Macro – Crossing the Rubicon

Donald J. Trump and the point of no return. 3 words, "Strategic Bitcoin Stockpile". It was theorized by many Bitcoiners for years, some would even say dreamed of, and it happened just last week. Fair to say that Bitcoin has indeed crossed some sort of Rubicon on Saturday, a point of no return where everything can suddenly accelerate. The culprit? – goes by the name of game theory. Nations around the world, from this day forward, have to take this idea of a Bitcoin reserve seriously or face the consequences of being left behind. If enacted, the US will own around 1% of the total bitcoin supply.

From the perspective of other countries

This strategy would be tough to replicate as the US basically got this bitcoin for free (through what could most likely be considered illegal and immoral means). Competing nations would be faced with the daunting/impossible task of accumulating hundreds of thousands of bitcoins without paying a huge premium for it. This is where Bitcoin mining becomes a matter of national security. On the back of that announcement from Trump, Michael Saylor also laid out a framework for nation-state adoption of bitcoin as a treasury asset (How to do it sensibly and why it makes sense) in front of 10+ senators. A good idea whose time has come is unstoppable.

Institutions are here

The same game theoretics apply for institutions. If nation-states are accumulating Bitcoin, corporations must do the same. Nation-state accumulation basically guarantees price go up over the long term, which means dollar-denominated corporate treasuries will suffer in relative terms. It becomes a bright line denominating winners and losers. Moving part of the treasury into BTC won't even necessarily make you a winner, it'll be the baseline requirement to compete. Anyone who doesn't do it will just be left behind. "It might make sense just to get some in case it catches on"

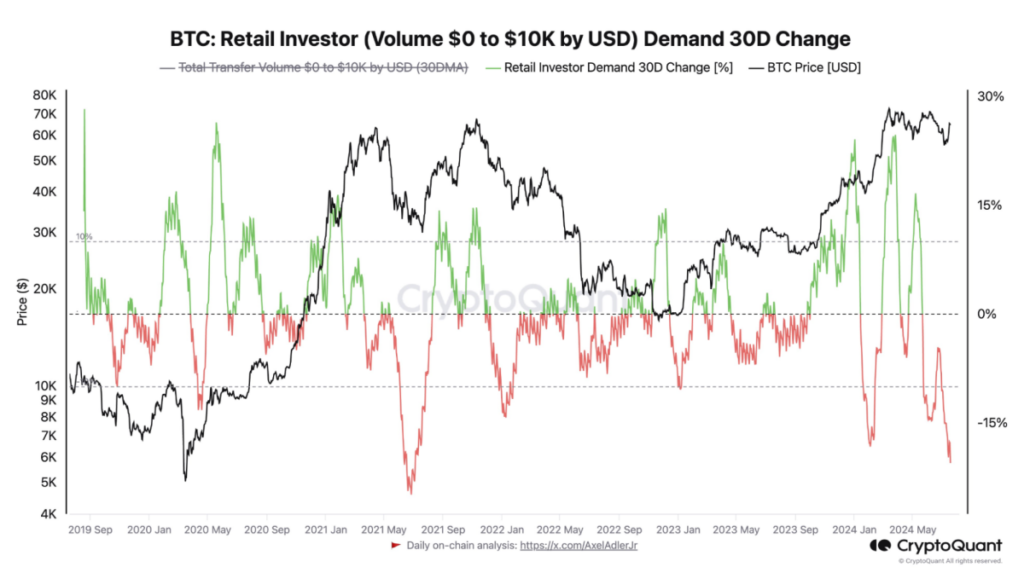

Retail is still absent

As the chart below describes, retail flow measured by the 30-day change in total transfer volume for transactions under $10K, is at a 3-year low. Despite BTC being less than 10% away from ATH. While the conference was an inevitable success in terms of retail participation, it would appear that retail buyers are either exhausted, already all-in or not willing to buy additional BTC at those prices. Another possible explanation for this was the overall feeling throughout the conference of "waiting for the next catalyst".

UTXO Alpha Day – The first of many for Venture Capitalists

We are blessed to support the best people. UTXO Management was hosting its inaugural investor day, UTXO Alpha Day, at the Bitcoin 2024 conference. We assembled hundreds of capital allocators, entrepreneurs, institutional investors, and angels for the event, where we explored yield-bearing assets in Bitcoin, the landscape of new Bitcoin layers, and the emergence of Bitcoin as the ultimate treasury asset. The event was a success and a great reminder that Venture Capital is first and foremost about exceptional individuals all competing to bring new utility to Bitcoin. BTC Startup Lab also hosted an incredible mixer event on Friday where we had the pleasure of meeting many different investors and founders.

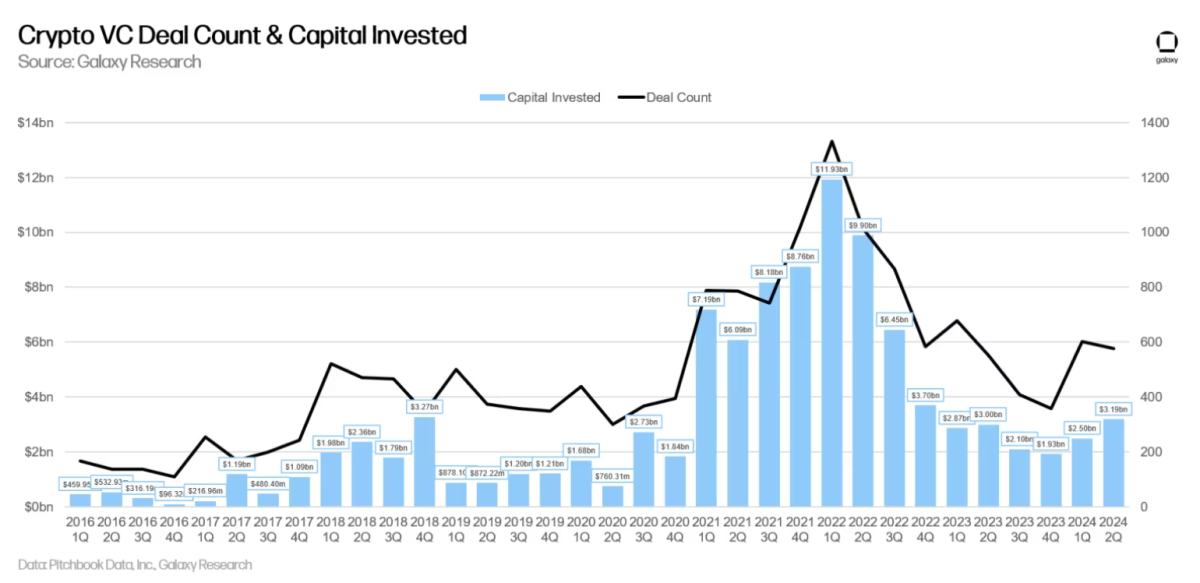

Venture Capital knowledge about Bitcoin remains limited

As it was highlighted in the most recent Galaxy report on Blockchain Venture Capital, the appetite for crypto investment has steadily increased YTD but remains nowhere near the top of Q1 2022. From the report: "In Q2 2024, venture capitalists invested $3.194bn (+28% QoQ) into crypto and blockchain-focused companies across 577 deals (-4% QoQ)." While this is a good sign for the space, Bitcoin investments only represented 3.1% of total deal flow or $96.4M in Q2 2024 while Bitcoin market capitalization constitutes above 55% of the whole crypto market.

We’ve got the Alpha

Henry Elder from UTXO highlighted during Alpha Day all the ways that traditional investors should think about deploying on-chain Bitcoin capital. Some takeaways: BTCfi is in its infancy and can be broadly organized into 3 categories: sidechains, Layer-2 chains, and metaprotocols.

Bitcoin L2’s – The cool kids on the block?

L2’s were the center of attention. With no surprise, L2’s were the talk of the town in Nashville. BitcoinOS (Grail) announced their new rollup protocol by verifying a proof directly on Bitcoin (BitVMX had done something similar just a few days earlier on testnet). Bitlayer and many others were big sponsors of the conference, often hosting some of the coolest afterparties throughout the week.

Mining – Is it even mining anymore?

Hashprice is no longer the key to becoming a profitable miner – it’s "we’re building an AI pilot project". It has become apparent throughout my discussions with miners and analysts alike that the only catalyst propping up miners currently has nothing to do with mining and everything to do with capital allocation. Miners are choosing to allocate resources to AI and HPC, while investors are choosing to allocate resources to miners with the most exposure to these relatively new verticals.

The Commoditization of Blockspace is becoming a reality

I had the chance to attend the launch party of Alkymia, hosted by Blockspace Media. For those not familiar with Alkymia, their newly released platform allows you to take a directional bet on Bitcoin transaction fees. This is the latest addition to a suite of tools allowing miners to stabilize their revenues while allowing exchanges, protocols, and traders to hedge transaction fee volatility risks. As blockspace becomes more valuable, the complexity of transacting on-chain will grow, giving an edge to specialized actors understanding the nuances of Bitcoin’s mempool.

The spirit of Matt Corallo's speech was overlooked

Being scheduled to speak right before the future president of the United States is never an easy exercise. However, Matt laid out the most fundamental principles that make Bitcoin what it is today in a brilliant way that would deserve more attention.

Frequently Asked Questions

What precious metals will be allowed in an IRA account?

The most common precious metallic used in IRA accounts, is gold. Also available as investments are bars and bullion gold coins.

Precious and precious metals are considered safe investments, as they don’t lose their value over the course of time. They're also considered a great way to diversify an investment portfolio.

Precious metallics include platinum, silver and palladium. These three metals all have similar properties. Each one has its own uses.

One example is platinum, which is used to create jewelry. To create catalysts, palladium is used. To produce coins, silver can be used.

You should consider the amount you will spend on your gold before you decide which precious metal. It may be more cost-effective to purchase gold at lower prices per ounce.

It is also important to consider whether you would like to keep your investment confidential. If you do, you should choose palladium.

Palladium is more valuable than gold. It's also more rare than gold. It's likely that you will have to pay more.

When choosing between gold or silver, another important aspect is the storage fees. Gold is measured by weight. If you have larger amounts of gold to store, you will be charged more.

Silver is stored according to its volume. Silver is priced by volume. You will pay less to store smaller amounts.

You should follow all IRS rules if you plan to store precious metals in an IRA. This includes keeping track, and reporting to the IRS, all transactions.

Are precious metal IRAs a good investment?

The answer depends on how much you are willing to risk an IRA account losing value. They make sense if you have $10,000 in cash as long as you don't expect them to grow very quickly. These might not be the best options if you're looking to invest in assets that have the potential to rise in value (gold) and plan to save for retirement for many decades. These fees can reduce any gains.

What precious metals do you have that you can invest in for your retirement?

The first step to retirement planning is understanding what you have saved now and where you are saving money. To find out how much money you have, take a inventory of everything that you own. You should list all savings accounts, stocks and bonds, mutual funds certificates of deposit (CDs), annuities, life insurance policies, annuities 401(k), real estate investments, and any other assets like precious metals. Add all these items together to calculate how much money you have for investment.

If you are less than 59 1/2 years of age, you may be interested in opening a Roth IRA. A Roth IRA, on the other hand, allows you to subtract contributions from your taxable revenue. However, you won't be able to take tax deductions for future earnings.

If you decide to invest more, you will most likely need to open a second investment account. Start with a regular brokerage account.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- Silver must be 99.9% pure • (forbes.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

External Links

takemetothesite.com

regalassets.com

forbes.com

investopedia.com

How To

How to open a Precious Metal IRA

Precious metals remain one of the most highly-valued investment options. They offer investors higher returns than traditional investments, such as bonds and stocks. This is why they are so popular. However, you need to be careful when investing in precious materials. Here's how to open a precious-metal IRA account.

There are two main types in precious metal accounts. These are physical precious metals and paper gold or silver certificates (GSCs). Each type has its advantages and disadvantages. GSCs offer easy access and trade, while physical precious metals accounts provide diversification benefits. Read on to find out more.

Physical precious metals accounts include bullion, bars and coins. Although this option can provide diversification benefits, there are some drawbacks. Precious metals can be expensive to store, buy and sell. Moreover, their large size can be difficult to transport them from one location to another.

However, paper silver and gold certificates are relatively cheap. They are also easily available and can be traded online. These make them ideal for people who don’t want to invest directly in precious metals. They aren’t as diversifiable as their physical counterparts. Also, since they're backed by government agencies such as the U.S. Mint, the value of these assets could decrease if inflation rates rise.

Choose the best account for you financial situation when opening a precious metal IRA. These are some factors to consider before you do this:

- Your tolerance level

- Your preferred asset allocation strategy

- What time do you have available to invest?

- Consider whether you will use the funds to trade short-term.

- What kind of tax treatment you'd prefer

- Which precious metal(s) you'd like to invest in

- How liquid do your portfolio need to be

- Your retirement age

- You'll need somewhere to keep your precious metals

- Your income level

- Your current savings rate

- Your future goals

- Your net worth

- Special circumstances that may influence your decision

- Your overall financial picture

- Your preference between paper and physical assets

- Your willingness to accept risks

- Your ability to manage losses

- Your budget constraints

- You desire to be financially independent

- Your investment experience

- Your familiarity with precious and rare metals

- Your knowledge of precious Metals

- Your confidence in the economy

- Your personal preferences

After you have determined the type of precious metal IRA that best suits you, you can open an account with a reputable dealer. These dealers can be found via referrals, word-of-mouth, and online research.

Once you have opened your precious-metal IRA, it is time to decide how much you want to deposit. You should note that every precious metal IRA account has a different minimum deposit amount. Some accounts require $100 while others allow you to invest up $50,000.

As stated above, the amount of money invested in your precious metal IRA is completely up to you. A higher initial deposit will help you build wealth over a prolonged period. On the other hand, if you're planning on investing smaller sums of money every month, a lower initial deposit might work better for you.

You have many options when it comes to the type of investments you can make. These are the most commonly used:

- Gold – Bullion bars, rounds, and coins

- Silver – Rounds, and coins

- Platinum – Coins

- Palladium – Round and bar forms

- Mercury – Bar and round forms

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]