When it comes to retirement savings and investments, the landscape can be complex and full of potential pitfalls. Self-directed and checkbook Bitcoin IRAs offer alternative investment opportunities that can be lucrative but also come with risks. In this article, we'll explore six common pitfalls associated with self-directed and checkbook IRAs, particularly in the context of Bitcoin.

Understanding Different IRA Structures

Before delving into the risks, it's essential to understand the various IRA structures available to investors. Traditional and Roth IRAs are the two main types, each with its own tax implications. Additionally, there are brokerage and bank IRAs, self-directed IRAs (SDIRAs), checkbook IRAs, and non-checkbook self-directed IRAs.

Brokerage and Bank IRAs

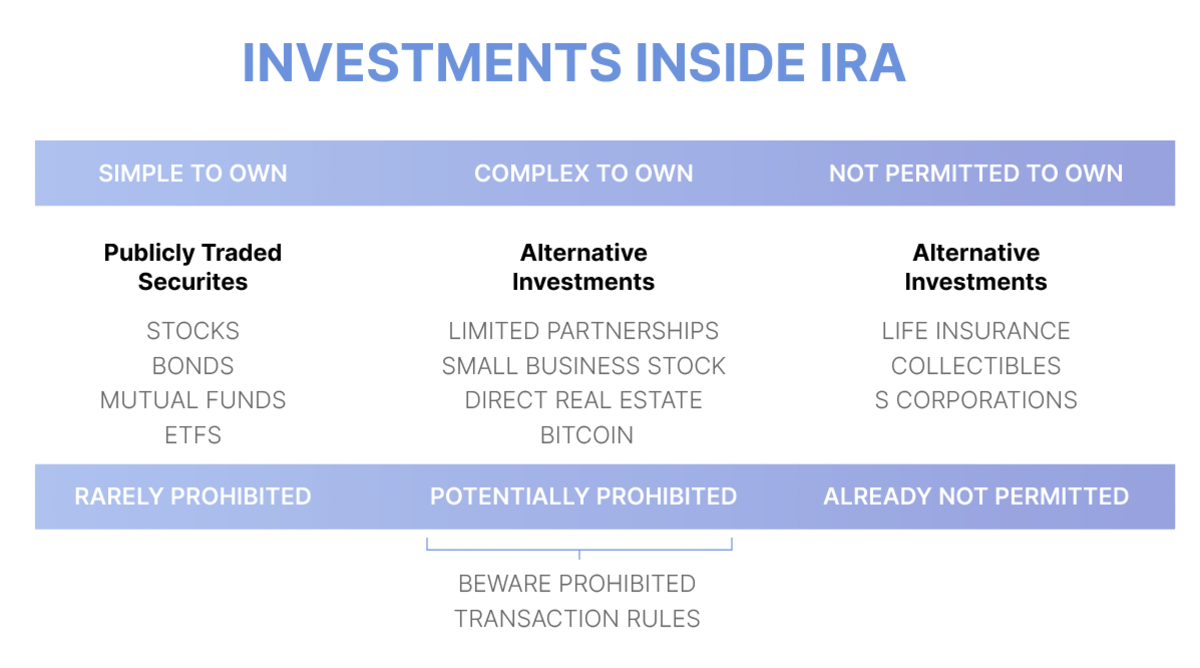

Brokerage and bank IRAs are the most common types of retirement accounts. They allow investors to trade stocks, bonds, ETFs, mutual funds, and other traditional securities. Examples include well-known institutions like Fidelity, TD Ameritrade, and Charles Schwab.

Self-Directed IRA (SDIRA)

A self-directed IRA expands investment options beyond traditional assets. Investors can venture into real estate, businesses, precious metals, and digital assets. While the IRS doesn't provide an exhaustive list of permissible investments, certain assets like collectibles are off-limits.

Checkbook IRA

Checkbook IRAs give owners direct control over their investments through a checking account, typically set up using an LLC. This allows for greater flexibility but also raises questions about compliance with IRA regulations.

Non-Checkbook Self-Directed IRA

Unlike checkbook IRAs, non-checkbook SDIRAs require custodial approval before transactions can be executed. This structure adds a layer of oversight but may limit investment speed.

Key Risks Associated with Self-Directed and Checkbook IRAs

1. Liquidity Concerns

Many self-directed assets lack liquidity, making them challenging to sell quickly when needed. Assets like real estate and precious metals may tie up funds, impacting cash flow and distribution flexibility.

2. Legal Structure Complexity

Establishing a checkbook IRA involves setting up an LLC and a checking account, which must comply with specific legal requirements. Failure to adhere to regulations could jeopardize the tax-advantaged status of the IRA.

3. Transaction Reporting Obligations

Owners of checkbook IRAs are responsible for accurately reporting transactions to the custodian at year-end. Failure to provide complete and precise information may lead to compliance issues and potential penalties.

4. "Deemed Distribution" Risks

Transactions involving certain assets like precious metals or real estate within a checkbook IRA may trigger deemed distribution treatment, potentially resulting in tax consequences. Recent legal cases have underscored the importance of proper asset supervision.

5. Prohibited Transactions

Engaging in prohibited transactions, such as commingling personal and IRA funds, can have severe tax implications. Self-dealing and using IRA assets for personal benefit are strictly prohibited and may result in penalties.

6. Financing Challenges

Financing transactions within a self-directed IRA require careful planning to avoid unintended tax consequences. Non-recourse loans, business income tax considerations, and asset segregation are critical factors to consider.

Implications for Bitcoin IRAs

Given the evolving regulatory environment and increased scrutiny on alternative investments, Bitcoin IRAs face unique challenges. Maintaining compliance with IRS rules and managing risks effectively is paramount for investors in this space.

Choosing the Right IRA Structure

For investors seeking exposure to Bitcoin in their retirement accounts, selecting the appropriate IRA structure is crucial. The Unchained IRA offers a compliant and transparent alternative to checkbook IRAs, helping users navigate the complexities of digital asset investments.

It's essential to consult with legal and financial professionals when considering self-directed or checkbook IRAs to ensure compliance and mitigate risks effectively.

Frequently Asked Questions

Can I take physical possession of gold in my IRA?

Many ask themselves whether they can physically possess gold in an IRA account. It is a valid question, as there is no legal way to possess gold in an IRA account.

But when you look closely at the law, nothing stops you from owning gold in an IRA.

The problem is that most people don't realize how much money they could save by putting their gold in an IRA instead of keeping it in their own homes.

It is easy to toss gold coins, but it's not easy to place them in an IRA. If you decide to keep your gold in your own home, you'll pay taxes on it twice. The IRS will collect once and the state where your residence is located will collect the other.

You can also lose your gold and have to pay twice the taxes. Why would you want to keep your gold in your house?

It might seem that you want the security of knowing your gold is safe inside your home. You can protect your gold from theft by storing it somewhere more secure.

If you're planning on visiting frequently, it is best to keep your gold safe at home. Theft can easily take your gold when you're not home.

It is better to keep your gold in an insured vault. This will ensure that your gold is protected against fire, flood, earthquake and robbery.

A vault can also be beneficial because you don't need to pay property tax. Instead, any gains that you make by selling your gold will be subject to income tax.

If you prefer not to pay tax on your precious metals, an IRA may be a good option. An IRA allows you to keep your gold free from income taxes, even though it earns interest.

Capital gains tax doesn't apply to gold. That means you have the right to cash your investment at whatever time you choose.

Federally regulated IRAs mean that you won't face any difficulties in transferring your gold to another bank if it moves.

The bottom line is that you can own gold in your IRA. Your fear of it being stolen is what holds you back.

What type of IRA is best?

It is essential to find an IRA that matches your needs and lifestyle when you are choosing one. You should consider whether you wish to maximize tax deferred growth, minimize taxes now, pay penalties later or avoid taxes altogether.

The Roth option may make sense if you are saving for retirement but don't have much other money invested. If you plan to continue working beyond age 59 1/2, and pay income taxes on any account withdrawals, the Roth option may be a good choice.

If you plan on retiring early, the traditional IRA may be better because you'll likely owe any taxes on the earnings. The Roth IRA is a better option if you plan to continue working well beyond age 65. It allows you to withdraw any or all of your earnings and not pay taxes.

How does a gold IRA generate interest?

It depends on how many dollars you put into it. If your income is $100,000, then yes. If your net worth is less than 100,000, no.

The amount of money you put into an IRA determines whether or not it earns interest.

You should consider opening a regular brokerage account instead if you put in more than $100,000 per year for retirement savings.

Although you'll likely earn higher interest, there are greater risks. You don't want your entire portfolio to go bankrupt if the stock markets crash.

However, if you only put in $100,000 per annum, you'll probably be better off with an IRA. At least until the market starts growing again.

Are precious metals allowed in an IRA?

The answer to that question will depend on whether the IRA owner plans to diversify his holdings to gold and/or keep them safekeeping.

Two options are available for him if diversification is something he desires. He could either buy bars of physical gold and/or sterling from a dealer or simply sell these items back at the end. He doesn't wish to sell any of his precious metal investments. In this case, he should hold onto the investments as they are perfect for storing inside an IRA account.

What are the pros and cons of a gold IRA?

An excellent investment vehicle is a gold IRA. This is for people who wish to diversify but do not have access to traditional banking services. You can invest in precious metals like gold, silver, or platinum, without having to pay taxes until the gains are withdrawn.

The downside is that withdrawing money early will pay ordinary income tax on the earnings. The funds are not located in the country and can be easily seized by creditors if your loan defaults.

A gold IRA is a great option if you want to own gold but not worry about taxes.

Are gold IRAs a good idea?

You should buy shares in companies that produce gold. These companies can make you money by investing in precious metals and gold.

There are however two problems with owning shares directly.

Holding on to your stock for too many years can lead you to losing money. Stocks can fall more than their underlying asset (like, gold) when they decline. This means that you might end up losing more money than you make.

Second, waiting for the market to recover before selling your gold holdings could result in you missing out on potential profits. It is possible to wait until the market recovers before selling your gold.

But if you prefer to keep your investments separate from your finances, you can still benefit from owning physical gold. A gold IRA will help protect your portfolio from inflation and diversify it.

Visit our website to learn more about gold investment.

Which is stronger: 14k gold or sterling silver?

Sterling silver, which contains 92% pure sterling silver instead of just 24%, is a stronger metal than gold or silver.

Sterling silver is sometimes called fine silver. This is because it is made with a mix of silver and different metals like copper or zinc.

Gold is generally considered to be very strong. It can only be broken apart by extreme pressure. If you dropped an object onto a piece or gold, it would break into thousands instead of two halves.

On the other hand, silver is not nearly as strong as gold. If you dropped an object onto a sheet silver, it would bend and fold with no damage.

Silver is often used in jewelry and coins. Because of this, silver's value is subject to fluctuations based upon supply and demand.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

External Links

wsj.com

kitco.com

forbes.com

- Gold IRA, Add Some Sparkle to Your Retirement Nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

en.wikipedia.org

How To

How to open a Precious Metal IRA

Precious metals are a highly sought-after investment vehicle. Precious metals have a higher return than traditional investments like bonds or stocks, which is why they are so sought-after. However, precious metals investing requires careful planning and research. If you want to open your own precious metal IRA account, here's what you should know first.

There are two types of precious metal accounts. They are paper gold and silver certificates (GSCs) and physical precious metals accounts. Each type of account has its own advantages and disadvantages. For example, physical precious metals accounts offer diversification benefits, while GSCs are easy to access and trade. Read on to find out more.

Physical precious metals accounts include bullion, bars and coins. This option is great for diversification, but it has its drawbacks. You will need to pay a lot of money for precious metals, whether you are buying, selling, or storing them. Due to their size, it can be difficult for them to be transported from one place to another.

The silver and paper gold certificates are also relatively affordable. Additionally, they can be easily traded online and accessible. These make them ideal for people who don’t want to invest directly in precious metals. However, they aren't as diversified as their physical counterparts. Also, since they're backed by government agencies such as the U.S. Mint, the value of these assets could decrease if inflation rates rise.

Choose the best account for you financial situation when opening a precious metal IRA. The following are important factors to consider before opening an IRA.

- Your risk tolerance level

- Your preferred asset allocation strategy

- How much time do you have to invest

- You can decide whether or not to use the funds for trading purposes.

- What type of tax treatment do YOU prefer?

- Which precious metal(s) you'd like to invest in

- How liquid can your portfolio have to be

- Your retirement age

- Where you will store precious metals

- Your income level

- Current savings rate

- Your future goals

- Your net worth

- Consider any special circumstances that could affect your decision

- Your overall financial position

- Your preference between physical and paper assets

- Your willingness and ability to take risks

- Your ability to handle losses

- Your budget constraints

- Financial independence is your goal

- Your investment experience

- Precious metals are familiar to you

- Your knowledge about precious metals

- Your confidence with the economy

- Your personal preferences

Once you have decided which type of precious-metal IRA is best for you, it's time to open an account at a reputable dealer. You can find these companies through referrals, word of mouth, or online research.

After opening your precious metal IRA you will need to decide how big you want it to be. Every precious metal IRA account will have a different minimum initial deposit amount. Some account require just $100, while some allow you to put up to $50,000.

As stated above, the amount of money invested in your precious metal IRA is completely up to you. You might choose to make a larger initial investment if your goal is to build wealth over the long-term. You might prefer a lower initial deposit if you intend to invest smaller amounts every month.

You can buy any type of investment, regardless of the amount of precious metals in your IRA. The most common include:

- Gold – Bullion bars, rounds, and coins

- Silver – Rounds or coins

- Platinum – Coins

- Palladium – Round and bar forms

- Mercury – Round and Bar Forms

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]