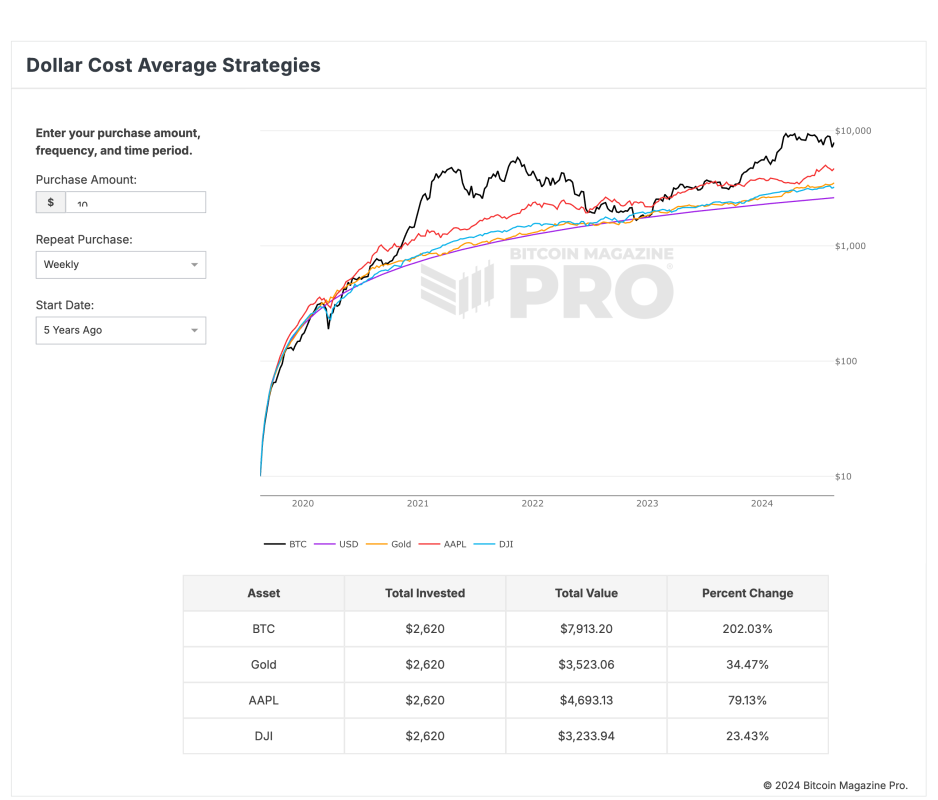

A recent analysis conducted by Bitcoin Magazine Pro highlights the effectiveness of dollar-cost averaging (DCA) when investing in Bitcoin compared to traditional assets such as gold, Apple stock, and the Dow Jones Industrial Average (DJI). The analysis reveals that consistently investing $10 weekly in Bitcoin over the past five years would have turned a total investment of $2,620 into $7,913.20, showcasing an impressive 202.03% return.

Comparing Bitcoin to Other Assets

When compared to other assets, the results are compelling. A $10 weekly investment in gold yielded a return of 34.47%, increasing the initial $2,620 to $3,523.06. Apple stock also performed well, providing a 79.13% return, transforming the $2,620 investment into $4,693.13. In contrast, the Dow Jones offered the lowest return, with a 23.43% increase, growing the investment to $3,233.94.

Bitcoin as an Ideal Long-Term Investment

This data reinforces Bitcoin's potential as one of the top assets, if not the best asset, for investors to include in their long-term investment strategies. The concept of dollar-cost averaging, which involves consistently investing a fixed amount regardless of price fluctuations, has proven to be highly effective with Bitcoin. It enables investors to accumulate wealth steadily over time.

The Benefits of Dollar Cost Averaging with Bitcoin

By saving $10 a week through Dollar Cost Averaging (DCA) into Bitcoin, individuals have an affordable and accessible way to enter the world of Bitcoin investments. This strategy is particularly attractive for beginners who may be hesitant to invest large sums upfront or are still getting to grips with the volatile nature of the Bitcoin market. Regularly investing a small fixed amount allows individuals to slowly build their Bitcoin holdings, mitigating the impact of market fluctuations and facilitating the adoption of a long-term investment perspective. This method promotes consistent growth without the pressure of trying to time the market perfectly.

Utilizing the Dollar Cost Average Strategies Tool

The Dollar Cost Average Strategies tool offered by Bitcoin Magazine Pro empowers users to explore various investment strategies, optimizing their Bitcoin investments across different time frames. The tool compares Bitcoin's performance with other assets like the US dollar, gold, Apple stock, and the Dow Jones, demonstrating Bitcoin's potential as a superior store of value in a diversified investment portfolio.

For more in-depth insights, information, and access to Bitcoin Magazine Pro's data and analytics, interested individuals can visit the official website.

Frequently Asked Questions

What are the fees for an IRA that holds gold?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This includes the account maintenance fees and any investment costs associated with your chosen investments.

Diversifying your portfolio may require you to pay additional fees. These fees will vary depending upon the type of IRA chosen. For example, some companies offer free checking accounts but charge monthly fees for IRA accounts.

Most providers also charge annual management costs. These fees vary from 0% to 11%. The average rate is.25% annually. These rates are often waived if a broker like TD Ameritrade is used.

What are the pros & con's of a golden IRA?

An Individual Retirement Plan (IRA) has a major advantage over regular savings accounts. It doesn't tax any interest earned. This makes an IRA great for people who want to save money but don't want to pay tax on the interest they earn. However, there are also disadvantages to this type of investment.

To give an example, if your IRA is withdrawn too often, you can lose all your accumulated funds. The IRS may prohibit you from withdrawing funds from your IRA before you are 59 1/2 years of age. A penalty fee will be charged if you decide to withdraw funds.

Another problem is the cost of managing your IRA. Many banks charge between 0.5%-2.0% per year. Other providers charge monthly management fees ranging from $10 to $50.

Insurance will be required if you would like to keep your cash out of banks. A majority of insurance companies require that you possess a minimum amount gold to be eligible for a claim. It is possible that you will be required to purchase insurance that covers losses of up to $500,000.

If you choose to go with a gold IRA, you'll need to determine how much gold you want to use. Some providers limit the number of ounces of gold that you can own. Others allow you the freedom to choose your own weight.

Also, you will need to decide if you want to buy physical gold futures contracts or physical gold. Futures contracts for gold are less expensive than physical gold. Futures contracts allow you to buy gold with more flexibility. Futures contracts allow you to create a contract with a specified expiration date.

Also, you will need to decide on the type of insurance coverage you would like. The standard policy doesn’t provide theft protection or loss due fire, flood, or earthquake. It does provide coverage for damage from natural disasters, however. Additional coverage may be necessary if you reside in high-risk areas.

In addition to insurance, you'll need to consider the cost of storing your gold. Storage costs are not covered by insurance. For safekeeping, banks typically charge $25-40 per month.

Before you can open a gold IRA you need to contact a qualified Custodian. A custodian helps you keep track of your investments, and ensures compliance with federal regulations. Custodians don't have the right to sell assets. They must instead keep them for as long as you ask.

After you have decided on the type of IRA that best suits you, you will need to complete paperwork detailing your goals. You should also include information about your desired investments, such as stocks or bonds, mutual funds, real estate, and mutual funds. The plan should also include information about how much you are willing to invest each month.

After completing the forms, send them along with a check or a small deposit to your chosen provider. The company will review your application and send you a confirmation letter.

Consider consulting a financial advisor when opening a golden IRA. A financial planner is an expert in investing and can help you choose the right type of IRA for you. They can also help reduce your costs by suggesting cheaper options for purchasing insurance.

How to open a Precious Metal IRA

It is important to decide if you would like an Individual Retirement Account (IRA). To open the account, complete Form 8606. For you to determine the type and eligibility for which IRA, you need Form 5204. This form should be completed within 60 days after opening the account. Once this is done, you can start investing. You could also opt to make a contribution directly from your paycheck by using payroll deduction.

You must complete Form 8903 if you choose a Roth IRA. Otherwise, the process will be identical to an ordinary IRA.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS says you must be 18 years old and have earned income. You cannot earn more than $110,000 annually ($220,000 if married filing jointly) in any one tax year. And, you have to make contributions regularly. These rules apply whether you're contributing through an employer or directly from your paychecks.

You can use a precious-metals IRA to purchase gold, silver and palladium. However, physical bullion will not be available for purchase. This means you won't be allowed to trade shares of stock or bonds.

To invest directly in precious metals companies, you can also use precious metals IRA. This option is available from some IRA providers.

However, there are two significant drawbacks to investing in precious metals via an IRA. First, they don't have the same liquidity as stocks or bonds. It's also more difficult to sell them when they are needed. They also don't pay dividends, like stocks and bonds. Therefore, you will lose more money than you gain over time.

How Much of Your IRA Should Include Precious Metals?

It's important to understand that precious metals aren't only for wealthy people. They don't require you to be wealthy to invest in them. There are many ways to make money on silver and gold investments without spending too much.

You might think about buying physical coins such a bullion bar or round. Stocks in companies that produce precious materials could be purchased. You may also be interested in an IRA transfer program offered by your retirement provider.

No matter what your preference, precious metals will still be of benefit to you. They are not stocks but offer long-term growth.

Their prices are more volatile than traditional investments. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

What should I pay into my Roth IRA

Roth IRAs are retirement accounts that allow you to withdraw your money tax-free. The account cannot be withdrawn from until you are 59 1/2. However, if your goal is to withdraw funds before that time, there are certain rules you must observe. You cannot touch your principal (the amount you originally deposited). This means that you can't take out more money than you originally contributed. If you take out more than the initial contribution, you must pay tax.

The second rule says that you cannot withdraw your earnings without paying income tax. So, when you withdraw, you'll pay taxes on those earnings. Let's suppose that you contribute $5,000 annually to your Roth IRA. Let's also assume that you make $10,000 per year from your Roth IRA contributions. On the earnings, you would be responsible for $3,500 federal income taxes. This leaves you with $6,500 remaining. Because you can only withdraw what you have initially contributed, this is all you can take out.

So, if you were to take out $4,000 of your earnings, you'd still owe taxes on the remaining $1,500. Additionally, half of your earnings would be lost because they will be taxed at 50% (half the 40%). Even though you had $7,000 in your Roth IRA account, you only received $4,000.

There are two types if Roth IRAs: Roth and Traditional. A traditional IRA allows you to deduct pre-tax contributions from your taxable income. To withdraw your retirement contribution balance plus interest, your traditional IRA is available to you. You have the option to withdraw any amount from a traditional IRA.

Roth IRAs won't let you deduct your contributions. But once you've retired, you can withdraw the entire contribution amount plus any accrued interest. There is no minimum withdrawal required, unlike a traditional IRA. You don't need to wait until your 70 1/2 year old age before you can withdraw your contribution.

Is gold a good IRA investment?

For anyone who wants to save some money, gold can be a good investment. You can also diversify your portfolio by investing in gold. But gold is not all that it seems.

It has been used throughout the history of currency and remains a popular payment method. It is often called “the most ancient currency in the universe.”

But unlike paper currencies, which governments create, gold is mined out of the earth. That makes it very valuable because it's rare and hard to create.

Gold prices fluctuate based on demand and supply. The economy that is strong tends to be more affluent, which means there are less gold miners. This results in gold prices rising.

The flip side is that people tend to save money when the economy slows. This increases the production of gold, which in turn drives down its value.

This is why gold investment makes sense for both individuals and businesses. You will benefit from economic growth if you invest in gold.

Your investments will also generate interest, which can help you increase your wealth. If gold's value falls, you don't have to lose any of your investments.

Statistics

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

External Links

bbb.org

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

investopedia.com

How To

A growing trend: Gold IRAs

Investors are increasingly turning to gold IRAs as a way to diversify and protect their portfolios from inflation.

Owners can invest in gold bars and bullion with the gold IRA. This IRA can be used to grow your wealth tax-free and is an alternative option to stocks and bonds.

A gold IRA allows investors the freedom to manage their wealth without worrying about volatility in the markets. Investors can protect themselves from inflation and other possible problems by using the gold IRA.

Investors also get the unique benefits of owning physical Gold, including its durability, portability, flexibility, and divisibility.

A gold IRA provides many additional benefits. One is the ability for heirs to quickly transfer ownership of gold. Another is the fact that gold is not considered a currency or a commodities by the IRS.

Investors who seek financial stability and a safe haven are finding the gold IRA increasingly attractive.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]