Jurrien Timmer, the Director of Global Macro at Fidelity, recently expressed his perspective on Bitcoin, referring to it as "exponential gold" and a rising star in the realm of "store of value" assets. Timmer's insights shed light on Bitcoin's evolving role in the financial landscape.

Bitcoin's Unique Position

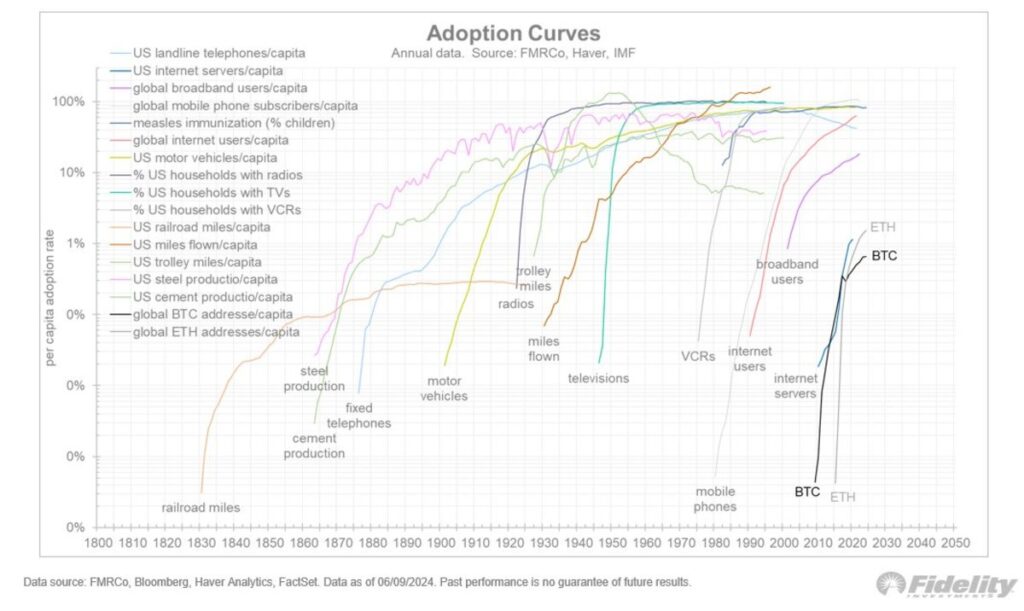

Timmer emphasized Bitcoin's distinctive position in the market, drawing parallels between its growth trajectory and the exponential adoption patterns witnessed in revolutionary technologies such as the internet and mobile phones. He underscored the significance of Bitcoin's scarcity and increasing recognition as a digital asset in solidifying its potential as a durable store of value, similar to gold.

The Role of Adoption and Network Growth

According to Timmer, the rate of adoption and expansion of Bitcoin's network are pivotal factors influencing its valuation. While acknowledging that Bitcoin is still in its nascent stages compared to conventional assets, Timmer highlighted the exponential pace at which its adoption is progressing. This trend supports the notion that Bitcoin could establish itself as a significant store of value in the future.

Bitcoin's Network Growth Dynamics

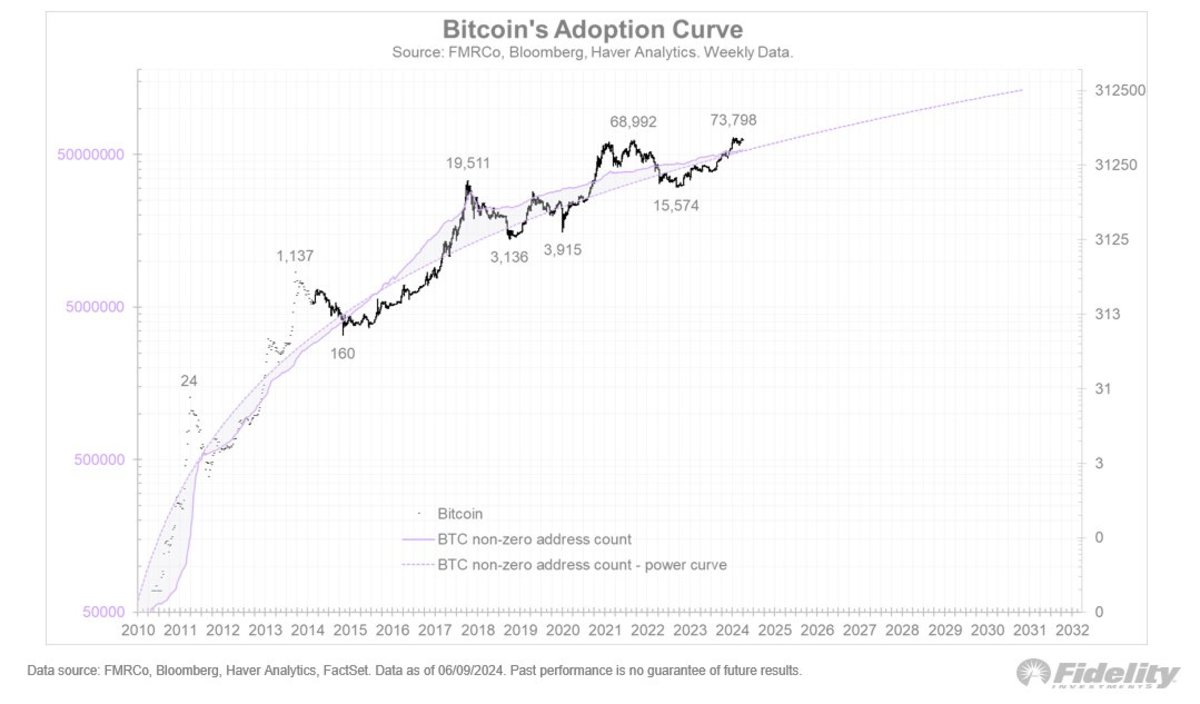

Timmer illustrated Bitcoin's network growth through a power curve, indicating that the number of non-zero addresses aligns with this curve, with Bitcoin's price fluctuating around it akin to a pendulum. He characterized Bitcoin's journey as a series of unique boom-bust cycles, highlighting its distinct market behavior.

Institutional Recognition and Future Prospects

Timmer's endorsement of Bitcoin reflects a broader trend observed among institutional investors who are acknowledging the potential of Bitcoin. His perspective reinforces the increasing acceptance of Bitcoin within the financial sector, hinting at its prospective role in forthcoming investment strategies.

Price-Adoption Divergence and Potential All-Time Highs

Timmer noted a deceleration in the growth of Bitcoin's network in recent months despite ongoing price appreciation. He suggested that the disparity between price movements and adoption rates might be responsible for Bitcoin's current slowdown in its journey towards potential new all-time highs. Timmer implied that for Bitcoin to sustain its upward trajectory, a resurgence in network acceleration may be necessary.

Frequently Asked Questions

Are gold investments a good idea for an IRA?

If you are looking for a way to save money, gold is a great investment. You can diversify your portfolio with gold. But gold is not all that it seems.

It has been used throughout history as currency and it is still a very popular method of payment. It is sometimes called the “oldest currency in the world”.

But gold is mined from the earth, unlike paper currencies that governments create. That makes it very valuable because it's rare and hard to create.

The supply-demand relationship determines the gold price. The strength of the economy means people spend more, and so, there is less demand for gold. This results in gold prices rising.

On the flip side, when the economy slows down, people hoard cash instead of spending it. This causes more gold to be produced, which lowers its value.

This is why gold investment makes sense for both individuals and businesses. You'll reap the benefits of investing in gold when the economy grows.

In addition to earning interest on your investments, this will allow you to grow your wealth. You won't lose your money if gold prices drop.

What is the best way to hold physical gold?

Not just paper money or coins, gold is money. It is an asset that people have used over thousands of years as money, and a way to protect wealth from inflation and economic uncertainties. Investors today use gold to diversify their portfolios because gold is more resilient to financial turmoil.

Today, many Americans invest in precious metals such as gold and silver rather than stocks and bonds. It is possible to make money by investing in gold. However, it doesn't guarantee that you'll make a lot of money.

Another reason is the fact that gold historically has performed better than other assets in times of financial panic. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. Gold was one asset that outperformed stocks in turbulent market conditions.

One of the best things about investing in gold is its virtually zero counterparty risk. Even if your stock portfolio is down, your shares are still yours. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold is liquid. This means you can easily sell your gold any time, unlike other investments. It makes sense to buy small quantities of gold, as it is more liquid than other investments. This allows you to take advantage of short-term fluctuations in the gold market.

Is buying gold a good way to save money for retirement?

Although it may not look appealing at first, buying gold for investment is worth considering when you consider the global average gold consumption per year.

Physical bullion bars are the most popular way to invest in gold. But there are many other options for investing in gold. It's best to thoroughly research all options before you make a decision.

If you don’t have the funds to invest in safe places, such as a safe deposit box or mining equipment companies, buying shares of these companies might be a better investment. If you need cash flow to finance your investment, then gold stocks could be a good option.

You can also invest your money in exchange-traded fund (ETFs), which give you exposure to the gold price by holding securities related to gold. These ETFs often include stocks of gold miners, precious metals refiners, and commodity trading companies.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

bbb.org

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

irs.gov

wsj.com

- Saddam Hussein's InvasionHelped Uncage a Bear In 90 – WSJ

- You want to keep gold in your IRA at home? It's Not Exactly Legal – WSJ

How To

Tips for Investing with Gold

Investing in Gold is a popular investment strategy. This is because there are many benefits if you choose to invest in gold. There are many ways to invest gold. There are many ways to invest in gold. Some prefer buying physical gold coins while others prefer gold ETFs (Exchange Traded Funds).

Before you buy any type of gold, there are some things that you should think about.

- First, you must check whether your country allows you to own gold. If your country allows you to own gold, then you are allowed to proceed. You might also consider buying gold in foreign countries.

- You should also know the type of gold coin that you desire. You can choose between yellow gold and white gold as well as rose gold.

- The third factor to consider is the price for gold. It is best to start small and work your way up. Diversifying your portfolio is a key thing to remember when purchasing gold. You should invest in different assets such as stocks, bonds, real estate, mutual funds, and commodities.

- Lastly, you should never forget that gold prices change frequently. You need to keep up with current trends.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]