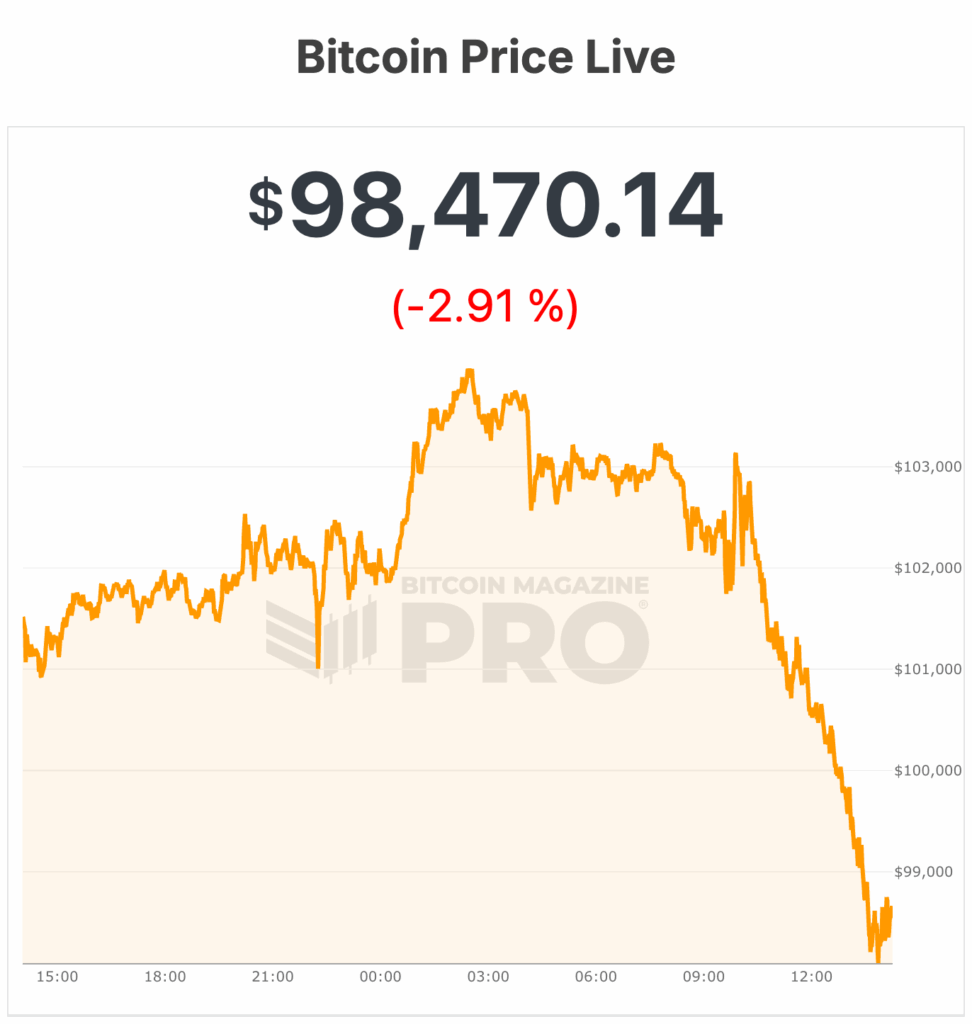

Today witnessed a significant plunge in Bitcoin price, dropping from a daily peak of $104,000 to $98,113, erasing previous gains and indicating a substantial shift in price momentum.

The Rollercoaster Ride of Bitcoin Price

Market Fluctuations and Investor Sentiment

As the day unfolded, Bitcoin's value steadily declined from the mid $102,000 range to a low of $97,870, reflecting ongoing market volatility and shifting investor sentiment.

Impact of Holder Actions on Price Levels

Recent data from CryptoQuant reveals a surge in long-term holders selling approximately 815,000 BTC in the past month, reminiscent of early 2024 trends. This, combined with weakening spot and ETF demand, has contributed to profit-taking activities, resulting in substantial realized gains.

Market Analysis and Future Projections

Factors Influencing Bitcoin Price Trends

Analyzing market dynamics, institutional buying has dipped below daily mining supply, heightening selling pressures. The current price hovers around the critical 365-day moving average, with potential deeper losses looming if this support level is breached.

Expert Insights and Price Forecasts

Bitfinex analysts draw parallels between the current Bitcoin pullback and historical mid-cycle retracements, indicating a 22% downturn similar to past market cycles. JPMorgan experts highlight the estimated production cost floor at $94,000, suggesting limited downside risk and projecting a bold price target of $170,000 in the coming months.

Bitcoin's Relationship with Market Events

Government Impact on Bitcoin's Price

The recent U.S. government reopening post a 43-day shutdown has introduced new uncertainties. While federal operations resume, the slow recovery pace and impending funding bill deadlines pose challenges to market stability.

Bitcoin as an Indicator of Market Liquidity

Experts view Bitcoin as a barometer of liquidity shifts, particularly in response to the recent government shutdown's effects on market dynamics. As liquidity injections follow the government's reopening, Bitcoin's price is expected to benefit in the short term.

The Intriguing Connection Between Bitcoin and Nasdaq

Unusual Correlation Patterns

Bitcoin's relationship with the Nasdaq reveals intriguing trends, with a recent report by Wintermute highlighting a negative skew in Bitcoin's reaction to stock market fluctuations. This anomaly suggests investor fatigue and a unique market response during near all-time highs.

Driving Forces Behind Market Behavior

Shifts in capital towards equities, coupled with liquidity challenges in the crypto market, have intensified Bitcoin's sensitivity to macroeconomic risks. Despite these challenges, Bitcoin continues to demonstrate resilience and maturity as a significant macro asset.

As Bitcoin's price currently stands at $98,470, the market continues to navigate through uncertainties and evolving dynamics, showcasing the cryptocurrency's resilience in the face of market turbulence.

Frequently Asked Questions

How much should precious metals make up your portfolio?

Protect yourself against inflation by investing in physical gold. You can invest in precious metals to buy into their future value, and not just the current price. The value of your investment increases with rising prices.

If you hold on to your investments for at least five years, you will receive tax benefits on any gains. If you decide to sell your investments after that period, you will be subject to capital gains tax. Our website has more information about how to purchase gold coins.

Can you hold precious metals in an IRA?

This question is dependent on whether an IRA owner wishes to diversify into gold or silver, or keep them safe.

If he does want to diversify, then there are two options available to him. He could either buy physical bars of silver and gold from a dealer, or he could sell the items to the dealer at year's end. However, suppose he isn't interested in selling back his precious metal investments. In that case, he should continue holding onto them as they would be perfectly suitable for storing within an IRA account.

Can you make a profit on a Gold IRA?

It is important to first understand the market in order to be able to invest and secondly to identify what products are currently available.

Trading should not be started if you don’t have sufficient information.

It is important to find a broker who provides the best services for your account type.

There are many accounts available, including Roth IRAs and standard IRAs.

If you have other investments such as bonds or stocks, you might also consider a rollover.

How does gold and silver IRA work?

An IRA for gold and/or silver allows you to invest without tax in precious metals such as silver and gold. These precious metals are an attractive investment for anyone looking to diversify their portfolios.

If you're over 59 1/2, you don't have to pay income taxes on interest earned through these accounts. Any appreciation in the account's worth does not attract capital gains tax. You have to limit the amount you can deposit into this type account. Minimum amount allowed is $10,000 Under 59 1/2 years old, you can't make any investments. The maximum annual contribution allowed is $5,500

If you die prior to retirement, your beneficiaries may not receive the full amount. After paying all expenses, your assets must be sufficient to cover the remaining balance in your account.

Some banks offer a gold or silver IRA option, while others require that you open a regular brokerage account where you can buy certificates or shares.

What precious metal should I invest in?

Investments in gold offer high returns on their capital. It can also protect against inflation and other risks. As inflation worries increase, gold prices tend to rise.

It is a smart move to purchase gold futures. These contracts guarantee you will receive a certain amount of gold at a fixed price.

But gold futures may not be right for everyone. Some people prefer physical gold.

They can easily trade their gold with others. They can also make a profit by selling their gold at any time they desire.

Some people choose to not pay taxes on gold. To do that, they buy gold directly from the government.

You will need to visit several post offices to complete this process. You will first need to convert any existing gold in coins or bars.

You will then need to obtain a stamp for the coins and bars. Finally, send them off to the US Mint. They will then melt down the bars and coins to create new coins.

These new coins, bars, and bars have the original stamps stamped onto them. They are therefore legal tender.

If you buy gold from the US Mint directly, you won’t have to pay tax.

Which precious metal would you prefer to invest in?

Can I physically possess gold in my IRA account?

Many people ask themselves whether it is possible to physically own gold in an IRA. This is a valid question as there is no legal route to it.

But when you look closely at the law, nothing stops you from owning gold in an IRA.

The problem is that most people aren't aware of how much money they could be saving by putting their precious gold in an IRA.

It's very easy to dispose of gold coins, but much harder to make an IRA. If you decide to keep your gold in your own home, you'll pay taxes on it twice. The IRS will collect once and the state where your residence is located will collect the other.

It is possible to lose your gold and pay twice as much tax. So why would you choose to keep it in your home?

Some might argue that gold should be safe at home. To protect yourself from theft, store your gold somewhere that is more secure.

If you plan on visiting often, you shouldn't leave your precious gold at home. If you leave your precious gold unattended thieves will easily steal it.

You can store your gold in an insurance vault. You can rest assured that your gold is safe from theft, fire, earthquake, flood, and other hazards.

A vault can also be beneficial because you don't need to pay property tax. Instead, you will have to pay income tax for any gains you make selling your gold.

An IRA is a way to avoid paying taxes on gold. An IRA will allow you to avoid income tax while earning interest on your gold.

Capital gains tax doesn't apply to gold. That means you have the right to cash your investment at whatever time you choose.

You won't have to move your gold because IRAs are federally regulated.

Bottom line: An IRA can allow you to own gold. Your fear of it being stolen is what holds you back.

Statistics

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The maximum yearly contribution to an individual's IRAs is currently $6,000 ($7,000 for those 50 years or older), or 100% of earned income, whichever is less. (monex.com)

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

External Links

regalassets.com

takemetothesite.com

en.wikipedia.org

investopedia.com

How To

How to buy gold for your Gold IRA

A term that describes precious metals is gold, silver and palladium. It refers only to elements with atomic number 79-110 (excluding helium). These elements are considered valuable because they are rare and beautiful. The most common precious metals are gold and silver. Precious Metals are often used for money, jewelry and industrial goods.

Due to supply and demand, the price of gold fluctuates every day. The demand for precious materials has increased dramatically over the last decade as investors seek to find safe havens in volatile economies. This has resulted in a substantial rise in the prices. However, the increasing cost of production has made some people concerned about investing in precious metals.

Gold is a good investment because it's rare and durable. Contrary to other investments, gold does not lose its value. You can also sell or buy gold without paying any taxes. There are two ways that you can invest your gold. You can buy bars and gold coins, or invest into gold futures contracts.

Instant liquidity is provided by physical gold coins and bars. They are easy to store and trade. However, they are not very inflation-proof. If you want to protect yourself from rising prices, consider purchasing gold bullion. Bullion is physical gold that comes in different sizes and shapes. Bullion comes in a variety of sizes, including kilo bars and one-ounce pieces. Bullion is typically stored in vaults to protect it from theft and fire.

If you prefer owning shares of gold rather than holding actual gold, you should consider buying gold futures. Futures allow you to speculate as to how the gold price will change. You can buy gold futures and get exposed to the price of gold without actually owning it.

A gold contract could be purchased if you wanted to speculate on the future price of gold. My position will change when the contract expires. It can be either “longer” or “shorter.” A long contract is one in which I believe that the price of gold will rise. I'm willing now to pay someone else money, but I promise I'll get more money at the end. A shorter contract would mean that I believe the gold price will fall. I'm willing and able to take the money now, in return for the promise that I will make less money later.

I'll get the contract's specified amount of gold plus interest when it expires. This way I have exposure to the gold's price without having to actually hold it.

Precious metals are great investments because they're extremely hard to counterfeit. While paper currency can be easily counterfeited simply by printing new notes, precious metals cannot. This is why precious metals have always held their value well over time.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]