Introduction

The open interest in Bitcoin options has reached unprecedented levels, surpassing $18 billion on December 22, 2023. This surge in open interest suggests that traders are increasingly leveraging Bitcoin options to manage risk and speculate on the future price movements of the cryptocurrency. One major catalyst for this trend is the upcoming decision by the U.S. Securities and Exchange Commission (SEC) regarding a spot Bitcoin exchange-traded fund (ETF).

Bitcoin Options and Risk Mitigation

Bitcoin options trading involves the buying or selling of contracts that give traders the right, but not the obligation, to purchase or sell a particular asset at a predetermined price by a specific date. Traders use options to predict price fluctuations in Bitcoin or protect their existing holdings from potential market volatility.

SEC ETF Decision and Investor Protection

The SEC is expected to announce its decision on a spot Bitcoin ETF by January 10, 2023. Reports suggest that many Bitcoin traders are taking steps to safeguard their investments against the anticipated volatility that may follow the SEC's ruling. A favorable decision could lead to a surge in Bitcoin's price, while an unfavorable one could trigger a downturn. By utilizing options, traders aim to protect their portfolios from adverse price movements.

Record-Breaking Open Interest

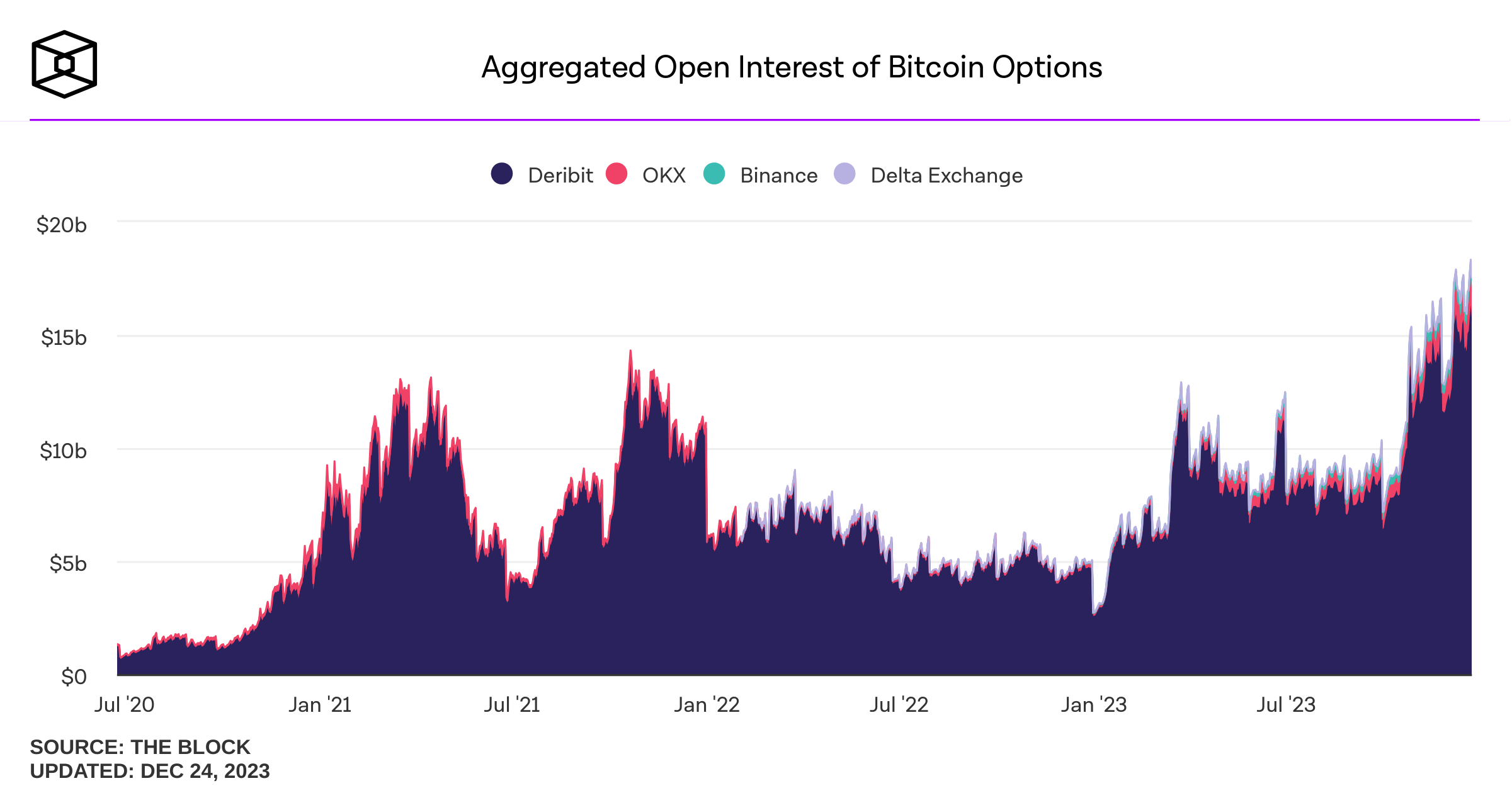

On December 22, 2023, the open interest in Bitcoin options reached approximately $18.33 billion. As of December 23, 2023, the open interest is valued at $17.55 billion. The final quarter of the year, including October, November, and December, has witnessed the highest options volume in Bitcoin's history. October saw a volume of $36.27 billion, followed by November with $36.16 billion, and December with $34.47 billion.

Traders' Perspective

Ryan Kim, the lead at Falconx's derivatives department, believes that the recent rally in Bitcoin options is driven by leveraged and speculative money. Traders who have taken leveraged long positions may choose to protect their investments by purchasing Bitcoin puts, which allows them to profit from a significant price movement in either direction.

Conclusion

The surge in Bitcoin options open interest highlights the growing importance of options trading for Bitcoin traders. As the SEC's decision on a spot Bitcoin ETF approaches, traders are seeking to mitigate risk and capitalize on potential price movements. The record-breaking open interest in Bitcoin options demonstrates the significant role options play in the cryptocurrency market.

We would love to hear your thoughts on the soaring Bitcoin options ahead of the SEC decision. Please share your opinions in the comments section below.

Frequently Asked Questions

What is the tax on gold in an IRA

The tax on the sale of gold is based on its fair market value when sold. You don't pay taxes when you buy gold. It is not income. If you sell it later, you'll have a taxable gain if the price goes up.

For loans, gold can be used to collateral. When you borrow against your assets, lenders try to find the highest return possible. In the case of gold, this usually means selling it. The lender might not do this. They may just keep it. They might decide to sell it. The bottom line is that you could lose potential profit in any case.

If you plan on using your gold as collateral, then you shouldn't lend against it. It's better to keep it alone.

Is it a good idea to open a Precious Metal IRA

You should be aware that precious metals cannot be covered by insurance. You cannot recover any money you have invested. This includes any loss of investments from theft, fire, flood or other circumstances.

It is best to invest in physical gold coins and silver coins to avoid this type loss. These coins have been around for thousands and represent a real asset that can never be lost. These items are worth more today than they were when first produced.

Choose a reputable company with competitive rates and quality products if you are looking to open an IRA. You should also consider using a third party custodian to protect your assets and give you access at any time.

You won't get any returns until you retire if you open an account. Do not forget about the future!

Should You Get Gold?

Gold was once considered an investment safe haven during times of economic crisis. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

While gold prices have been rising in recent years they are still low relative to other commodities, such as silver and oil.

This could be changing, according to some experts. They say that gold prices could rise dramatically with another global financial crisis.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

Here are some things to consider if you're considering investing in gold.

- The first thing to do is assess whether you actually need the money you're putting aside for retirement. It's possible to save for retirement without putting your savings into gold. However, when you retire at age 65, gold can provide additional protection.

- You should also be aware of what you are getting into before you buy gold. There are many types of gold IRA accounts. Each type offers varying levels and levels of security.

- Last but not least, gold doesn't provide the same level security as a savings account. Losing your gold coins could result in you never being able to retrieve them.

Do your research before you buy gold. Protect your gold if you already have it.

Statistics

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

External Links

bbb.org

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- Are you interested in keeping gold in your IRA at-home? It's Not Exactly Legal – WSJ

investopedia.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Guidelines for Gold Roth IRA

It is best to start saving early for retirement. Start saving as soon and as often as you're eligible (usually around 50 years old) and keep going until retirement. It is important to invest enough money each and every year to ensure you get adequate growth.

Also, you want to take advantage tax-free options such as a traditional 401k, SEP IRA or SIMPLE IRA. These savings vehicles allow you to make contributions without paying taxes on earnings until they are withdrawn from the account. This makes them a great choice for people who don’t have access employer matching funds.

Save regularly and continue to save over time. You may not be eligible for any tax benefits if your contribution is less than the maximum allowed.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]