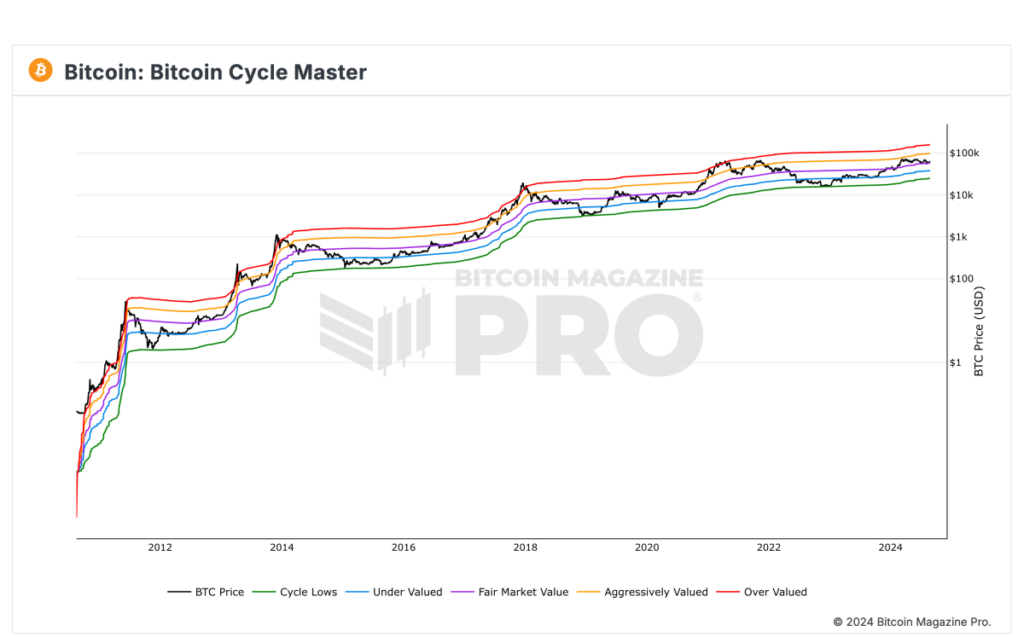

As of the latest update, Bitcoin is currently priced at $63,500, considered to be at a fair market value based on insights from the Bitcoin Cycle Master chart and data sourced from Bitcoin Magazine Pro. The Bitcoin Cycle Master chart utilizes on-chain metrics like Coin Value Days Destroyed and Terminal Price to evaluate Bitcoin's position within its economic cycles, which historically occur every four years in conjunction with Bitcoin halving events.

Understanding Bitcoin Cycle Master Chart

The Bitcoin Cycle Master tool examines real economic activities on the Bitcoin blockchain to determine whether Bitcoin is undervalued, fairly valued, aggressively valued, or overvalued. At present, the data suggests that Bitcoin is trading at a fair market price, indicating a harmonious equilibrium between demand and supply in the ongoing cycle.

Identifying Opportunities and Risks

Not only does this tool pinpoint periods of heightened risk, signaling potential cycle peaks based on transaction behaviors, but it also uncovers value opportunities during cycle downturns. By monitoring on-chain transaction trends, the Bitcoin Cycle Master offers valuable insights into potential future price trends, assisting investors in making well-informed decisions.

Optimistic Outlook on Bitcoin Price

Institutions, analysts, and Bitcoin enthusiasts are optimistic about a potential price surge later in the year, drawing on historical patterns where Bitcoin's value typically sees an upswing several months post-halving. This optimism has been reinforced by recent forecasts from key figures in the financial industry. Jan van Eck, the CEO of VanEck, a prominent ETF & Mutual Fund Manager, recently predicted a price target of $350,000 for Bitcoin, showcasing strong conviction in Bitcoin's long-term growth trajectory.

Access Exclusive Data and Insights

For more in-depth information, comprehensive insights, and to subscribe for access to Bitcoin Magazine Pro's data and analytics, you can visit the official website here.

Frequently Asked Questions

What are the benefits of a Gold IRA?

An Individual Retirement Account (IRA) is the best way to put money towards retirement. It is tax-deferred until it's withdrawn. You control how much you take each year. There are many types available. Some are better for those who want to save money for college. Some are better suited for investors who want higher returns. Roth IRAs let individuals contribute after age 591/2 and pay tax on any earnings at retirement. These earnings don't get taxed if they withdraw funds. This account may be worth considering if you are looking to retire earlier.

Because you can invest money in many asset classes, a gold IRA works similarly to other IRAs. Unlike a regular IRA you don't need to worry about taxes while you wait for your gains to be available. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another advantage to owning gold via an IRA is the ease of automatic withdraws. That means you won't have to think about making deposits every month. You could also set up direct debits to never miss a payment.

Finally, the gold investment is among the most reliable. Because it isn't tied to any particular country its value tends be steady. Even in times of economic turmoil gold prices tend to remain stable. As a result, it's often considered a good choice when protecting your savings from inflation.

What precious metals do you have that you can invest in for your retirement?

It is gold and silver that are the best precious metal investment. Both are easy to sell and can be bought easily. If you want to diversify your portfolio, you should consider adding them to your list.

Gold: Gold is one of man's oldest forms of currency. It is stable and very secure. Because of this, it is considered a great way of preserving wealth during times when there are uncertainties.

Silver: Silver is a popular investment choice. It is an excellent choice for investors who wish to avoid volatility. Silver, unlike gold, tends not to go down but up.

Platinium: Platinum is another form of precious metal that's becoming increasingly popular. It is very durable and resistant against corrosion, much like silver and gold. It is, however, more expensive than its competitors.

Rhodium. Rhodium is used as a catalyst. It's also used in jewelry making. And, it's relatively cheap compared to other types of precious metals.

Palladium (or Palladium): Palladium can be compared to platinum, but is much more common. It's also less expensive. It's a popular choice for investors who want to add precious metals into their portfolios.

Can I purchase gold with my self directed IRA?

You can purchase gold with your self-directed IRA, but you must first open an account at a brokerage firm like TD Ameritrade. If you have an existing retirement account, you can transfer funds to another one.

The IRS allows individuals to contribute up to $5,500 annually ($6,500 if married and filing jointly) to a traditional IRA. Individuals are allowed to contribute $1,000 each ($2,000 if married or filing jointly) to a Roth IRA.

If you do decide you want to invest your money in gold, you should look into purchasing physical bullion instead of futures contracts. Futures contract are financial instruments that depend on the gold price. You can speculate on future prices, but not own the metal. However, physical bullion is real gold or silver bars you can hold in your hands.

Statistics

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

External Links

finance.yahoo.com

wsj.com

- Saddam Hussein’s InvasionHelped Uncage a Bear In 1989 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Lawful – WSJ

forbes.com

- Gold IRA, Add Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

bbb.org

How To

Three Ways to Invest In Gold For Retirement

It's crucial to understand where gold fits in your retirement strategy. You can invest in gold through your 401(k), if you have one at work. You might also consider investing in gold outside your workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. You may also want to purchase precious metals from a reputable dealer if you don’t already have them.

These are three simple rules to help you make an investment in gold.

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, deposit cash into your accounts. This will help to keep your purchasing power high and protect you against inflation.

- Physical Gold Coins: You should own physical gold coins, not just a certificate. The reason is that it's much easier to sell physical gold coins than certificates. Physical gold coins don't require storage fees.

- Diversify your Portfolio. Also, diversify your wealth and invest in different assets. This helps to reduce risk and provides more flexibility when markets are volatile.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]