Fidelity Gold IRA is a massive institutional investor that works on behalf of investors. They have years of experience and over $5 trillion under management. With more than 50,000 employees, they are a huge company with a lot to offer you as an investor. Whether you are a new investor or an experienced one, you can trust Fidelity to keep your money safe.

Investing in a gold IRA

Investing in physical gold in an IRA is an excellent way to protect your investment. Gold is a stable asset that appreciates in value over time, unlike cash, which quickly loses its value. In times of economic crisis, investors protect their investments by putting physical gold in an IRA.

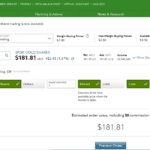

Fidelity offers many different options for investing in gold, including several gold ETFs. The retirement account offers a variety of gold ETFs that Fidelity does not sell elsewhere. Fidelity is a large company that manages $4.9 trillion in assets. Fidelity also offers a large range of other financial services, including wealth management, life insurance, and fund distribution. Another key benefit of Fidelity is that it does not charge commissions or fees for purchasing stocks and ETFs.

Choosing an IRA custodian

Investing in gold or silver through an IRA is a great way to diversify your portfolio. This type of investment has historically outperformed stocks over long periods of time, making it an attractive investment for retirees. However, there are some things to consider before opening an account.

The first thing to consider is whether your custodian will allow you to own precious metals through your IRA. The IRS has specific guidelines about what types of assets are allowed in IRAs. Make sure to check with your custodian to ensure that you can own gold and silver.

Choosing a gold IRA custodian

Choosing a gold IRA custdian is an important part of the process of creating a gold IRA. A custodian will oversee the transaction and ensure that your assets are safe. These companies will also adhere to IRS regulations. The process to open a gold IRA is more involved than opening a regular IRA. A reputable company will guide you through the entire process and provide all the paperwork up front.

Fidelity offers a variety of retirement planning options, including employer-sponsored retirement plans and individual retirement accounts. Individual retirement accounts are a great way to protect your retirement while providing tax-protected savings. Investing in a solid asset is essential to the success of your retirement.

Trustworthiness of a gold IRA custodian

It's important to choose a custodian who specializes in Gold IRAs. While many brokerage firms offer custodial services as part of their overall portfolio, it's advisable to find a specialist who will be more proactive in managing your accounts. In contrast, a passive custodian will look after your account without taking any action to improve the performance.

It's also important to choose a custodian who provides secure storage. The best gold IRA providers will offer fully insured depositories, which ensures that your assets will be protected in the event of a fire, theft, or natural disaster. Additionally, a gold IRA custodian should have excellent customer service. You should consider how responsive the customer service is and how helpful they are throughout the process.

Frequently Asked Questions

Which is more powerful: sterling silver or 14k gold?

Both gold and silver make strong metals. Sterling silver is more affordable than sterling silver which has only 24% pure silver.

Sterling silver is also known as fine silver because it is made from a mixture of silver and other metals such as copper and zinc.

Gold is considered very strong. It takes a lot of pressure to break it down. If you drop something on top of a chunk of gold it will shatter into thousands of pieces rather than breaking into two halves.

However, silver doesn't have the same strength as gold. A sheet of silver would likely bend and fold if you dropped an item on it.

Silver is used in jewelry and coins. Silver's value can fluctuate depending on the supply and demand.

Does a gold IRA make money?

Yes, but not as often as you think. It depends on how much you're willing to risk. A $10,000 investment per year for 20 years could lead to $1 million by retirement age. However, if you have all your eggs in one place, you could lose everything.

Diversifying your investments is essential. When there is inflation, gold does well. It is important to invest in assets that increase with inflation. Stocks do this well because they rise when companies increase profits. Bonds are also able to do this. They pay interest every year. They're very useful during periods of economic growth.

What happens if there is no inflation? Stocks fall more and bonds lose value during deflationary times. Investors should not put all of their savings in one investment such as a stock mutual fund or bond.

They should instead invest in a combination of different types of funds. They could invest in stocks or bonds. Or they could invest in both cash and bonds.

By doing so, they are exposed to both the positive and negative sides of the coin. Both deflation and inflation. They will still see a return in time.

How can I choose an IRA?

Understanding your account type will help you find the right IRA. This is whether you want a Roth IRA, a traditional IRA, or both. It is also important to determine how much money you have to invest.

The next step is to choose the best provider for you. Some providers offer both accounts while others are specialized in one.

You should also consider the fees associated each option. Fees can vary greatly between providers, and may include annual maintenance charges and other fees. Some providers charge a monthly fee depending on how many shares you have. Others may only charge one quarter.

Which precious metals are best to invest in retirement?

Understanding what you have now saved and where you are currently saving money is the first step in retirement planning. You can start by making a list of all your assets. This includes all savings accounts and stocks, bonds or mutual funds. It also should include certificates of Deposit (CDs), life insurance policies. Annuities, 401k plans, real-estate investments, and other assets like precious metals. To determine how much money is available to invest, add all these items.

If you are less than 59 1/2 years of age, you may be interested in opening a Roth IRA. A Roth IRA is not able to allow contributions to be deducted from your taxable earnings, but a traditional IRA can. You won't be allowed to deduct tax for future earnings.

You will need another investment account if you decide that you require more money. Start with a regular broker account.

What are the different types of IRA?

There are three basic types for IRAs. Each type of IRA has its pros and cons. Below, we'll discuss each one.

Traditional Individual Retirement Accounts (IRA)

A traditional IRA allows for you to contribute pretax money to an account, where you can defer tax on contributions made now and earn interest. When you retire, your withdrawals are not subject to tax.

Roth IRA

Roth IRAs allow you to deposit after-tax dollars into an account. This allows earnings to grow tax-free. If you withdraw funds for retirement, your withdrawals from the account are exempted of tax.

SEP IRA

This is similar with a Roth IRA, but employees are required to make additional contributions. The additional contributions are taxed but earnings remain tax-deferred. You may choose to convert the entire amount to a Roth IRA when you leave the company.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

forbes.com

- Gold IRA, Add Some Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

en.wikipedia.org

wsj.com

takemetothesite.com

How To

How to convert your IRA into a Gold IRA

You want to convert your retirement savings from a traditional IRA to a gold IRA. This article will show you how to do it. Here are some tips to help you switch.

“Rolling Over” refers to the process of transferring money between two types of IRAs (traditional and gold). Rolling over an IRA account can provide tax advantages. People may also prefer to invest physical assets, such precious metals.

There are two types IRAs: Traditional IRAs or Roth IRAs. The difference between the two accounts is simple. Roth IRAs have no tax deductions, but Traditional IRAs can deduct taxes. If you put $5,000 into a Traditional IRA today, after five years you can only withdraw $4,850. The Roth IRA would allow you to keep every cent if you invested the same amount.

If you are looking to convert your traditional IRA into a gold IRA, here's what to know.

First, you must decide whether to move your balance into a new bank account or transfer funds from your existing account to the new one. If you transfer money, income tax will apply to any earnings exceeding $10,000. You can rollover your IRA to avoid paying income tax until you are 59 1/2.

After you have made your decision, you will need to open a new account. It is likely that you will be asked to prove your identity by providing proof such as a Social Security card or passport. After that, you'll need to sign paperwork proving you own an IRA. Once you've completed the forms, you'll submit them to your bank. They'll verify your identity and give instructions on where to send the checks and wire transfers.

Now comes the fun part. Once your IRS approves your request, you'll deposit cash in your new account. You will be notified by mail that your request has been approved.

That's it! Now, all you have left to do is relax and watch your wealth grow. If you decide to convert your IRA you can close it and transfer the remaining balance into a different IRA.