As we kick off December, the crypto world is buzzing with the recent 8% drop in Bitcoin prices, tumbling down to the mid-$84,000 range. This sudden shift has left many investors on edge, grappling with a mix of macroeconomic uncertainties, liquidity challenges, and crypto-specific pressures that are rattling the markets.

What's Behind the Bitcoin Price Rollercoaster?

Security Incidents and Market Sentiments

One catalyst for this downturn could be traced back to a security breach at Yearn Finance, where vulnerabilities in the yETH pool led to a significant token minting exploit. This incident triggered panic across the DeFi space, spilling over to major cryptocurrencies like Bitcoin and Ethereum.

Global Economic Factors at Play

On a broader scale, macroeconomic factors are also at play. For instance, a sudden surge in Japanese government bond yields has sparked a risk-averse sentiment in the Asian markets. Speculations around a potential rate hike by the Bank of Japan after years of negative interest rates have further added to the uncertainty.

Liquidity Crunch and Institutional Selling

Adding to the mix is the liquidity crisis. Recent data indicates that the market experienced one of its lowest-liquidity phases, amplifying the impact of institutional selloffs. This lack of depth in the market exacerbated the price correction, leading to significant liquidations and losses.

Navigating the Uncertainty: What Lies Ahead?

The Federal Reserve's Influence

Investors are closely monitoring the Federal Reserve's upcoming meeting, with expectations of a rate cut. Such a move could potentially benefit Bitcoin prices by enhancing liquidity and investor appetite for risk. However, any deviation from this anticipated decision might trigger a broader market correction.

Corporate Strategies and Market Response

Corporate actions are also shaping the market landscape. Companies like Strategy Inc. and BlackRock are making strategic moves to navigate the volatile market conditions. These developments, coupled with new investment products tied to Bitcoin, are influencing price dynamics and investor sentiments.

The Future of Bitcoin Price

Despite the recent plunge and market turbulence, Bitcoin has shown resilience by rebounding from the lows. With ongoing volatility in the fourth quarter, institutions are exploring innovative financial products linked to Bitcoin, hinting at a potential shift in the market landscape.

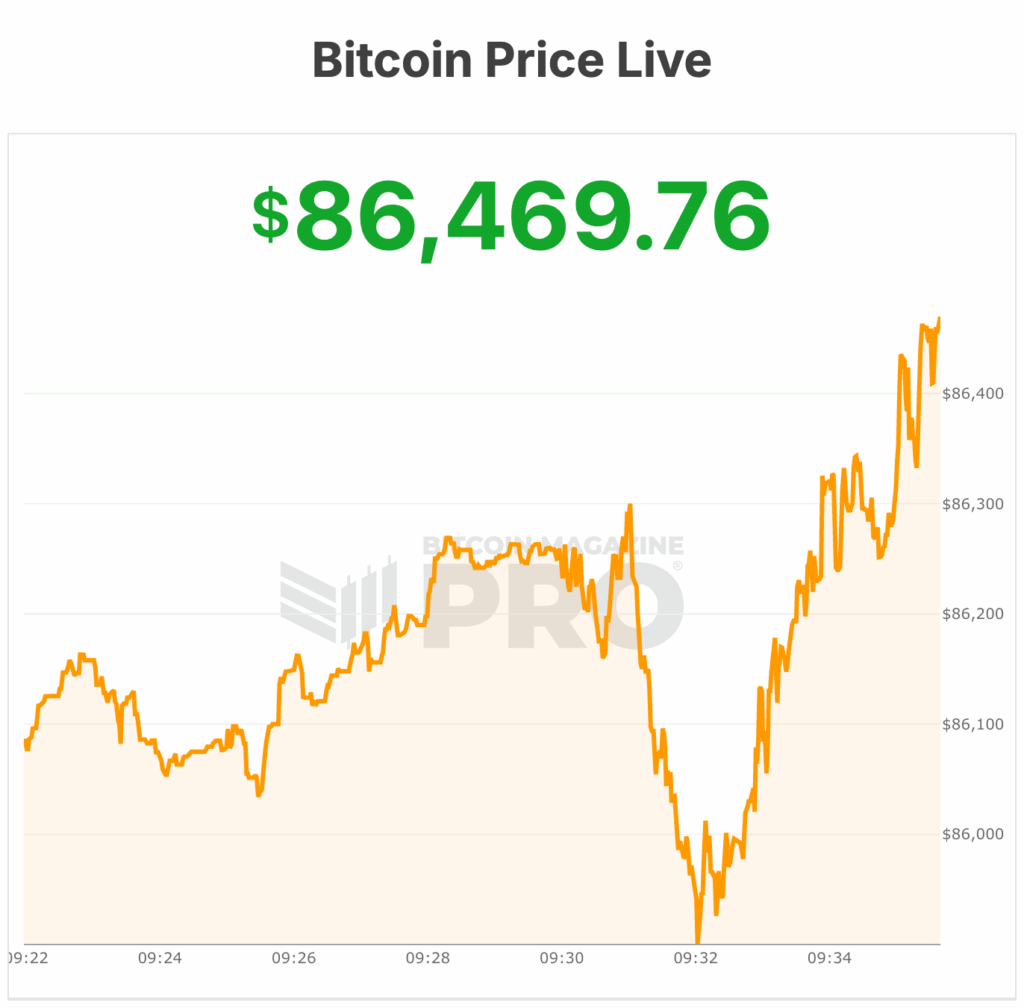

As we witness Bitcoin's price hovering around $86,469, the crypto market continues to evolve amidst uncertainties and opportunities. Stay informed, stay cautious, and navigate these market fluctuations with a strategic outlook.

Frequently Asked Questions

Can I add gold to my IRA?

The answer is yes You can add gold into your retirement plan. Gold is an excellent investment because it doesn't lose value over time. It protects against inflation. It also protects against inflation.

You need to understand that gold is not like other investments before you invest in it. You cannot buy shares of companies that are gold, like stocks and bonds. You cannot also sell them.

Instead, you should convert your gold to cash. This means you will need to get rid. You cannot keep it.

This makes gold an attractive investment. With other investments, you can always sell them later. That's not true with gold.

You can't even use your gold as collateral to get loans. You may have to part with some of your gold if you take out mortgages.

What does this translate to? You can't hold onto your gold forever. It will eventually have to be converted into cash.

There's no need to be concerned about this right now. All you need to do is create an IRA. Then, you can invest in gold.

Do You Need to Open a Precious Metal IRA

This will depend on whether or not you have an investment objective and what level of risk you are willing to accept.

You should start an account if you intend to retire with the money.

This is because precious metals are more likely to appreciate in the future. They offer diversification advantages.

Additionally, silver and Gold prices tends to move together. They make a good choice for both assets and are a better investment.

You shouldn't invest precious metal IRAs if you don't plan on retiring or aren't willing to take risks.

What precious metals may I allow in my IRA?

Gold is the most popular precious metal for IRA accounts. As investments, you can also buy bars and bullion coins made of gold.

Precious metals can be considered safe investments as they don't lose their value over time. They can also be used to diversify investment portfolios.

Precious metals include silver, platinum, and palladium. These three metals are similar in their properties. Each has its own purpose.

For instance, platinum can be used in jewelry manufacturing. To create catalysts, palladium is used. Silver is used to producing coins.

Consider how much you plan to spend on gold when deciding on which precious metal to buy. You may be better buying gold that is less expensive per ounce.

It is also important to consider whether you would like to keep your investment confidential. If so, then you should go with palladium.

Palladium is more valuable than gold. It is also more rare. So you'll likely have to pay more for it.

Their storage fees are another important factor to consider when choosing between sterling and gold. Gold is measured by weight. So you'll pay a higher fee for storing larger amounts of gold.

Silver is measured in volume. You'll pay less if you store smaller quantities of silver.

Keep in mind all IRS rules when you store precious metals inside an IRA. This includes keeping track and reporting transactions to the IRS.

How to Open a Precious Metal IRA

An IRA to hold precious metals can be opened by opening a Roth Individual Retirement Account (IRA) that is self-directed.

This type of account is better than other types of IRAs because you don't have to pay any taxes on the interest you earn from your investments until you withdraw them.

This makes it attractive to those who want a tax break but still want to save some money.

You are not limited to investing in gold or silver. You can invest in whatever you like, provided it conforms to IRS guidelines.

People often think of silver and gold when they hear “precious metal” but there are many other precious metals.

These include palladium, platinum, rhodium,osmium,iridium, andruthenium.

There are many ways to invest in precious materials. You can buy bullion coins or bars, or shares in mining businesses.

Bullion Coins and Bars

One of the best ways to invest in precious metals is by buying bullion bars and coins. Bullion is a generic term that refers only to physical ounces in gold or silver.

Bullion bars and bullion coins are actual pieces of the metal.

Although you may not be able to see any change immediately after purchasing bullion bars and coins at a shop, you will soon notice some positive effects.

For example, you'll get a piece of history in a tangible form. Each coin and bar has its own unique story behind it.

You'll often find that the face value of a coin is far lower than its nominal value. For example, in 1986 the American Eagle Silver Coin sold for $1.00 an ounce. Today, however, the price of an American eagle is closer to $40.00 per ounce.

Bullion has seen a dramatic rise in value since its introduction. Many investors would rather buy bullion coins or bullion bars than futures contracts.

Mining Companies

For those who want to purchase precious metals, another option is investing in shares of mining companies. You're investing in the company’s ability to produce precious metals.

You will then be entitled to dividends which are based upon the company’s profit. These dividends will be used to pay shareholders.

Furthermore, the company has the potential to grow. The share prices of the company should rise as more people buy the product.

You should diversify because these stocks have a tendency to fluctuate in their prices. This is how you spread your risk across different companies.

However, it's also important to remember that mining companies aren't immune to financial loss, just like any stock market investment.

Your share of ownership may be worthless if gold prices fall significantly.

The Bottom Line

Precious metals such silver and gold provide an economic refuge from uncertainty.

Gold and silver can fluctuate in price. If you're interested in making a long-term investment in precious metals, consider opening up a precious metals IRA account with a reputable firm.

By doing this, you can reap the tax benefits and still have physical assets.

How much of your IRA should include precious metals?

Protect yourself from inflation by investing in precious metallics like silver and gold. It's more than just an investment in retirement. It also prepares you for any economic downturn.

Although gold and silver prices have risen significantly in the past few years they are still considered safe investments. They don't fluctuate quite as much like stocks. There is always demand for these materials.

Prices for silver and gold are predictable and usually stable. They increase with economic growth and decrease in recessions. This makes them very valuable money-savers and long term investments.

10% of your total portfolio should be invested in precious metals. If you want to diversify even further your portfolio, that percentage could rise.

Are you able to keep precious metals in your IRA?

The answer to that question will depend on whether the IRA owner plans to diversify his holdings to gold and/or keep them safekeeping.

Two options are available for him if diversification is something he desires. He could buy physical bars of gold and/or silver from a dealer or sell these items back to the dealer at the end of the year. However, suppose he isn't interested in selling back his precious metal investments. In that case, he should continue holding onto them as they would be perfectly suitable for storing within an IRA account.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

en.wikipedia.org

kitco.com

How To

How to buy silver with your IRA

How to start buying silver with your IRA – The best way to invest in gold and silver is through direct ownership of physical bullion. The most popular investment form is silver bars and coins. This is because it offers diversification and liquidity.

There are many options to buy precious metals like silver and gold. You can either buy them directly from their producers like mining companies or refiners. You can also buy bullion products from dealers, but this will not save you the trouble of dealing with producers directly.

This article will show you how to get started investing in silver using your IRA.

- Investing in Gold & Silver through Direct Ownership – The best way to purchase precious metals is to directly go to the source. This is the best way to get bullion right from the source and have it delivered straight to your house. Some investors store their bullion in their home. Others choose to store their bullion in a safe storage location that is insured and protected. Make sure you properly store your precious metal when you keep it. Many storage facilities offer insurance coverage for fire, theft, damage, and other risks. Even with insurance, your investments could be damaged by natural disasters or human error. For these reasons, storing your precious metals in a safe deposit box at a bank or credit union is always recommended.

- Online Precious Metals Shopping – Bullion online can be a great alternative to carrying around heavy boxes. Bullion dealers sell bullion in different forms, including coins and bars. You can find coins in many sizes, shapes, or designs. Coins are generally more convenient to carry than bars. Bars come with a range of weights and sizes. Some bars weigh hundreds of pounds, while others only weigh a few ounces. A good rule of thumb when selecting which type of bar you should get is to look at what you plan to use it for. It might be a good idea to choose something smaller if it is intended to be given as a gift. It might not be the best choice if you're looking to add it in your collection or display it proudly.

- Buying Precious Metal From Dealers – A third option is to buy bullion from a dealer. Dealers usually specialize in one market area, such as silver or gold. Some dealers specialize in particular types of bullion like rounds or minted currency. Others are specialists in specific regions. And yet others specialize in bulk purchases. You will be able to find competitive prices and simple payment options no matter who dealer you choose.

- Buying Precious Metallics Through Retirement Accounts – While not technically considered an “investment,” another way to gain exposure to precious metals is by investing in retirement accounts. Investments in precious metals must be made through a qualified retirement plan to receive tax benefits as per Section 219 of IRS Code. These accounts can be IRAs, 401 (k)s or 403 (3(b) plans). These accounts are often set up to help you save more for retirement. They offer higher returns than most other investment vehicles. These accounts also allow you to diversify across multiple metals. But what's the downside? The drawback? Only people who work for employers that sponsor them can invest in these accounts.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]