There are a number of advantages of a GoldStar IRA. First of all, it offers a wide range of options. You don't have to stick to the traditional real estate deals that you see on television. You can invest in various exotic alternatives and have access to investor services. Secondly, it offers tax advantages to its members.

Fees associated with setting up a gold IRA

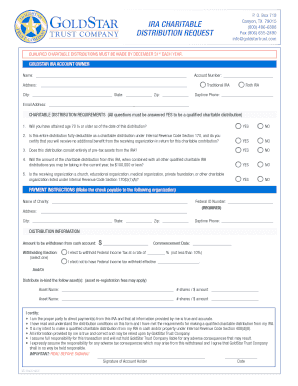

To open a gold IRA, you must complete an application online or on paper. You can also hire an attorney to help you open the account. The setup fee is around $250, but you must be aware of other fees, such as an annual maintenance fee, which can add up to hundreds of dollars. In addition, you must pay fees to your custodian and transaction services provider.

Fees associated with setting up a GoldStar account vary from company to company. Some charge a $50 account setup fee, while others charge $100 for each year of storage and administration. The fees also vary based on the amount of money you invest in your account. While some companies may offer lower fees, you should still be careful about the fees associated with setting up a GoldStar account.

Tax implications of taking money out of a gold IRA

When it comes to taxes, owning a gold star IRA has its pros and cons. This type of account allows you to purchase certain precious metal coins and bullion, such as gold American Eagles. These coins are minted by the U.S. Treasury, and you can hold them personally without paying fees. No other precious metal enjoys the same privilege. In addition, you don't have to sell your gold to meet the required minimum distribution. However, this may not be an ideal choice. Instead, you may want to take your total RMD from other traditional IRAs.

Taking money out of a gold star IRA can have tax implications, depending on the amount of money that is taken out of it. You'll need to consult with a tax advisor to determine the exact tax consequences. Most IRA companies charge a small fee to store and maintain your gold, so be sure to compare a few companies before you make a final decision. Also, keep in mind that precious metals are subject to strict government regulations, so it is important to choose gold that meets the standards of both the IRA and the IRS. If you're thinking of buying gold, look for a gold IRA provider that offers buyback programs for customers.

Buying gold as an asset in a traditional IRA

There are several things to consider when buying gold as an asset in a traditional 401(k) or IRA. Buying gold will increase your account balance, but there will also be fees involved. These fees will depend on the type of gold you purchase and the market conditions. Some sellers may charge as much as $40 per transaction, while others may charge as little as $0.01. Also, you must be prepared to pay storage fees based on the amount of gold in your account. Depending on the custodian you choose, these fees can cost up to $350 or more.

Buying gold as an asset in a retirement account may be a great way to diversify your portfolio, as it offers a unique value proposition. Unlike paper investments, gold does not pay dividends or earnings. Gold is used in industrial applications and for jewelry, but most of it sits in bank vaults. Despite this, many people still believe that gold is safe and sound, especially in tough economic times.

Buying gold in a Roth IRA

Buying gold in a Roth IRA is a way to invest in gold without having to pay taxes on it. This type of retirement account functions much like a traditional one, but it allows you to invest in gold and other IRS-approved metals. Unlike the traditional IRA, this type of account requires you to maintain the gold in an approved depository institution.

Some self-directed IRA custodians offer to store your gold and manage it, but not all of them do. You must choose a reputable custodian who can take care of the gold for you. You also need to be aware of the costs associated with buying and shipping precious metals. Some companies will charge you a one-time setup fee.

Investing in precious metals in a traditional IRA

Investing in precious metals in your IRA offers you several benefits. For starters, you can hedge against inflation. These assets tend to increase when paper assets decline, so you can use your precious metals IRA as an inflation hedge. You can also take advantage of the tax benefits associated with owning physical precious metals.

While holding gold in your IRA is not ideal for your long-term financial health, it has its place in your portfolio. You can take advantage of its industrial and jewelry uses. It is also a safe investment, and many people feel safe storing gold in bank vaults. However, this precious metal will need to rise in value in order to match the returns of the broad market.

Frequently Asked Questions

What are the best ways to choose an IRA.

Understanding your account type will help you find the right IRA. This includes whether your goal is to open a Roth IRA (or a traditional IRA). You will also need to know how much you can invest.

Next is deciding which provider best suits your needs. Some providers offer both accounts while others are specialized in one.

The fees associated with each option should be considered. Fees may vary from one provider to another and could include annual maintenance fees as well. One example is that some providers charge a monthly subscription based upon the number of shares you hold. Others charge only once per quarter.

Which type of IRA can be used to store precious metals?

Most financial institutions and employers offer an Individual Retirement Account (IRA). This is an investment vehicle that most people can use. You can contribute to an IRA account which grows tax-deferred and can be withdrawn at any time.

You can save taxes and pay them later with an IRA. This allows for more money to be deposited in your retirement plan today than having to pay taxes tomorrow on it.

An IRA is a tax-free way to make contributions and earn income until you withdraw the funds. If you do withdraw the funds earlier than that, you will be subject to penalties.

After age 50, you can make additional contributions to an IRA without penalty. You'll owe income tax and a 10% federal penalty if you withdraw from your IRA in retirement.

Withdrawals made before age 59 1/2 are subject to a 5% IRS penalty. A 3.4% IRS penalty is applicable to withdrawals made between the ages of 59 1/2 and 701/2.

Withdrawal amounts exceeding $10,000 per year are subject to a 6.2% IRS penalty.

What is the best precious metal to invest in?

Gold is an investment that offers high returns on its capital. It can also protect against inflation and other risks. As people worry about inflation, the price of gold tends increase.

It's a good idea to purchase gold futures. These contracts guarantee that you will receive certain amounts of gold at a given price.

But gold futures may not be right for everyone. Some prefer physical gold.

They can also trade their gold easily with others. They can also sell it whenever they want.

Some people would rather not pay tax on their gold. They purchase gold directly from governments to achieve this.

This will require you to make multiple trips to your local postal office. First, convert any gold you have into coins or bars.

You will then need to obtain a stamp for the coins and bars. Finally, send the coins or bars to the US Mint. There they will melt the coins or bars into new ones.

The original stamps are used to stamp the new coins and bars. This means they can be used as legal tender.

However, if you purchase gold directly from the US Mint you won't be required to pay any taxes.

So, which precious metal would you like to invest in?

Can I get physical ownership of gold in my IRA

Many people ask themselves whether it is possible to physically own gold in an IRA. It is a valid question, as there is no legal way to possess gold in an IRA account.

If you take a closer look at the law, there is nothing that can stop you from having gold in your IRA.

Most people don't realize the cost savings they could make by putting their gold into an IRA rather than keeping it in their homes.

It's very easy to dispose of gold coins, but much harder to make an IRA. If you decide to keep your gold in your own home, you'll pay taxes on it twice. Once for the IRS and once for the state where you live.

You can also lose your gold and have to pay twice the taxes. So why would anyone want to keep their gold in their home?

Some might argue that gold should be safe at home. However, to guard yourself against theft, it is worth considering storing your gold in a more secure location.

If you plan on visiting often, you shouldn't leave your precious gold at home. If you leave your precious gold unattended thieves will easily steal it.

It is better to keep your gold in an insured vault. Your gold will be safe from fire, flood and earthquake as well as robbery.

You won't be responsible for paying any property tax if you store your gold in a vault. You will have to pay income taxes on any gains from the sale of your gold.

If you'd rather avoid paying taxes on your gold, you may want to consider putting it in an IRA. With an IRA, you won't have to pay income tax even though you earn interest on your gold.

Capital gains tax is not required on gold. If you decide to cash it out, you will have full access to its value.

Federally regulated IRAs mean that you won't face any difficulties in transferring your gold to another bank if it moves.

The bottom line is: You can own gold in an IRA. Fear of theft is all that holds you back.

Which type of IRA is the best?

It is crucial to find the right IRA for your needs. Consider whether you are looking to maximize tax-deferred growth, minimize taxes and pay penalties later, avoid taxes, or both.

If you have little money to invest, the Roth option might make sense. It's also worth considering if your plan is to work after the age of 59 1/2.

If you plan on retiring early, the traditional IRA may be better because you'll likely owe any taxes on the earnings. The Roth IRA could be more beneficial if you intend to continue working after age 65. This allows you the freedom to withdraw some, or all, of your earnings.

What Precious Metals Can You Invest in for Retirement?

The first step to retirement planning is understanding what you have saved now and where you are saving money. To find out how much money you have, take a inventory of everything that you own. This includes stocks, bonds and mutual funds, as well as certificates of deposit (CDs), life policies, annuities and 401(k), plans, real estate investments and other assets, such precious metals. To determine how much money is available to invest, add all these items.

If you are under 59 1/2 you should consider opening a Roth IRA Account. A traditional IRA allows you to deduct contributions from your taxable income, while a Roth IRA doesn't. However, you will not be able take tax deductions on future earnings.

You may need additional money if you decide you want more. Begin with a regular brokerage.

What are the 3 types of IRA?

There are three basic types of IRAs. Each type of IRA has its pros and cons. We'll go over each of them below.

Traditional Individual Retirement Accounts (IRA)

A traditional IRA allows pre-tax money to be contributed to an account. This allows you to earn interest and defer taxes. Withdrawals from this account are exempted from tax once you have retired.

Roth IRA

Roth IRAs allow after-tax dollars to go into an account. Earnings are exempt from tax. If you withdraw funds for retirement, your withdrawals from the account are exempted of tax.

SEP IRA

This is similar to a Roth IRA, except that it requires employees to make additional contributions. These additional contributions can be taxed. However, any earnings are now tax-deferred. You may choose to convert the entire amount to a Roth IRA when you leave the company.

Statistics

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

wsj.com

investopedia.com

takemetothesite.com

en.wikipedia.org

How To

How to turn your IRA into a IRA with gold content

So you want to move your retirement savings from a traditional IRA into a gold IRA? This article will guide you through the process. Here are the steps to help you make the change.

Rolling over is the process of transferring money from one type of IRA to another. Rolling over an account offers tax advantages. Some prefer to invest directly in physical assets like precious and rare metals.

There are two types IRAs: Traditional IRAs or Roth IRAs. The difference between these two accounts is simple: Traditional IRAs allow investors to deduct taxes when they withdraw their earnings, while Roth IRAs don't. If you invest $5,000 in a Traditional IRA now, then you'll be able only to withdraw $4,000. You would still be able to keep all your money if you had the same amount invested in a Roth IRA.

These are the things you need to know if your goal is to convert from a traditional IRA or a gold IRA.

You must first decide whether you want to transfer funds from one account to another or roll over your current balance to a new account. Any earnings over $10,000 will be subject to income tax at the regular rate. If you decide to roll over your IRA you will not be subject to income tax on these earnings until you turn 59 1/2.

Once you have decided to open a new bank account, Most likely, you will need to present proof of identity such as a Social Security Card, passport, or birth certificate. After that, you'll need to sign paperwork proving you own an IRA. Once you have filled out the forms, your bank will receive them. They will verify your identity as well as give instructions on how to send wire transfers and checks.

Now comes fun. Now, deposit money into your account and wait for approval from the IRS. After you receive approval, you'll get a letter stating that you can now begin withdrawing funds.

That's it! Now, all you have left to do is relax and watch your wealth grow. Keep in mind that if your mind changes about converting your IRA to another type, you can simply close it and transfer any remaining balance to a new IRA.