Hey there, cryptocurrency enthusiasts! If you've been keeping an eye on the latest Bitcoin news, you might have noticed the recent plunge in Bitcoin's price to $86,000. But don't let the market's extreme fear deter you. There's more to this story than meets the eye.

The Current Bitcoin Landscape

The Numbers Game

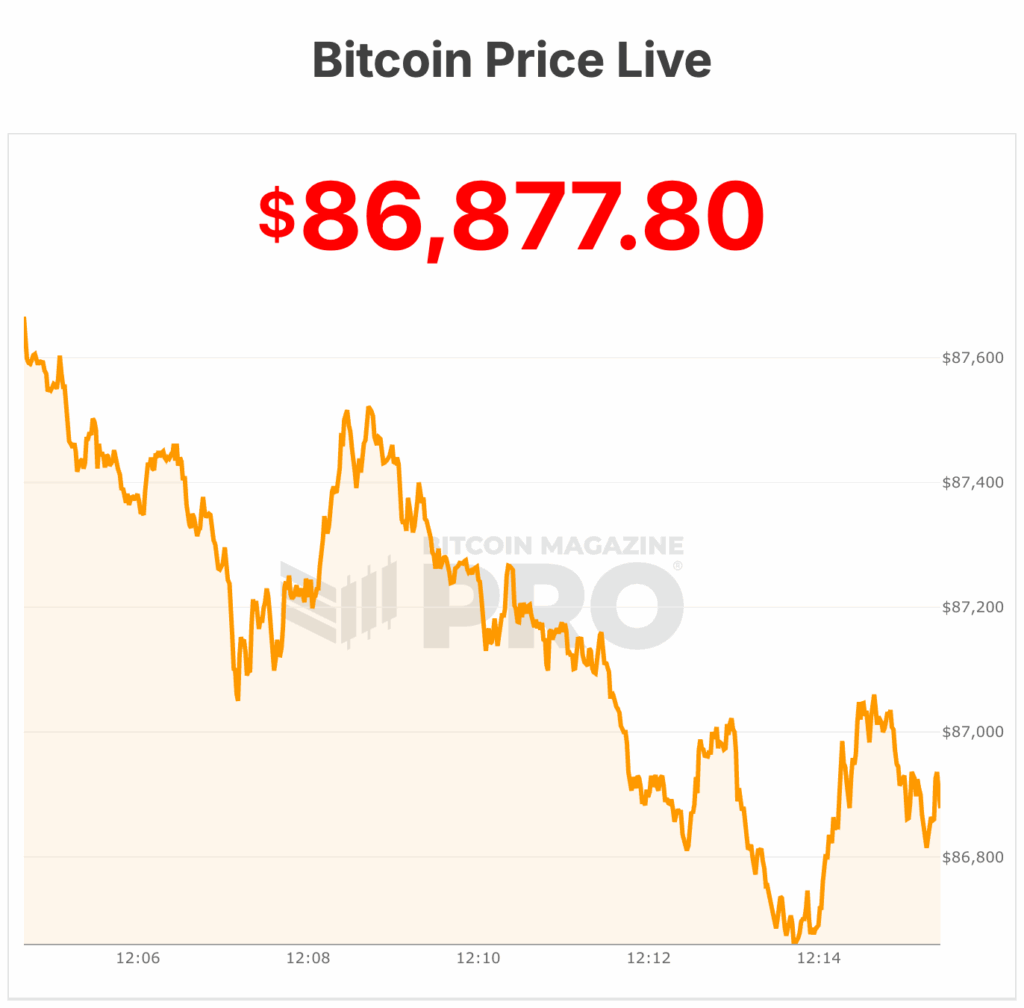

As of now, Bitcoin is hovering around $86,610, marking a slight dip in the past 24 hours. The trading volume sits at $87 billion, showcasing some intense market activity.

Market Psychology

What's interesting is that the Fear and Greed Index for Bitcoin is currently sitting at "Extreme Fear." It's like a rollercoaster ride of emotions in the crypto world right now.

Market Influencers

The Job Market Impact

Recent data on the U.S. labor market revealed unexpected strength, injecting some optimism into the overall economic scene. This positive news, combined with other factors, can sway the crypto market sentiment.

Nvidia's Ripple Effect

Nvidia's stellar earnings report also played a significant role in shaping the market landscape. The tech giant's performance reassured investors, hinting at continued support for AI investments by major players such as Amazon and Microsoft.

The Bitcoin Price Rollercoaster

What Lies Ahead

Following the recent price drop, analysts are eyeing key support levels and resistance barriers. While the road ahead might seem bumpy, there are potential opportunities for both bears and bulls in the crypto market.

The Road to Recovery

Despite the current dip, remember that the crypto market is known for its volatility. As Bitcoin sits at $86,877, it's crucial to stay informed, keep a close watch on market trends, and consider your investment strategies carefully.

Curious to explore more insights on Bitcoin's price trends? Dive deeper into the article here. Stay informed, stay engaged, and embrace the ever-evolving world of cryptocurrency!

Frequently Asked Questions

What is the Performance of Gold as an Investment?

Gold's price fluctuates depending on the supply and demand. Interest rates also have an impact on the price of gold.

Due to their limited supply, gold prices fluctuate. In addition, there is a risk associated with owning physical gold because you have to store it somewhere.

How to Open a Precious Metal IRA

The first step in opening an Individual Retirement Account, (IRA), is to decide if it's something you want. To open the account, complete Form 8606. For you to determine the type and eligibility for which IRA, you need Form 5204. This form should not be completed more than 60 days after the account is opened. Once this has been completed, you can begin investing. You can also contribute directly to your paycheck via payroll deduction.

Complete Form 8903 if your Roth IRA option is chosen. The process for an ordinary IRA will not be affected.

To qualify for a precious-metals IRA, you'll need to meet some requirements. The IRS says you must be 18 years old and have earned income. For any tax year, your earnings must not exceed $110,000 ($220,000 for married filing jointly). Contributions must be made regularly. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

An IRA for precious metals allows you to invest in gold and silver as well as platinum, rhodium, and even platinum. You can only purchase bullion in physical form. This means you won't be allowed to trade shares of stock or bonds.

You can also use your precious metals IRA to invest directly in companies that deal in precious metals. This option may be offered by some IRA providers.

An IRA is a great way to invest in precious metals. However, there are two important drawbacks. They aren't as liquid as bonds or stocks. It's also more difficult to sell them when they are needed. Second, they don’t produce dividends like stocks or bonds. So, you'll lose money over time rather than gain it.

How is gold taxed within a Roth IRA

An investment account's tax rate is determined based upon its current value, rather than what you originally paid. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Only earnings from capital gains and dividends are subject to tax. These taxes do not apply to investments that have been held for more than one year.

These accounts are subject to different rules depending on where you live. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. You can delay until April 1st in Massachusetts. And in New York, you have until age 70 1/2 . To avoid penalties, plan ahead so you can take distributions at the right time.

Can the government take your gold

Your gold is yours, so the government cannot confiscate it. You earned it through hard work. It belongs entirely to you. This rule may not apply to all cases. You can lose your gold if you have been convicted for fraud against the federal governments. Additionally, your precious metals may be forfeited if you owe the IRS taxes. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

What are the fees associated with an IRA for gold?

Six dollars per month is the fee for an Individual Retirement Account (IRA). This includes account maintenance and any investment costs.

If you want to diversify, you may be required to pay extra fees. The fees you pay will vary depending on the type of IRA that you choose. Some companies offer checking accounts for free, while others charge monthly fees for IRA account.

In addition, most providers charge annual management fees. These fees are usually between 0% and 1%. The average rate is.25% annually. These rates can be waived if the broker is TD Ameritrade.

Who is entitled to the gold in a IRA that holds gold?

The IRS considers an individual who owns gold as holding “a form of money” subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

Consult a financial advisor or accountant to determine your options.

Should You Get Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. Many people are shifting away from traditional investments like bonds or stocks to instead look toward precious metals such gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

Experts think this could change quickly. According to them, gold prices could soar if there is another financial crisis.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

These are some important things to remember if your goal is to invest in gold.

- First, consider whether or not you need the money you're saving for retirement. It is possible to save enough money to retire without investing in gold. However, you can still save for retirement without putting your savings into gold.

- Second, ensure you fully understand the risks involved in buying gold. Each offer varying degrees of security and flexibility.

- Remember that gold is not as safe as a bank account. Losing your gold coins could result in you never being able to retrieve them.

So, if you're thinking about buying gold, make sure you do your research first. If you already have gold, make sure you protect it.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement funds