In the ever-changing world of cryptocurrency markets, recent trends have shed light on intriguing divergences in the altcoin market, specifically between ethereum and solana in relation to bitcoin. A comprehensive report published by Glassnode, a leading onchain analytics firm, delves deep into this phenomenon and provides valuable insights.

Altcoin Dynamics in Focus: Ethereum Takes the Lead in the Post-ETF Era

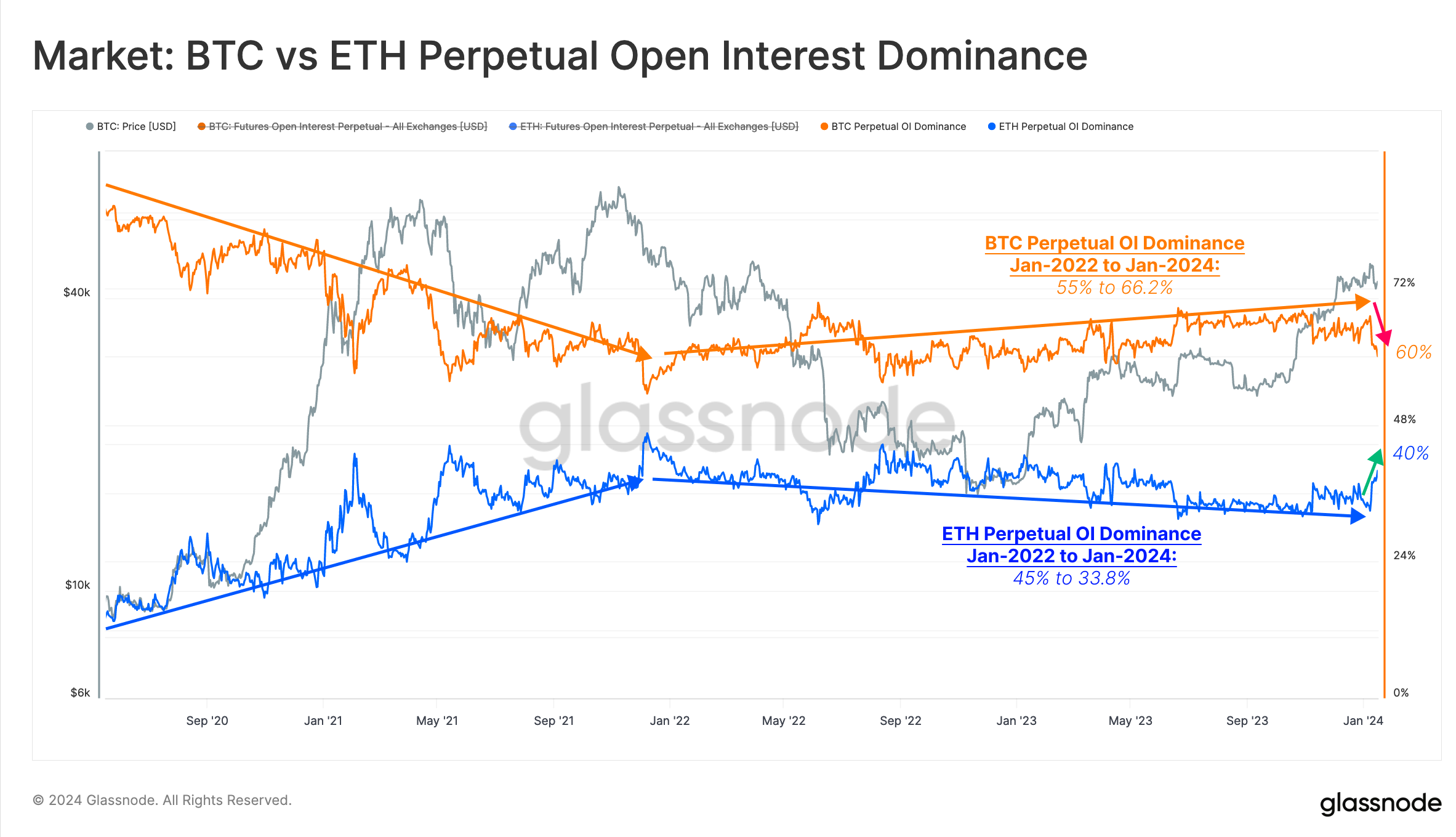

The latest edition of Glassnode's report, titled "The Week Onchain" and authored by Alice Kohn, highlights the exceptional performance of ethereum (ETH) and the remarkable journey of solana (SOL), particularly after the approval of bitcoin exchange-traded funds (ETFs). Ethereum has outperformed bitcoin, showcasing its strongest performance since late 2022. Kohn's report notes a surge of over 20% in ethereum's value compared to bitcoin, accompanied by a significant increase in activity in the ethereum derivatives market.

This resurgence in ethereum's performance, indicating a potential shift in capital flows, has sparked speculation about the possibility of a spot-based ethereum ETF. However, despite these gains, ethereum still lags behind other altcoins in terms of momentum, underperforming by 17%. On the other hand, solana has charted a different trajectory, as highlighted in Glassnode's report. Despite setbacks related to its association with FTX, SOL has exhibited exceptional price performance.

During this period, SOL has significantly outperformed ETH, with the SOL/BTC ratio increasing by 290% since October 2023. Interestingly, unlike ethereum, solana's price did not experience a significant revaluation following the approval of BTC ETFs, suggesting a distinct market response to broader sector movements. The overall altcoin market has witnessed a nearly 69% increase in market capitalization since the filing of the Blackrock Bitcoin ETF.

Altcoin Season: Ethereum Scaling Solutions and Beyond

On January 14, 2024, Bitcoin.com News highlighted the commencement of the altcoin season, as indicated by blockchaincenter.net's Altcoin Season Index. This index continues to declare it as "altcoin season," with the top 50 coins outperforming bitcoin in the previous 90 days. Glassnode's Kohn emphasizes that this trend is primarily driven by tokens associated with ethereum scaling solutions such as Optimism, Arbitrum, and Polygon. Additionally, staking and Gamefi tokens have also outperformed bitcoin in the early stages of 2023, indicating a diverse appetite for risk across various altcoin sectors.

Kohn's research underscores the significance of these developments, stating, "The approval of new bitcoin ETFs has become a classic sell-the-news event, leading to a tumultuous few weeks in the market." Glassnode suggests that ethereum has emerged as the short-term winner, with investors recording multi-year highs in net realized profits. This indicates a growing willingness to engage in speculative activities, particularly in relation to an ETH ETF and capital rotation.

What are your thoughts on Glassnode's report regarding the altered dynamics of altcoins in the crypto market? Share your opinions in the comments section below.

Frequently Asked Questions

What is the best way to hold physical gold?

Gold is money, not just paper currency or coinage. People have been using gold for thousands of years to store their wealth and protect it from economic instability and inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Today, Americans prefer precious metals like silver and gold to stocks and bonds. While owning gold doesn't guarantee you'll make money investing in gold, there are several reasons why it may make sense to consider adding gold to your retirement portfolio.

Gold has historically performed better during financial panics than other assets. Between August 2011 to early 2013, gold prices rose close to 100 percent while the S&P 500 fell 21 per cent. During those turbulent market conditions, gold was among the few assets that outperformed stocks.

Another benefit to investing in gold? It has virtually zero counterparty exposure. Your stock portfolio can fall, but you will still own your shares. But if you own gold, its value will increase even if the company you invested in defaults on its debt.

Finally, gold offers liquidity. You can sell your gold at any time without worrying about finding a buyer, which is a major advantage over other investments. Because gold is so liquid compared to other investments, buying it in small amounts makes sense. This allows you to profit from short-term fluctuations on the gold market.

How much gold should your portfolio contain?

The amount of money you need to make depends on how much capital you are looking for. A small investment of $5k-10k would be a great option if you are looking to start small. As you grow, you can move into an office and rent out desks. You don't need to worry about paying rent every month. You just pay per month.

Consider what type of business your company will be running. My company is a website creator. We charge our clients about $1000-2000 per monthly depending on what they order. You should also consider the expected income from each client when you do this type of thing.

Because freelance work pays freelancers, you won't likely get a monthly income if you do freelance work. So you might only get paid once every 6 months or so.

Before you can determine how much gold you'll need, you must decide what type of income you want.

I would recommend that you start with $1k-2k worth of gold and then increase your wealth.

Is gold a good investment IRA?

Gold is an excellent investment for any person who wants to save money. It's also a great way to diversify your portfolio. There's more to gold that meets the eye.

It has been used as a currency throughout history and is still a popular method of payment. It's sometimes called “the world's oldest money”.

But gold, unlike paper currency, which is created by governments, is mined out from the ground. That makes it very valuable because it's rare and hard to create.

The supply and demand factors determine how much gold is worth. If the economy is strong, people will spend more money which means less people can mine gold. Gold's value rises as a result.

On the flip side, when the economy slows down, people hoard cash instead of spending it. This results in more gold being produced, which drives down its value.

This is why gold investment makes sense for both individuals and businesses. If you have gold to invest, you will reap the rewards when the economy expands.

You'll also earn interest on your investments, which helps you grow your wealth. You won't lose your money if gold prices drop.

How much of your IRA should include precious metals?

You should remember that precious metals are not only for the wealthy. They don't require you to be wealthy to invest in them. There are many ways that you can make money with gold and silver investments, even if you don't have much money.

You might think about buying physical coins such a bullion bar or round. Stocks in companies that produce precious materials could be purchased. Your retirement plan provider may offer an IRA rollingover program.

You can still get benefits from precious metals regardless of what choice you make. Although they aren’t stocks, they offer the possibility for long-term gains.

And unlike traditional investments, they tend to increase in value over time. If you decide to sell your investment, you will likely make more than with traditional investments.

Statistics

- (Basically, if your GDP grows by 2%, you need miners to dig 2% more gold out of the ground every year to keep prices steady.) (smartasset.com)

- Indeed, several financial advisers interviewed for this article suggest you invest 5 to 15 percent of your portfolio in gold, just in case. (aarp.org)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- Gold is considered a collectible, and profits from a sale are taxed at a maximum rate of 28 percent. (aarp.org)

- Contribution limits$6,000 (49 and under) $7,000 (50 and up)$6,000 (49 and under) $7,000 (50 and up)$58,000 or 25% of your annual compensation (whichever is smaller) (lendedu.com)

External Links

finance.yahoo.com

bbb.org

investopedia.com

law.cornell.edu

- 7 U.S. Code SS7 – Designation of boards for trade as contract markets

- 26 U.S. Code SS 408 – Individual retirement accounts

How To

Tips to Invest in Gold

Investing in Gold is a popular investment strategy. There are many benefits to investing in gold. There are several ways to invest in gold. Some people purchase physical gold coins. Others prefer to invest their money in gold ETFs.

Before you buy any type of gold, there are some things that you should think about.

- First, check to see if your country permits you to possess gold. If you have permission to possess gold in your country, you can then proceed. If not, you may want to consider purchasing gold from overseas.

- Secondly, you should know what kind of gold coin you want. There are many options for gold coins: yellow, white, and rose.

- Thirdly, you should take into consideration the price of gold. It is best to begin small and work your ways up. One thing that you should never forget when purchasing gold is to diversify your portfolio. Diversify your investments in stocks, bonds or real estate.

- You should also remember that gold prices can change often. You need to keep up with current trends.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]