Hey there, crypto enthusiasts! If you've been keeping an eye on Bitcoin's rollercoaster ride, you're probably wondering where this wild journey is headed next. Well, let's dive into the realm of possibilities together and explore why the Bitcoin bear market might just be on its way out.

Decoding Bitcoin's Relationship with Gold

Unlocking Valuable Insights through Gold

Bitcoin's dance with Gold has been quite the spectacle lately. While it used to boogie with Gold only when the market was down, a closer look reveals a treasure trove of insights. By peeking through the Gold lens instead of the USD window, we get a clearer view of the ongoing market cycle. It's like swapping your regular glasses for a pair with a sharper focus!

Bitcoin Bear Market: Navigating Critical Support Levels

Entering the Bear's Den

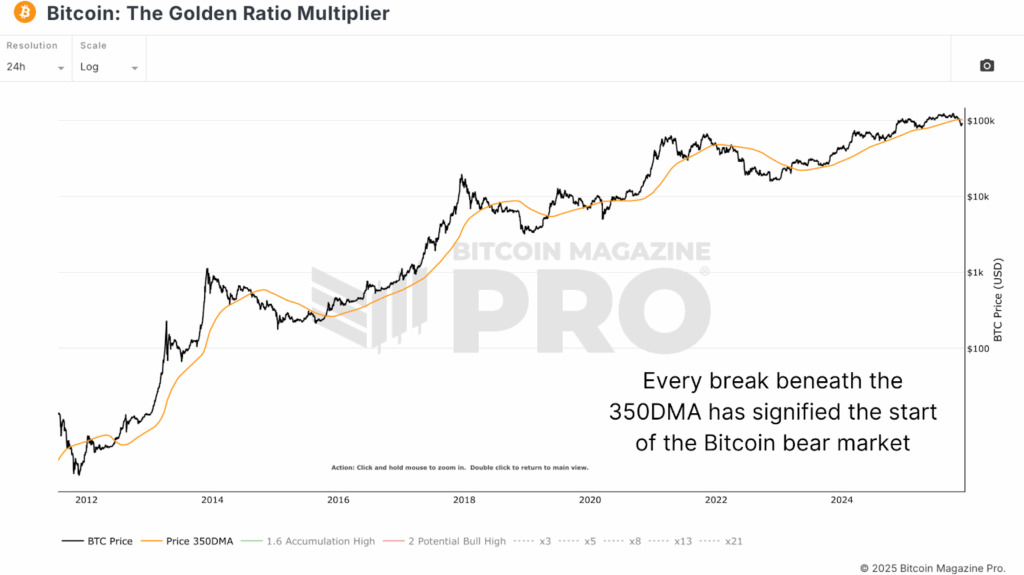

Picture this: Bitcoin took a tumble below the 350-day moving average at around $100,000 – a key support level. This nosedive past the six-figure milestone signaled the start of the bear market journey. The numbers didn't lie, with Bitcoin immediately sliding by around 20%. When the Golden Ratio Multiplier moving average waved goodbye, history whispered tales of bear cycles ahead. But here's the twist – when we view this saga through the Gold-goggles, a whole new narrative unfolds.

Spotting Patterns in the Gold Mine

Comparing Bitcoin's performance against Gold versus the USD uncovers a plot twist. While Bitcoin's peak dates back to December 2024, boasting a 50% drop, the USD story hit its peak in October 2025, miles away from the previous year's highs. This divergence hints at a prolonged bear market journey for Bitcoin, hidden in plain sight. History buffs might recall similar patterns from past bear cycles measured in Gold, signaling that the current dip could be inching closer to crucial support territories.

Fibonacci Whispers and Support Zones

Let's talk numbers! Remember the 2015 bear cycle's 86% retracement lasting 406 days? Or the 2017 rollercoaster with a 364-day journey and an 84% decline? Fast forward to today, where we find Bitcoin down by 51% in 350 days when contrasted with Gold. While the percentages may be dwindling, it's not a plot twist but a reflection of institutional embrace and Bitcoin scarcity. The Fibonacci levels are like breadcrumbs leading us to potential support havens – think $67,000 to $80,000 range.

Wrapping Up: The Light at the End of the Tunnel

Shedding Light on the Bear's Retreat

Peeling back the layers, it becomes evident that Bitcoin's bear market story extends far beyond USD boundaries, with signs of struggle dating back to December 2024. By delving into historical Fibonacci retracements and intertwining them with today's data, we're eyeing a potential soft landing zone between $67,000 and $80,000. While this crystal ball analysis isn't foolproof, the symphony of data points hints that the bear market might bid us adieu sooner than expected.

CFTC

How To

Tips for Investing In Gold

Investing in Gold has become a very popular investment strategy. This is due to the many benefits of investing in gold. There are many ways to invest gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before buying any kind of gold, you need to consider these things.

- First, find out if your country allows gold ownership. If it is, you can move on. If not, you may want to consider purchasing gold from overseas.

- The second is to decide which kind of gold coin it is you want. You can choose between yellow gold and white gold as well as rose gold.

- The third factor to consider is the price for gold. It is best to begin small and work your ways up. It is important to diversify your portfolio whenever you purchase gold. Diversify your investments in stocks, bonds or real estate.

- Lastly, you should never forget that gold prices change frequently. Keep an eye on current trends.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]