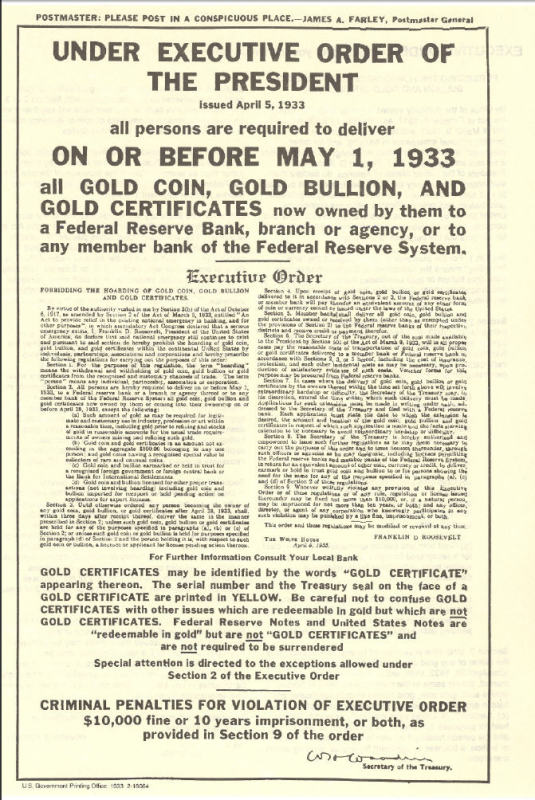

Ninety-one years ago today, President Franklin D. Roosevelt orchestrated the most significant heist in American history, all within legal bounds. Unlike typical robberies, this one did not involve breaking safes or armed theft; rather, it was executed with just a pen and White House letterhead. On April 5, 1933, FDR issued Executive Order 6102, effectively banning private ownership of gold in the United States. Citizens faced penalties of up to a $10,000 fine or 10 years in prison if they did not surrender their gold to the government by the end of the month.1

Significance of EO 6102

EO 6102 marked a crucial milestone in the evolution of money. Positioned between the establishment of the Federal Reserve in 1913 and the termination of the Bretton Woods system in 1971, it signified the shift of the USA from the gold standard to a fiat currency model. This executive order holds relevance in Bitcoin's history as well. Beyond its historical context, Bitcoin enthusiasts view EO 6102 as a cautionary tale of governmental confiscation of personal property, emphasizing the importance of self-custody of assets like Bitcoin.

Understanding the Legal Aspect

While debates often revolve around the justification of FDR's actions under EO 6102, the focus should shift to the mechanics of how FDR executed the order within the legal framework. Despite his presidency's authoritarian undertones, FDR adhered to specific legal precedents and utilized executive powers to legitimize EO 6102. This legal foundation, albeit a veneer for tyranny, played a pivotal role in standardizing a method that subsequent Presidents have utilized to infringe on Americans' rights.

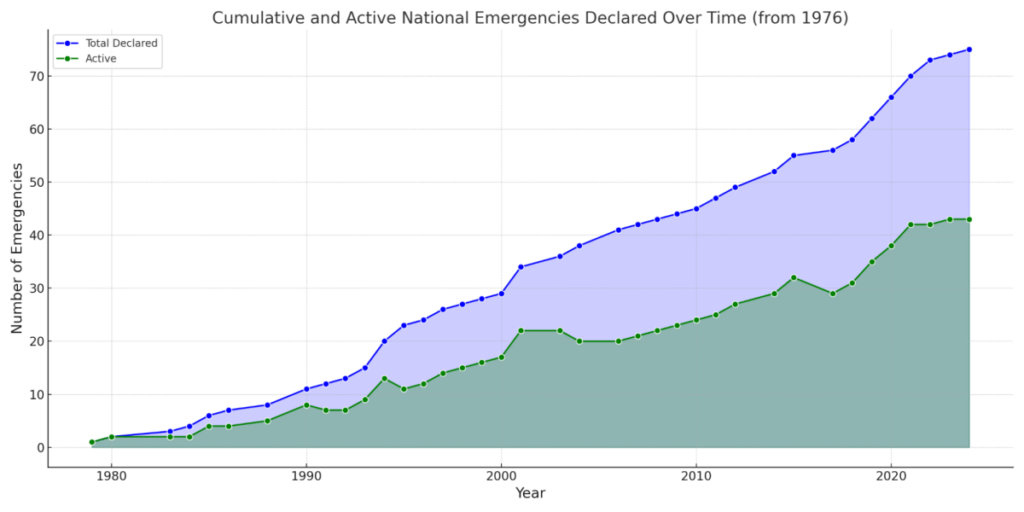

The Role of National Emergency

A recurring theme in American history is the invocation of 'national emergency' to justify executive actions that circumvent constitutional norms. This practice dates back to Abraham Lincoln's suspension of habeas corpus in 1862 and has been a recurring strategy for Presidents to expand their powers. The phrase 'national emergency' has become a linchpin for enabling questionable legislation, as seen in various acts like the Patriot Act and responses to public health crises.

Evolution from 1917 to 1933

The trajectory of 'national emergency' powers can be traced back to the Espionage Act of 1917, a pivotal year for expanding government control. Subsequent legislations, such as the Trading with the Enemy Act, laid the groundwork for FDR's actions in 1933. The Emergency Banking Relief Act granted FDR unprecedented control over the banking system, setting the stage for EO 6102. The evolution of emergency powers showcased how crises enabled the consolidation of executive authority.

Relevance in Modern Context

Reflecting on EO 6102 prompts questions about its relevance today. Could a similar mass seizure of assets, like Bitcoin, occur in the future under the guise of a national emergency? While history doesn't repeat itself verbatim, the underlying lesson lies in the unchecked power granted to governments during crises. As the state faces economic challenges and escalating debts, the specter of asset expropriation looms large. Sovereign custody of assets like Bitcoin may offer a safeguard against potential government overreach, emphasizing the importance of self-ownership in turbulent times.

In conclusion, the legacy of EO 6102 serves as a stark reminder of the perils of unchecked executive authority during emergencies. As the state navigates through crises, the age-old adage of 'not your keys, not your coins' resonates more than ever, underscoring the importance of preserving individual sovereignty in an ever-changing landscape.

Frequently Asked Questions

How Much of Your IRA Should Include Precious Metals?

Investing in precious metals such as gold and silver is the best way to protect yourself from inflation. It's more than just an investment in retirement. It also prepares you for any economic downturn.

Gold and silver prices have increased significantly over the past few years, but they are still considered safe investments because they don't fluctuate as much as stocks do. There is always demand for these materials.

Prices for silver and gold are predictable and usually stable. They are most likely to rise when the economy grows and fall during recessions. This makes them excellent money-savers, and long-term investment options.

You should invest 10 percent of your total portfolio into precious metals. If you wish to diversify further, this percentage could be higher.

Can I add gold to my IRA?

The answer is yes It is possible to add gold to your retirement plans. Gold is an excellent investment because it doesn't lose value over time. It protects against inflation. It also protects against inflation.

You need to understand that gold is not like other investments before you invest in it. You can't buy shares in companies that make gold unlike bonds or stocks. You cannot also sell them.

Instead, convert your gold to money. This means that you must get rid of your gold. You can't just hold onto it.

This makes gold an investment that is different from other investments. Similar to other investments, gold can be sold at any time. But that's not the case with gold.

Even worse, gold cannot be used to secure loans. If you get a mortgage, for example, you might have to give up some of the gold you own in order to pay off the loan.

So what does this mean? Your gold can't be kept forever. You'll have to turn it into cash at some point.

You don't need to worry. Open an IRA account. Then you can invest your money in gold.

Should You Open a Precious Metal IRA?

It all depends on your investment goals and risk tolerance.

An account should be opened if you are planning to use the money in retirement.

Precious metals will appreciate over time. You can also diversify your portfolio with them.

In addition, gold and silver prices tend to move together. They make a good choice for both assets and are a better investment.

You should not invest in precious-metal IRAs if it is not your intention to use your money for retirement, or if you are unwilling to take any risks.

What is the best precious metal to invest in?

High returns on capital are possible with gold investments. It protects against inflation as well as other risks. The price of gold tends to rise as people become concerned about inflation.

It's a good idea to purchase gold futures. These contracts ensure that you receive a set amount of gold at a fixed rate.

However, futures on gold aren't for everyone. Some people prefer to own physical gold instead.

They can easily trade their gold with others. They can also make a profit by selling their gold at any time they desire.

Some people want to avoid paying tax on their gold. They purchase gold directly from governments to achieve this.

This will require several trips to your local Post Office. You must first convert any existing gold into coins or bars.

Then, you need to get a stamp on those coins or bars. Finally, send them off to the US Mint. The US Mint will melt the coins and bars to make new ones.

These bars and coins are stamped with the original stamps. These new coins and bars are legal tender.

You won't need to pay taxes if gold is purchased directly from the US Mint.

Decide which precious metal you would like to invest.

What precious metals will be allowed in an IRA account?

The most common precious metal used for IRA accounts is gold. As investments, you can also buy bars and bullion coins made of gold.

Precious metals, which don't lose any value over time, are considered safe investments. Precious metals are also great for diversifying an investment portfolio.

Precious metals include palladium and platinum. These three metals are similar in their properties. Each one has its own uses.

In jewelry making, for instance, platinum is used. To create catalysts, palladium is used. The production of coins is done with silver.

It is important to consider how much money you are willing to spend on your precious metals when making a decision about which precious material to choose. A lower-cost ounce of gold might be a better option.

It is also important to consider whether you would like to keep your investment confidential. If you are unsure, palladium is the right choice.

Palladium has a higher value than gold. It is also more rare. You'll probably have to pay more.

When choosing between gold or silver, another important aspect is the storage fees. You store gold by weight. So you'll pay a higher fee for storing larger amounts of gold.

Silver is measured in volume. You'll pay less if you store smaller quantities of silver.

You should follow all IRS rules if you plan to store precious metals in an IRA. This includes keeping track, and reporting to the IRS, all transactions.

Are gold IRAs a good place to invest?

The best way to invest in gold is by buying shares in companies that mine for it. These companies are a great way to make money investing in precious metals like gold.

However, there are two drawbacks to owning shares directly:

The first is that you could lose money if your stock is held on for too long. Stocks that fall are less than their underlying asset (like silver) and can end up losing more money. You could lose your money, rather than make it.

Second, you may miss out on potential profits if you wait until the market recovers before selling. It is possible to wait until the market recovers before selling your gold.

However, if you want to separate your investments from your financial affairs, physical gold can still be a great investment option. An IRA in gold can diversify your portfolio and protect you against inflation.

You can find out more information about gold investing on our website.

Which type of IRA is the best?

When selecting an IRA for yourself, the most important thing is to find one that meets your lifestyle and goals. You need to decide whether you want to maximize tax deduction on your contributions, minimize taxes now but pay penalties later, and if you just want to avoid taxes.

The Roth option may make sense if you are saving for retirement but don't have much other money invested. It is also an option if you are still working after age 59 1/2. You can expect to pay income taxes for any accounts that are withdrawn.

Traditional IRAs might be more beneficial if you are looking to retire early. You'll likely owe income taxes. If you are going to be working beyond 65 years old, the traditional IRA may make more sense because you can withdraw all or part of your earnings without having to pay taxes.

Statistics

- Depending on your financial situation, most experts recommend you invest no more than 5% to 10% of your retirement funds in precious metals. (forbes.com)

- Silver must be 99.9% pure • (forbes.com)

- If you accidentally make an improper transaction, the IRS will disallow it and count it as a withdrawal so that you would owe income tax on the item's value and, if you are younger than 59 ½, an additional 10% early withdrawal penalty. (forbes.com)

- The IRS also allows American Eagle coins, even though they do not meet gold's 99.5% purity standard. (forbes.com)

External Links

en.wikipedia.org

takemetothesite.com

forbes.com

- Gold IRA: Add some sparkle to your retirement nest egg

- Understanding China's Evergrande Crisis – Forbes Advisor

kitco.com

How To

How to convert your IRA into a Gold IRA

You want to convert your retirement savings from a traditional IRA to a gold IRA. This article will assist you in that endeavor. Here's how to make the switch.

The process of transferring money out of one type of IRA (traditional) and into another (gold) is called “rolling over.” This is done because tax advantages go along with rolling over an account. Some people also prefer to invest in physical assets such as precious metals.

There are two types IRAs: Traditional IRAs or Roth IRAs. The difference between the two accounts is simple. Roth IRAs have no tax deductions, but Traditional IRAs can deduct taxes. That means that if you invest $5,000 in a Traditional IRA today, then after five years, you'll only be able to take out $4,850. The Roth IRA would allow you to keep every cent if you invested the same amount.

These are the things you need to know if your goal is to convert from a traditional IRA or a gold IRA.

First, decide whether to transfer funds from an old account to your new account or to rollover your current balance. Any earnings over $10,000 will be subject to income tax at the regular rate. But if you choose to roll over your IRA, you won't be taxed on those earnings until you reach age 59 1/2.

After making your decision, you can open a new financial account. You may be asked for proof of identity (e.g., a Social Security or passport card, birth certificate, etc.). Then, you'll fill out paperwork showing that you own the IRA. Once you've filled out the forms you'll send them to your bank. You'll be verified and given instructions on where you can send your wire transfers and checks.

This is the fun part. The fun part is when you deposit cash into the account, and then wait for the IRS approval. After approval, you'll receive a letter stating that funds can be withdrawn.

That's it! All you need to do now is watch your money grow. Remember that if you are unsure whether you want to convert your IRA, it is possible to close it and roll the balance over into a new IRA.

—————————————————————————————————————————————————————————————-

Based on [POSTTITLE]

by [POSTAUTHOR]