Whether you’re young, mid-career, or playing the back nine, Roth IRAs can be an important tool for your financial goals. Four case studies below will illustrate how by combining Roth IRAs with bitcoin, you can save for retirement, optimize for your personal tax situation during retirement, and leave your bitcoin for the next generation.

Sally the Super Stacker: Saving for Retirement

Sally is in her early 30s and has fallen down the bitcoin rabbit hole. Sally views bitcoin as the best savings technology given today’s current macroeconomic backdrop and bitcoin’s fixed supply of 21 million and is committed to a disciplined accumulation strategy.

She’s looking for a way to save her hard-earned money without suffering debasement over time. Ultimately, she would like to use her savings for major goals: a dream vacation, a house, starting a family, and maybe retiring someday. But retirement is a distant goal, and she thinks the United States could go through some significant changes before she’s ready to settle down.

Importance of Tax-Free Growth

Like most bitcoiners, Sally is stacking bitcoin with money that has already been taxed. Her payroll taxes are withheld on payday, and she is paid the remaining U.S. dollars into her bank account. She then sends money to an exchange and purchases bitcoin. This is the typical way most people stack sats—post-tax.

However, just because the bitcoin is purchased post-tax does not mean it won’t be taxed again. Non-retirement bitcoin earnings are taxed as a capital gain when sold. Over her years of stacking, she will need to keep track of her cost basis and deduct that amount from the gross proceeds when selling.

Enter the Roth IRA

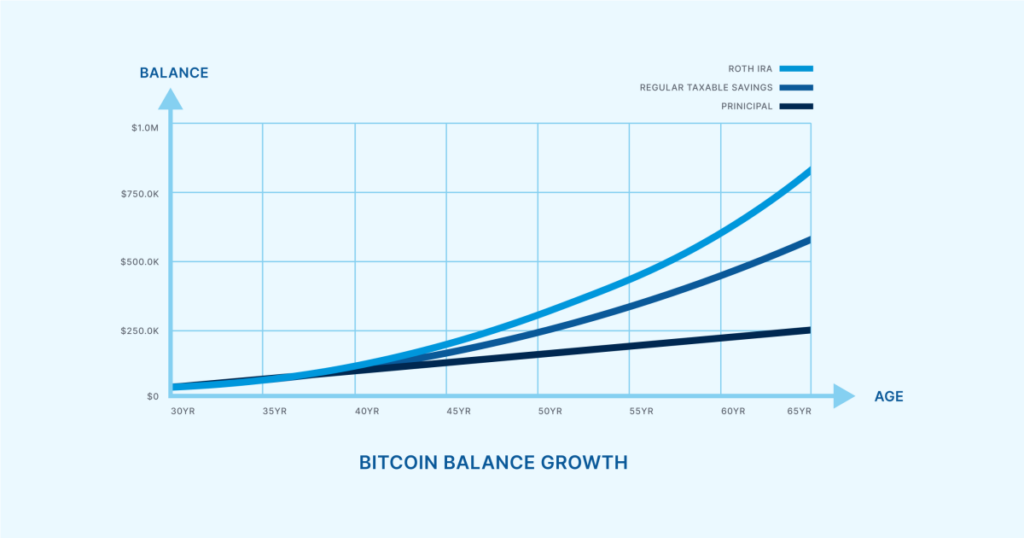

This is where a Roth IRA savings vehicle adds value. If Sally were to contribute to a bitcoin Roth IRA, contributions would still be made post-tax—same as before. But the key difference is that qualified Roth IRA distributions are tax-free. She only pays tax once, not twice.

The potential implications of tax-free bitcoin are massive. If the dollar value of bitcoin exponentially increases as Sally expects, then reducing her potential tax burden becomes increasingly rewarding.

Not Just Retirement: Withdrawing Contributions

Four years into maximizing her bitcoin Roth IRA contributions, Sally has contributed $24,000 (four years of $6,000 max) and experienced a rapid increase in bitcoin price—a common experience for many bitcoiners. Let’s assume a hypothetical balance of $100,000. To celebrate and reward herself, she has planned a Miami vacation. However, she can’t decide if she should sell her non-retirement bitcoin and pay gains tax or take it from her retirement account and pay penalties.

With penalty-free access to Roth contributions, Sally can take up to $24,000 (her total contributions) out of her Roth without incurring penalty or tax. In this imaginary scenario, let’s say she ends up pulling $10,000 from the Roth for her Miami vacation.

More Ways to Maximize a Roth

If Sally meets someone in Miami, she could pull $10,000 more from the Roth for an elopement wedding. And the house with the picket fence? The Roth allows for some flexibility in that, too: Roth IRAs allow for up to $10,000 of earnings to be withdrawn penalty-free if used for a first-time home purchase. With $4,000 of contributions left and an additional $10,000 in earnings for the first-time home purchase, Sally could combine forces with her equally-wise new spouse—who was also contributing to a Roth—and compile $24,000 for a down payment.

After the tax- and penalty-free spending spree has subsided, she and her spouse can continue to regularly contribute again, saving for the next big goal, and ultimately for retirement.

Key Takeaways

The Roth account has more flexibility than just saving for the classic age 59 ½ retirement scenario. Tax-free growth is a powerful tool to grow wealth over time and should be strongly considered for any retirement plan. You can pull contributions tax- and penalty-free at any time, and earnings are tax-free at retirement age. Certain conditions even allow you to pull earnings from your Roth without a penalty.

Rod is Retirement Ready: Entering Retirement

Rod has been diligently preparing for retirement. He’s mentally there, but financially not ready to take the leap. Still, bitcoin has become an increasingly important position in his portfolio. What started as a hedge (1-2%) has become a core component (+10%). He holds some bitcoin directly but has more exposure through bitcoin-adjacent assets (GBTC, MicroStrategy, mining stocks, etc.).

He’s not ready to go all-in on bitcoin because, although he believes in its importance, the volatility conflicts with his desire for financial stability during retirement. He has worked hard to earn his nest egg and would hate for it to disappear—especially to taxes. Within the next 5-10 years, he will transition out of his career and live off his 401k, investment account, real estate equity/income, and bitcoin. Any social security or pension are just a bonus.

Brackets and Buckets

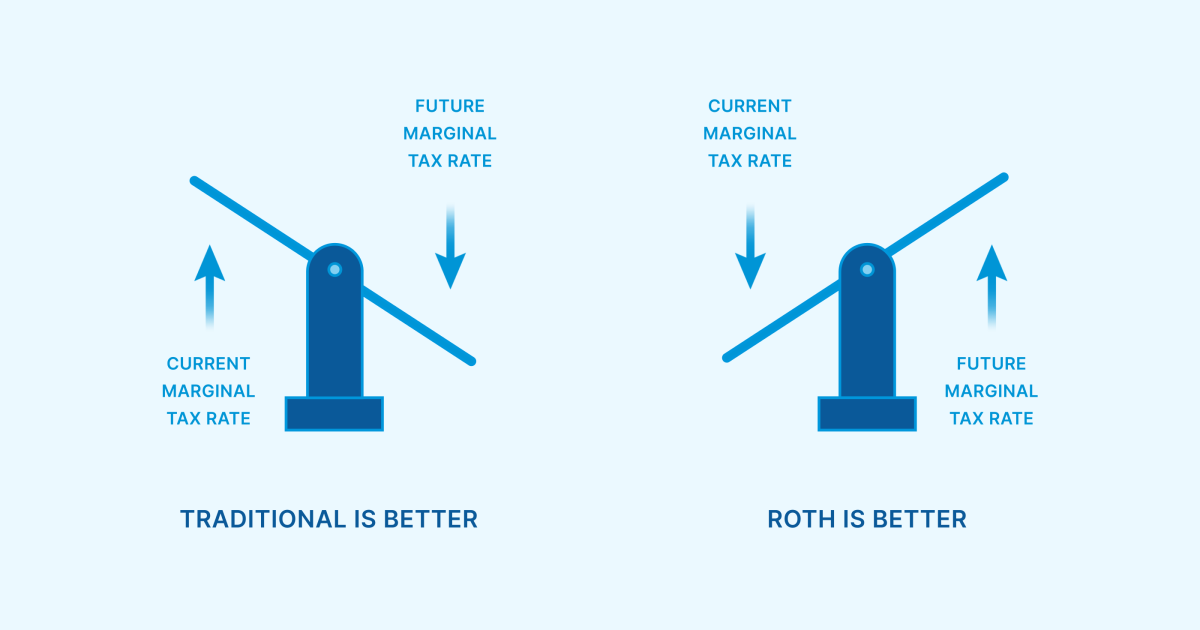

Rod needs to dive into his financial situation and see how his tax brackets will look. What will they look like the Monday morning after he retires? What will they look like after the pension or social security start? What about when the 401k required minimum distributions start at age 72? Knowing where the money is coming from, when it occurs, and how it’s taxed are critical components to retiring—and staying retired.

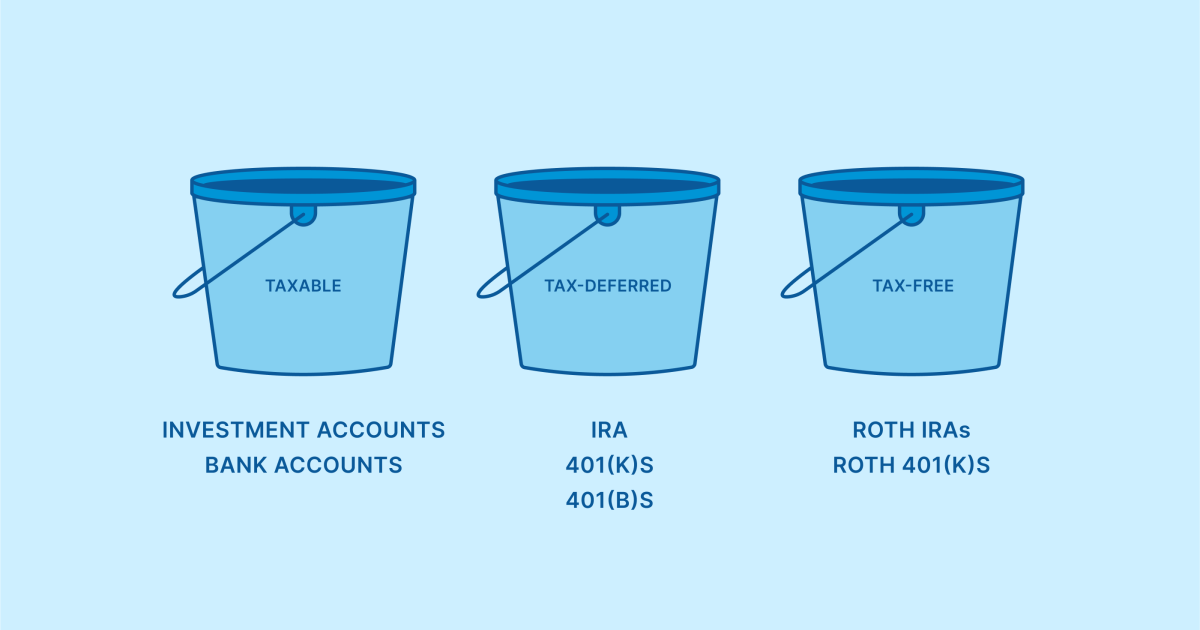

To make a plan, Rod needs to think about each account type as being in a different "tax bucket". His taxable assets are taxed upon sale, and his tax-deferred accounts are taxed when he takes income from them. The Roth provides another bucket: tax-free income. If Rod were to add a Roth IRA, he could pull from different buckets depending on the plan and the need.

For example, Rod can pull from the Roth in high tax years and keep his bracket from climbing too quickly. He can pull from taxable or Traditional IRAs in low tax years and accelerate that income at a lower marginal rate. More sophisticated strategies could include conversions, delaying income, gifting taxable assets, etc. The key point: Roth allows for diversification in "tax buckets" to optimize your tax bracket in retirement.

When Rod adds this tax-free bucket to his picture, he decides to fill it with high risk/reward assets like bitcoin. If the growth is tax-free, then it makes sense for it to grow as much as possible. He decides to sell his mining stocks, GBTC, and MSTR and convert that cash into a bitcoin IRA.

Frequently Asked Questions

What are the benefits of a gold IRA

There are many advantages to a gold IRA. It's an investment vehicle that allows you to diversify your portfolio. You control how much money goes into each account and when it's withdrawn.

You have the option of rolling over funds from other retirement account into a gold IRA. This is a great way to make a smooth transition if you want to retire earlier.

The best part? You don’t need to have any special skills to invest into gold IRAs. They are readily available at most banks and brokerages. Withdrawals can happen automatically, without any fees or penalties.

There are also drawbacks. Gold is historically volatile. Understanding why you want to invest in gold is essential. Are you looking for safety or growth? Are you trying to find safety or growth? Only by knowing the answer, you will be able to make an informed choice.

If you plan to keep your gold IRA indefinitely, you'll probably want to consider buying more than one ounce of gold. A single ounce isn't enough to cover all of your needs. Depending on the purpose of your gold, you might need more than one ounce.

You don’t necessarily need a lot if you’re looking to sell your gold. You can even manage with one ounce. But you won't be able to buy anything else with those funds.

Should You Buy Gold?

Gold was once considered an investment safe haven during times of economic crisis. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

This could be changing, according to some experts. According to them, gold prices could soar if there is another financial crisis.

They also pointed out that gold is gaining popularity due to its perceived value, and potential return.

If you are considering investing in gold, here are some things that you need to keep in mind.

- Before you start saving money for retirement, think about whether you really need it. You can save for retirement and not invest your savings in gold. That said, gold does provide an additional layer of protection when you reach retirement age.

- Second, make sure you understand what you're getting yourself into before you start buying gold.There are several different types of gold IRA accounts available. Each type offers varying levels and levels of security.

- Don't forget that gold does not offer the same safety level as a bank accounts. If you lose your gold coins, you may never recover them.

Do your research before you buy gold. You should also ensure that you do everything you can to protect your gold.

How is gold taxed in Roth IRA?

A tax assessment for an investment account will be based on the current market value, and not what you paid initially. All gains, even if you have invested $1,000 in a mutual funds stock, are subject to tax.

But if you put the money into a traditional IRA or 401(k), there's no tax when you withdraw the money. You pay taxes only on earnings from dividends and capital gains — which apply only to investments held longer than one year.

Each state has its own rules regarding these accounts. Maryland's rules require that withdrawals be taken within 60 days after you turn 59 1/2. You can delay until April 1st in Massachusetts. And in New York, you have until age 70 1/2 . You should plan and take distributions early enough to cover all retirement savings expenses to avoid penalties.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

bbb.org

investopedia.com

How To

The History of Gold as an Asset

From ancient times to the beginning of the 20th century, gold was used as a currency. It was universally accepted and loved for its beauty, durability, purity and divisibility. It was also traded internationally due to its high value. There was no international standard for measuring gold at that time, so different weights and measures were used around the world. For example, in England, one pound sterling was equal to 24 carats of silver; in France, one livre tournois was equal to 25 carats of gold; in Germany, one mark was equal to 28 carats of gold; etc.

The United States began issuing American coin made up 90% copper, 10% zinc and 0.942 fine-gold in the 1860s. This resulted in a decline of foreign currency demand and an increase in the price. At this point, the United States minted large amounts of gold coins, causing the price of gold to drop. Because the U.S. government had too much money coming into circulation, they needed to find a way to pay off some debt. They sold some of their excess gold to Europe to pay off the debt.

Most European countries distrusted the U.S. Dollar and began to accept gold as payment. Many European countries started to accept paper money as a substitute for gold after World War I. The price of gold has risen significantly since then. Even though the price of gold fluctuates, it remains one the best investments you can make.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]