Hey there, crypto enthusiasts! Wondering if Bitcoin is truly stealing the spotlight this cycle? Let's dive into the comparison with Gold and NASDAQ to uncover the real story behind Bitcoin's performance. Strap in for some eye-opening insights!

Bitcoin's Growth Trajectory Since Cycle Lows

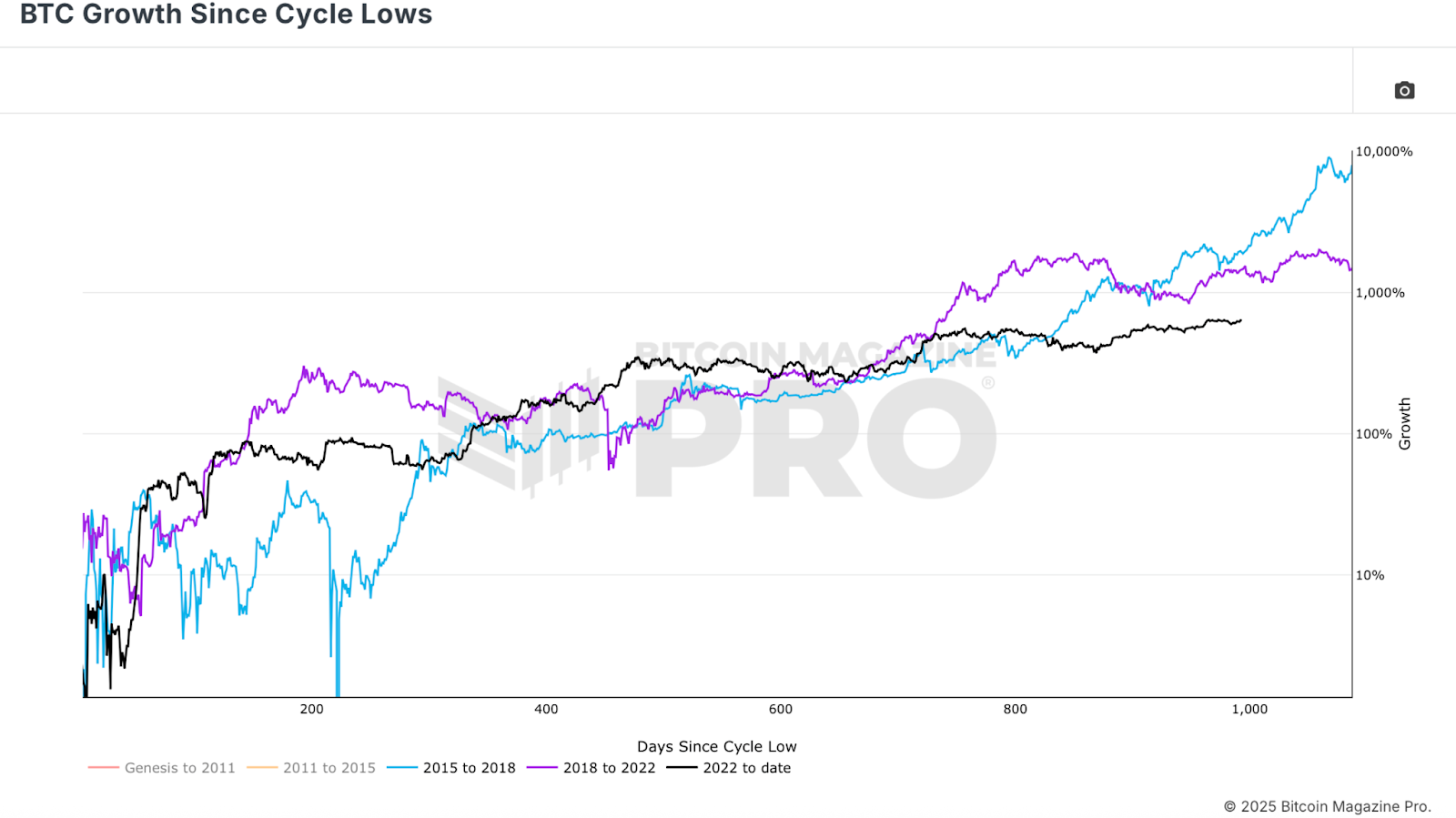

Unveiling Bitcoin's Impressive Journey

When we peek at the Bitcoin Growth Since Cycle Lows chart, the numbers paint a promising picture. With returns soaring around 634% from the previous bear market's lows, Bitcoin's performance seems robust. The solid foundation of institutional investments and steadfast hodlers hints at a potential surge in the near future, akin to past cycles.

Bitcoin Price Movement in USD: Stability in Action

USD Price Chart Insights

Examining the USD price chart highlights Bitcoin's stability this cycle. With minor retracements of around 32% post $100,000 milestones, the market showcases a smoother ride compared to historical fluctuations. Though reduced volatility may hint at limited upside, it also promises a safer landscape for investors. The market's fundamental strength remains unwavering.

Bitcoin vs. NASDAQ and US Tech Stocks

Decoding Bitcoin's Performance Against Tech Giants

Contrasting Bitcoin with high-growth assets like NASDAQ and US tech stocks reveals a less dazzling performance. While this cycle's climb lacks grandeur, the shift from resistance to support signals a potential upward surge. The prior double-top cycle hints that external factors like global liquidity and currency dynamics might have influenced Bitcoin's past peaks more than genuine excellence.

Bitcoin vs. Gold: The Digital Gold Debate

Assessing Bitcoin's Shine Against Gold

The comparison of Bitcoin with Gold unveils that Bitcoin is yet to surpass its 2021 peak in Gold terms. Holding Bitcoin since 2021 might have underperformed compared to Gold's steadfast rise. Despite a 300%+ return since the last cycle lows, Gold's enduring bull run puts Bitcoin's purchasing power in perspective.

Adjusting the Bitcoin vs. Gold chart for Global M2 money supply expansion offers a reality check. Despite Bitcoin's impressive gains, the liquidity-adjusted peak remains below previous levels, indicating a plateau in real purchasing power terms.

While Bitcoin's journey in dollar values is commendable, the comparisons with US tech stocks, Gold, and liquidity-adjusted metrics reveal a more nuanced story. Understanding these ratio charts can provide valuable insights into Bitcoin's future trajectory. Stay informed, stay sharp!

Ready to navigate the crypto waves with newfound clarity? Keep a close eye on these comparisons for a well-rounded perspective on Bitcoin's performance. Let's ride this crypto rollercoaster together!

Frequently Asked Questions

How can you withdraw from a Precious metal IRA?

You may consider withdrawing your funds if you have an account with a precious metal IRA company such as Goldco International Inc. You can sell your metals at a higher price if they are still in the account than if you left them there.

Here is how to withdraw precious metal IRA funds.

First, verify that your precious metal IRA allows withdrawals. Some companies will allow withdrawals, while others won't.

Second, consider whether your sale of metals can allow you to take advantage tax-deferred profits. Most IRA providers offer this benefit. But, not all IRA providers offer this benefit.

Third, make sure to check with your precious metal IRA provider if there are any fees associated with these steps. The withdrawal may cost extra.

Fourth, keep track of your precious metal IRA investments for at least three years after you sell them. In other words, wait until January 1st each year to calculate capital gains on your investment portfolio. Follow the instructions on Form 8949 to calculate the gain.

In addition to filing Form 8949, you must also report the sale of your precious metals to the IRS. This will ensure you pay taxes on all the profits that your sales generate.

A trusted attorney or accountant should be consulted before you sell your precious metals. They can help ensure you follow all necessary procedures and avoid costly mistakes.

How to Open a Precious Metal IRA

A self-directed Roth Individual Retirement Account is the best way to open a IRA for precious metals.

This type of account is superior to other types of IRAs in that you don't pay any taxes on the interest earned from your investments, until you withdraw them.

It is attractive for people who want to save money, but need a tax break.

There are many other options than investing in gold and silver. You can invest in anything you want if it fits the IRS guidelines.

Many people think only of silver and gold when they hear the word “precious metallic” but there are other types.

Examples include platinum, palladium and rhodium.

There are many ways that you can invest precious metals. The two most popular options include buying bullion coins and bars and purchasing shares of mining companies.

Bullion Coins and Bars

Buying bullion coins and bars is one of the easiest ways to invest in precious metals. Bullion is a general term that refers to physical ounces of gold and silver.

Bullion bars and bullion coin are real pieces of metal.

While you may not immediately see any change after buying bullion coins and bars in a store, there will be some long-term benefits.

This is an example of a tangible piece in history. Each coin and each bar have a story.

It is often worth less than its nominal price if you examine the face value. The American Eagle Silver Coin cost $1.00 an ounce in 1986 when it was first introduced. The price of an American Eagle is now closer to $40.00 a ounce.

Bullion has seen a dramatic rise in value since its introduction. Many investors would rather buy bullion coins or bullion bars than futures contracts.

Mining Companies

Another option for people who are interested in buying precious metals is to invest in shares of mining corporations. When you invest in mining businesses, you are investing in their ability to produce silver and gold.

You will then receive dividends, which are calculated based upon the company's profit. These dividends are then used to pay shareholders.

In addition, you will benefit from the growth potential of the company. The demand for the product will also cause an increase in share prices.

These stocks can fluctuate in value so it is important to diversify your portfolio. This involves spreading your risk over multiple companies.

However, mining companies are not immune to financial loss just like any stock-market investment.

If gold prices drop significantly, your share of ownership could be worthless.

The Bottom Line

Precious metals such as gold and silver provide a haven during economic uncertainty.

Silver and gold, however, can experience wild swings in their prices. If you're interested in making a long-term investment in precious metals, consider opening up a precious metals IRA account with a reputable firm.

You will be able to take advantage of tax incentives while also benefiting from physical assets.

What Precious Metals Can You Invest in for Retirement?

Understanding what you have now saved and where you are currently saving money is the first step in retirement planning. Start by listing everything you have. This includes stocks, bonds and mutual funds, as well as certificates of deposit (CDs), life policies, annuities and 401(k), plans, real estate investments and other assets, such precious metals. You can then add up all these items to determine the amount of investment you have.

If you are younger than 59 1/2, you might want to open a Roth IRA account. A Roth IRA, on the other hand, allows you to subtract contributions from your taxable revenue. However, you won't be able to take tax deductions for future earnings.

If you decide you need more money, you will likely need to open another investment account. Begin with a regular brokerage.

Statistics

- Silver must be 99.9% pure • (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

External Links

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

wsj.com

takemetothesite.com

investopedia.com

How To

How to Open a Precious Metal IRA

Precious Metals are one of today's most desired investment vehicles. They are so popular because they allow investors to earn higher returns than traditional investments like stocks and bonds. However, investing in precious metals requires careful planning and research before purchasing. Here's how to open a precious-metal IRA account.

There are two types of precious metal accounts. They are paper gold and silver certificates (GSCs) and physical precious metals accounts. Each type has advantages and drawbacks. GSCs, on the other hand, are more accessible and can be traded. Keep reading to find out more about these options.

Physical precious Metals accounts consist of bullion, bullion, and bars. Although diversification benefits are great, this option has drawbacks. You will need to pay a lot of money for precious metals, whether you are buying, selling, or storing them. Moreover, their large size can be difficult to transport them from one location to another.

On the other hand, paper gold and silver certificates are relatively inexpensive. They can also be traded online and are easily accessible. This makes them an ideal choice for those who don’t desire to invest in precious metallics. However, they aren't as diversified as their physical counterparts. These assets are also supported by government agencies, such as the U.S. Mint. Inflation rates could cause their value to drop.

Choose the best account for you financial situation when opening a precious metal IRA. These are some factors to consider before you do this:

- Your tolerance level

- Your preferred asset allocation strategy

- What time do you have available to invest?

- No matter if you intend to use the funds in short-term trading.

- What kind of tax treatment you'd prefer

- Which precious metal(s), you would like to invest in

- How liquid should your portfolio be?

- Your retirement date

- Where will you store your precious metals?

- Your income level

- Current savings rate

- Your future goals

- Your net worth

- Any other special circumstances that may impact your decision

- Your overall financial picture

- Preference between paper and physical assets

- Your willingness and ability to take risks

- Your ability to manage losses

- Your budget constraints

- Financial independence is what you want

- Your investment experience

- Your familiarity in precious metals

- Your knowledge of precious metals

- Your confidence in the economy

- Your personal preferences

Once you've determined which type of precious metal IRA best suits your needs, you can proceed to open an account with a reputable dealer. These companies can be found through word of mouth, referrals and online research.

After you have opened your precious metal IRA account, you will need to decide how much money to put in it. It's important to note that each precious metal IRA account carries different minimum initial deposit amounts. Some accounts require $100 while others allow you to invest up $50,000.

As you can see, your precious metal IRA IRA investment amount is completely up to the individual. You should choose a higher initial deposit if you want to build wealth over time. You might prefer a lower initial deposit if you intend to invest smaller amounts every month.

There are many types of investments that can be purchased, as well as precious metals you can use in your IRA. These are the most commonly used:

- Gold – Bullion bars, rounds, and coins

- Silver – Rounds or coins

- Platinum – Coins

- Palladium – Round and bar forms

- Mercury – Round and bar forms

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]