long-term success.

For up-to-date data, charts, indicators, and comprehensive research on Bitcoin's price movements, visit Bitcoin Magazine Pro.

Disclaimer: This article serves informational purposes exclusively and should not be construed as financial advice. Always conduct thorough research before making any investment decisions.

Frequently Asked Questions

What precious metals can you invest in for retirement?

The first step to retirement planning is understanding what you have saved now and where you are saving money. Start by listing everything you have. This includes stocks, bonds and mutual funds, as well as certificates of deposit (CDs), life policies, annuities and 401(k), plans, real estate investments and other assets, such precious metals. To determine how much money is available to invest, add all these items.

If you haven't already done so, you may want to consider opening a Roth IRA account if you're younger than 59 1/2 years old. While a Roth IRA does not allow you to deduct contributions from taxable income, a traditional IRA allows for that. However, you won't be able to take tax deductions for future earnings.

If you decide you need more money, you will likely need to open another investment account. You can start with a regular brokerage account.

Does a gold IRA earn interest?

It depends on how much money you put into it if you have $100,000, then yes. You can't if you have less than $100,000

How much money you place in an IRA will determine how it earns interest.

You should consider opening a regular brokerage account instead if you put in more than $100,000 per year for retirement savings.

While you may earn more interest there than elsewhere, you are also exposed to more risky investments. It's not a good idea to lose all of the money you have invested in the stock exchange.

However, if you only put in $100,000 per annum, you'll probably be better off with an IRA. You can do this until the market grows again.

What precious metals are permitted in an IRA

Gold is the most popular precious metal for IRA accounts. Investments in gold bullion coins or bars can be made as well.

Precious Metals are safe investments since they don’t lose value over the long-term. They can also be used to diversify investment portfolios.

Precious metals are silver, palladium, and platinum. These three metals are similar in their properties. Each has its own purpose.

One example is platinum, which is used to create jewelry. You can create catalysts with palladium. To produce coins, silver can be used.

Consider how much you plan to spend on gold when deciding on which precious metal to buy. A lower-cost ounce of gold might be a better option.

Also, think about whether or not you wish to keep your investment secret. If you have the desire to keep your investment private, palladium might be the best choice.

Palladium has a higher value than gold. It is also more rare. It is likely you will need to pay more.

Their storage fees are another important factor to consider when choosing between sterling and gold. The weight of gold is what you store. So you'll pay a higher fee for storing larger amounts of gold.

Silver is best stored in volumes. You'll pay less if you store smaller quantities of silver.

All IRS rules concerning gold and silver should be followed if your precious metals are stored in an IRA. This includes keeping track, and reporting to the IRS, all transactions.

What is the cost of gold IRA fees

The average annual fee to open an individual retirement account (IRA), is $1,000. There are many types available: SIMPLE IRAs (SEP-IRAs), Roth IRAs, Traditional IRAs and Roth IRAs. Each type comes with its own set rules and requirements. For example, you may have to pay taxes on any earnings from your investments if they're not tax-deferred. You must also consider how long you want to hold onto the money. If you are planning to hold onto your money for a longer time, you will likely save more money opening a Traditional IRA than a Roth IRA.

A traditional IRA lets you contribute up to $5,500 each year ($6,500 if your age is 50+). A Roth IRA lets you contribute unlimited amounts each year. The difference between them? With a traditional IRA, the money can be withdrawn at your retirement without tax. You'll owe tax on any Roth IRA withdrawals.

Statistics

- Silver must be 99.9% pure • (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

takemetothesite.com

regalassets.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

How To

How to Buy Gold for Your Gold IRA

The term precious metal refers to gold, silver, palladium and rhodium. It refers to any naturally occurring element with atomic numbers 79 through 110 (excluding helium), which is considered valuable because of its rarity and beauty. Silver and gold are the most well-known precious metals. Precious metallics are frequently used as jewelry, money and industrial goods.

Gold's price fluctuates each day due to supply/demand. Investors are looking for safe havens away from unstable countries and precious metals has seen a large demand over the past decade. Prices have risen significantly due to this increased demand. Some are concerned about the increased cost of production and have resisted investing in precious materials.

Because gold is rare and durable, it makes a good investment. Like many investments, gold doesn't lose value. Gold can be bought and sold without tax. There are two methods to invest gold. You have two options: you can buy gold bars and coins, or you can invest in futures contracts.

You can instantly have liquidity with physical gold bars and coins. They are easy and convenient to trade or store. They do not offer any protection against inflation. Consider purchasing gold bullion if you want to be protected from rising prices. Bullion is physical gold that comes in different sizes and shapes. One-ounce pieces are available for billions, while larger quantities such as kilobars and tens of thousands can be purchased. Bullion is usually stored in vaults protected from theft and fire.

You might prefer to own shares of gold than actual gold. If so, then you should look into buying futures gold. Futures allow you to speculate as to how the gold price will change. Gold futures allow you to be exposed to its price without owning any physical commodity.

For instance, if my goal was to speculate on the movement of the gold price, I could purchase a contract. My position will change when the contract expires. It can be either “longer” or “shorter.” A long contract means that I believe the price of gold will go higher, so I'm willing to give someone else money now in exchange for a promise that I'll get more money later when the contract ends. A short contract, on the other hand, means I believe the price of gold is going to drop. In exchange for making less money in the future, I am willing to accept the money now.

I'll be paid the amount of gold and interest specified in the contract when it expires. That way, I've gained exposure to the price of the gold without actually having to hold the gold myself.

Because they are extremely difficult to counterfeit, precious metals make great investments. Precious metals can't be counterfeited like paper currency. However, new bills can be printed to make them look more authentic. It is because precious metals are hardier than paper currencies that they can be counterfeited by printing new bills.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]