Introduction

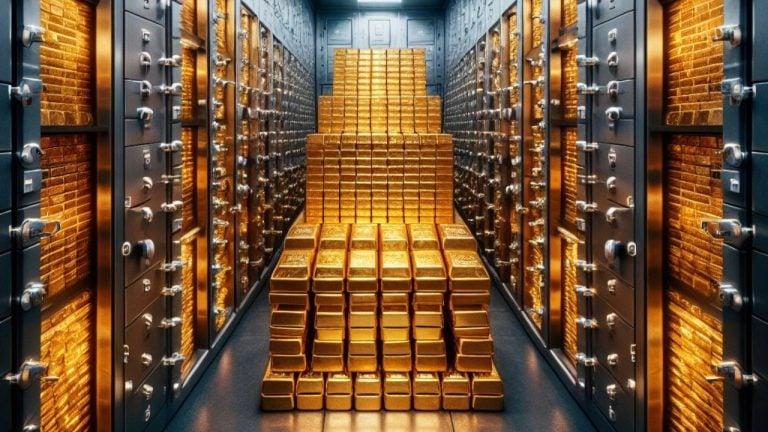

HSBC, one of the world's largest financial institutions, has announced the launch of a platform that will enable the tokenization of gold bullion. This new platform has the potential to revolutionize the gold trading industry, with a projected market reach of $525 billion.

Streamlining Gold Trading

The new tokenization platform will simplify the process of trading gold, allowing traders to have better control over their bullion. Mark Williamson, HSBC's global head of FX and commodities partnerships and propositions, explained that gold bars will be tokenized, enabling owners to track their bullion using a unique serial number and information about the vault it is held in. This eliminates the need for manual record-keeping, which can often be outdated in the over-the-counter gold markets.

Expanding to Other Precious Metals

In addition to gold, HSBC plans to use this tokenization system for other precious metals as well. The platform will use tokens that represent 0.001 troy ounces of gold, allowing for easy fractional ownership. While the current focus is on the institutional market, there is potential for retail users to invest directly in gold fractions in the future, pending regulatory approval.

HSBC's Significance in the Gold Market

HSBC's entry into the gold tokenization market is significant due to the institution's size and reputation. As one of the largest precious metals brokers in the world and one of only four gold clearing institutions in the London market, HSBC holds a prominent position in the industry. This positions them to have a substantial impact on the adoption and growth of gold tokenization.

Previous Attempts and Competitors

HSBC is not the first institution to explore gold tokenization. In 2016, Paxos partnered with Euroclear to offer an on-chain settlement service for tokenized gold. Although this service was later dissolved, Paxos still offers a tokenized gold product called pax gold, which represents one fine troy ounce of gold held in the vaults of the London Bullion Market Association (LBMA). Additionally, Tether, the stablecoin company behind USDT, has its own gold token called XAUT.

Conclusion

The launch of HSBC's gold tokenization platform marks a significant step forward in the modernization of the precious metals trading industry. With its extensive reach and reputation, HSBC has the potential to bring about widespread adoption of gold tokenization. As the market evolves, it will be interesting to see how this technology develops and if it expands to other precious metals.

What are your thoughts on HSBC's entry into the gold tokenization market? Share your opinions in the comments section below.

Frequently Asked Questions

Can you make money from a gold IRA

You must first understand the market and then know which products are available to make money.

If you don’t know anything, it is best to wait until you have enough information so that you can trade effectively.

It is important to find a broker who provides the best services for your account type.

You have many options, including Roth IRAs as well as standard IRAs.

If you have other investments such as bonds or stocks, you might also consider a rollover.

What type of IRA is best?

When selecting an IRA for yourself, the most important thing is to find one that meets your lifestyle and goals. You should consider whether you wish to maximize tax deferred growth, minimize taxes now, pay penalties later or avoid taxes altogether.

If you have little money to invest, the Roth option might make sense. It is also an option if you are still working after age 59 1/2. You can expect to pay income taxes for any accounts that are withdrawn.

Traditional IRAs are more suitable if you intend to retire young. However, you will most likely owe taxes on any earnings from those funds. However, if your goal is to retire early, the traditional IRA might be more sensible. The Roth IRA allows you to withdraw some of your earnings or all without paying taxes.

How do I choose an IRA?

Understanding your account type is the first step in finding the right IRA for you. This will include whether you're looking for a Roth IRA or a traditional IRA. You will also need to know how much you can invest.

The next step is determining which provider fits your situation best. Some providers offer both accounts, while others specialize in just one type.

Finally, you should consider the fees associated with each option. Fees can vary greatly between providers, and may include annual maintenance charges and other fees. For example, some providers charge a monthly fee based on the number of shares you own. Some providers charge only once a quarter.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- To qualify as IRA allowable precious metals and be accepted by STRATA, the following minimum fineness requirements must be met: Gold must be 99.5% pure, silver must be 99.9% pure, and platinum and palladium must both be 99.95% pure. (stratatrust.com)

- Silver must be 99.9% pure • (forbes.com)

- Same tax rules as traditional IRA SEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less Before setting up a Silver IRA, understand the fees and IRS restrictions. (sltrib.com)

External Links

regalassets.com

forbes.com

- Gold IRA – Add Sparkle to Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

en.wikipedia.org

kitco.com

How To

How to decide if a Gold IRA is right for you

The most popular type of retirement account is the Individual Retirement Account (IRA). IRAs are available through employers, banks, mutual funds, and financial planners. The IRS allows individuals up to $5,000 in annual contributions without tax consequences. This amount can go into any IRA. There are limits to how much money you may put into certain IRAs. A Roth IRA is only available to those who are at least 59 1/2. Contributions must be made by those under 50 years old. Additional, employees who work for their employer might be eligible to receive matching contributions.

There are two types: Roth and Traditional IRAs. Traditional IRAs allow you to invest in stocks, bonds and other investments. A Roth IRA allows you to only invest in after-tax dollars. Contributions to a Roth IRA aren't taxed when they come out, but withdrawals taken from a Roth IRA are taxed once again. Some people may choose to use both. There are pros and cons to each type of IRA. There are pros and cons to each type of IRA. Here are three things to keep in mind:

Traditional IRA pros:

- Each company has its own contribution options

- Employer match possible

- You can save up to $5,000 per person

- Tax-deferred growth until withdrawal

- Income level may be a factor in some restrictions

- Maximum annual contribution is $5,500 ($6,500 for married couples filing jointly).

- Minimum investment: $1,000

- After age 70 1/2, you must begin taking mandatory distributions

- For an IRA to be opened, you must have at least five-years-old

- Transfer assets between IRAs cannot be done

Roth IRA Pros

- No taxes owed when contributing

- Earnings increase tax-free

- No required minimum distributions

- Investment options are limited to stocks, bonds, and mutual funds

- There is no maximum contribution limit

- Transfer assets between IRAs is possible without restrictions

- Age 55 or older to open an IRA

When opening a new IRA it's important to realize that not all companies offer identical IRAs. Some companies provide the choice of a Roth IRA as well as a traditional IRA. Others offer the possibility to combine them. Noting that different types IRAs have different requirements, it's worth noting. Roth IRAs do not require a minimum amount of investment, while traditional IRAs are limited to a maximum investment of $1,000.

The bottom line

When choosing an IRA, the critical factor is whether you want to pay taxes now or later. A traditional IRA is a good choice if you expect to retire within ten. Otherwise, a Roth IRA could be a better fit for you. However, it's always a good idea for you to talk with a professional regarding your retirement plans. It's important to have someone who is knowledgeable about the market and can suggest the best options for you.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]