Robert Kiyosaki, the author of the best-selling book Rich Dad Poor Dad, has disclosed the reason behind his ongoing investments in gold, silver, and bitcoin. In a recent social media post, Kiyosaki emphasized that "our leaders want more war and poverty," which has led him to prioritize these three investment types for lifelong financial security and freedom. Notably, Kiyosaki has also made several bullish predictions about the price of bitcoin, ranging from $135,000 to $1 million.

Understanding Robert Kiyosaki's Investment Strategy

Robert Kiyosaki, co-author of the renowned book Rich Dad Poor Dad, has been vocal about his investment choices, including gold, silver, and bitcoin. Rich Dad Poor Dad, first published in 1997 and co-authored by Kiyosaki and Sharon Lechter, has remained on the New York Times Best Seller List for over six years. With more than 32 million copies sold across 109 countries and available in 51 languages, it has become a global phenomenon.

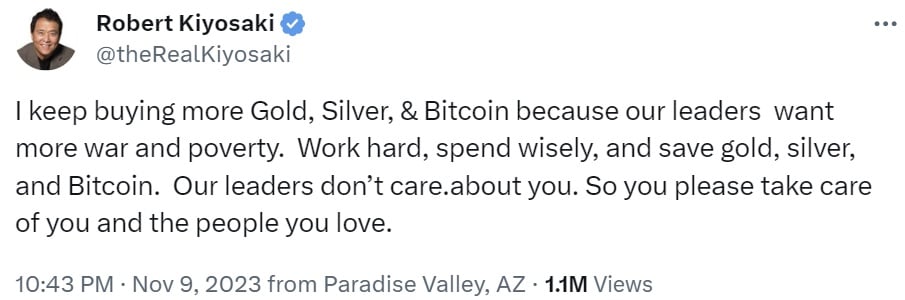

Kiyosaki recently shared his reasons for consistently investing in gold, silver, and bitcoin, highlighting his belief that U.S. leaders are inclined towards perpetuating "more war and poverty." As a result, he advises individuals to preserve their wealth by diversifying into these three asset classes.

Kiyosaki has long been endorsing gold, silver, and bitcoin as reliable investment options. Earlier this month, he emphasized in one of his lessons from Rich Dad that these asset classes offer "lifelong financial security and freedom." Furthermore, he considers them to be the best investments for uncertain times.

According to Kiyosaki, individuals should allocate 75% of their investment portfolios to gold, silver, and bitcoin, while the remaining 25% should be invested in real estate and oil stocks. He asserts that such a mix could help navigate through the anticipated "greatest crash in world history." Additionally, he recommends using dollar cost averaging and does not advocate for stock-picking in the same way as Warren Buffett.

Kiyosaki has made several optimistic predictions about the price of bitcoin. These predictions range from $135,000 in the near term to $1 million in the event of a global economic crisis. In a similar scenario, he also envisions gold reaching $75,000 and silver reaching $60,000. In February, he projected that bitcoin would reach $500,000 by 2025, while gold could rise to $5,000 and silver could reach $500 within the same timeframe.

In light of the current market conditions, Kiyosaki has urged investors to buy bitcoin immediately. He anticipates a rush to purchase BTC as the stock, bond, and real estate markets experience a crash. Furthermore, he strongly believes in the future of cryptocurrency, contrasting it with fiat money, which he refers to as "toast" and dismisses as "fake money." In addition to his warnings about an impending crash in the real estate, stocks, and bonds markets, Kiyosaki cautions that an increase in interest rates by the Federal Reserve would lead to a crash in the U.S. dollar.

What are your thoughts on Robert Kiyosaki's explanation for his continued investments in gold, silver, and bitcoin? Share your opinions in the comments section below.

Frequently Asked Questions

What is the Performance of Gold as an Investment?

The supply and demand for gold affect the price of gold. Interest rates are also a factor.

Due to the limited supply of gold, prices for gold are highly volatile. Physical gold is not always in stock.

What Is a Precious Metal IRA?

A precious metal IRA lets you diversify your retirement savings to include gold, silver, palladium, rhodium, iridium, osmium, osmium, rhodium, iridium and other rare metallics. These rare metals are often called “precious” as they are very difficult to find and highly valuable. These metals are great investments and can help protect your financial future from economic instability and inflation.

Precious metals are often referred to as “bullion.” Bullion refers actually to the metal.

Bullion can be purchased through many channels including online retailers and large coin dealers as well as some grocery stores.

A precious metal IRA lets you invest in bullion direct, instead of purchasing stock. This will ensure that you receive annual dividends.

Unlike regular IRAs, precious metal IRAs don't require paperwork or annual fees. Instead, you pay only a small percentage tax on your gains. You also have unlimited access to your funds whenever and wherever you wish.

Can I buy or sell gold from my self-directed IRA

However, gold can only be purchased with your self-directed IRA. To do so, you must first open a brokerage account at TD Ameritrade. Transfer funds from an existing retirement account are also possible.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals can contribute up to $1,000 annually ($2,000 if married and filing jointly) directly to a Roth IRA.

You might want to purchase physical bullion, rather than futures contracts if you are going to invest in gold. Futures contract are financial instruments that depend on the gold price. They let you speculate on future price without having to own the metal. But, physical bullion is real bars of gold or silver that you can hold in one's hand.

What is the benefit of a gold IRA?

The benefits of a gold IRA are many. It is an investment vehicle that can diversify your portfolio. You control how much money goes into each account and when it's withdrawn.

You also have the option to roll over funds from other retirement accounts into a gold IRA. This makes for an easy transition if you decide to retire early.

The best thing is that investing in gold IRAs doesn't require any special skills. They are offered by most banks and brokerage companies. Withdrawals can be made instantly without the need to pay fees or penalties.

There are also drawbacks. Gold has historically been volatile. It's important to understand the reasons you're considering investing in gold. Are you seeking safety or growth? Are you looking for growth or insurance? Only once you know, that will you be able to make an informed decision.

If you plan on keeping your gold IRA alive for a while, you may want to consider purchasing more than 1 ounce of pure gold. One ounce doesn't suffice to cover all your needs. Depending on the purpose of your gold, you might need more than one ounce.

If you're planning to sell off your gold, you don't necessarily need a large amount. Even a single ounce can suffice. But, those funds will not allow you to buy anything.

Who is entitled to the gold in a IRA that holds gold?

An individual who has gold is considered to be a “form of money” by the IRS and subject to taxation.

You must have at least $10,000 in gold and keep it for at most five years to qualify for this tax-free status.

While gold may be a great investment to help prevent inflation and volatility in the market, it's not wise to keep it if you won't use it.

If you plan to eventually sell the gold, you'll need a report on its value. This could impact the amount of capital gains taxes your owe if you cash in your investments.

Consult a financial advisor or accountant to determine your options.

Should You Buy Gold?

Gold was considered a safety net for investors during times of economic turmoil in the past. Today, many people are looking to precious metals like gold and avoiding traditional investments like bonds and stocks.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Experts think this could change quickly. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also mention that gold is becoming more popular due to its perceived worth and potential return.

Here are some things to consider if you're considering investing in gold.

- Before you start saving money for retirement, think about whether you really need it. It's possible to save for retirement without putting your savings into gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each type offers varying levels and levels of security.

- Keep in mind that gold may not be as secure as a bank deposit. Your gold coins may be lost and you might never get them back.

Don't buy gold unless you have done your research. Make sure to protect any gold you already own.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

External Links

finance.yahoo.com

irs.gov

wsj.com

- Saddam Hussein's Invasion Helped Uncage a Bear In 1990 – WSJ

- Want to Keep Gold in Your IRA at Home? It's not exactly legal – WSJ

bbb.org

How To

Gold Roth IRA guidelines

Starting early is the best way to save for retirement. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. To ensure sufficient growth, it is vital that you contribute enough each year.

You also want to take advantage of tax-free opportunities such as a traditional 401(k), SEP IRA, or SIMPLE IRA. These savings vehicles allow you to make contributions without paying taxes on earnings until they are withdrawn from the account. These savings vehicles can be a great option for individuals who don't qualify for employer matching funds.

The key is to save regularly and consistently over time. You will lose any potential tax advantages if you don't contribute enough.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]