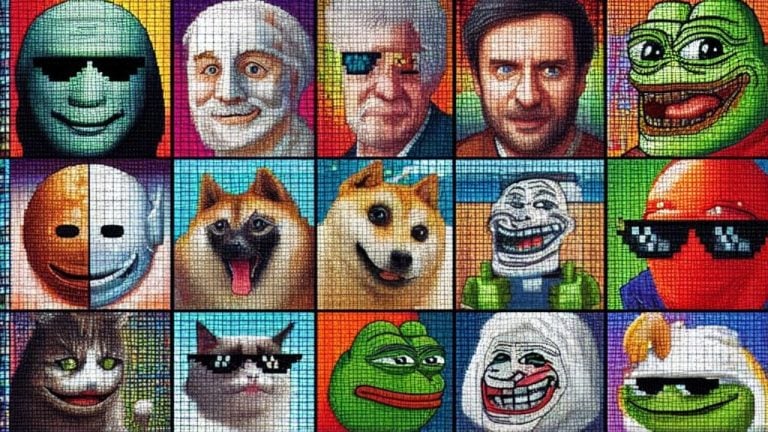

The Avalanche Foundation, a leading institution that supports avalanche initiatives, has recently announced its decision to venture into the world of meme coins. This strategic move involves investing in carefully selected meme coins using funds from the highly acclaimed $100 million Culture Catalyst fund, which was launched in 2022. The tokens will be chosen based on various factors, including the number of holders, liquidity thresholds, and project maturity, among others.

Expanding the Portfolio with Meme Coins

In a recent announcement, the Avalanche Foundation unveiled its plans to invest in meme coins, diversifying its investment portfolio and embracing a wider range of opportunities. This move reflects the foundation's commitment to exploring "a more complete spectrum of possibilities" within the cryptocurrency landscape.

The investment in meme coins will be facilitated through the Culture Catalyst fund, which was introduced during the Avalanche Summit in Barcelona. Initially designed to support and nurture the emerging realms of creativity, culture, and lifestyle enabled by blockchain technology, the $100 million fund will now be utilized to acquire these unique tokens.

The Significance of Meme Coins in Today's Crypto Market

The Avalanche Foundation acknowledges the relevance of meme coins in the current crypto market. According to the foundation, these coins go beyond mere utility assets, as they represent the collective spirit and shared interests of diverse crypto communities. The selection process for meme tokens will consider factors such as the number of holders, liquidity thresholds, project maturity, principles of a fair launch, and overall social sentiment.

Emin Gün Sirer, the founder and CEO of Ava Labs, initially had reservations about meme coins and their appeal. However, he has since recognized their value within the crypto ecosystem. In his own words, "It took me a while to see the value of memecoins myself. I wasn't happy when Elon was pumping Doge. It also took a while for me to see the value of high-end NFTs. But I now understand the cultural importance of coins that are just social signaling mechanisms."

Growth of the Meme Coin Economy

The meme coin economy has experienced remarkable growth, as evidenced by its market cap of nearly $24 billion on December 9. This surge in popularity further highlights the increasing significance of meme coins in the cryptocurrency space.

What are your thoughts on Avalanche's foray into meme coins? Share your opinions in the comments section below.

Frequently Asked Questions

Who owns the gold in a Gold IRA?

The IRS considers anyone who owns gold to be “a form money” and therefore subject to taxation.

To be eligible for the tax-free status, you must possess at least $10,000 gold and have had it stored for at least five consecutive years.

Gold can be used to protect against inflation and price volatility. However, it is not a good idea to own gold if you don't intend to use it.

If you plan on selling the gold someday, you'll need to report its value, which could affect how much capital gains taxes you owe when you cash in your investments.

Consult a financial advisor or accountant to determine your options.

How does a gold IRA work?

People who wish to invest in precious metals can use Gold Ira accounts as a tax-free investment vehicle.

You can purchase physical bullion gold coins at any point in time. To start investing in gold, it doesn't matter if you are retired.

An IRA lets you keep your gold for life. Your gold assets will not be subjected tax upon your death.

Your heirs can inherit your gold and avoid capital gains taxes. It is not required that you include your gold in the final estate report because it remains outside your estate.

To open a Gold IRA, you'll need to first set up an Individual Retirement Account (IRA). Once you've done so, you'll be given an IRA custodian. This company acts in the role of a middleman between your IRS agent and you.

Your gold IRA Custodian will manage the paperwork and submit all necessary forms to IRS. This includes filing annual reports.

After you have created your gold IRA, the only thing you need to do is purchase gold bullion. The minimum deposit required for gold bullion coins purchase is $1,000 However, you'll receive a higher interest rate if you put in more.

You'll have to pay taxes if you take your gold out of your IRA. If you are withdrawing your entire balance, you will owe income tax plus a 10% penalty.

You may not be required to pay taxes if you take out only a small amount. There are exceptions. However, there are exceptions. If you take 30% or more of your total IRA asset, you'll owe federal Income Taxes plus a 20% penalty.

You should avoid taking out more than 50% of your total IRA assets yearly. A violation of this rule can lead to severe financial consequences.

Can I hold physical gold in my IRA?

Not just paper money or coins, gold is money. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Many Americans are now more inclined to invest in precious metals like gold and silver than stocks or bonds. Although owning gold does not guarantee that you will make money investing in it, there are many reasons to consider adding gold into your retirement portfolio.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

The best thing about gold investing is the fact that there's virtually no counterparty risk. If your stock portfolio goes down, you still own your shares. Gold can be worth more than its investment in a company that defaults on its obligations.

Finally, gold offers liquidity. This allows you to sell your gold whenever you want, unlike many other investments. You can buy gold in small amounts because it is so liquid. This allows for you to benefit from the short-term fluctuations of the gold market.

How do I Withdraw from an IRA with Precious Metals?

You first need to decide if you want to withdraw money from an IRA account. Next, ensure you have enough cash on hand to pay any penalties or fees that could be associated with withdrawing funds.

A taxable brokerage account is a better option than an IRA if you are prepared to pay a penalty for early withdrawals. This option is also available if you are willing to pay taxes on the amount you withdraw.

Next, calculate how much money your IRA will allow you to withdraw. This calculation depends on several factors, including the age when you withdraw the money, how long you've owned the account, and whether you intend to continue contributing to your retirement plan.

Once you know how much of your total savings to convert to cash, it's time to choose the type of IRA that you want. While traditional IRAs are tax-free, Roth IRAs can be withdrawn at any time after you reach 59 1/2. However, Roth IRAs will charge income taxes upfront and allow you to access your earnings later without additional taxes.

Once the calculations have been completed, it's time to open a brokerage accounts. Many brokers offer signup bonuses or other promotions to encourage people to open accounts. To avoid unnecessary fees, however, try opening an account using a debit card rather than a credit card.

You will need a safe place to store your coins when you are ready to withdraw from your precious metal IRA. Some storage facilities will take bullion bars while others require you only to purchase individual coins. You'll have to weigh the pros of each option before you make a decision.

Because you don't have to store individual coins, bullion bars take up less space than other items. You will need to count each coin individually. You can track their value by keeping individual coins.

Some prefer to keep their money in a vault. Some prefer to keep them in a vault. Whatever method you choose to store your bullion, you should ensure it is safe and secure so you can enjoy its many benefits for many years.

Is it possible to hold a gold ETF within a Roth IRA

While a 401k may not offer this option for you, it is worth considering other options, such an Individual Retirement Plan (IRA).

Traditional IRAs allow for contributions from both employees and employers. Another way to invest in publicly traded companies is through an Employee Stock Ownership Plan.

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money in the ESOP can then be subject to lower tax rates than if the money were in the individual's hands.

An Individual Retirement Annuity (IRA) is also available. An IRA allows you to make regular payments throughout your life and earn income in retirement. Contributions to IRAs can be made without tax.

Statistics

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

bbb.org

finance.yahoo.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

How To

Guidelines for Gold Roth IRA

Start saving as soon as possible to save for your retirement. It is best to start saving for retirement as soon you can (typically at age 50). It is essential to save enough money each year in order to maintain a steady growth rate.

You also want to take advantage of tax-free opportunities such as a traditional 401(k), SEP IRA, or SIMPLE IRA. These savings vehicles allow you the freedom to contribute without having to pay tax on your earnings until they are withdrawn. These savings vehicles are great for those who don't have access or can't get employer matching funds.

It is important to save consistently over time. If you don't contribute the maximum amount, you will miss any tax benefits.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]

Related posts:

The Avalanche Foundation Announces Requirements for Meme Coin Purchasing Program

The Avalanche Foundation Announces Requirements for Meme Coin Purchasing Program

Meme Tokens Defy Crypto Slump with 3.2% Increase in Value

Meme Tokens Defy Crypto Slump with 3.2% Increase in Value

Cardano and Avalanche Experience Significant Surges, Outperforming Top 20 Cryptocurrencies

Cardano and Avalanche Experience Significant Surges, Outperforming Top 20 Cryptocurrencies

BONK’s Meteoric Rise: Outpaces PEPE with 621% Surge, Secures Third Place in Meme Coin Market

BONK’s Meteoric Rise: Outpaces PEPE with 621% Surge, Secures Third Place in Meme Coin Market