The Role of Bitcoin Miners in the Current Blockchain Landscape

Bitcoin miners have faced unique challenges in recent months due to the increased demand on Bitcoin's blockchain. The introduction of the Ordinals protocol has allowed users to inscribe unique data on small denominations of bitcoin, creating new "tokens" directly on the blockchain. This has led to a high volume of transactions that need to be processed by miners, resulting in a surge in network usage.

The Importance of Bitcoin Miners in the Digital Economy

Bitcoin miners play a crucial role in verifying transactions and ensuring the smooth operation of the digital economy. While their primary function is to generate new bitcoin, the current high network usage has provided them with ample opportunities to earn revenue by processing transactions. As a result, the production of newly-issued bitcoin has taken a backseat to transaction processing.

The Impact of Mining Difficulty and Industry Profits

The increased demand and high network usage have led to higher mining difficulty levels than ever before. Despite the challenges, the mining industry has been generating substantial profits. However, the Bitcoin market is known for its fee volatility, which can significantly impact miners. The question arises: what will happen to miners when these conditions change?

The Introduction of Government Regulations

In January 2024, federal regulators mandated a survey of electricity use by all miners operating in the United States. This survey, conducted by the EIA, aims to study the evolving energy demand of cryptocurrency mining and assess potential public harm. The language used in the mandate has raised concerns within the Bitcoin community, as it suggests a potential crackdown on the industry.

Potential Threats to the Mining Ecosystem

The regulatory actions and rhetoric surrounding the mining industry have created unease among leading miners. The narrative from regulators portrays miners as potential threats to the environment, electrical infrastructure, and public well-being. While some of these claims can be easily debunked, the possibility of hostile government actions remains a concern.

The Impending Bitcoin Halving and Its Impact on Miners

In addition to government regulations, miners are also preparing for the upcoming Bitcoin halving. This protocol, set to take place in April at block 840,000, will automatically reduce mining rewards by half. Some pessimists predict that this event could lead to the downfall of the entire mining industry. However, well-prepared and well-capitalized firms are expected to weather the storm.

Market Conditions and Opportunities for Miners

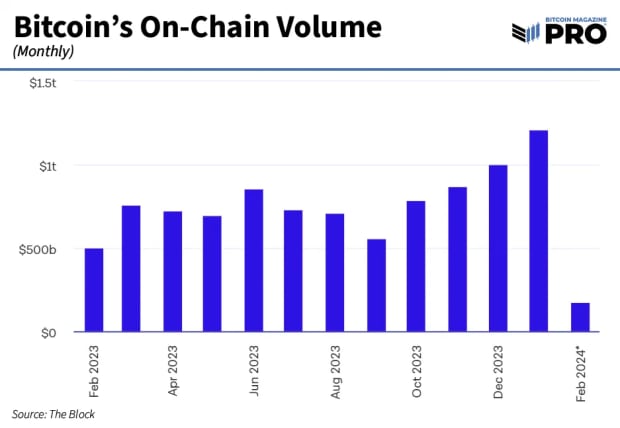

Market conditions independent of government actions indicate potential shifts for miners. While the demand for Ordinals sales may diminish, regular bitcoin transactions are thriving. The trading volume of bitcoin has been steadily increasing, presenting opportunities for miners to mint new bitcoin. Well-capitalized firms have been preparing for the halving and are likely to emerge stronger.

The Government's Perspective and Potential Outcomes

The federal government's concerns about the energy consumption and impact of the mining industry on society are driving their actions. However, as less efficient mining operations close down, the more efficient ones will have a larger share of the market. Leading firms have already expressed their willingness to fight against any crackdown on the industry.

Conclusion: Adapting to Change and the Strength of Bitcoin

While concerns about government regulations and the impending halving persist, the Bitcoin ecosystem is known for its ability to adapt rapidly. The industry has thrived amidst changing rules and regulations for over a decade. The opponents of Bitcoin are unlikely to match its resilience and innovative spirit. As the mining industry faces new challenges, it will continue to evolve and seize opportunities in this ever-changing landscape.

Frequently Asked Questions

Is physical gold allowed in an IRA.

Not only is gold paper currency, but it's also money. Gold is an asset people have used for thousands years as a place to store value and protect their wealth from economic uncertainty and inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Many Americans today prefer to invest in precious metals, such as silver and gold, over stocks and bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

Gold has historically performed better during financial panics than other assets. Gold prices rose nearly 100 percent between August 2011 and early 2013, while the S&P 500 fell 21 percent over the same period. Gold was one of the few assets that performed better than stocks during turbulent market conditions.

One of the best things about investing in gold is its virtually zero counterparty risk. Your stock portfolio can fall, but you will still own your shares. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold provides liquidity. This means that, unlike most other investments, you can sell your gold anytime without worrying about finding another buyer. You can buy gold in small amounts because it is so liquid. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

What is the best precious-metal to invest?

This depends on what risk you are willing take and what kind of return you desire. Gold is a traditional haven investment. However, it is not always the most profitable. If you are looking for quick profits, gold might not be the right investment. If patience and time are your priorities, silver is the best investment.

If you don't care about getting rich quickly, gold is probably the way to go. If you are looking for a long-term investment that will provide steady returns, silver may be a better choice.

How Much of Your IRA Should Be Made Up Of Precious Metals

The most important thing you should know when investing in precious metals is that they are not just for wealthy people. You don’t need to have a lot of money to invest. There are many ways to make money on silver and gold investments without spending too much.

You may consider buying physical coins such as bullion bars or rounds. It is possible to also purchase shares in companies that make precious metals. Your retirement plan provider may offer an IRA rollingover program.

You'll still get the benefit of precious metals no matter which country you live in. These metals are not stocks, but they can still provide long-term growth.

And, unlike traditional investments, their prices tend to rise over time. If you decide to make a sale of your investment in the future, you will likely realize more profit than with traditional investments.

Can the government seize your gold?

Your gold is yours and the government cannot take it. You earned it through hard work. It belongs to your. There may be exceptions to this rule. You could lose your gold if convicted of fraud against a federal government agency. If you owe taxes, your precious metals could be taken away. However, even though your taxes have not been paid, you can still keep your precious metals, even though they are considered the property of United States Government.

Should You Buy or Sell Gold?

In times past, gold was considered a safe haven for investors in times of economic trouble. However, today many people are turning away from traditional investments such as stocks and bonds and instead looking toward precious metals such as gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

This could be changing, according to some experts. Experts believe that gold prices could skyrocket in the face of another global financial crisis.

They also noted that gold is growing in popularity because of its perceived value as well as potential return.

These are some important things to remember if your goal is to invest in gold.

- The first thing to do is assess whether you actually need the money you're putting aside for retirement. It is possible to save for retirement while still investing your gold savings. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each account offers different levels of security and flexibility.

- Don't forget that gold does not offer the same safety level as a bank accounts. You may lose your gold coins and never be able to recover them.

You should do your research before buying gold. You should also ensure that you do everything you can to protect your gold.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)