American Hartford Gold offers many advantages for its investors. These include monthly conferences, phone support, and a transparent pricing model with no hidden fees. It also has knowledgeable, experienced staff that can answer any questions. This can be a great benefit for individuals who are new to investing. If you're considering opening a gold IRA, you'll want to carefully consider these benefits.

Costs of investing in precious metals

While precious metals are an attractive way to diversify your investment portfolio, they are not without their own risks. Investing in these rare commodities can involve high costs and risky use of borrowed money. Some companies require investors to pay a portion of their investment in cash while borrowing the rest in the form of margin. This margined portion can be as much as 80 percent of the purchase price and carries interest. It is also subject to margin calls, which can force the liquidation of your investment without prior consent.

One of the disadvantages of investing in precious metals is the high cost of transaction fees and commissions. Physical traders usually operate during business hours and cannot provide you with the same benefits as an investor who works from home. Fortunately, there are a number of options available for investing in precious metals online. Investing in gold and silver in the stock market is another great option. However, it may not be right for everyone.

Costs of opening a gold IRA

The American Hartford Gold IRA is an excellent option for people who are looking to invest in gold. The company is small and family-owned, which means they can provide personalized service and education to their customers. Additionally, they do not charge any maintenance or purchase fees. The company also offers a buyback option, which can help you sell off your gold holdings at a later date.

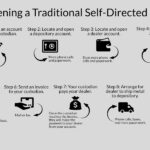

First, customers must contact a customer service representative to open an account. The customer service representative will help them complete the necessary paperwork and answer any questions they may have. After this, the account specialist will send the necessary paperwork to the account holder. This paperwork will include banking information and personal information. Once the paperwork is submitted, the customer must wait for the money to transfer, which typically takes about three days.

The next step in opening a gold IRA is to choose a depository. There are many options for this, but the American Hartford Gold recommends using a depository with an IRS-approved vault. The company also recommends Brinks Global Services, Delaware Depository Service Company, or International Depository Services. These three companies charge a storage fee for the gold held in the account, but this fee is usually less than $75 a year, depending on the value of the gold.

Cost of storage fees

American Hartford Gold has a reputation for providing exceptional service. The company is a proud sponsor of NASCAR, and journalist Bill O'Reilly has recommended them as his gold and silver provider. The company understands the value of convenience and offers storage and delivery services for precious metals. With two locations to choose from, American Hartford Gold can meet your specific needs.

American Hartford does not offer online pricing for its services, so you'll need to call and ask about prices. However, it's worth noting that they do not charge for establishing a Gold IRA or rolling over a retirement account. Additionally, shipping your precious metals to the depository is free and includes tracking and insurance.

American Hartford Gold provides storage for all types of gold and silver. Its staff has over 20 years of experience, and it's easy to get started. Its executives work to help customers find the right investments for them and make sure they receive the best possible prices. Furthermore, IRA holders can enjoy the service's no-fee first-year and three-year storage periods.

Frequently Asked Questions

Can I buy or sell gold from my self-directed IRA

Although you can buy gold using your self-directed IRA account, you will need to open an account at a brokerage like TD Ameritrade. If you already have a retirement account, funds can be transferred to it.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals can contribute as much as $1,000 per year ($2,000 if married filing jointly) to a Roth IRA.

If you do decide that you want to invest, it is a good idea to buy physical bullion and not in futures. Futures contracts, which are financial instruments based upon the price of gold, are financial instruments. They allow you to speculate on future prices without owning the metal itself. You can only hold physical bullion, which is real silver and gold bars.

How to Open a Precious Metal IRA

The first step is to decide if you want an Individual Retirement Account (IRA). To open the account, complete Form 8606. Next, fill out Form 5204. This will determine the type of IRA that you are eligible for. You must complete this form within 60 days of opening your account. Once you have completed this form, it is possible to begin investing. You can also contribute directly to your paycheck via payroll deduction.

To get a Roth IRA, complete Form 8903. Otherwise, the process is identical to an ordinary IRA.

To be eligible to have a precious metals IRA you must meet certain criteria. The IRS says you must be 18 years old and have earned income. Your annual earnings cannot exceed $110,000 ($220,000 if you are married and file jointly) for any tax year. Additionally, you must make regular contributions. These rules will apply regardless of whether your contributions are made through an employer or directly out of your paychecks.

You can use a precious metals IRA to invest in gold, silver, palladium, platinum, rhodium, or even platinum. However, physical bullion will not be available for purchase. This means you can't trade shares of stock and bonds.

You can also use your precious metallics IRA to invest in companies that deal with precious metals. This option is offered by some IRA providers.

However, investing in precious metals via an IRA has two serious drawbacks. They aren't as liquid as bonds or stocks. They are therefore more difficult to sell when necessary. They don't yield dividends like bonds and stocks. Also, they don't generate dividends like stocks and bonds. You will eventually lose money rather than make it.

Do you need to open a Precious Metal IRA

Before opening an IRA, it is important to understand that precious metals aren't covered by insurance. There are no ways to recover the money you lost in an investment. All your investments can be lost due to theft, fire or flood.

Protect yourself against this type of loss by investing in physical gold or silver coins. These coins have been around for thousands and represent a real asset that can never be lost. These items are worth more today than they were when first produced.

When opening an IRA account, make sure you choose a reputable company offering competitive rates and high-quality products. A third-party custodian is a good option. They will protect your assets while giving you easy access whenever you need them.

You won't get any returns until you retire if you open an account. Don't forget the future!

Should you Invest In Gold For Retirement?

How much money you have saved, and whether or not gold was an option when you first started saving will determine the answer. If you are unsure which option to choose, consider investing in both options.

Gold is a safe investment and can also offer potential returns. This makes it a worthwhile choice for retirees.

While many investments promise fixed returns, gold is subject to fluctuations. This causes its value to fluctuate over time.

But this doesn't mean you shouldn't invest in gold. Instead, it just means you should factor the fluctuations into your overall portfolio.

Another benefit of gold is that it's a tangible asset. Gold can be stored more easily than stocks and bonds. It can also be carried.

You can always access your gold if it is stored in a secure place. There are no storage charges for holding physical gold.

Investing in gold can help protect against inflation. You can hedge against rising costs by investing in gold, which tends to rise alongside other commodities.

It's also a good idea to have a portion your savings invested in something which isn't losing value. When the stock market drops, gold usually rises instead.

Another advantage to investing in gold is the ability to sell it whenever you wish. Like stocks, you can sell your position anytime you need cash. You don't even have to wait until you retire.

If you do decide to invest in gold, make sure to diversify your holdings. Don't place all your eggs in the same basket.

Don't purchase too much at once. Start with just a few drops. Next, add more as required.

It's not about getting rich fast. Instead, the goal here is to build enough wealth to not need to rely upon Social Security benefits.

Gold may not be the most attractive investment, but it could be a great complement to any retirement strategy.

Statistics

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

External Links

law.cornell.edu

- 7 U.S. Code SS 7 – Designation of boards of trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement account

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

finance.yahoo.com

How To

Investing In Gold vs. Investing In Stocks

This might make it seem very risky to invest gold as an investment tool. This is because many people believe that gold investment is no longer profitable. This belief comes from the fact most people see gold prices falling due to the global economy. They fear that investing in gold will result in a loss of money. However, investing in gold can still provide significant benefits. We'll be looking at some of these benefits below.

Gold is the oldest known form of currency. There are thousands of records that show gold was used over the years. People around the world have used it as a store of value. Even today, countries such as South Africa continue to rely heavily on it as a form of payment for their citizens.

Consider the price per gram when you decide whether you should invest in or not. You must determine how much gold bullion you can afford per gram before you consider buying it. You could contact a local jeweler to find out what their current market rate is.

It is also worth noting that although gold prices have declined recently, the cost of producing gold has increased. So, although gold prices have declined in recent years, the cost of producing it has not changed.

It is important to keep in mind the amount you plan to purchase of gold when you're weighing whether or not it is worth your time. It makes sense to save any gold you don't need to purchase if your goal is to use it for wedding rings. But, if your goal is to make long-term investments in gold, this might be worth considering. You can profit if you sell your gold at a higher price than you bought it.

We hope this article has given you an improved understanding of gold investment tools. We strongly recommend that you research all available options before making any decisions. Only then will you be able to make an informed decision.