In today’s ever-changing economic landscape, experienced investors are reassessing their investment portfolios and looking into the potential of Bitcoin as a viable alternative to traditional assets like real estate. With its finite supply and promising growth prospects, Bitcoin presents a compelling argument for forward-thinking investment strategies.

Real Estate: The Myth of Stability

Real estate has been traditionally viewed as a secure investment for wealth preservation. However, the real estate market is susceptible to systemic risks such as interest rate fluctuations, government interventions, and economic downturns. Additionally, property investments often come with substantial maintenance costs, taxes, and liquidity constraints.

The Emergence of Bitcoin as a Value Store

With a capped supply of 21 million coins, Bitcoin is often referred to as "digital gold" for the modern era. Over the past decade, Bitcoin has consistently outperformed other asset classes, delivering significant returns despite its volatility.

Liquidity and Accessibility

Unlike real estate investments that involve lengthy processes, high fees, and regulatory obstacles, Bitcoin offers instant liquidity and can be traded around the clock on global exchanges. This accessibility enables investors to swiftly move their assets across borders.

Hedging Against Inflation

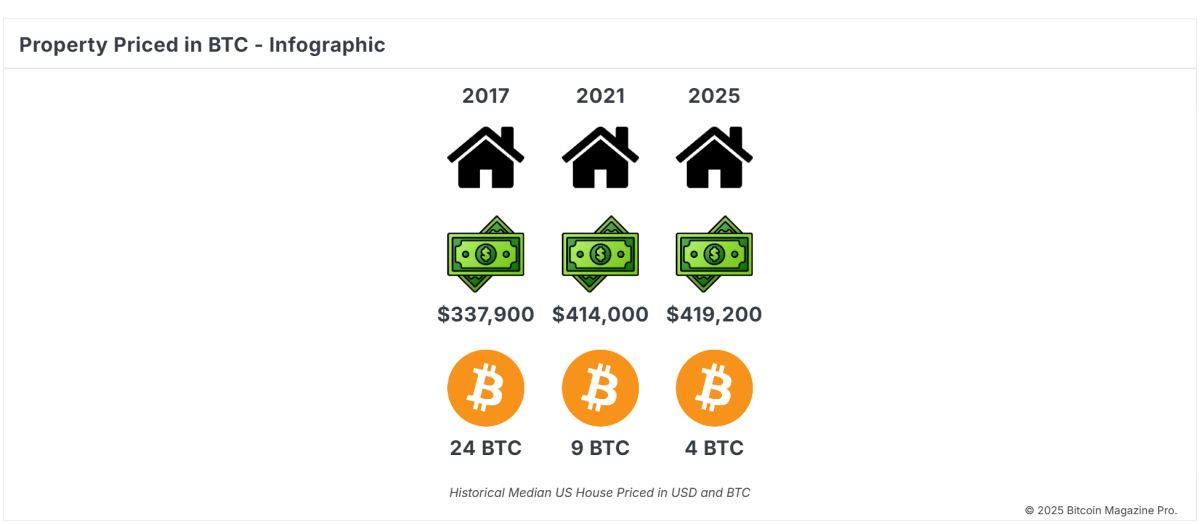

While real estate prices tend to follow inflationary trends, they often fail to outpace them significantly. On the other hand, Bitcoin serves as a hedge against fiat currency devaluation and has shown resilience during periods of inflation.

Flexibility for Modern Investors

Today's investors value flexibility and global reach. Real estate, being a localized and illiquid asset, restricts mobility. In contrast, Bitcoin is borderless, allowing for decentralized ownership without reliance on traditional financial systems.

A Vision for the Future

Bitcoin represents not just a speculative asset but a financial revolution. By embracing Bitcoin, savvy investors position themselves at the vanguard of this transformative shift. As Bitcoin gains wider acceptance, its value as a robust, deflationary asset tailored for the contemporary economy becomes more evident.

While real estate has historically been a staple in investment portfolios, Bitcoin presents a disruptive alternative that resonates with the requirements of a rapidly evolving global market. For those looking to safeguard wealth, hedge against inflation, and leverage groundbreaking technology, Bitcoin stands out as the preferred asset. The question isn't "Why Bitcoin?" but rather "Why not Bitcoin?"

If you seek more in-depth analysis and real-time insights, exploring Bitcoin Magazine Pro can provide valuable information on the Bitcoin market.

Disclaimer: This content is intended for informational purposes only and should not be construed as financial advice. It is advisable to conduct thorough research before making any investment decisions.

CFTC

finance.yahoo.com

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 1991 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

How To

Gold Roth IRA guidelines

Starting early is the best way to save for retirement. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. To ensure sufficient growth, it is vital that you contribute enough each year.

You may also wish to take advantage of tax-free investments such as a SIMPLE IRA, SEP IRA, and traditional 401(k). These savings vehicles enable you to make contributions while not paying any taxes on the earnings, until they are withdrawn. This makes them a great choice for people who don’t have access employer matching funds.

The key is to save regularly and consistently over time. You'll miss out on any potential tax benefits if you're not contributing the maximum amount allowed.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]