There are two kinds of IRA rollovers: direct and indirect. A direct rollover is easiest to perform and involves sending money directly from your first IRA to your second IRA. You must do this transfer within 60 days or you will face early withdrawal penalties. The company will then mail a check to the new account.

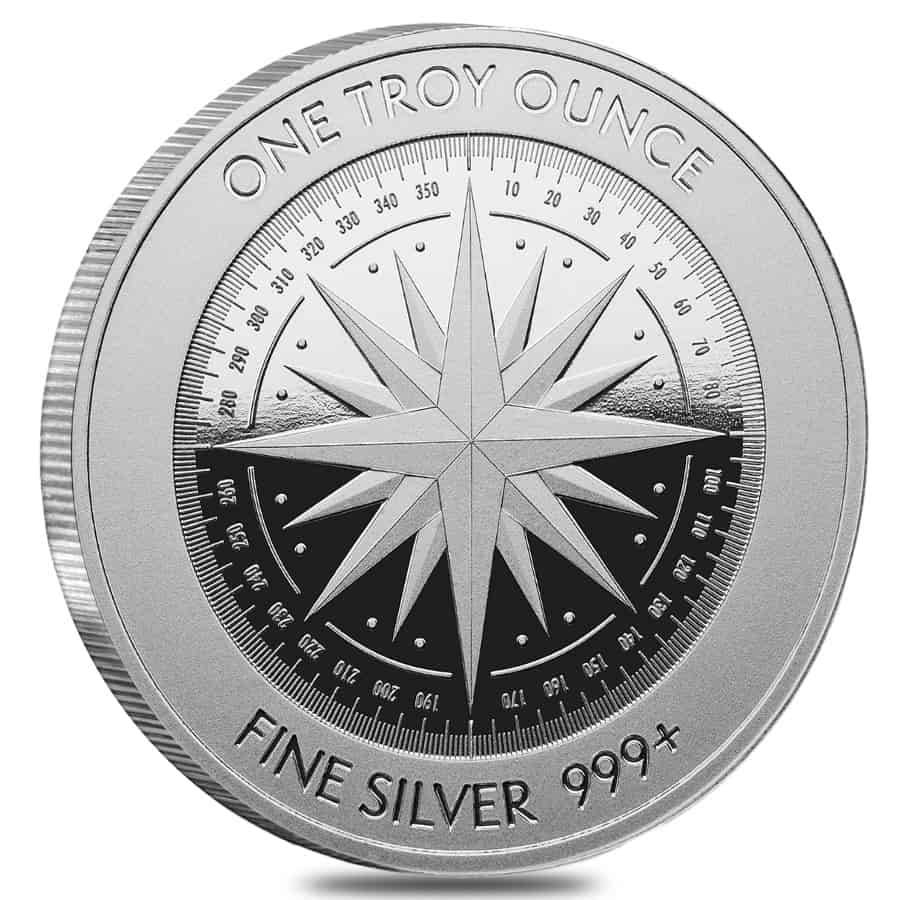

IRA gold compass vs IRA gold compass

There are several factors to consider when choosing between an IRA gold compass and an IRA. The first consideration is your level of risk tolerance. If you are unable to accept risk, you should consider investing in other assets instead. Diversifying your retirement portfolio can reduce the risk factor and increase your security. A good rule of thumb is to invest a portion of your money in gold and a smaller percentage in other assets.

You should also check if the company is reputable and has the proper licenses. The company should also have appropriate insurance coverage and a bond. In addition, make sure to read the terms of service. Remember that there are markups when it comes to gold, and these vary depending on the supplier and the type of gold. Doing your homework will help you avoid getting ripped off or losing money.

Rollover options

There are several types of rollover options for Ira gold accounts. You can either invest your entire IRA in one form or have some of your money rolled over to another type. Precious metals are an excellent choice for those looking for more stability in their investments. In addition, they offer the flexibility to reallocate funds whenever you want. To learn about rollover options for gold IRAs, read this guide.

A gold IRA rollover is a convenient way to move your money from one retirement account to another. The original custodian transfers the funds from your old account to your new one. Many people underuse precious metals for retirement savings, but it can be a good choice.

Cost

If you are planning to purchase a gold IRA, you should consider the cost of storage. Most gold IRA firms do not list their charges on their website. You should look for the firm that charges the least amount while offering a personalized account service. The customer care of a gold IRA provider is a very important factor in deciding which firm to buy from.

Compass Therapeutics' lead product candidate, COMP360, is a highly purified dose of psilocybin that is indicated for patients with treatment-resistant depression. The drug is administered in a controlled setting, under the supervision of a trained therapist. Recently, the company reported positive top-line results in a phase 2b study, with the highest dose showing a significant reduction in key TRD symptoms. A significant number of patients in the 25mg group achieved sustained remission, compared to just over 10% in the one-mg cohort.

Cost of holding rare-earth elements in an IRA

Holding rare-earth elements in your IRA may offer tax benefits, but there are also costs to consider. These include fees for handling, storage and management. The fees are usually based on the dollar value of rare-earth elements and can vary depending on the vault chosen.

Rare-earth metals are less volatile than most commodities, but their mining process is expensive and many US companies are forced to send their materials to China for processing. In addition, the country where most of the REE mining takes place has threatened to restrict supply in the past, so investors should pay attention to these risks.

Frequently Asked Questions

Should You Purchase Gold?

In the past, gold was considered a haven for investors during economic turmoil. Many people are now turning their backs on traditional investments like stocks and bonds, and instead look to precious metals like Gold.

Gold prices have been on an upward trend over recent years, but they remain relatively low compared to other commodities such as oil and silver.

Experts think this could change quickly. Experts predict that gold prices will rise sharply in the wake of another global financial collapse.

They also note that gold is increasingly popular because of its perceived intrinsic value and potential return.

These are some things you should consider when considering gold investing.

- Consider first whether you will need the money to save for retirement. It is possible to save for retirement while still investing your gold savings. Gold does offer an extra layer of protection for those who reach retirement age.

- Second, be sure to understand your obligations before you purchase gold. Each offers varying levels of flexibility and security.

- Last but not least, gold doesn't provide the same level security as a savings account. If you lose your gold coins, you may never recover them.

So, if you're thinking about buying gold, make sure you do your research first. You should also ensure that you do everything you can to protect your gold.

What is the best way to hold physical gold?

Not just paper money or coins, gold is money. People have used gold as a currency for thousands of centuries to preserve their wealth and keep it safe from inflation. Gold is a part of a diversified portfolio that investors can use to protect their wealth from financial uncertainty.

Many Americans now invest in precious metals. It's not guaranteed that you'll make any money investing gold, but there are several reasons it might be worthwhile to add gold to retirement funds.

One reason is that gold has historically performed better than other assets during periods of financial panic. Between August 2011 and early 2013 gold prices soared nearly 100 percent, while the S&P 500 plunged 21 percent. During these turbulent market times, gold was among few assets that outperformed the stocks.

Another advantage of investing in gold is that it's one of the few assets with virtually zero counterparty risk. Your stock portfolio can fall, but you will still own your shares. If you have gold, it will still be worth your shares even if the company in which you invested defaults on its debt.

Finally, gold offers liquidity. This means you can easily sell your gold any time, unlike other investments. The liquidity of gold makes it a good investment. This allows you take advantage of the short-term fluctuations that occur in the gold markets.

Can I hold a gold ETF in a Roth IRA?

A 401(k) plan may not offer this option, but you should consider other options, such as an Individual Retirement Account (IRA).

A traditional IRA allows for contributions from both employer and employee. You can also invest in publicly traded businesses by creating an Employee Stock Ownership Plan (ESOP).

An ESOP provides tax advantages because employees share ownership of company stock and profits the business generates. The tax rate on money that is invested in an ESOP is lower than if it was held in the employees' hands.

You can also get an Individual Retirement Annuity, or IRA. An IRA lets you make regular, income-generating payments to yourself over your life. Contributions to IRAs will not be taxed

Is gold a good investment IRA?

Gold is an excellent investment for any person who wants to save money. You can diversify your portfolio with gold. But there is more to gold than meets the eye.

It has been used throughout history as currency and it is still a very popular method of payment. It is often called “the oldest currency in the world.”

But gold is mined from the earth, unlike paper currencies that governments create. This makes it highly valuable as it is hard and rare to produce.

The supply-demand relationship determines the gold price. People tend to spend more when the economy is healthy, which means that fewer people are able to mine gold. As a result, the value of gold goes up.

On the other hand, people will save cash when the economy slows and not spend it. This leads to more gold being produced which decreases its value.

This is why both individuals as well as businesses can benefit from investing in gold. If you invest in gold, you'll benefit whenever the economy grows.

Additionally, you'll earn interest on your investments which will help you grow your wealth. If gold's value falls, you don't have to lose any of your investments.

Statistics

- Instead, the economy improved, stocks rebounded, and gold plunged, losing 28 percent of its value in 2013. (aarp.org)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal, so you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- If you take distributions before hitting 59.5, you'll owe a 10% penalty on the amount withdrawn. (lendedu.com)

- The price of gold jumped 131 percent from late 2007 to September 2011, when it hit a high of $1,921 an ounce, according to the World Gold Council. (aarp.org)

- You can only purchase gold bars at least 99.5% purity. (forbes.com)