For individuals new to the concept of investing in or owning bitcoin, especially those nearing retirement age, initial reactions may range from skepticism to disbelief. However, looking beyond the common narratives reveals a compelling story. Here are six reasons why owning at least some bitcoin during retirement could be beneficial:

1. Diversification with Bitcoin

Asset allocation is a strategy investors traditionally use to distribute and protect funds from investment risks over time. By diversifying across various asset classes like bonds, stocks, real estate, cash, and commodities, investors can mitigate risk. Despite current challenges due to increased correlation among different asset classes, owning bitcoin introduces a new asset class to diversify your portfolio effectively.

2. Hedge Against Inflation

Bitcoin serves as a hedge against inflation and currency devaluation, safeguarding your purchasing power during retirement. With a fixed supply of 21 million coins and no centralized authority controlling its value, bitcoin stands out as a reliable store of value compared to fiat currencies.

3. Potential for Asymmetric Returns

Due to its limited supply and growing demand, bitcoin has the potential for asymmetric returns, outperforming other asset classes in the long run. Holding bitcoin for the long term allows retirees to benefit from its appreciation potential, offering a unique opportunity for wealth growth.

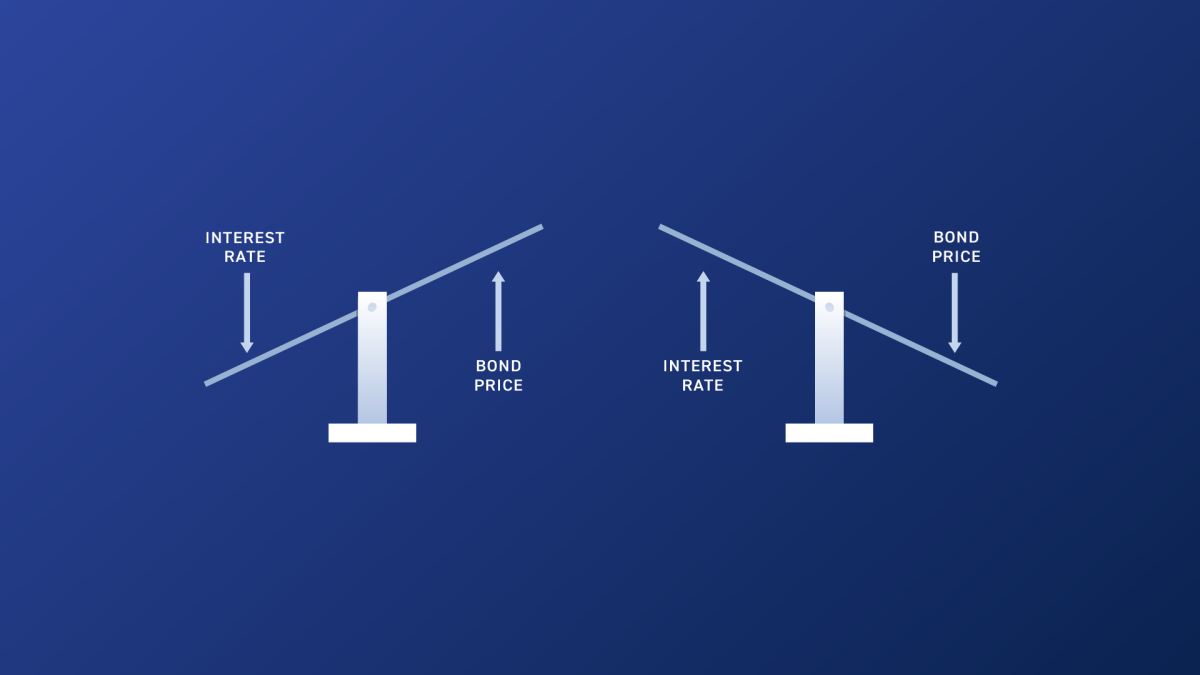

4. Protection Against Long-Term Bond Risks

In a low-yield bond environment with potential market value fluctuations, owning bitcoin can offset risks associated with long-term bonds in retirement portfolios. Bitcoin's classification as a separate asset class provides a distinct advantage in diversifying risk exposure.

5. Mitigating Long-Term Healthcare Costs

As healthcare expenses rise due to inflation and aging populations, bitcoin can serve as a hedge against increasing long-term care costs. Setting aside bitcoin specifically for healthcare expenses provides a potential solution for managing healthcare risks during retirement.

6. Individual Sovereignty with Bitcoin

Bitcoin offers individuals increased sovereignty over their wealth by providing ownership that transcends geographic borders and financial institutions. Holding bitcoin securely in a wallet grants autonomy and protection against external interference, making it a valuable asset for retirement planning.

By integrating sound financial principles with bitcoin ownership, retirees can benefit from its potential without compromising financial stability. Understanding the role of bitcoin in a diversified retirement portfolio and applying prudent investment strategies can enhance long-term financial security.

Frequently Asked Questions

What are some of the advantages and disadvantages to a gold IRA

An excellent investment vehicle is a gold IRA. This is for people who wish to diversify but do not have access to traditional banking services. It allows you to invest in precious metals such as gold, silver, and platinum without paying taxes on any gains until they're withdrawn from the account.

The downside is that early withdrawals will result in ordinary income taxes on earnings. However, creditors will not be able to seize these funds if you default on your loan.

A gold IRA could be the best option for you if your goal is to have gold that you can own without worrying about taxes.

Are precious metal IRAs a good investment?

How willing you are to risk your IRA account losing value will decide the answer. If you have $10,000 cash, they make sense as long as you don’t expect your IRA account to grow rapidly. These might not be the best options if you're looking to invest in assets that have the potential to rise in value (gold) and plan to save for retirement for many decades. These investments can also be subject to fees that could reduce any gains.

What are the 3 types IRAs?

There are three basic types of IRAs. Traditional, Roth, and SEP. Each type offers its advantages and disadvantages. Below, we'll discuss each one.

Traditional Individual Retirement Account (IRA).

Traditional IRAs allow you to make pretax contributions to an account that allows you to defer taxes while still earning interest. You can withdraw money from the account tax-free after you retire.

Roth IRA

Roth IRAs allow for you to make after-tax deposits into an account. The earnings are tax-free. When you withdraw funds from the account for retirement purposes, withdrawals are also exempted from tax.

SEP IRA

This is similar to a Roth IRA, except that it requires employees to make additional contributions. The additional contributions are subject to tax, but earnings accrue tax-deferred. You may choose to convert the entire amount to a Roth IRA when you leave the company.

What Precious Metals Can You Invest in for Retirement?

The first step to retirement planning is understanding what you have saved now and where you are saving money. If you don't know how much you currently have saved, start by taking an inventory of everything you own. This should include any savings accounts, stocks, bonds, mutual funds, certificates of deposit (CDs), life insurance policies, annuities, 401(k) plans, real estate investments, and other assets such as precious metals. Then add up all of these items to determine how much you have available for investment.

If you are between 59 and 59 1/2 years, you might consider opening a Roth IRA. Traditional IRAs allow you to deduct contributions out of your taxable income. Roth IRAs don't. But, future earnings won't allow you to take tax deductions.

You may need additional money if you decide you want more. Start with a regular brokerage.

What kind of IRA can you use to hold precious metals in?

An Individual Retirement Account (IRA) is an investment vehicle most employers and financial institutions offer. An IRA allows you to contribute money that is tax-deferred until it is withdrawn.

An IRA allows for you to save taxes while still paying taxes when you retire. This means more money deposited into your retirement plan today versus having to pay taxes on that money tomorrow.

The beauty of an IRA is that contributions and earnings grow tax-free until you withdraw the funds. When you do, there are penalties for early withdrawal.

You can also make additional contributions to your IRA after age 50 without penalty. If you decide to withdraw your IRA from retirement, you will owe income taxes as well as a 10% federal penalty.

Withdrawals that are made prior to the age of 60 1/2 are subjected to a 5% IRS tax penalty. There is a 3.4% penalty for withdrawals between the ages 70 1/2 and 59 1/2.

The IRS will penalize withdrawals of more than $10,000 annually.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

External Links

wsj.com

forbes.com

regalassets.com

takemetothesite.com

How To

IRA-Approved Precious Metals

IRA-approved precious materials are excellent investments whether you're looking for ways to save money for retirement or to invest in your next business venture. There are many options available to diversify and protect your portfolio from gold bars through silver coins.

Precious Metal Investment Products come in two main formats. Physical assets such as coins and bars are called physical bullion because they can be physically accessed. Exchange-traded funds (ETFs), on the other side, are financial instruments which track the price movements for an underlying asset like gold. ETFs work just like stock exchange stocks and can be bought directly by the company issuing them.

There are many precious metals to choose from. Silver and gold are commonly used for jewellery making and decoration. However, platinum and palladium tend to be associated with luxury goods. Palladium has a tendency to retain its value longer than platinum making it an ideal choice for industrial uses. Silver is also useful for industrial purposes, although it is usually preferred for decorative applications.

Due to the expense of mining and refining natural materials, physical bullion is more expensive. But they are generally safer than traditional paper currencies and provide buyers with more security. Consumers may lose faith in the currency and seek out alternatives if the U.S. dollar falls in purchasing power. However, physical bullion products don't rely on trust between nations or companies. Instead, they have the backing of central banks and governments. This gives customers confidence.

The supply and demand for gold affect the price of gold. The price of gold will rise if there is more demand. Conversely, a decrease in supply can cause the price to fall. This dynamic creates opportunities for investors to profit from fluctuations in the price of gold. These fluctuations are good for investors who have physical bullion products as they get a better return on their investment.

Precious metals are not affected by interest rate changes or economic recessions, unlike traditional investments. As long as the demand for gold remains strong, it will continue to rise. This is why precious metals are considered safe havens when times are uncertain.

The most popular precious metals include:

- Gold – Gold is the oldest type of precious metal and is often called “yellow metal.” Gold is a common name, but it's a rare element that can be found underground. The majority of the world's reserves of gold are located in South Africa, Australia and Peru.

- Silver – Silver is second most valuable precious metal, after gold. Silver can be mined from naturally occurring deposits, much like gold. However, silver is usually extracted from ore and not from rock formations. Because of its malleability and durability, as well resistance to tarnishing and conductivity, silver is widely used by industry and commerce. The United States is responsible for 98% worldwide silver production.

- Platinum – The third most precious precious metal is platinum. It is used in many industries, such as fuel cells, catalytic converters and high-end medical equipment. It is used in dentistry for dental crowns, fillings and bridges.

- Palladium: Palladium is the 4th most valuable precious metallic. Its popularity is growing rapidly among manufacturers because of its strength and stability. Palladium can also be used in electronics, military technology, and automobiles.

- Rhodium – Rhodium is the fifth most valuable precious metal. Rhodium, although it is rare, is highly sought after for its use in automotive catalysts.

- Ruthenium-Ruthenium is the sixth-most valuable precious metal. There are limited quantities of platinum and palladium. However, ruthenium is abundant. It is used for steel manufacturing, chemical manufacturing, and aircraft engines.

- Iridium – Iridium is the seventh-most valuable precious metal. Iridium is an important component in satellite technology. It is used in the construction of orbiting satellites that transmit TV signals and telephone calls.

- Osmium – Osmium is the eighth most valuable precious metal. Osmium's ability to withstand extreme temperatures makes it a common metal in nuclear reactors. Osmium is used in medicine, cutting tools, jewelry, as well as medicine.

- Rhenium – Rhenium has been ranked as the ninth most valuable precious metallic. Rhenium is used in refining oil and gas, semiconductors, and rocketry.

- Iodine- Iodine ranks as the tenth most precious precious metal. Iodine is used in photography, radiography, and pharmaceuticals.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]