Hey there, crypto enthusiasts! Have you heard the latest on Bitcoin's price rollercoaster? Brace yourselves for a bumpy ride as we delve into the recent nosedive of the world's most famous cryptocurrency.

The Federal Reserve's Influence on Bitcoin's Fate

Uncertainty Looms Over Interest Rates

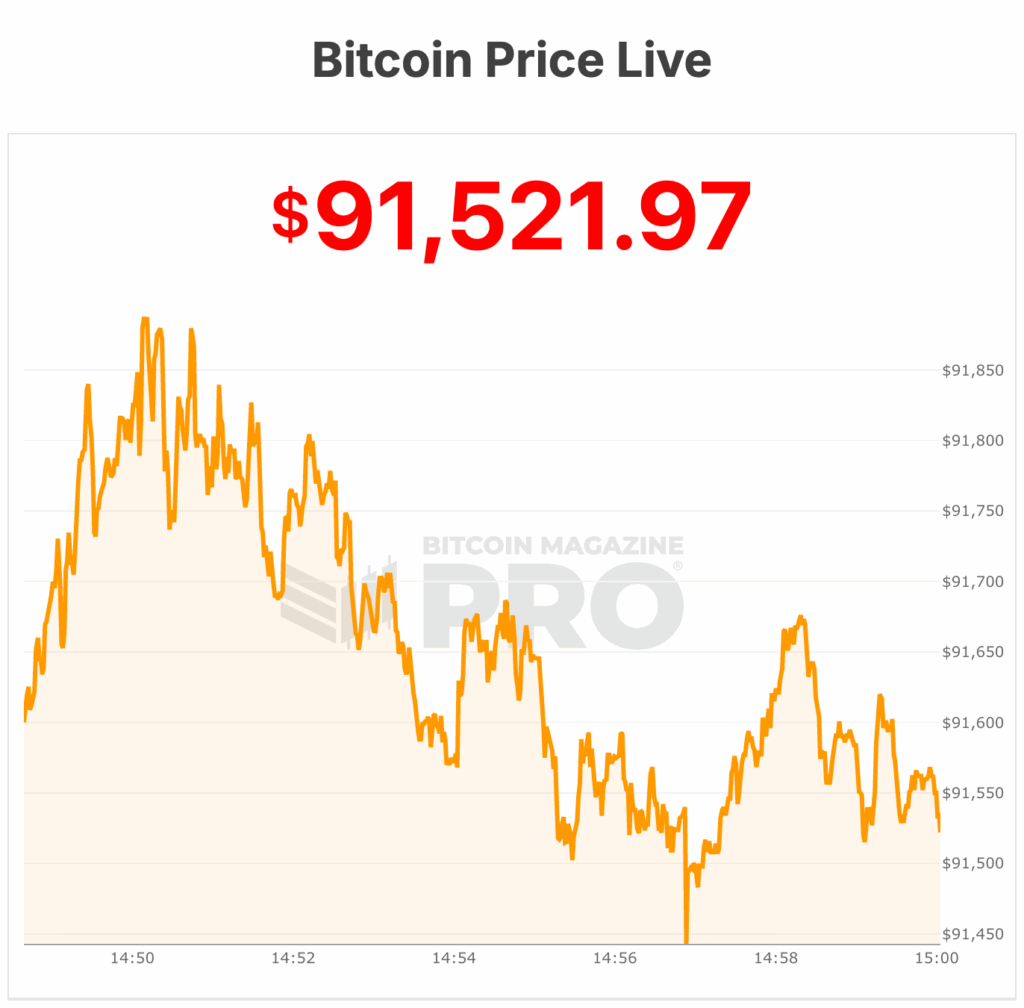

Picture this: Bitcoin's price has taken a sharp nosedive, plummeting to a six-month low. Just a stone's throw away from hitting an all-time high near $126,000, it's now struggling in the $91,000 range. What's causing this freefall, you ask?

- Traders are fretting over the Federal Reserve's upcoming December meeting, unsure if interest rates will be cut.

- Economic data gaps from the recent government shutdown have policymakers on edge, with cautious statements from Fed Chair Jerome Powell.

Market Sentiment Shifts and Big Players Retreat

The Impact of the Fed's Hawkish Stance

It's not just you feeling the jitters; the market sentiment has done a 180. Major players are bowing out, with crypto ETFs witnessing hefty outflows. The recent crypto downturn isn't just a blip; it's a significant shift in the financial landscape.

- Analysts warn of underestimating the Fed's hawkish stance and its ripple effect on the market.

- Even big institutions are stepping back, with billions flowing out of crypto products in recent weeks.

The Ripple Effect of Trump's Tariff Talk

Remember the excitement over Trump's crypto-friendly agenda? Well, that ship has sailed. The recent slump in Bitcoin's price is partly due to Trump's tariff threats on Chinese imports. Market volatility ensued, erasing billions in a matter of hours.

Technical Indicators and Altcoins in the Mix

Decoding Bitcoin's Death Cross

Technical indicators are painting a grim picture, with Bitcoin flashing a "death cross" pattern. But fear not, as history suggests this might signal a market bottom and a potential rebound.

- Altcoins like Ethereum and Solana are following Bitcoin's lead, contributing to a broader wipeout across the crypto market.

The Future Awaits: Federal Rate Decision and Market Catalysts

What Lies Ahead for Bitcoin's Price?

As we look to the future, all eyes are on the Federal Open Market Committee's December rate decision. Will Bitcoin see further losses, or could a "Santa rally" save the day? Only time will tell as the crypto rollercoaster continues.

Bitcoin Price and Crypto Stocks on a Slippery Slope

The Ripple Effect on Crypto-Linked Stocks

It's not just Bitcoin feeling the heat; crypto-linked stocks are also taking a hit. Companies like Coinbase and miners are facing losses, mirroring Bitcoin's downward trend. Strategy Inc's recent massive Bitcoin purchase is a bold move amid the market turmoil.

- Strategy's strategic Bitcoin buys have raised eyebrows, showcasing their confidence in the digital asset.

- Stay tuned for more market turbulence and crypto price fluctuations as the saga unfolds.

So, dear readers, buckle up and stay informed as the crypto market weathers the storm. Remember, volatility breeds opportunity, and the world of Bitcoin is never short on surprises. Happy investing!

Frequently Asked Questions

How much are gold IRA fees?

A monthly fee of $6 for an Individual Retirement Account is charged. This fee covers account maintenance fees, as well any investment costs that may be associated with your investments.

If you want to diversify, you may be required to pay extra fees. The type of IRA you choose will determine the fees. Some companies offer free checking, but charge monthly fees for IRAs.

In addition, most providers charge annual management fees. These fees range from 0% to 1%. The average rate for a year is.25%. These rates are often waived if a broker like TD Ameritrade is used.

How much gold can you keep in your portfolio

The amount of capital required will affect the amount you make. A small investment of $5k-10k would be a great option if you are looking to start small. You could then rent out desks and office space as your business grows. Renting out desks and other equipment is a great way to save money on rent. It's only one monthly payment.

Consider what type of business your company will be running. In my case, we charge clients between $1000-2000/month, depending on what they order. If you are doing this type of thing, it is important to think about how much you can expect from each client.

If you are doing freelance work, you probably won't have a monthly salary like I do because the project pays freelancers. Therefore, you might only get paid one time every six months.

You must first decide what kind and amount of income you are looking to generate before you can calculate how much gold will be needed.

I recommend starting with $1k to $2k of gold, and then growing from there.

Can I keep a Gold ETF in a Roth IRA

Although a 401k plan might not provide this option, you should still consider other options like an Individual Retirement Account (IRA).

A traditional IRA allows contributions from both employee and employer. You can also invest in publicly traded businesses by creating an Employee Stock Ownership Plan (ESOP).

An ESOP offers tax benefits because employees can share in the company stock and any profits that it generates. The money invested in the ESOP is then taxed at lower rates than if it were held directly in the hands of the employee.

Also available is an Individual Retirement Annuity. With an IRA, you make regular payments to yourself throughout your lifetime and receive income during retirement. Contributions to IRAs do not have to be taxable

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

law.cornell.edu

- 7 U.S. Code SS7 – Designation boards of trade as contract market authorities

- 26 U.S. Code SS 408 – Individual retirement plans

forbes.com

irs.gov

finance.yahoo.com

How To

3 Ways to Invest Gold for Retirement

It's essential to understand how gold fits into your retirement plan. There are many ways to invest in gold if you have a 401k account at work. You might also consider investing in gold outside your workplace. A custodial account can be opened by a brokerage firm like Fidelity Investments if you already have an IRA. If precious metals aren't your thing, you may be interested in buying them from a dealer.

These are three easy rules to remember if you invest in gold.

- Buy Gold with Your Money – You don't need credit cards, or to borrow money to finance your investments. Instead, deposit cash into your accounts. This will protect your against inflation and increase your purchasing power.

- Own Physical Gold Coins – You should buy physical gold coins rather than just owning a paper certificate. It's easier to sell physical gold coins rather than certificates. Physical gold coins are also free from storage fees.

- Diversify Your Portfolio – Never put all of your eggs in one basket. In other words, spread your wealth around by investing in different assets. This reduces risk and allows you to be more flexible during market volatility.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]