Unveiling a Historic Decision

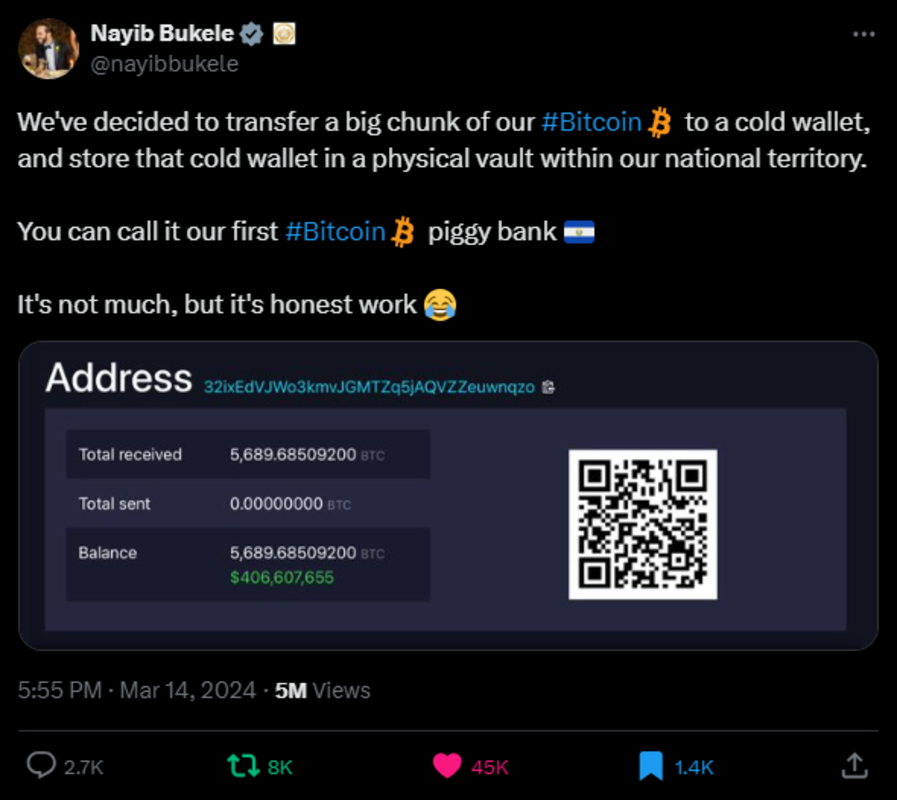

On March 14, 2024, El Salvador's president-elect, Nayib Bukele, made a groundbreaking announcement that reverberated throughout the Bitcoin community. El Salvador confirmed the relocation of a significant portion of its Bitcoin holdings to a cold storage facility, securely housed within a vault within the country's borders. This strategic shift marks a pivotal moment in El Salvador's Bitcoin journey following the enactment of the Bitcoin Law, which has garnered both praise and skepticism globally.

Transparency Amidst Critiques

Despite facing criticism ranging from allegations of human rights violations to criticisms of outdated infrastructure, El Salvador has remained steadfast, weathering disapproval from traditional financial institutions and even ardent Bitcoin supporters on social media platforms. The veil of secrecy surrounding the size of El Salvador's Bitcoin reserves, a point of contention for many, has now been lifted, ushering in a new era of transparency and confidence in the nation's commitment to fostering a thriving Bitcoin ecosystem.

Empowering Audits and Transparency

With this bold move, Salvadorans and Bitcoin enthusiasts globally now have the ability to audit El Salvador's Bitcoin reserves, including tracking all incoming and outgoing transactions. This voluntary step underscores El Salvador's dedication to earning the trust of its citizens and upholding the ethos of openness within the Bitcoin community. Shortly after the announcement, donations began flowing into El Salvador's Bitcoin wallet, with nearly 6 million Sats in transactions recorded. The nation's daily 1 bitcoin Dollar-Cost Averaging (DCA) purchases are now open for public scrutiny, marking a significant milestone in financial governance.

Strategic Wealth Management

With 5,689 Bitcoins valued at $385,111,456 USD, El Salvador has not only secured its digital wealth but also navigated the complexities of international politics with finesse. The decision to transfer Bitcoin holdings from an American custodian to a local vault was not just a public relations coup but a strategic necessity. Given the strained relations between the US and El Salvador over the Bitcoin Law, safeguarding the nation's financial autonomy was paramount to avoid potential sanctions and regulatory challenges.

Balancing Transparency and Strategy

While the disclosure of reserves has garnered praise, El Salvador's initial reluctance to reveal its complete holdings may have been rooted in strategic considerations. President Bukele's acknowledgment that only a portion of the reserves has been moved to cold storage underscores a nuanced approach to financial management. In the evolving landscape of a Bitcoin-driven economy, maintaining a level of opacity can be a prudent move to navigate geopolitical challenges effectively.

Innovative Financial Strategies

Bukele's transparency on El Salvador's Bitcoin holdings has surpassed earlier acquisition methods, showcasing a multifaceted approach that includes revenue from various sources beyond direct purchases. The nation's innovative visa program, profits from Bitcoin exchanges, government service revenues, and mining initiatives have all contributed to a robust Bitcoin treasury. This diversification strategy highlights El Salvador's forward-thinking approach to building and managing its digital wealth.

Fostering Trust and Investment

While critics may persist, the disclosure of Bitcoin reserves is a crucial step towards transparency and accountability for Salvadorans. Establishing a positive business environment where Bitcoin entrepreneurs feel supported is essential for fostering growth and innovation. El Salvador's goal goes beyond silencing detractors; it aims to create a flourishing ecosystem that rewards hard work and long-term commitment, paving the way for a prosperous future for its citizens.

A Vision for Prosperity

By fortifying its Bitcoin reserves in a transparent manner, El Salvador is laying the groundwork for economic empowerment and progress. The nation's commitment to building a prosperous hub of opportunity for its people is exemplified by its innovative approach to financial governance. By nurturing trust and investment at home, El Salvador is forging a path towards a brighter and more prosperous future for all.

This guest post was written by Jaime Garcia. The opinions expressed are solely those of the author and do not necessarily reflect the views of BTC Inc or Bitcoin Magazine.

Frequently Asked Questions

What are the benefits of having a gold IRA?

The best way to save money for retirement is to place it in an Individual Retirement Account. You can withdraw it at any time, but it is tax-deferred. You are in complete control of how much you take out each fiscal year. There are many types and types of IRAs. Some are better for those who want to save money for college. Others are designed for investors looking for higher returns. For example, Roth IRAs allow individuals to contribute after age 59 1/2 and pay taxes on any earnings at retirement. These earnings don't get taxed if they withdraw funds. This account may be worth considering if you are looking to retire earlier.

The gold IRA allows you to invest in different asset classes, which is similar to other IRAs. Unlike a regular IRA that requires you to pay taxes on the gains you make while you wait to access them, a gold IRA does not have to do this. This makes gold IRA accounts a great choice for those who want their money to be invested, not spent.

Another benefit to owning IRA gold is the ability to withdraw automatically. It means that you don’t have to remember to make deposits every month. To avoid missing a payment, direct debits can be set up.

Gold is one of today's most safest investments. Because it isn't tied to any particular country its value tends be steady. Even during economic turmoil the gold price tends to remain fairly stable. This makes it a great investment option to protect your savings from inflation.

How is gold taxed by Roth IRA?

Investment accounts are subject to tax based only on their current value and not the amount you originally paid. So if you invest $1,000 in a mutual fund or stock and then sell it later, any gains are subject to taxes.

The money can be withdrawn tax-free if it's deposited in a traditional IRA (or 401(k)). Capital gains and dividends earn you no tax. This applies only to investments made for longer than one-year.

The rules governing these accounts vary by state. Maryland requires that you withdraw funds within 60 business days after reaching the age of 59 1/2. Massachusetts allows you to delay withdrawals until April 1. New York allows you to wait until age 70 1/2. To avoid any penalties, plan your retirement savings and take your distributions as early as possible.

How Much of Your IRA Should Be Made Up Of Precious Metals

It's important to understand that precious metals aren't only for wealthy people. You don’t need to have a lot of money to invest. In fact, there are many ways to make money from gold and silver investments without spending much money.

You might consider purchasing physical coins, such as bullion bars and rounds. Shares in precious metals-producing companies could be an option. Another option is to make use of the IRA rollover programs offered by your retirement plan provider.

You can still get benefits from precious metals regardless of what choice you make. Even though they aren't stocks, they still offer the possibility of long-term growth.

Their prices are more volatile than traditional investments. So, if you decide to sell your investment down the road, you'll likely see more profit than you would with traditional investments.

Statistics

- This is a 15% margin that has shown no stable direction of growth but fluctuates seemingly at random. (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)

External Links

investopedia.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

law.cornell.edu

- 7 U.S. Code SS7 – Designation Boards of Trade as Contract Markets

- 26 U.S. Code SS 408 – Individual retirement accounts

irs.gov

How To

A growing trend: Gold IRAs

The gold IRA trend is growing as investors seek ways to diversify their portfolios while protecting against inflation and other risks.

Gold IRA owners can now invest in physical gold bullion or bars. This IRA can be used to grow your wealth tax-free and is an alternative option to stocks and bonds.

A gold IRA allows investors the freedom to manage their wealth without worrying about volatility in the markets. They can also use the gold IRA as a protection against potential problems like inflation.

Investors also have the benefit of physical gold, which has unique properties such durability, portability and divisibility.

Additionally, the gold IRA has many benefits. It allows you to quickly transfer your gold ownership to your heirs. The IRS doesn't consider gold a commodity or currency.

Investors who seek financial stability and a safe haven are finding the gold IRA increasingly attractive.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]

Related posts:

El Salvador Reaffirms Commitment to Bitcoin, Defying IMF’s Call to Drop BTC as Legal Tender

El Salvador Reaffirms Commitment to Bitcoin, Defying IMF’s Call to Drop BTC as Legal Tender

El Salvador’s Bitcoin Experiment Gains Momentum as Re-Election Nears

El Salvador’s Bitcoin Experiment Gains Momentum as Re-Election Nears

El Salvador Introduces Exclusive Citizenship Through $1 Million Crypto Investment

El Salvador Introduces Exclusive Citizenship Through $1 Million Crypto Investment

El Salvador’s National Bitcoin Treasury Shows Profitability

El Salvador’s National Bitcoin Treasury Shows Profitability