Discussing the optimal timing and methods for selling Bitcoin can spark debate, yet strategically planning to take profits during market cycles is crucial. While some investors choose to hold Bitcoin long-term, others seek to realize gains, cover expenses, or reinvest at lower prices. Historical data reveals that Bitcoin often undergoes significant drawdowns of 70-80%, presenting opportunities to buy back at discounted prices.

Why Selling Can Be Beneficial

Contrary to the "HODL" mindset promoted by some, such as Michael Saylor, selling Bitcoin can offer advantages to individual investors. Taking partial profits can provide flexibility and peace of mind. For instance, if Bitcoin reaches $250,000 and experiences a 60% correction, dropping to $100,000, it becomes a chance to re-enter at more favorable levels.

Strategic Scaling Out

The emphasis is not on selling everything but on strategically scaling out of positions. This approach aims to maximize returns and manage risks effectively. Making informed decisions based on data rather than emotions is key. However, if holding indefinitely aligns with your goals, that's a valid strategy too.

Key Timing Indicators

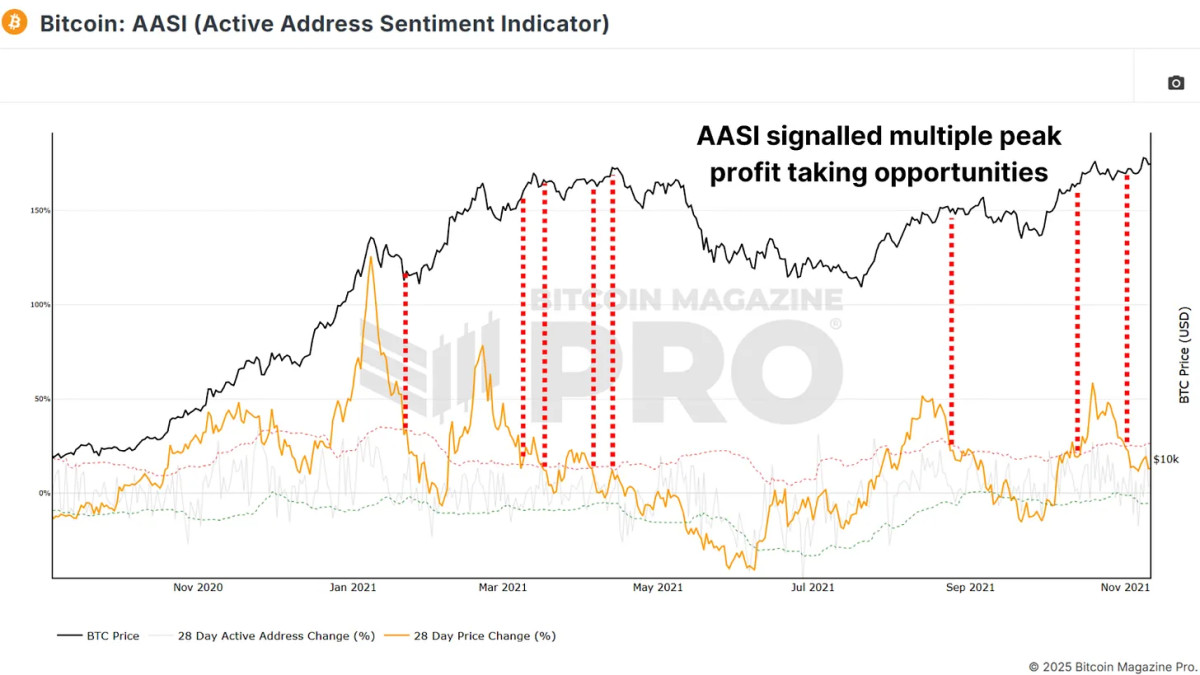

The Active Address Sentiment Indicator (AASI) tracks changes in network activity against Bitcoin's price movements. By comparing price deviations with network activity, it serves as a valuable timing tool.

The Fear and Greed Index measures market sentiment, indicating potential market tops. Values above 90 often signal extreme greed, suggesting a correction may be imminent.

The Short-Term Holder MVRV gauges the average profit or loss of new market participants. Profit levels around 33% typically indicate reversals, while levels exceeding 66% suggest overheated markets.

The Bitcoin Funding Rates reflect traders' leverage positions in futures markets. High funding rates may indicate excessive bullishness, often preceding corrections.

The Crosby Ratio identifies overheated market conditions, aiding in pinpointing potential turning points.

Key Takeaways

Predicting the exact market peak is challenging, and no single metric guarantees accuracy. Utilize a combination of indicators for confirmation and avoid selling all at once. Instead, gradually scale out as key indicators signal overheated conditions. Consider employing trailing stops to capture additional gains if prices continue to rise.

For comprehensive Bitcoin analysis, live charts, indicator alerts, and industry reports, explore Bitcoin Magazine Pro.

Disclaimer: This article provides information and not financial advice. Conduct thorough research before making investment decisions.

Frequently Asked Questions

How do I open a Precious Metal IRA

A self-directed Roth Individual Retirement Account is the best way to open a IRA for precious metals.

This account is more advantageous than other types of IRAs, because you don’t have to pay taxes on any interest earned from your investments until they are withdrawn.

It is attractive for people who want to save money, but need a tax break.

You are not limited to investing in gold or silver. You can invest in anything you want if it fits the IRS guidelines.

While most people associate precious metals with silver and gold, there are many types of precious metals.

You can find examples in palladium (platinum), rhodium (osmium), iridium and ruthenium.

There are many ways to invest in precious materials. Two of the most popular ways to invest in precious metals are buying bullion coin and bar coins, and also purchasing shares in mining corporations.

Bullion Coins and Bars

One of the best ways to invest in precious metals is by buying bullion bars and coins. Bullion is a general term that describes physical ounces, or physical gold and silver.

Bullion bars and bullion coins are actual pieces of the metal.

Although you may not be able to see any change immediately after purchasing bullion bars and coins at a shop, you will soon notice some positive effects.

This is an example of a tangible piece in history. Each coin and bar is unique.

If you compare the nominal value to face value, you will often find that it is worth much less than its nominal. When it was first introduced in 1986, the American Eagle Silver Coin cost only $1.00 per troy ounce. Today, however the American Eagle's silver coin is worth closer to $40.00 an ounce.

Bullion has had a tremendous increase in its value since its introduction. This is why many investors choose bullion bars and bullion coin over futures.

Mining Companies

Investing in shares of mining companies is another great option for those looking to buy precious metals. You're investing in the company’s ability to produce precious metals.

You will get dividends based off the company's profits in return. These dividends are then used to pay shareholders.

In addition, you will benefit from the growth potential of the company. The demand for the product will also cause an increase in share prices.

These stocks can fluctuate in value so it is important to diversify your portfolio. This allows you to spread your risk among multiple companies.

It's important to remember, however, that mining companies can still be subject to financial losses, just as any other stock market investment.

If gold prices drop dramatically, your ownership share could be worthless.

The Bottom Line

Precious metals such silver and gold provide an economic refuge from uncertainty.

Gold and silver can fluctuate in price. If you are interested in long-term investing in precious metals, open a precious Metals IRA account at a reputable firm.

This way, you can take advantage of tax advantages while benefiting from owning physical assets.

How do you withdraw from an IRA that holds precious metals?

If your account is with a precious metal IRA firm such as Goldco International Inc., you may want to consider withdrawing funds. When you sell your metals, the value of those funds will be higher than if it was kept in the account.

This article will help you understand how to withdraw funds from an IRA that holds precious metals.

First, you need to find out if the provider of your precious metal IRA allows withdrawals. Some companies offer this option while others do not.

Second, consider whether your sale of metals can allow you to take advantage tax-deferred profits. This benefit is offered by most IRA providers. But, not all IRA providers offer this benefit.

To find out if fees apply, thirdly check with your precious-metal IRA provider. Extra fees may apply for withdrawals.

Fourth, ensure that you keep track your precious metal IRA investment for at least 3 years after selling them. In other words, wait until January 1st each year to calculate capital gains on your investment portfolio. Next, fill out Form 8949 to determine the amount you gained.

In addition to filing Form 8949, you must also report the sale of your precious metals to the IRS. This will ensure you pay taxes on all the profits that your sales generate.

Consider consulting a trusted attorney or accountant before selling your precious metals. These professionals can ensure that you adhere to all procedures and avoid costly errors.

What precious metals could you invest in to retire?

Understanding what you have now saved and where you are currently saving money is the first step in retirement planning. Take a look at everything you own to determine how much you have left. This should include all stocks, bonds, mutual fund, certificates of deposits (CDs), insurance policies, life insurance policies and annuities. Add all these items together to calculate how much money you have for investment.

If you are between 59 and 59 1/2 years, you might consider opening a Roth IRA. A traditional IRA allows you to deduct contributions from your taxable income, while a Roth IRA doesn't. However, you can't take tax deductions from future earnings.

You will need another investment account if you decide that you require more money. Start with a regular broker account.

Statistics

- SEP-IRA”Simplified employee pension” For self-employed people like independent contractors, freelancers, and small-business ownersSame tax rules as traditional IRASEP IRA contributions in 2022 are limited to 25% of compensation or $66,000, whichever is less4. (sltrib.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- You can only purchase gold bars of at least 99.5% purity. (forbes.com)

External Links

regalassets.com

takemetothesite.com

en.wikipedia.org

forbes.com

- Gold IRA: Add Some Sparkle To Your Retirement Nest Egg

- Understanding China's Evergrande Crisis – Forbes Advisor

How To

Things to Remember About the 2022 Best Precious Metals Ira

Precious Metals Ira has become a popular choice for investors. This article will help you understand what makes this asset class so attractive and how to make wise decisions when investing in precious metals.

These assets are renowned for their long-term potential growth. Gold prices have been able to show remarkable returns over the past 200 years, according to historical data. Over the past 200 years, gold has increased from $20 per ounce to almost $1900 per ounce. Comparatively, the S&P 500 Index has only grown by approximately 50%.

In times of economic uncertainty, gold is often considered a safe haven. When the stock markets is down, people tend not to hold onto their stocks but rather move into the safety and security of gold. Inflation is also a hedge, so gold can be used as a security measure. Many economists believe that there will always exist some level of inflation. They believe that physical gold can be used to protect your savings against future price rises.

There are a few things you need to remember before purchasing precious metals like silver, gold or platinum. First, you should know whether you want to invest in bullion bars or coins. Bullion bars are typically purchased in large quantities, like 100 ounces, and kept away until they are needed. Bullion bars are often replaced by coins, which can be used to buy smaller amounts of bullion.

You should also consider where your precious metals will be stored. Some countries are safer than other. For example, you might consider storing precious metals overseas if your home country is the United States. However, if you plan on keeping them in Switzerland you may want to think about why.

Finally, you should decide whether you want to invest directly in precious metals or through “precious metals exchange-traded funds” (ETFs). ETFs track the performance of various commodities such as gold and are financial instruments. These are a way to have exposure to precious metals but not necessarily own them.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]